International finance through the lens of BIS statistics: the international dimensions of credit

International sources of credit can be a boon to borrower countries in need of capital. But they can also be destabilising by enabling domestic credit booms. Before the global financial crisis (GFC), internationally active banks drove credit growth by lending both across borders as well as locally in the host countries where they operated. Since the GFC, borrowers have increasingly turned to international bond markets. This article shows how BIS statistics can help disentangle the various international dimensions of credit to borrower economies and describes the role of foreign banks and international bond markets in the credit provision process.1

JEL classification: F34, F36, G21, F23, F31, F36, G15.

In the last half century, borrower countries have been repeatedly rocked by swings in international capital flows. The ebb and flow of cross-border credit, often driven by changes in investor risk appetite, can expose vulnerabilities and thus be destabilising. Before the Great Financial Crisis (GFC) of 2007–09, for example, international banks fuelled domestic credit booms in advanced economies (AEs) and emerging market economies (EMEs) alike. In the post-GFC low rate environment, many corporate borrowers bulked up on foreign currency bonds, mainly denominated in the US dollar. Rising dollar borrowing costs since 2020 have curtailed this somewhat, but continued dollar appreciation and geopolitical uncertainty have brought questions of debt sustainability to the fore yet again.

This article is a primer on how BIS statistics shed light on various international dimensions of credit and their impact on financial stability in borrower economies. The first dimension is the funding source. Cross-border credit can be direct, such as a cross-border loan to a non-bank borrower, or indirect, such as a loan extended by a local (ie resident) bank but that is funded by cross-border borrowing. In both cases, the funding for this credit is sourced from abroad. A second dimension is the currency of denomination, which can be the borrower's domestic currency or a foreign currency. A third dimension is the mix of creditors and their structures: they can be banks or non-banks, foreign or domestic, and extend credit locally or across borders.

International credit bears watching, in particular when it grows faster than domestic credit. This can enable domestic credit booms, as happened in many countries in the run up to the GFC (CGFS (2011)). Direct cross-border credit fuelled by a search for yield inflated asset prices, and the resulting rise in collateral values further amplified credit growth. Indirect cross-border credit also played a key role in many economies by allowing local banks to extend credit in excess of what would be sustainable by the domestic deposit base alone.

Key takeaways

- Rapid international credit growth can enable domestic credit booms, posing risks to financial stability. Both direct cross-border credit and indirect cross-border credit bear watching.

- Foreign banks operating in domestic markets may enhance credit provision in local credit markets, but their cross-border credit tends to dry up first when financial volatility arises.

- Foreign currency credit is increasingly intermediated through capital markets rather than through banks, which diversifies the sources of credit but also alters the risks.

Borrowing during such boom periods is often denominated in a foreign currency, mainly the US dollar. This enables borrowers to take advantage of lower funding costs or access larger pools of capital. However, it also creates risk when the borrower's local currency depreciates: higher debt burdens beget higher repayment costs and potential defaults. For example, mortgages denominated in low interest rate foreign currencies (eg the Swiss franc) were popular in some eastern European countries ahead of the GFC. But in its wake, the debt burden ballooned in local currency terms. After the GFC, borrowers increasingly took advantage of low long-term rates in bond markets. This helped diversify and deepen their access to capital, but also exposed them to changes in the risk appetite of international bond investors.

Dynamics in the growth of cross-border credit in part reflect conditions in global wholesale funding markets. This makes it important to also consider the composition of creditors, how they fund their credit and thus how flighty the credit is. For banks, BIS statistics provide useful measures of how much credit is provided by foreign banks versus home banks, and how much of the credit is funded and extended locally versus across borders. Short-term wholesale funding, which proved to be unstable in the GFC (Bruno and Shin (2015), Ivashina and Scharfstein (2010)), is often used to fund cross-border credit. Consequently, during periods of financial stress, foreign banks tend to withdraw cross-border credit more rapidly than do domestic banks or foreign banks operating locally in the country.

The international dimensions of credit growth pose policy challenges (Borio et al (2011)). In economies experiencing booms, international credit complicates the job of domestic authorities who seek to constrain credit. They have several tools to slow the growth of domestic credit but only limited tools to control credit extended by institutions abroad. In addition, borrowers may shift from local to foreign currency liabilities if local currency rates rise. This can reduce the efficacy of domestic monetary policy and ties the economy to interest rate conditions set elsewhere – including in international bond markets.

This article first describes the international dimensions of credit and how they are reflected in BIS statistics. It then discusses the implications of such credit for financial stability. The final section concludes.

International dimensions of credit

International credit can help economies grow, but a rapid expansion in such credit can be destabilising. The BIS international banking statistics (IBS) and global liquidity indicators (GLIs) are key resources that provide visibility on three dimensions of credit to non-bank borrowers in a particular economy (see Box A): the source of funding (ie cross-border or local), the currency of denomination and the identity of the creditor (eg a foreign bank, domestic bank or non-bank creditor).

