The US dollar and capital flows to EMEs

Over the past two decades, emerging market economies (EMEs) have shifted their external financing sources away from foreign currency bank lending to local currency bonds and equities. What does this imply for the drivers of capital flows? We document that the strength of the US dollar against advanced economy currencies is a key driver of local currency bond and equity flows as it affects global investors' risk appetite. Moreover, its importance has risen over the past decade, in part driven by a growing role of mutual funds among foreign investors. These findings may help EMEs achieve more stable external financing.1

JEL classification: G12, G15, G21, G23.

Since the Great Financial Crisis (GFC), the landscape of portfolio flows to emerging market economies (EMEs) has shifted radically. Portfolio inflows have become a much more important component of capital flows to these economies than bank lending. The growth in local currency bond and equity flows to EMEs has been particularly pronounced, while the share of their foreign currency (FX) borrowing (in the form of both bond and bank flows) has declined.

What does this change in financing patterns imply for the global drivers of capital flows? While a vast literature on capital flows has focused on the role of interest rate differentials and traditional proxies for global financial conditions and risk appetite (in particular the VIX), recent research has pointed to the role of the overall strength of the US dollar as a key driver (eg Hofmann et al (2022) and Bruno et al (2022)).

The current conjuncture underscores the importance of this issue. With some EMEs now cutting policy rates ahead of the United States, narrowing interest rate differentials between EMEs and the United States are seen by market commentators as exerting pressures on capital flows to EMEs. Therefore, it is crucial to understand how important different proxies for global risk appetite and interest rate differentials are in explaining these flows.

Against this backdrop, we first document the shifts in EMEs' external financing over the past two decades. Then we systematically assess and compare the key drivers of EMEs' external financing across types of portfolio flows and banking flows, focusing on the role of the US dollar relative to that of interest rate differentials and other proxies for global risk appetite. In doing so, we take care to avoid potential identification problems related to the possibility that exchange rate movements themselves may reflect EME fundamentals or could be affected by capital flows themselves. We also explore how the importance of these drivers of capital flows has evolved over time.

Key takeaways

- Since the Great Financial Crisis, local currency bond and equity flows have become more important components of total capital flows to EMEs; the share of foreign currency bank lending, by contrast, has declined.

- The US dollar as a proxy for the risk-taking propensity of global investors is a more important driver of local currency bond and equity flows than interest rate differentials. By contrast, changes in policy rate differentials continue to be an important driver of foreign currency loan flows.

- The US dollar's role as a determinant of capital flows to EME local currency bonds has risen since 2015, while that of the VIX has diminished somewhat.

Two main results stand out from our analysis. As our first core finding, we document that changes in the dollar's strength affect capital flows to local currency bonds and equities, but not those to FX bonds and loans. For local currency flows, the impact of the US dollar dominates that of interest rate differentials. By contrast, the VIX – the most commonly used proxy for global risk appetite – is not a strong driver of local currency bond flows, but matters for equity flows. Our second main finding is that the sensitivity of local currency flows to the US dollar appears to have increased since 2015, particularly for equity flows. By contrast, the importance of the VIX as a driver of local currency bond flows has declined somewhat.

What could explain these patterns? The crucial role of the US dollar is in line with its impact on the risk-taking propensity of global investors: when the dollar depreciates against foreign currencies, local currency assets in global portfolios gain in dollar value, raising the risk appetite of investors focused on dollar returns (Hofmann et al (2022)). It is also in line with the importance of return-chasing, US dollar-based investors. The growing importance of this factor probably reflects both the increasing share of local currency asset holdings in global investors' portfolios and the growing share of mutual funds as investors in EME local currency assets.2 The dwindling importance of the VIX, in turn, is consistent with its declining role as a gauge of global risk appetite documented elsewhere (eg Erik et al (2020), Miranda-Agrippino and Rey (2022) and Obstfeld and Zhou (2023)). More recently, the VIX has also been affected by structured products selling options and thus has become more distorted as a measure of risk-taking.3

The remainder of this article proceeds as follows. The first section describes the shift in the source of EMEs' external financing over the past two decades. The second provides a brief conceptual discussion of global factors and interest rate differentials as major drivers of capital to EMEs. The third analyses the impact of the US dollar, the VIX and policy rate differential on portfolio and banking flows, while the fourth examines how the roles of different drivers have evolved over time. The final section draws some policy implications.

