International finance through the lens of BIS statistics: the geography of banks' operations

Global banks differ substantially in how they structure their operations across host countries. This feature draws on the BIS international banking statistics to distinguish between "international" bank structures, where positions with counterparties abroad are mainly booked from banks' home offices, and "multinational" structures, where they are booked in affiliates in host countries. It then assesses how differences in these structures shape banks' funding patterns, and what they imply for regulatory oversight and, ultimately, financial stability.1

JEL classification: F34, F36, G21, F23, F31, F36, G15

Banks' global operations are shaped by their history and the economic and regulatory environments in which they operate. Japanese banks rode the post-war industrial boom in Japan to become dominant lenders in cross-border banking by the late 1980s. In the 1990s, Spanish banks expanded their global footprint, mainly in Latin America, with a model that prioritised stand-alone affiliates. For their part, other European banks and US banks embarked on a merger spree throughout the 1990s that transformed them into universal banks with offices in major financial centres that serve all types of clients in every corner of the world. The imprints of these histories are still discernible in banks' global operations today.

Operating abroad exposes banks to complexities and risks that do not arise in purely domestic banking. Banks that lend exclusively at home tend to deal mainly in the domestic currency, face a single regulatory authority, enjoy access to liquidity from the home central bank and compete with other banks in a familiar financial landscape. By contrast, internationally active banks compete on a global stage, face multiple regulatory authorities and deal in various currencies where access to liquidity is not always guaranteed. Banks' geography – ie their organisational structure across countries – has bearing on how resilient they are to economic shocks and is thus of first-order importance for financial stability.

This feature is a primer on how the BIS international banking statistics (IBS) can be used to gain insights into the geography of banks' global operations. These statistics track the outstanding assets and liabilities of banks of a given nationality in various locations where they have offices, eg the balance sheet of the offices in Japan of banks headquartered in the United Kingdom ("UK banks"). This helps to shed light, for example, on how intragroup positions (ie "internal markets") enable funds raised in an office in one location to be used by offices elsewhere.

Key takeaways

- The BIS international banking statistics reveal banks' structures across home and host country locations, thus providing a view of banks' consolidated operations with geographic detail.

- Banks with an international structure mainly lend cross-border from their home country. Multinational banks use affiliates in host countries and allocate funds across the group via intragroup positions.

- Bank structure shapes the profile of risks that banks face as well as their ability to withstand funding shocks, access foreign currency liquidity and comply with home and host country regulation.

Banks headquartered in 15 countries, which account for the bulk of cross-border banking activity, operate with somewhat distinct organisational structures. Banks with an international structure borrow and lend abroad mainly from their home office (eg Japanese banks), drawing on their domestic deposit base. Others adopt a multinational structure, operating branches and subsidiaries in multiple jurisdictions. The multinational structure, in turn, can take different forms: centralised banks pool funds at major offices (eg in financial centres) and deploy them across the banking group (eg Swiss banks), whereas decentralised banks have autonomous subsidiaries that raise deposit funding to finance local assets (eg Spanish banks) (CGFS (2010)).

Each structure is associated with trade-offs and risks. The pooling of resources in a global treasury in international or centralised multinational structures tends to be cost-efficient and robust to local shocks in host countries but can make banks more vulnerable to disruptions in wholesale funding markets. By contrast, a decentralised multinational bank that raises deposits autonomously in each host location where it lends forgoes the benefits of centralised pooling but may be insulated from disruptions in global funding markets.

Episodes of financial volatility and elevated country risk have exposed the importance of bank structure for financial stability. For example, during the Great Financial Crisis (GFC) of 2008–09, centralised multinational banks that had relied extensively on wholesale funding markets were particularly vulnerable when those markets seized up. Banks with autonomous subsidiaries were more insulated from those disruptions. With post-crisis deleveraging and regulatory reforms, banks gravitated towards international or multinational decentralised structures.

Banks' intragroup cross-border funding has played a supportive role during such stress events, but it can also be a vulnerability. For example, when non-US banks faced difficulty in rolling over dollar funding during the GFC and in March 2020, extraordinary policy measures in the form of central bank swap lines were required to restore market functioning. Those banks with affiliates in countries that had access to dollar liquidity were able to deploy funds to affiliates elsewhere, leading to a surge in intragroup cross-border dollar flows. At the same time, multinational banks that rely extensively on cross-border intragroup funding are vulnerable to changes in regulation or macroeconomic downturns in funding locations that may impede the release of funds for use elsewhere.