Direct and indirect cross-border credit and foreign currency credit

One key aspect of financial stability analysis is the extent to which credit to non-banks in a particular economy is supported by funding from abroad. Zeroing in on non-bank borrowers – ie non-bank financial institutions, non-financial corporations, households and governments – puts the focus on the real economy. Cross-border credit can take various forms. The most common is direct borrowing by non-banks from non-resident creditors, either bank or non-bank creditors. Such direct cross-border credit is the standard metric used in assessing reliance on international credit.

However, international credit can also be indirect. Creditors located in a particular country may finance a large share of their own locally extended credit to non-banks (ie domestic credit2) with net borrowing from non-residents (from other banks or non-banks). Importantly, this indirect cross-border credit allows credit growth to outrun domestic deposit growth. This component is often ignored in empirical analysis of credit booms, but as discussed below, it has been the marginal source of credit in many economies (Ehlers and McGuire (2017), Avdjiev et al (2020)).

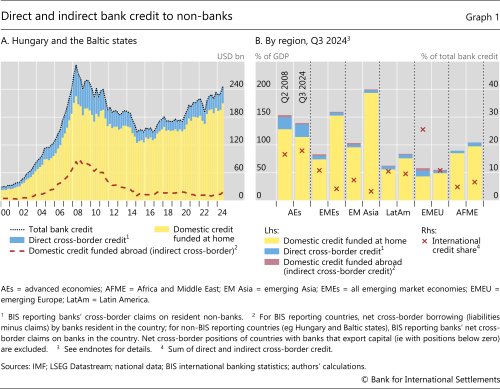

Several European cases highlight the roles of direct and indirect cross-border bank credit during the global credit boom ahead of the GFC. Direct cross-border credit to non-banks in Hungary and the Baltic states, for example, grew at roughly 34% year on year in the six years prior to Q1 2009 (Graph 1.A), about three percentage points above the rate for domestic bank credit. In addition, banks in these countries drew on indirect cross-border credit to support their domestic lending (dashed red line). Combined, these two cross-border components accounted for more than half of the stock of total bank credit to non-banks in these countries by 2008.

Since the GFC, direct and indirect bank credit have grown in importance in some regions but not in others (Graph 1.B). For AE borrowers, total bank credit has fallen somewhat relative to the scale of economic activity (stacked bars). But the combined share of direct and indirect bank credit rose modestly, to reach 18% of total bank credit (red x). For EME borrowers, by contrast, international bank credit has fallen as a share of total bank credit. This mainly reflected significant growth in domestic credit funded with local deposits (yellow bars) in the Asia-Pacific region and to a lesser extent Latin America. Emerging Europe, where international credit had surged leading up to the GFC, saw the largest declines in its share.

International credit is often denominated in a currency that is foreign to the borrower. The currency of denomination of credit, regardless of whether this credit is extended by banks inside or outside the country, is of particular concern to policymakers since sudden moves in the exchange rate can significantly increase the debt burden expressed in local currency terms. As of end-Q3 2024, 90% of the total direct cross-border bank credit was denominated in five major currencies (USD, EUR, JPY, GBP, CHF). As discussed below, borrowing via bond issuance in international markets, mainly in US dollars, in part replaced bank borrowing in foreign currencies.

Policy measures such as capital controls and financial regulation can affect the channels through which international credit flows. Some of these measures focus on direct cross-border credit, while leaving a banks' intragroup funding alone. Ultimately, the mix of direct versus indirect international credit is shaped by policy and by the organisation of globally active banks (Hardy et al (2024b)). Thus, focusing on only one type of international credit (eg direct cross-border) risks missing important developments in other forms (eg indirect cross-border).

Credit providers: nationality and location

Cross-border bank credit can, but need not, give foreign-owned banks an outsize role in domestic credit markets. Such non-domestic banks loom large in economies where direct cross-border bank credit is a large part of overall credit. But even in economies with relatively little cross-border credit, foreign banks can play a pivotal role via their local presence in the domestic banking system. While some operate like domestic banks, raising deposits in the country to lend locally, others fund their local lending with cross-border liabilities. These can take a variety of forms, including interoffice funding, wholesale funding or cross-border deposits (Hardy et al (2024b).