Portfolio and banking inflows to EMEs

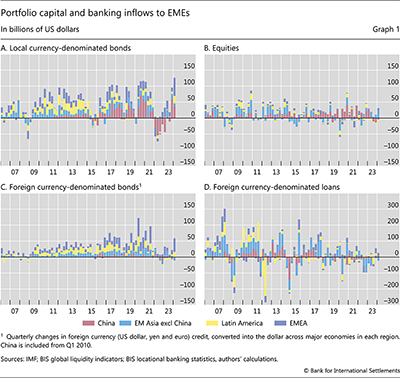

The growth in capital flows since the GFC saw a notable shift in composition from FX to local currency. Specifically, the volume of portfolio inflows to EME local currency bond and equity markets has become larger than that of FX bond and loan inflows since 2006 (Graph 1).4

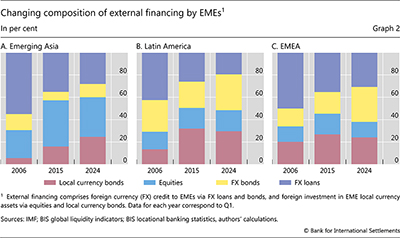

The share of external financing in local currency bonds and equities has grown particularly strongly in emerging Asia and Latin America (where it now stands at 60% and 50%, respectively) at the expense of the FX loan share (Graph 2). Notably, from 2006 to 2014, the share of local currency bond financing rose in all EME regions. From 2015 to the first quarter of 2024, the proportion declined slightly in Latin America, and emerging Europe, the Middle East and Africa (EMEA), but it continued to increase in emerging Asia.

The increased role of flows into local currency bonds reflects EMEs' efforts to reduce their reliance on FX loans and develop their domestic bond markets, as well as regulatory changes affecting global banks' business models (Ichiue and Lambert (2016)). Higher borrowing in local currency (overcoming "original sin") is generally seen to bring financial stability benefits as it avoids the build-up of FX mismatches among borrowers, which can entail substantial vulnerabilities and complicate policymaking. However, local currency flows do not come without risks. This is because they typically come with currency mismatches on foreign investors' balance sheets, so that exchange rate fluctuations affect investors' risk appetite. This implies that even though the currency mismatch of EME borrowers might be mitigated, EMEs' financial conditions may still be heavily influenced by global factors ("original sin redux"; see Carstens and Shin (2019)).

What factors drive portfolio and banking inflows to EMEs?

A useful and common way of thinking about drivers is to distinguish between push and pull factors (Koepke (2019)). Push factors are external to the recipient economy (such as US interest rates or balance sheet policies of advanced economy (AE) central banks). Pull factors are domestic (eg EME interest rates and local economic prospects). Push factors tend to be more important for lenders and investors, but in general pull and push factors affect both the supply and demand for funds. In the following, we discuss conceptually the role of three proxies for key push and pull factors: (i) proxies for global investors' risk appetite; (ii) the strength of the US dollar; and (iii) interest rate differentials between EMEs and the United States.5

Further reading

A drop in global investors' risk appetite can be expected to reduce demand for all EME assets across the board. The most popular proxy in the literature has been the VIX (Koepke (2019)). More recently, the strength of the dollar vis-à-vis other currencies has been proposed as a proxy for the risk appetite of US dollar-based investors. For example, Hofmann et al (2022) find that this risk-taking channel operates for foreign investors in EME local currency bonds, and Bruno et al (2022) for those in EME equities. A global investor who holds a diversified portfolio of assets in different currencies (unhedged), but who evaluates gains and losses in dollar terms typically faces an economic capital constraint which limits risk-taking. A broad-based dollar depreciation increases capital through the ensuing valuation effect on local currency assets, relaxing the value-at-risk (VaR) constraint. More generally, the positive wealth effect as such is likely to reduce effective risk aversion. Further, valuation effects that stem from the impact of the dollar on asset returns when converted into dollars may induce return-chasing investors to increase their exposure to EME local currency assets. All these effects work in the same direction.