This feature uses the IBS to first characterise banks' global operations, distinguishing between those with international and multinational (de)centralised structures. It then examines the importance of intragroup funding and how banks' structures affect their resilience to global funding shocks. The final section concludes.

The architecture of global banking

Historically, many banks that engaged in transactions with counterparties abroad often did not establish a foreign presence. In the 19th century, merchant or investment banks, eg those started by the Morgans, Rothschilds and Barings, were engaged in trade finance and foreign bond issuance; they undertook this activity without establishing affiliates abroad (Jones (1992)).2 At the same time, British overseas banks established branches in the colonies. A second wave of multinational banking was led by US banks in the 1960–70s, to serve corporates, exploit regulatory differences and run wholesale market operations in financial centres.

The organisational structures seen today have been shaped by domestic economic booms, recurrent financial crises and subsequent regulatory changes, and waves of bank mergers and acquisitions. Riding the post-war economic boom in Japan, low capital costs enabled Japanese banks to lever up and expand internationally. They facilitated the export of capital from Japan to borrowers elsewhere, driving a surge in interbank lending in the second half of the 1980s. Concerns that Japanese banks were undercapitalised during this period were an impetus for the first Basel capital accord in 1988 (Ito and Hoshi (2020)). For their part, several European and US banks that operate today emerged as global giants from the merger and acquisition wave that began in the late 1980s and culminated in the GFC.3 These banks established extensive international networks with major operations in key financial centres such as London and New York.

The structure of banks' consolidated global operations

The IBS are a unique source of information for understanding banks' organisational structures across countries. The IBS are aggregate data that group banks by residence (where they operate) and by nationality (where they are headquartered). For each of these perspectives, banks' assets and liabilities are broken down by the sector and country of residence of its counterparties (see Box A). The IBS can thus be used to deconstruct, at the level of national banking systems, banks' consolidated balance sheets according to the geography of their operations across countries. This helps to characterise the structure of banks' operations, as discussed below.

A banking group may have offices in multiple host countries that serve different functions. Some offices are sources of funding for the consolidated bank group, to be on-lent elsewhere. By contrast, other offices are local intermediaries that fund and lend within a host country, or international intermediaries that engage mainly in cross-border funding and lending (Box B). In some host jurisdictions, the regulatory and/or economic environment favours one office type over others. A banks' overall consolidated structure will reflect the mix of office types that make up the whole.

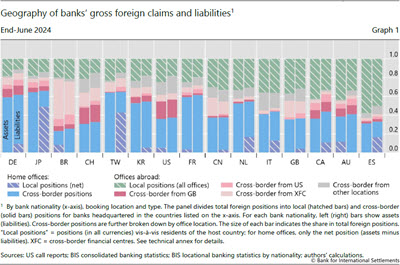

A useful starting point for characterising banks' operations is to examine this mix, focusing on where banks book their foreign claims and liabilities (Graph 1).4 At one end of the spectrum are Japanese and German banks, which have large home offices that lend to the rest of the world. Most of their foreign claims are booked as cross-border positions by their home offices in Tokyo and Frankfurt (left bars, blue area). Japanese banks fund around half of their foreign claims via net borrowing from domestic depositors (right bars, purple area).

At the other end of the spectrum are banks that engage mainly in local intermediation in multiple host countries. Spanish banks stand out as having the largest share of their foreign positions booked as local positions in the country of the borrower (Graph 1, green bars). This reflects a preference of banks and supervisors at home and in host countries (eg Latin America) to fund offices in those countries through local deposits (CGFS (2010); Argimón (2019)). Australian banks, with their large presence in New Zealand, have a similar structure.

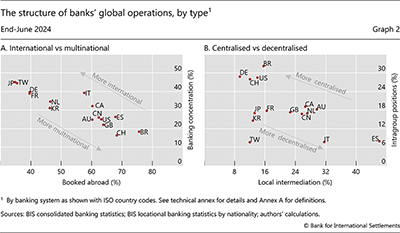

The geographic patterns suggest that banking systems can be broadly characterised along two dimensions. The first captures banks' local presence across countries (Graph 2.A). Banks with an international structure run business mainly out of their home country (eg Japanese, German and French banks). Accordingly, they book a low share of positions abroad (dots to the left) and concentrate their positions on a few booking locations (dots towards the top). Other banks have a multinational structure, with sizeable foreign branches and subsidiaries in multiple jurisdictions. Spanish, Swiss, UK and US banks thus appear in the opposite quadrant (dots to the bottom right), since they raise most funds abroad in multiple host countries.