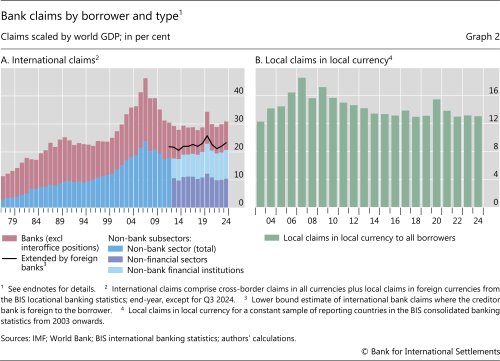

The role of foreign banks as credit providers has evolved over the decades. International claims (comprising all cross-border lending and local lending in foreign currency) expanded through the 1970s and 1980s (Graph 2.A), fuelled by regulatory arbitrage, financial innovation and financial liberalisation (McCauley et al (2021)). A second wave of expansion preceded the GFC, after which many banks – in particular European banks (IMF (2015), McCauley et al (2019)) – retrenched their overseas operations. Of the total international bank credit outstanding at end-Q3 2024, an estimated 75% was extended by a bank that is foreign to the borrower (black line).

But foreign banks also have local operations in the borrower countries, much of which are denominated in the borrower's local currency (Graph 2.B). Combining these claims with their international claims provides a measure of foreign banks' share in total bank credit to non-bank borrowers – ie the foreign bank participation (FBP) rate (Ehlers and McGuire (2017); see Box A).

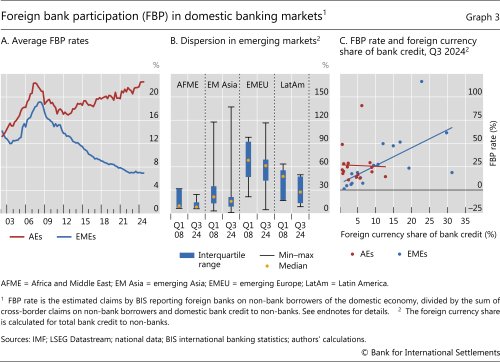

Since the GFC, foreign banks have accounted for a decreasing share of total bank credit to EMEs as domestic financial systems have grown. For EMEs as a group, their FBP rate fell from over 20% in 2008 to 7% in 2024 (Graph 3.A, blue line). While foreign bank credit rose faster than economic activity for much of this period, it was overshadowed by the dramatic expansion in credit from domestic banks (Avdjiev et al (2024), Hardy (2019)). By contrast, the FBP rate for advanced economies (red line) has continued to rise after the GFC.

Foreign bank participation rates varied markedly both across and within EME regions in mid-2024. Asia-Pacific EMEs stood out with relatively low FBP rates (Graph 3.B). For instance, the rate for China was close to 1% in Q2 2024, falling from an already low 3% a decade earlier. Similarly, both India and Korea have had FBP rates below 15% for the last two decades. FBPs in Latin America and other EMEs have been consistently higher than in Asia but have shifted down since the GFC.

Foreign banks often, but not always, bring foreign currency credit to borrower economies. Their access to foreign currency funding sources makes them a natural conduit. They tend to transact much more in foreign currencies than do domestic banks (Aldasoro et al (2022)), and their lending can be linked to borrowing costs in their home currency (Morais et al (2019)). EMEs with relatively higher FBP rates also tend to have a higher share of bank credit denominated in foreign currencies (Graph 3.C).3 No such correlation is evident for AE borrowers, which tend to borrow primarily in domestic currency regardless of the banks' ownership. Moreover, many domestic banks in AEs are well integrated in the global financial system and thus can access foreign currency funds themselves directly or via affiliates abroad.

Capital markets as a rising force in global finance

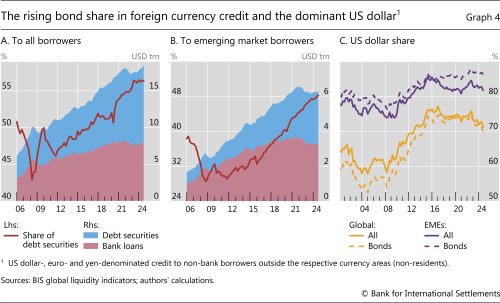

While banks remain key providers of foreign currency credit, international capital markets have become increasingly important since the GFC (Hardy and von Peter (2023)). This development is reflected in the BIS GLIs, which track credit denominated in US dollars, euros and yen to non-bank borrowers outside the respective currency-issuing jurisdictions (Graph 4.A). The major share of credit captured in the GLIs is to private sector firms4. The rise in credit through debt securities occurred as bank creditors stepped out after the GFC and non-bank investors stepped in (McCauley et al (2015), Shin (2012)). The shift has been particularly stark in EMEs, where the bond share rose from almost a third at end-2008 to almost a half in mid-2024 (Graph 4.B). The shift towards capital market financing is likely to be even starker if growth of domestic capital markets is factored in.5

Greater reliance on capital markets has both pros and cons for borrowers. Debt securities allow EME borrowers to tap larger investment pools, which in turn helps diversify risks away from banks and across a broader set of investors. Further, EME borrowers have been able to obtain credit at tenors that can exceed those generally offered by banks. On the other hand, capital markets can be more prone to swings in global risk sentiment, which in turn can affect exchange rates and thereby the ability to repay foreign currency credit (Koepke (2019), Hofmann et al (2022)).