By contrast, US dollar-based lenders extending EME credit only through US dollar-denominated bonds and loans are immune to the effects operating via this mechanism.6 That said, the dollar's strength can still have an indirect impact, because EME FX borrowers facing a currency mismatch are affected by the dollar's general strength to the extent that it has an impact on their balance sheet strength and repayment capacity.7 This could potentially dampen EME lending.

However, conceptually and empirically it is very important to distinguish broader US dollar movements driven by factors exogenous to the recipient country from those driven by domestic factors. After all, changes in the value of the local currency may reflect changes in the recipient country's economy, which would influence investors' demand for the economy's assets. Moreover, bilateral exchange rates themselves can be influenced by capital flows. We deal with this issue by focusing on strength of the US dollar against other AE currencies (ie excluding EME currencies) in our empirical research design.

Turning to interest rate differentials, both policy rate and bond yield differentials could drive capital flows, but through different channels depending on the types of flow. The bond yield differential is more relevant than the policy rate differential for investors in EME local currency and FX bonds, although the policy rate can affect long-term bond yields at least to some degree. We further expect the policy rate differential to be more important for FX loan flows than the long-term bond yield differential, since US dollar-denominated loans extended to EME borrowers are typically short-term (eg less than one-year maturity) or variable rate.

When EME bond yield differentials change, their impact on overall investor flows to EME local currency bonds can be ambiguous. On the one hand, a rise in an EME's bond yields vis-à-vis the United States increases the relative attractiveness of the EME's bonds to new carry-oriented investors such as insurance companies and pension funds, incentivising them to increase positions. On the other hand, for existing holders of local currency bonds, a rise in the EME's yields implies negative returns and valuation losses. This may, in turn, induce a negative wealth effect and tighten the economic capital constraint, which increases effective risk aversion and dampens demand for EME bonds. In addition, investors in EME local currency bonds who chase returns, such as mutual funds, may be driven to sell bond holdings.8

Impact of global factors and interest differentials

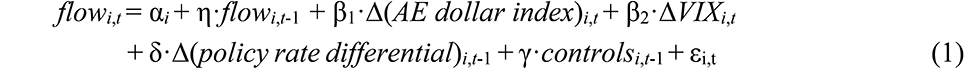

We run panel regressions comparing the relative role of two global factors and one interest differential variable, while including a variety of standard control variables. We use monthly balance of payments (BOP)-based data for portfolio flows and quarterly data for FX loan flows from 2006 to early 2024 covering up to 17 EMEs depending on flow types. The annex provides details on the data, our selection of variables and the modelling choices used to arrive at our baseline specification.

Our baseline specification is:

As the first global factor, we use the US dollar index against AEs only, to alleviate the endogeneity issues mentioned above. As the second global factor, we consider the VIX given its prominence in the literature (but financial condition indices provide a similar picture; see the annex). Finally, among interest rate differential variables, we include the change in the policy rate differential9 (Graph A1). As is standard in the literature, we use lags of domestic variables (pull factors) to avoid endogeneity as they could be affected by capital flows (Hofmann et al (2022)). For statistical inference, we use standard errors corrected for cross-country and serial correlation.

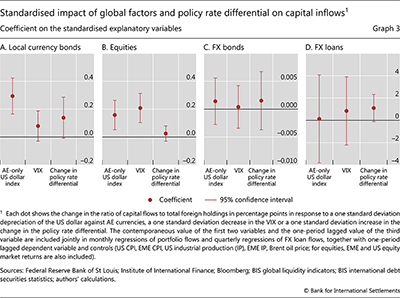

As expected, the relative importance of the three drivers varies across types of flows (Graph 3). For local currency bond flows, the AE-only dollar index has a much larger impact than the change in the VIX or in the policy rate differential. For equity flows, the change in the VIX is the most important driver, although the US dollar also matters. For FX bond flows, we do not find any significant drivers. Finally, the change in the policy rate differential emerges as the most important driver of FX loan flows.