While the international structure is necessarily centralised, the multinational structure can also be decentralised. This second dimension is about the internal organisation of a banking group (Graph 2.B). Centralised banks pool funds at headquarters or at offices in financial centres and deploy them elsewhere via intragroup positions. Swiss, German, US and Brazilian banks stand out in this regard. Decentralised banks let their affiliates raise funds autonomously to finance assets in each country (CGFS (2010)). This often involves a high share of local intermediation through retail subsidiaries.5 Accordingly, Spanish, Italian and Australian banks rely more on local intermediation than on intragroup funding (bottom right).

A bank's structure is rooted in its broader business model – subject to regulatory constraints. Banks with an international structure often rely on a large domestic deposit base to shift capital out of their home countries (eg Japan or Germany), where they centralise control at headquarters. Those with a centralised multinational structure may operate in financial centres outside their home country (eg Swiss banks in wealth management and US banks in investment banking and capital markets). They do so with a central treasury that pools and deploys resources across the group (CGFS (2010); Pokutta and Schmalz (2011); Cetorelli and Goldberg (2012)). More retail-focused decentralised banks with global footprints (eg Spanish banks) often take over local banks and let them operate autonomously (CGFS (2010)).6

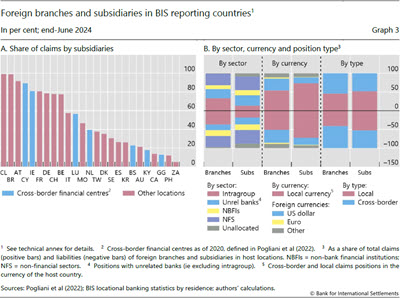

Each structure tends to go with a particular choice between branches and subsidiaries. Unlike subsidiaries, branches do not have their own capital; they operate as an extension of the parent bank's balance sheet. While this makes them easy to manage and integrate in centralised operations, branches may not meet host country regulatory requirements for certain operations, eg taking insured deposits. Decentralised multinational banks therefore rely more on subsidiaries, incorporated as separate legal entities adapted to local regulations and market conditions. Some host countries (eg Brazil, Chile) favour subsidiarisation of foreign banks (Graph 3.A). Banking groups with major operations in such countries (eg Spanish banks) are shown to be decentralised in IBS data. On the other hand, branch activity is more prevalent in some cross-border financial centres (eg the Cayman Islands (KY), Guernsey (GG) and the Bahamas (BS)).

Foreign branches and subsidiaries operate with distinct balance sheet structures. Branches typically have larger interbank positions, particularly intragroup positions, reflecting their integration with the group's balance sheet (Graph 3.B). Subsidiaries, on the other hand, typically have larger positions vis-à-vis the non-financial sector, as being incorporated as subsidiaries facilitates deposit-taking and compliance with local regulatory requirements (Fiechter et al (2011); OECD (2017)). Branches often deal more in foreign currency and more with cross-border counterparties, since they are less often subject to host country limits on foreign exchange and interbank exposures. With this flexibility comes potential instability: compared with foreign subsidiaries, lending by foreign branches tends to be more volatile and more reactive to economic conditions in both their home and host countries (Aldasoro et al (2022)).

Banks' structures have evolved in response to changes in the economic and regulatory environment. Multinational banking was ascendent in the two decades before the GFC, reflected in the rise of local banking. After the emerging market crises of the 1980s and 1990s, banks shifted towards the multinational decentralised structure.7 As a result, the share of local currency claims in foreign claims on emerging market economies rose from 7% in 1983 to near 40% in the early 2000s (Hardy et al (2024)).8

This trend slowed in the 2000s. The introduction of the euro spurred an area-wide interbank market, and European banks ramped up their cross-border investment in asset-backed securities when US markets boomed. This boosted London's position as Europe's financial hub. In emerging markets, cross-border bank flows resumed in the mid-2000s in response to higher yields and US dollar depreciation (Galati et al (2007); CGFS (2009)).