The dollar remains EMEs' foreign currency of choice in both bank and bond credit (Graph 4.C). Countries with exports denominated in dollars (eg commodities producers) have a natural hedge. But those without such a hedge face both balance sheet and rollover risk when the dollar appreciates or when borrowing costs rise. As discussed below, the recent dollar appreciation and rising dollar borrowing costs make EMEs more vulnerable to sudden changes in investor sentiment.

Implications of international credit for domestic policy

International credit bears watching by policymakers. For one, international credit is often the marginal source of credit and can be subject to destabilising reversals. For another, the modes of credit extension and funding (ie cross-border vs local) by foreign banks affect the stability of their lending (Hardy et al (2024b)). The following subsections discuss cases that illustrate these points.

International credit and domestic credit booms

Rapid expansion in international credit can be an enabler of domestic credit booms (Domanski et al (2011), Aldasoro et al (2023), Borio et al (2011)). In the run-up to the GFC, for example, international credit was the marginal source for borrowers in many countries, fuelling a rise in ratios of bank credit to GDP. As the crisis unfolded, countries that had relied heavily on such credit saw the largest credit contractions.

Further reading

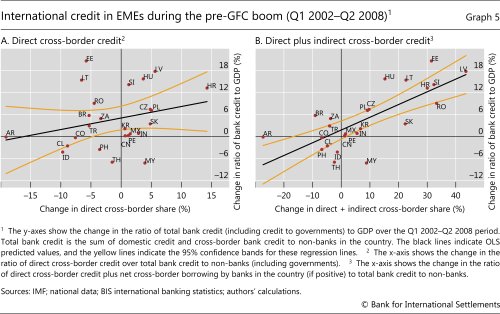

The type of international credit matters in these boom-bust episodes. In a sample of EME borrower countries, there is a statistically significant relationship between the change in the share of direct cross-border bank credit between 2002 and 2008 and the change in the ratio of bank credit to GDP (Graph 5.A). Importantly, the relationship is more pronounced when the more comprehensive measure of international credit is used. That is, the rise in the ratio of bank credit to GDP is more tightly related to the change in the combined share of direct cross-border credit and indirect cross-border credit (Graph 5.B). This is seen in the steeper slope of the regression line and the much narrower confidence bands for the estimated regression line (yellow lines).

Such indirect cross-border credit can come in different forms. In several eastern European countries, foreign banks advanced euros or Swiss francs to their local affiliates, which in turn extended foreign currency mortgages to households. Indeed, these countries experienced big credit booms with a high share of foreign currency credit in mid-2008. By contrast, in Korea, foreign banks advanced dollars to banks in the country, but those were not used to fund dollar-denominated assets. Rather, banks in Korea bought won-denominated investments that were hedged back into dollars using FX forwards (McCauley and Zukunft (2008)). The forward counterparties, mostly Korean exporters such as shipbuilders, in effect borrowed dollars by contracting to sell future dollar revenues.

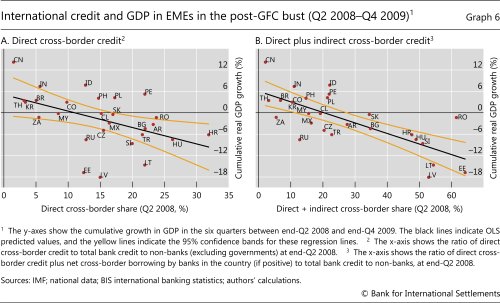

As in the boom period, so too in the bust period: international credit drove larger swings in activity (Graph 6). Note that here the focus is on the cumulative contraction in output (real GDP) during the GFC rather than the change in the ratio of bank credit to GDP. Those EMEs most dependent on international credit before the Lehman Brothers collapse tended to suffer sharper downturns.6 The share of direct cross-border credit on the eve of the GFC is only loosely related to GDP growth in the following years (Graph 6.A). But once again, the combined (direct plus indirect) share of cross-border credit (Graph 6.B) and foreign currency credit (Graph 6.C) are more tightly associated with the severity of the downturn.

The trade-offs of greater foreign bank participation

The identity of the lender is another key dimension of international credit. A greater share of credit from foreign banks brings both benefits and risks for the borrower. Foreign banks, which typically enjoy a broader intragroup support network and funding mix, can both bring best practice to domestic markets and increase competition that drives cost reductions at domestic banks (Caparusso and Hardy (2022), Claessens and van Horen (2014)).