Regarding the economic magnitude of the effects, the US dollar also stands out among the candidate drivers. Specifically, a one standard deviation depreciation of the US dollar against other AE currencies tends to increase local currency bond and equity flows to EMEs during the same month by 0.29 and 0.16 percentage points, respectively (Graphs 3.A and 3.B).10 By contrast, it does not have a significant impact on either FX bond or loan flows11 (Graphs 3.C and 3.D).12 A one standard deviation fall in the VIX raises equity flows by 0.21 percentage points, but has no significant effect on any other flow types. Finally, a one standard deviation increase in the policy rate differential boosts FX loan flows by 1.1 percentage points in the next quarter13 and local currency bond flows by 0.14 percentage points in the next month.14

Overall, these results support the important role of the US dollar in driving local currency flows.15 A stronger dollar reduces foreign investment in local currency assets, presumably through its effects on investors' balance sheets and risk appetite, as well as on US dollar return-chasing investors. And the impact is greater than that of the policy rate differential. By contrast, the US dollar is not important for FX flows. Finally, rising EME policy rates attract more FX loan inflows as it becomes more cost-efficient to borrow in US dollars.

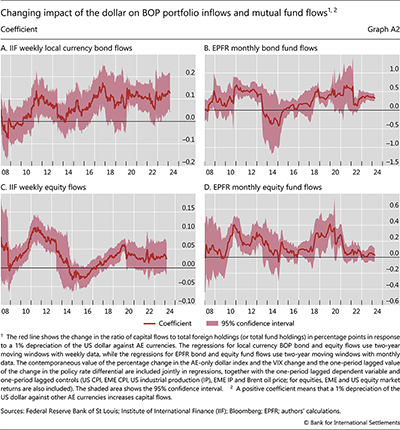

Given the growing importance of mutual funds in local currency flows to EMEs, we investigate their sensitivity to the US dollar further by using mutual fund flow data. We relegate the results to the annex for brevity. A one standard deviation depreciation of the AE-only dollar index increases EPFR bond and equity fund flows by 0.43 and 0.20 percentage points, respectively, which is larger than the corresponding increase by 0.29 and 0.16 percentage points reported in Graph 3. This result suggests that the growing share of mutual funds is probably a factor behind the rising role of the US dollar for local currency asset flows.16

Finally, we also consider the role of financial conditions as opposed to the VIX, with broadly similar results (again reported in the annex for brevity). The financial conditions proxy we use, the Goldman Sachs Global Financial Conditions Index (FCI), exhibits properties that are similar to those of the US dollar and the VIX. It is highly correlated with local currency bond and equity flows, but not with FX loan or bond flows. Its impact on local currency bond flows is less marked than that of the AE dollar index, but it is larger for equity flows. This pattern is not surprising since the FCI comprises a policy rate, a long-term riskless bond yield, a corporate credit spread, a measure of equity valuations and a trade-weighted exchange rate (Arnaut and Bauer (2024)). In fact, its correlation with the dollar and the VIX is high (0.45 and 0.62, respectively). It is, however, remarkable that the simple AE-only dollar index still outperforms the FCI for local currency bond flows, suggesting that the exchange rate mechanism through investors' balance sheets is very powerful.

Has the impact of global factors changed over time?

Has the US dollar always been a key driver of local capital flows, or is this a recent phenomenon? How has the importance of other global drivers evolved? Considering the increasing importance of foreign investment in local currency assets in external financing by EMEs, we focus on the time-varying impact of the AE-only dollar index and the VIX on local currency bond and equity inflows.