Further reading

The expansion of cross-border activity from offices in major financial centres proved to be transitory. The GFC exposed weaknesses in banks' overextended balance sheets and forced a broad deleveraging. Disruptions in funding markets disproportionately affected multinational banks that had relied on centralised operations (see the next section). Following the GFC, the international regulatory framework was strengthened (Basel III), and many countries tightened regulation of banks operating in their jurisdiction (Borio et al (2020)). Common measures included requirements to operate as subsidiaries, resolution frameworks and restrictions on business models, including on cross-border positions.9

These changes, especially when imposed by host country regulators, discouraged dependence on centralised wholesale funding. Some centralised multinational banks – in particular European banks – reacted by scaling down foreign operations in financial centres, shifting away from a multinational and towards an international structure (McCauley et al (2019)). Other banks gravitated towards the decentralised multinational model (Caparusso et al (2019).10

Implications of bank structure for policy

Bank structure shapes the profile of risks that banks face. For one, it has implications for the resilience of banks' funding models, which depend on their ability to shift funding internally between office locations. For another, the location of banks' affiliates matters in terms of access to central bank liquidity, particularly in foreign currencies. These have bearing on banks' ability to provide credit to the economy and thus are of concern to policymakers.

Bank resilience during the GFC

International bank credit contracted sharply in the wake of the GFC and again during the European sovereign debt crisis of 2010–12. Many interrelated factors affected the extent of contraction, including banks' business models, their asset quality and funding structures, recessions in countries they operated in, and home and host country regulations.

To disentangle the various factors at play, McGuire and von Peter (2016) examine how major banks' affiliates shed assets across host countries after the GFC. The IBS structure makes it possible to jointly examine the claims and liabilities of banks' foreign offices in different countries, separately from their parent. This in turn enables analysis of the peak-to-trough contraction in assets during the GFC that accounts for factors specific to bank nationality, host country and bank offices (notably their funding mix). Contractions were larger for: (i) offices operating in troubled economies and financial centres (host country effect); (ii) offices that were more exposed to the financial crisis (bank nationality effect); and (iii) offices with a fragile funding mix that relied more on interbank, foreign currency or cross-border funding than on local deposits (funding source effect).11

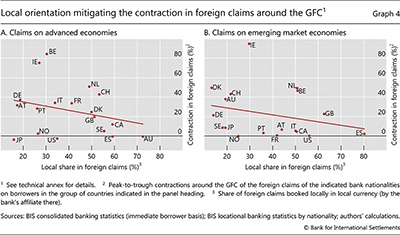

Banks with a decentralised multinational structure fared better in the wake of the GFC. Operating autonomous subsidiaries – ie with local claims funded by local liabilities – can shield banks from shocks to global wholesale funding markets.12 Banks that had, on the eve of the GFC, booked a higher share of their overall foreign claims locally in local currencies (Graph 4, x-axis) experienced smaller subsequent contractions (y-axis). These affiliates' local operations, which are often retail banking activity, proved to be resilient when global wholesale funding markets seized up.13 By contrast, affiliates that relied more on other liabilities (eg cross-border, interbank or foreign currency funding) saw larger balance sheet contractions.

Internal markets: banks' intragroup funding

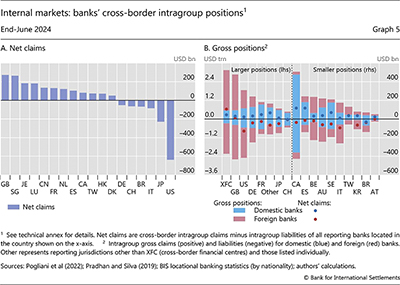

Banking groups routinely deploy funds raised in funding markets to investment markets (Cetorelli and Goldberg (2012)). A bank may set up funding operations in countries with a large deposit base or deep bond markets to fund credit by affiliates elsewhere that cannot rely on local deposits. For example, Swedish banks financed their operations in the Baltics in the 2000s through intragroup funding (CGFS (2010)). In the IBS for mid-2024, the United Kingdom and Singapore appear as funding centres – as evidenced by large net intragroup claims (Graph 5.A). By contrast, banks in the United States, Japan and Italy are net users of intragroup funds.

Domestic and foreign banks in a given country use intragroup positions in somewhat distinct ways (Graph 5.B). In France, Japan and Switzerland, for instance, most positions are reported by domestic banks (blue bars), while foreign banks (red bars) play a greater role in countries with financial centres (eg United States, United Kingdom) and in smaller cross-border financial centres (XFC). Domestic banks typically extend net intragroup funding to their affiliates abroad (blue dots), while foreign branches and subsidiaries are net receivers (red dots below zero).