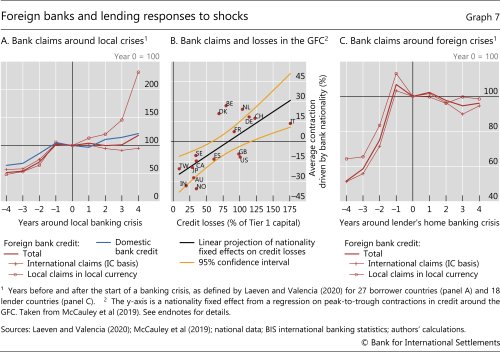

However, for the stability of credit in borrower countries, the source of funding matters more than the ownership of the bank (Ehlers and McGuire (2017), Ongena et al (2015)). For example, foreign banks operating locally can often rely on support from their parent bank (De Haas and van Lelyveld (2010)). In such cases, they can be better equipped than domestic banks to handle economic shocks originating in the borrower country (Cull et al (2017)). BIS statistics show that, following a local banking crisis, local credit extended by foreign banks expands strongly in subsequent years (Graph 7.A). Indeed, it is more resilient than local lending by domestic banks (blue line). By contrast, foreign banks' international claims are fickle and tend to disappear.

This ordering of resilience stems mainly from the funding source. International credit is more likely to be funded by wholesale funding, which is subject to periodic squeezes (Bruno and Shin (2015), Ivashina and Scharfstein (2010)). By contrast, local credit, particularly if denominated in the local currency, is often funded by local liabilities (eg stable domestic deposits) in the local currency. This matching of currencies across the assets and liabilities sides of the balance sheet helps insulate creditors from movements in exchange rates (IMF (2015), McGuire and von Peter (2016)) and thus tends to be a stabilising force.

However, in the case of global shocks or shocks in a bank's home country, foreign banks can be transmitters of risk to local economies. For instance, a bank that faces a shock in one location may adjust its globally consolidated balance sheet, leading to credit contractions in other locations (Adams-Kane et al (2017), Peek and Rosengren (1997)). During the GFC, banks that racked up larger credit losses saw larger peak-to-trough contractions in their foreign claims (Graph 7.B) after accounting for borrower- and location-specific factors (see endnotes). More generally, banking crises in the foreign bank's home country are followed by a decline in lending abroad, mainly due to lower international claims (Graph 7.C).

Dollar debt, dollar appreciation and rising dollar rates

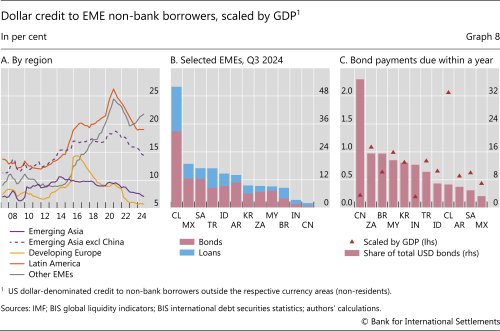

Low long-term borrowing costs in the major currencies after the GFC led to a nearly decade-long rise in foreign currency borrowing by EMEs (Graph 8.A). However, the rise in dollar policy rates and sustained dollar appreciation since 2020 have led to a steepening of the dollar yield curve, which, in turn, has curtailed this borrowing.

Despite this decline, dollar repayment obligations remain a concern in the current environment (Graph 8.C). Changes in policies that affect trade (eg tariffs) – and any further appreciation of the US dollar – could put additional pressure on EMEs' ability to repay. Many EMEs are exporters of commodities, goods and services priced and traded in dollars. The associated dollar revenue has served as a natural hedge against currency mismatches. However, falling sales and commodity prices can foreshadow difficulties in servicing their international debt. This debt bears watching as trade policies evolve and their impact on the global economy is felt.

Conclusions

The international dimensions of credit growth pose various policy challenges.7

First, in economies experiencing booms, international credit often complicates the job of domestic authorities who seek to monitor and constrain credit. For example, domestic authorities have several tools to slow the growth of credit extended by banks within their jurisdiction. But short of capital controls, the tools to measure, much less control, credit extended by institutions outside the country are limited. BIS work on the early warning properties of various "gap" variables, in particular the credit-to-GDP gap, has proven quite useful in this regard (Borio and Lowe (2002, 2004), Borio and Drehmann (2009), Aldasoro et al (2018)).8

Second, the post-GFC push in several jurisdictions for local capital requirements and "ring-fencing" of banks' operations presents its own trade-offs. The longer-term implications of such a move are widely debated. While such regulatory changes may make banks more stable in the near term, they do so by possibly hampering cross-border transfers of capital. Policymakers should continue to examine these trade-offs.

Finally, policymakers should not lose sight of other challenges that have emerged since the GFC. Cross-border bank credit has taken a back seat to bond issuance, much of which was absorbed by non-bank creditors (McCauley et al (2015)). Such "non-bank to non-bank credit" remains opaque because of a lack of data on the consolidated holders of the claims. Moreover, it has been less affected by many of the post-GFC regulatory initiatives that targeted the banking sector.