Dollar funding is of particular importance, since the US dollar is the dominant currency across financial markets (McGuire et al (2024b)). Non-US banks hold large asset positions denominated in US dollars and use their network of affiliates around the world to source dollar funding. Less than a quarter (23% at end-2023) of their dollar liabilities are booked by their affiliates in the United States, where dollar funding markets are deep and banks have access to Federal Reserve facilities. The bulk is borrowed either by their home office or by offices elsewhere, in jurisdictions where the dollar is a foreign currency (Aldasoro and Ehlers (2018)).

Intragroup positions are especially important following regulatory changes. Prior to the GFC, non-US banks raised dollar funding from their US operations to lend intragroup to affiliates elsewhere. With US quantitative easing after the GFC and subsequent changes in Federal Deposit Insurance Corporation (FDIC) regulation, intragroup flows reversed as these banks invested heavily in reserve holdings at the Federal Reserve (Kreicher et al (2013)).

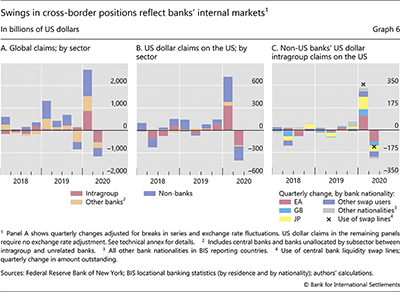

Similarly, intragroup positions are essential for reallocating funds during periods of financial stress. During the GFC and again in March 2020, non-US banks tapped dollar facilities at major central banks and used intragroup positions to allocate dollars. Intragroup flows in all currencies explained almost $1 trillion of the outsize expansion in cross-border flows in the first quarter of 2020 (Graph 6.A). The surge in intragroup dollar flows, mostly vis-à-vis affiliates in the United States (Graph 6.B), largely reversed in the second quarter as financial conditions improved (Aldasoro et al (2020)).

These extraordinary movements reflect how funds secured via the Federal Reserve's US dollar swap lines propagated through the global banking network via intragroup positions. By end-March 2020, a total of $358 billion had been drawn from dollar swap lines. In practice, banks draw on the swap line by booking a liability to their home central bank and an intragroup claim on their US affiliate that obtains dollar reserves at the Federal Reserve (Aldasoro et al (2020); McCauley (2024)). Not by coincidence, banks in Japan, the euro area and the United Kingdom, which tapped dollar swap lines the most, reported the largest increases in intragroup dollar claims on their affiliates in the United States (Graph 6.C).14

Conclusion

Banks' organisational structures reflect their unique histories and business models and have evolved with changes in the regulatory and economic environments in which banks operate. The BIS IBS are a unique source of data on banks' structures since they provide a view of banks' global consolidated operations at the level of the constituent parts. This reveals not only the location of banks' major affiliates but also the location of their funding sources and use of internal markets.

The geography of banks' global operations has important policy implications. It has a bearing on banks' resilience. Supervisory guidance by both home and host regulators can push banks to a decentralised multinational structure, which proved resilient during the GFC. At the same time, a purely local orientation in a host country limits a foreign bank's ability to intermediate capital flows that can benefit host countries. Further, managing access to foreign currency liquidity during stress events is a global challenge that requires cooperation between central banks: banks without affiliates in countries with access to dollar liquidity facilities may face constraints.

References

Aldasoro, I, C Cabanilla, P Disyatat, T Ehlers, P McGuire and G von Peter (2020): "Central bank swap lines and cross-border bank flows", BIS Bulletin, no 34, December.

Aldasoro, I, J Caparusso and Y Chen (2022): "Global banks' local presence: a new lens", BIS Quarterly Review, March, pp 31–43.

Aldasoro, I and T Ehlers (2018): "The geography of dollar funding of non-US banks", BIS Quarterly Review, December, pp 15–26.

Argimón, I (2019): "Spanish banks' internationalisation strategy: characteristics and comparison", Banco de España, Economic Bulletin, no 1, January.

Borio, C, M Farag and N Tarashev (2020): "Post-crisis international financial regulatory reforms: a primer", BIS Working Papers, no 859, April.

Caparusso, J, Y Chen, P Dattels, R Goel and P Hiebert (2019): "Post-crisis changes in global bank business models: a new taxonomy", IMF Working Papers, no 19/295, December.

Cetorelli, N and L Goldberg (2012): "Liquidity management of US global banks: internal capital markets in the great recession", Journal of International Economics, vol 88, no 2, pp 299–311.

Committee on the Global Financial System (CGFS) (2009): "Capital flows and emerging market economies", CGFS Papers, no 33, January.

--- (2010): "Funding patterns and liquidity management of internationally active banks", CGFS Papers, no 39, May.

de Haas, R and I van Lelyveld (2014): "Multinational banks and the global financial crisis: weathering the perfect storm?", Journal of Money, Credit and Banking, vol 46, no s1, pp 333–64.

Fiechter, J, I Ötker-Robe, A Ilyina, M Hsu, A Santos and J Surti (2011): "Subsidiaries or branches: does one size fit all?", IMF Staff Discussion Notes, no 11/04, March.

Galati, G, A Heath and P McGuire (2007): "Evidence of carry trade activity", BIS Quarterly Review, September, pp 27–41.

Hahm, J-H, H S Shin and K Shin (2013): "Noncore bank liabilities and financial vulnerability", Journal of Money, Credit and Banking, vol 45, issue s1, pp 3–36.

Hardy, B, P McGuire and G von Peter (2024): "International finance through the lens of BIS statistics: bank exposures and country risk", BIS Quarterly Review, September, pp 69–86.

Ichiue, H and F Lambert (2016): "Post-crisis international banking: an analysis with new regulatory survey data", IMF Working papers, no16/88, April.

International Monetary Fund (IMF) (2015): "International banking after the crisis: increasingly local and safer?", Global Financial Stability Report, chapter 2, April, pp 55–91.

Ito, T and T Hoshi (2020): The Japanese economy, second edition, MIT Press.

Kamil, H and K Rai (2010): "The global credit crunch and foreign banks' lending to emerging markets: why did Latin America fare better?", IMF Working Papers, no 10/102, April.

Kreicher, L, R McCauley and P McGuire (2013): "The 2011 FDIC assessment on banks' managed liabilities: interest-rate and balance-sheet responses", BIS Working Papers, no 413, May.

McCauley, R (2024): "The offshore dollar and US policy", Federal Reserve Bank of Atlanta Policy Hub, no 2-2024.

McCauley, R, A Bénétrix, P McGuire and G von Peter (2019): "Financial deglobalisation in banking?", Journal of International Money and Finance, vol 94, June, pp 116–31.

McGuire, P and G von Peter (2016): "The resilience of banks' international operations", BIS Quarterly Review, March, pp 65–78.

McGuire, P, G von Peter and S Zhu (2024a): "International finance through the lens of BIS statistics: residence vs nationality", BIS Quarterly Review, March, pp 73–88.

--- (2024b): "International finance through the lens of BIS statistics: the global reach of currencies", BIS Quarterly Review, June, pp 1–16.

Organisation for Economic Co-operation and Development (OECD) (2017): The conditions for establishment of subsidiaries and branches in the provision of banking services by non-resident institutions, January.

Peek, J and E Rosengren (1997): "The international transmission of financial shocks: the case of Japan", American Economic Review, vol 87, no 4, pp 485–505.

Pogliani, P, G von Peter and P Wooldridge (2022): "The outsize role of cross-border financial centres", BIS Quarterly Review, June, pp 1–15.

Pokutta, S and C Schmalz (2011): "Managing liquidity: optimal degree of centralization", Journal of Banking and Finance, vol 35, no 3, pp 627–38.

Pradhan, S-K and J-F Silva (2019): "Using mirror data to track international banking", IFC Working Papers, no 19, December.

Annex A: The structure of banks' operations

This annex defines key terms and concepts used throughout the feature, based on the BIS Glossary and the Box in the previous feature in this series (Hardy et al (2024)).

-

Domestic positions: claims15 or liabilities of a domestic bank vis-à-vis residents of the bank's home country.

-

Cross-border positions: positions on a non-resident – for example, claim on or liability to a counterparty located in a country other than the country where the banking office that books the position is located.

-

Local positions: claims on or liabilities to a counterparty located in the same country as the office that books the positions (the opposite of cross-border positions). Local positions in the home country are domestic positions (see 1.).

-

International positions: positions on a non-resident or denominated in a foreign currency. International claims comprise banks' cross-border claims in all currencies plus their local claims denominated in foreign currencies.

-

Foreign positions: claims on, or liabilities to, counterparties outside the bank's home country (typically the country of headquarters). Foreign claims comprise positions 2 and 3 above, ie local claims of the bank's offices abroad as well as cross-border claims of the bank's offices worldwide.

-

Gross foreign positions: foreign positions plus intragroup positions and net local claims (or liabilities) on home country residents (Graph 1). This, together with gross domestic positions on home country residents, makes up the total of banks' global positions, ie all financial positions on banks' balance sheets.