References

Adams-Kane, J, J Caballero and J J Lim (2017): "Foreign bank behavior during financial crises", Journal of Money, Credit and Banking, vol 49, no 2/3, pp 351–92.

Albertazzi, U and M Bottero (2014): "Foreign bank lending: evidence from the global financial crisis", Journal of International Economics, vol 92, supplement 1: pp S22–S35.

Aldasoro, I, S Avdjiev, C Borio and P Disyatat (2023): "Global and domestic financial cycles: variations on a theme", International Journal of Central Banking, vol 19, no 5, pp 49–98.

Aldasoro, I, C Borio and M Drehmann (2018): "Early warning indicators of banking crises: expanding the family", BIS Quarterly Review, March, pp 29–45.

Avdjiev, S, J Burger and B Hardy (2024): "New spare tires: local currency credit as a global shock absorber", BIS Working Papers, no 1199, July.

Avdjiev, S, P McGuire and G von Peter (2020): "International dimensions of EME corporate debt, BIS Quarterly Review, June, pp 1–13.

Basel Committee on Banking Supervision (BCBS) (2010): "Basel III: A global regulatory framework for more resilient banks and banking systems", December.

Berkmen, S P, G Gelos, R Rennhack and J Walsh (2012): "The global financial crisis: explaining cross-country differences in the output impact", Journal of International Money and Finance, vol 31, no 1, pp 42–59.

Borio, C, R McCauley and P McGuire (2011): "Global credit and domestic credit booms", BIS Quarterly Review, September, pp 43–57.

Bruno, V and H S Shin (2015): "Cross-border banking and global liquidity", Review of Economic Studies, vol 82, no 2, pp 535–64.

Caparusso, J and B Hardy (2022): "Bank funding: evolution, stability and the role of foreign offices", BIS Quarterly Review, September, pp 67–78.

Claessens, S and N van Horen (2014): "Foreign banks: trends and impact", Journal of Money, Credit and Banking, vol 46, no 1, pp 295–326.

Committee on the Global Financial System (CGFS) (2011): "Global liquidity – concept, measurement and policy implications", CGFS Papers, no 45, November.

Cull, R, M S Martinez Peria and J Verrier (2017): "Bank ownership: trends and implications", IMF Working Papers, no 17/60, March.

De Haas, R and I van Lelyveld (2010): "Internal capital markets and lending by multinational bank subsidiaries", Journal of Financial Intermediation, vol 19, no 1, pp 1–25.

Ehlers, T and P McGuire (2017): "Foreign banks and credit conditions in EMEs", BIS Papers, no 91.

Espinosa-Vega, M, C Kahn and J Sole (2010): "Systemic risk and the redesign of financial regulation", IMF Global Financial Stability Report, chapter 2, April.

Gelos, G, P Patelli and I Shim (2024): "The US dollar and capital flows to EMEs", BIS Quarterly Review, September, pp 51–67.

Hardy, B (2019): "Emerging markets' reliance on foreign bank credit", BIS Quarterly Review, March, pp 15–28.

Hardy, B, P McGuire and G von Peter (2024a): "International finance through the lens of BIS statistics: bank exposures and country risk", BIS Quarterly Review, September, pp 69–86.

----- (2024b): "International finance through the lens of BIS statistics: the geography of banks' operations", BIS Quarterly Review, December, pp 69–86.

Hardy, B and G von Peter (2023): "Global liquidity: a new phase?", BIS Quarterly Review, December, pp 21–31.

Hofmann, B, A Mehrota and D Sandri (2022): "Global exchange rate adjustments: drivers, impacts and policy implications", BIS Bulletin, no 62, November.

International Monetary Fund (IMF) (2015): "International Banking after the Crisis: Increasingly Local and Safer?", Global Financial Stability Report, chapter 2, April, pp 55–91.

----- (2018): "Regulatory reform 10 years after the global financial crisis: looking back, looking forward", IMF Global Financial Stability Report, chapter 2, October, pp 55–81.

Ivashina, V and D Scharfstein (2010): "Bank lending during the financial crisis of 2008", Journal of Financial Economics, vol 97, no 3, pp 319–38.

Kim, K and S Mitra (2014): "Real and financial vulnerabilities from crossborder banking linkages", IMF Working Papers, no 14/136, July.

Koepke, R (2019): "What drives capital flows to emerging markets? A survey of the empirical literature", Journal of Economic Surveys, vol 33, no 2, pp 516–40.

Laeven, L and F Valencia (2020): "Systemic banking crises database II", IMF Economic Review, vol 68, pp 307–61.