The various indicators on the structure of banks' operations (Graph 2) can be constructed from foreign positions broken down by booking location. Let FCn denote gross foreign claims (and FLn gross foreign liabilities) of banks headquartered in country n (nationality), and FCnl denote those booked in country l (office location), so  . When foreign claims and liabilities are combined, the share of foreign positions booked in country l equals

. When foreign claims and liabilities are combined, the share of foreign positions booked in country l equals  .

.

The share booked abroad is the share of positions booked by offices abroad, ie the share not booked at home, 1-snn. The share booked abroad equals 0 for banks booking all positions in their home country, as would be the case for purely domestic banks or international banks booking cross-border claims from their headquarters.

Booking concentration can be measured by the Herfindahl-Hirschman index,  . It equals one if all positions are booked in one location (eg at home) and falls when banks book positions in a greater number of countries in similar amounts.

. It equals one if all positions are booked in one location (eg at home) and falls when banks book positions in a greater number of countries in similar amounts.

Intragroup positions are the sum of gross intragroup claims and liabilities across all offices, as a share of gross foreign positions (FCn + FLn).

Local intermediation is the minimum of local claims and local liabilities (in all currencies) across all office locations, scaled by overall foreign claims:

where LCnl stands for local claims in country l booked by banks from n, and LLnl likewise stands for local liabilities. This indicator is zero for banks that source liabilities in one country to fund lending in another. It approaches unity for banks acting as local intermediaries without relying on any cross-border lending or funding.

Technical annex

All graphs are based on data from the LBS and CBS. While China does not report to the CBS, its data in Graph 1 and Graph 2 are estimated using (incomplete) data available in these two data sets. Banking systems with long historical data for local claims in local currency are BE, CA, CH, DE, ES, FR, GB, IT, JP, NL and US. For the denominator (foreign claims), all reporters are included irrespective of whether a country reported local claims in local currency. The cross-border financial centres (XFC) comprise 23 jurisdictions, of which 14 report locational banking statistics. They are BH, BM, BS, CY, GG, HK, IE, IM, JE, KY, LU, NL, PA and SG. The data for these jurisdictions are shown aggregated together in Graph 1, Graph 3.A and Graph 5.B.

"Emerging market economies" is a short form for emerging markets and developing economies, the set of economies not classified as advanced economies in the BIS country grouping convention. Cross-border financial centres are defined in Pogliani et al (2022). The names of jurisdictions corresponding to ISO codes are provided under the abbreviations on pages iv–vii.

Graph 1: All LBS reporting jurisdictions except BH, CN, IN, JE, JP, PA, SG, TR and US report local currency claims and local liabilities of banks' foreign affiliates in their jurisdictions (IN and JP report these local positions only for domestic banks). The consolidated banking statistics on an immediate borrower basis (CBSI) data fill this gap for bank nationalities shown on the x-axis. The CBSI are also sourced for these positions in all countries other than BIS LBS reporting countries. Intragroup claims (liabilities) vis-à-vis non-reporting countries are mirrored as liabilities (claims) of affiliates in these locations. XFC = cross-border positions booked by offices in cross-border financial centres (Pogliani et al (2022)), excluding NL, which is shown separately. Local positions of banks in the United States for Chinese banks are sourced from the US call reports.

Graph 2: Banking concentration, intragroup positions and local intermediation are defined in Annex A. The Herfindahl-Hirschman index is calculated for gross foreign claims and liabilities (both cross-border and local, including intragroup) by individual office location and expressed as a percentage. Booked abroad relates to the percentage of gross foreign claims and liabilities booked by offices outside the home country.

Graph 3: Based on the bank type breakdown (branch vs subsidiary) reported by 35 of 46 reporting countries (does not include BH, CN, GB, JE, JP, MX, NO, PA, SG, TR and US).

Graph 4: For each banking system, peak values are the maximum values observed in the Q1 2006–Q1 2009 period, and trough values are the minimum values in the Q2 2009–Q2 2012 period. Locally booked claims in local currency relate to the average share during the Q1 2006–Q1 2009 period. Taken from McGuire and von Peter (2016).

Graph 5: Domestic banks and foreign banks by host locations. The LBSN is used for the split of domestic and foreign banks. Reporting gaps in bilateral intragroup positions are filled in using mirror data techniques (see Pradhan and Silva (2019)). Panel A shows net positions of all banks (domestic and foreign banks) in the host locations.

Graph 6: Non-banks in panels A and B include non-banks and those unallocated by sector. Changes in intragroup claims (panel C) are derived from estimated stocks using mirror data reported by two or more jurisdictions for each observation. The approach reconciles banks' reported claims on related offices in the United States with the intragroup liabilities of those same offices vis-à-vis reporting banks outside the United States. EA banks are those headquartered in any of the 13 BIS reporting euro area countries. Other swap users comprise AU, CH, DK, KR, NO, MX and SG (KR and MX started to use their swap lines in Q2 2020).

1 The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements. This is the fourth feature in a series showcasing the BIS international banking and financial statistics, following McGuire et al (2024a, 2024b) and Hardy et al (2024). We thank Iñaki Aldasoro, Claudio Borio, Torsten Ehlers, Gaston Gelos, Robert McCauley, Benoît Mojon, Andreas Schrimpf, Hyun Song Shin and Sonya Zhu for their helpful comments, and Swapan-Kumar Pradhan for excellent research assistance.

2 Banks can also rely on correspondent banks to transact with counterparties abroad.

3 To name but a few, Deutsche Bank acquired Morgan Grenfell Group in the United Kingdom in 1989; Bankers Trust in the United States in 1999; and Scudder Investments, a US asset management firm, in 2002. UBS/SBC acquired SG Warburg plc in London in 1995. In 1997, it acquired Dillon, Read & Co, an investment bank in New York, and later merged with PaineWebber (in 2001). Credit Suisse increased its holdings in First Boston in 1990 and then reorganised into CSFB in 1996–97. Barclays created an investment banking operation in 1986, which subsequently developed into Barclays Capital. In 1995 Barclays purchased the fund manager Wells Fargo Nikko Investment Advisors, which was integrated with BZW Investment Management to form Barclays Global Investors.

4 The analysis defines home/domestic and foreign with respect to a bank's country of headquarters; the euro area is treated as 20 distinct countries. See also the glossary of terms in Annex A.

5 Local intermediation gauges the extent to which local claims are funded through local liabilities, rather than through crossborder (eg intragroup) borrowing (see Annex A).

6 On the pros and cons of a more decentralised structure in which a greater portion of lending to residents of a particular country is funded, managed and supervised by offices in the country, see CGFS (2010). Kamil and Rai (2010) present empirical evidence on the relative stability of banks' local activities in Latin America during the GFC.

7 Establishing or acquiring a local bank to borrow and lend locally avoided transfer risk, if not country risk (Hardy et al (2024)).

8 This feature uses "emerging market economies" as a short form for emerging market and developing economies, the set of economies not classified as advanced economies in the BIS country grouping convention.

9 See IMF (2015), informed by a survey of bank supervisors in 40 major banking markets, further examined by Ichiue and Lambert (2016).

10 Since 2009, Swiss, German and Dutch banks have downsized their operations abroad, giving their home offices a larger relative role. This shifted them towards the international structure (top left area in Graph 2). By contrast, Korean and Taiwanese banks have shifted in the direction of the decentralised multinational structure (bottom right area).

11 Hahm et al (2013) and de Haas and van Lelyveld (2014) find similar effects using country-level and bank-level data, respectively. Peek and Rosengren (1997) trace how Japanese banks transmitted financial distress at home to the supply of credit in the United States through their US affiliates. IMF (2015) finds cross-border lending is more volatile and has a stronger transmission of global shocks compared with local lending.

12 At the same time, autonomous affiliates can expose banks to local shocks and limit their role in intermediating capital flows that can benefit host countries.

13 For each country grouping, there is a weak but discernible downward slope in the regression line. That said, there are some clear outliers. For example, Dutch and Belgian banks experienced some of the largest overall contractions, reflecting the breakup of ABN AMRO and Fortis. By contrast, Japanese banks hardly contracted at all, yet they had the lowest ratio of local claims to foreign claims. Japanese banks were less exposed to toxic assets and suffered smaller losses during the crisis than did many European banking systems.

14 Cetorelli et al (2020b) suggest that the dollar liquidity obtained through the swap lines was an important source of funding for many foreign banks in the United States to handle drawdowns of credit lines by their customers.

15 In the BIS LBS, bank claims comprise (i) loans and deposits, (ii) holdings of debt securities, and (iii) derivatives with a positive market value and other residual instruments (combined). Credit is defined as the sum of (i) and (ii). In the BIS CBS, derivatives are broken out from claims. See Hardy et al (2024).