McCauley, R, Bénétrix A, P McGuire and G von Peter (2019): "Financial deglobalisation in banking?", Journal of International Money and Finance, vol 94, June, pp 116–31.

McCauley, R, P McGuire and V Sushko (2015): "Dollar credit to emerging market economies", BIS Quarterly Review, December, pp 27–41.

McCauley, R, P McGuire and P Wooldridge (2021): "Seven decades of international banking", BIS Quarterly Review, September, pp 61–75.

McCauley, R and J Zukunft (2008): "Asian banks and the international interbank market", BIS Quarterly Review, June, pp 67–79.

McGuire, P and G von Peter (2016): "The resilience of banks' international operations", BIS Quarterly Review, March, pp 65–78.

McGuire, P, G von Peter and S Zhu (2024a): "International finance through the lens of BIS statistics: residence vs nationality", BIS Quarterly Review, March, pp 73–88.

----- (2024b): "International finance through the lens of BIS statistics: the global reach of currencies", BIS Quarterly Review, June, pp 1–16.

Morais, B, J-L Peydró, J Roldán-Peña and C Ruiz-Ortega (2019): "The international bank lending channel of monetary policy rates and QE: credit supply, reach for yield, and real effects", Journal of Finance, vol 74, no 1, pp 55–90.

Ongena, S, J-L Peydró and N van Horen (2015): "Shocks abroad, pain at home? Bank-firm-level evidence of the international transmission of financial shocks", IMF Economic Review, vol 63, pp 698–750.

Peek, J and E Rosengren (1997): "The international transmission of financial shocks: the case of Japan", American Economic Review, vol 87, no 4, pp 495–505.

Popov, A and G Udell (2012): "Cross-border banking, credit access, and the financial crisis", Journal of International Economics, vol 87, no 1, pp 147–61.

Shin, H S (2012): "Global banking glut and loan risk premium", IMF Economic Review, vol 60, no 2, pp 155–92.

Annex A: Sources of credit

This annex defines key terms and concepts used throughout the feature, based on the BIS Glossary and the Box in a previous feature in this series (Hardy et al (2024a)).

- Domestic positions: claims9 or liabilities of a domestic bank vis-à-vis residents of the bank's home country. They are not usually covered in the IBS.

- Cross-border positions : positions on a non-resident – for example, a claim on or liability to a counterparty located in a country other than the country where the banking office that books the position is located.

- Local positions: claims on or liabilities to a counterparty located in the same country as the office that books the positions (the opposite of "cross-border positions"). Local positions in the home country are domestic positions (1).

- International positions: positions on a non-resident or denominated in a foreign currency. International claims comprise cross-border claims in any currency plus local claims of foreign affiliates in non-local (foreign) currencies.

- Foreign position: claims on, or liabilities to, residents of countries other than the country where the controlling parent is located. Foreign claims comprise positions 2 + 3 above, ie local claims of the bank's offices abroad as well as cross-border claims of the bank's offices worldwide.

Endnotes

AFME = Africa and Middle East; EM Asia = emerging Asia; EMEU = emerging Europe; LatAm = Latin America. All graphs are based on data from the locational banking statistics (LBS) and the consolidated banking statistics (CBS). China does not report to the CBS.

"Emerging market economies (EMEs)" is used as a short form for emerging market and developing economies, the set of economies not classified as advanced economies (AEs) in the BIS country grouping convention. The names of jurisdictions corresponding to ISO codes are provided under the abbreviations on pages iv–vii.

Graph 1.B: The number of countries in each region are: AEs (24), AFME (4), EM Asia (10), EMEs (32), EMEU (12) and LatAm (6).

Graph 2.A: International claims extended by foreign banks are derived as the sum of all parent bank nationalities in the BIS consolidated banking statistics on an immediate counterparty basis and estimated international claims of nine parent bank nationalities that do not report to the CBS (from the BIS locational banking statistics by nationality). Interoffice claims are included in "Banks" (red bars) prior to 1983.

Graph 2.B: The following reporting countries are excluded due to data unavailability or because they started reporting later than 2003: AT, CL, HK, KR, LU, MX and PA.

Graph 3: The numerator of the FBP rate is the sum of international claims (IC) and local claims in local currency (LCLC) on non-bank borrowers, on an immediate counterparty basis. IC consist of cross-border claims of foreign banks plus local claims extended in foreign currency by hosted foreign banks (in domestic economy). LCLC are claims made by foreign banks resident in the domestic economy to domestic non-bank borrowers in the domestic currency; LCLC to non-bank borrowers are calculated by multiplying LCLC on all sectors (on an immediate counterparty basis) by the share of non-banks in total foreign claims (on a guarantor basis). Since most countries started reporting claims on an guarantor basis around end-2004, the Q1 2005 figures are used for the shares between 2000 and 2004.

Graph 3.A: The regional aggregates are made up of 23 AEs and 31 EMEs.

Graph 3.B: The number of countries in each region are: AFME (7), EM Asia (8), EMEU (9) and LatAm (7).

Graph 3.C: The regional aggregates are made up of 16 AEs and 18 EMEs. Foreign currency share of bank credit: the currency composition of banks' cross-border claims on non-banks in a country is captured in the BIS LBS, which break down cross-border claims into five major currencies (USD, EUR, JPY, GBP and CHF). The method for obtaining the currency breakdown of domestic credit to non-banks depends on the country. In the LBS, reporting countries provide the same breakdown for banks' local positions in foreign currencies, and thus the difference between this total and domestic credit is the amount in domestic currency. This yields the estimates for EMEs that themselves report to the LBS (ie BR, CL, MX, KR, TR and ZA). For other EMEs, the share of local claims in foreign currency of domestic credit is estimated as the difference between BIS reporting banks consolidated cross-border claims (guarantor basis) and their international claims (IC basis) (ie local claims in non-local currencies booked by foreign banks). Thus, the figures are incomplete for these countries because (a) there is no explicit currency breakdown for this piece, and thus assumptions are required to determine the USD, EUR, JPY, GBP and CHF shares; and (b) the positions of domestic banks' local foreign currency positions are not known. For (b), we assume for most countries that these banks' local positions are all in domestic currency.

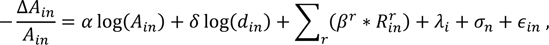

Graph 7B: "Average contraction driven by bank nationality" is derived from a nationality fixed effect σn derived from the following regression equation in McCauley et al (2019):

where ΔAin is the peak-to-trough contraction in foreign claims Ain of bank nationality n on borrowers in country i. din is the geographic distance between home and borrower countries, Rrin are the values of various balance sheet variables of the foreign affiliate measured at the peak of Ain. These include balance sheet size, peak-to-trough contraction (of the affiliate), local intermediation share, interbank funding ratio, foreign currency funding ratio, cross-border funding ratio, cross-border excluding intragroup ratio, net intragroup funding, intragroup funding received, pre-crisis expansion (log) and a post-crisis recovery dummy. λin is a borrower country fixed effect. Credit losses for each nationality are the maximum credit losses on securities (from Bloomberg-reported company statements) and non-performing loans (from S&P CapitalIQ) expressed as a share of Tier 1 capital in 2008.

1 This is the fifth article in a series showcasing the BIS international banking and financial statistics, following McGuire et al (2024a, 2024b) and Hardy et al (2024a, 2024b). We thank Stefan Avdjiev, Gaston Gelos, Benoît Mojon, Swapan-Kumar Pradhan, Andreas Schrimpf, Ilhyock Shim, Hyun Song Shin, Goetz von Peter and Sonya Zhu for their helpful comments, and Jhuvesh Sobrun for excellent research assistance. The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements.

2 Domestic credit, as usually measured, captures only loans or securities booked at banks in a given jurisdiction vis-à-vis residents of that jurisdiction. The addition of cross-border bank credit (from the IBS) yields a measure of the total credit provided by banks to non-banks in a particular country.

3 The declining FBP rates are thus consistent with the declining reliance on foreign currency credit in general (Avdjiev et al (2024), Gelos et al (2024)).

4 See BIS, "BIS global liquidity indicators: methodology", December 2022, at www.bis.org/statistics/gli/gli_methodology.pdf, for the GLI compilation methodology..

5 International investors also hold local currency bonds issued in domestic markets, but these are not captured in the GLIs (Gelos et al (2024)).

6 Berkmen et al (2012) show that financial factors were key in determining the size of the growth impact of the GFC. Leverage and the share of short-term debt in GDP are significant explanatory variables in various regression specifications. Lending from advanced economies also factors in significantly.

7 See, inter alia, IMF (2018), Albertazzi and Bottero (2014), Kim and Mitra (2014), Popov and Udell (2012), Borio et al (2011), CGFS (2011), Espinosa-Vega et al (2010).

8 In addition, some provisions in the Basel III framework may help policymakers dampen unwanted credit flows. "Jurisdictional reciprocity", as detailed in BCBS (2010), should help promote supervisory coordination across jurisdictions. Supervisors in a jurisdiction seeking to dampen cross-border bank credit in that jurisdiction can coordinate with supervisory authorities abroad in setting buffer requirements on the creditor banks' cross-border positions.

9 In the BIS LBS, bank claims comprise: (i) loans and deposits; (ii) holdings of debt securities; and (iii) derivatives with a positive market value and other residual instruments (combined). Credit is defined as the sum of (i) and (ii). In the BIS LBS, derivatives are broken out from claims, see Hardy et al (2024a).