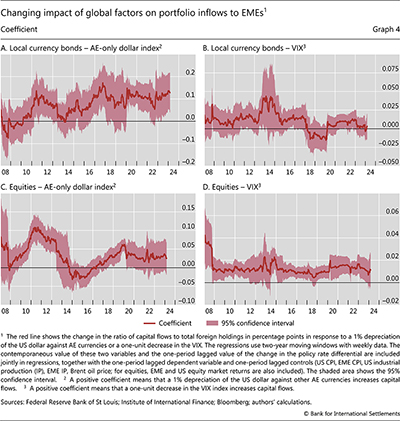

After the GFC, the sensitivity of local currency bond and equity flows to the dollar's strength rose and peaked around 2011–12, before declining rapidly towards zero in 2013–14, around the "taper tantrum" (Graphs 4.A and 4.C). This pattern reflects the unusually large capital flows to EMEs during that period, which coincided with a depreciation of the US dollar. Avdjiev et al (2020) argue that flows were particularly sensitive to US monetary policy around that time, due to a higher degree of monetary policy convergence among AEs, with US monetary policy serving as a stronger indicator of global monetary policy trends.17

Since the trough in 2014, the sensitivity of local currency bond and equity flows to the strength of the US dollar has gradually risen (Graphs 4.A and 4.C). The increasing sensitivity can be explained by the combination of a larger share of local currency assets in global investors' portfolios as well as the increasing share of mutual funds and exchange-traded funds (ETFs) in foreign holdings of EME bonds and equities (Schmidt and Yeşin (2023)).18 These funds display a greater sensitivity to the dollar than other investors (Graph A2 in the annex). Moreover, the lengthening maturity of EME local currency bonds has probably accentuated the responsiveness to US dollar fluctuations (Bertaut et al (2024)).

In contrast to the dollar, the impact of the VIX on local currency bonds declined starting around 2014 and has remained weak since 2017 (Graph 4.B). This is consistent with the findings of Forbes and Warnock (2020) that the relationship between extreme capital flow episodes and the VIX has weakened after 2010, as well as those in Miranda-Agrippino and Rey (2020) who find a reduced correlation between the VIX and the global financial cycle.19 In addition, the decline in credit risk and the increase in policy transparency in many EMEs over the past decade may also have played a role, if it has reduced the sensitivity of the risk component of local currency bonds to the VIX.20 By contrast, the VIX has remained highly correlated with equity flows to EMEs in both tranquil and stress periods (Graph 4.D), probably due to the close linkage between US and other major EMEs' equity markets and volatility spillovers from US to EME markets (Hattori et al (2021)).

Conclusions

This article presents novel evidence on the importance of the US dollar as a proximate driver of local currency portfolio flows to EMEs for both bonds and equites. Its significance is in line with its effects on global investors' risk-taking propensity. It is also consistent with US dollar return-chasing behaviour of mutual funds, which are the most important investor type in EME local currency bonds. By contrast, we do not find a significant link between the US dollar and FX flows, whether loans or bonds. This may reflect the limited effect of the dollar's swings on the balance sheet of lenders and the more important role of stable and carry-oriented investors in these types of bonds, such as insurance companies and pension funds (Bertaut et al (2024)).

Interestingly, policy rate differentials play only a subordinate role in driving the capital flows considered in our study. Increases in the policy rate differential vis-à-vis the United States attract yield-oriented investors in EME local currency bond markets. But their effects on these flows are considerably lower than those of changes in the US dollar. By contrast, rises in the policy rate differential affect FX loan flows to EMEs by making borrowing in US dollars more attractive.

When assessing the changing role of various global factors over time, we find that the importance of the general strength of the US dollar for local currency bond and equity flows has gradually increased since a trough around 2014. The impact of the VIX on local currency bond flows, by contrast, has weakened somewhat since then. The overall change in the composition of portfolio and bank capital flows towards local currency flows, and the increasing role of mutual funds as EME investors since the GFC are likely to be key factors behind the US dollar's rising importance as a driver for aggregate capital flows.

These findings shed light on the current debate on whether some EMEs, especially those with narrowing interest rate differentials against the United States, may face capital outflows. For example, if the policy rate differential for an EME increases due to a fall in the federal funds rate, the EME may see local currency bond and FX loan inflows. If the US dollar weakens against other AE currencies at the same time, the EME may face local currency bond and equity inflows. The analysis of such scenarios could help EMEs design the appropriate policy mix to mitigate the short-term impact of these shocks on capital flows and exchange rates.21

Finally, it will be helpful for EMEs to make efforts to deepen their FX, derivatives, bond and equity markets during normal times, in particular by building a diverse investor base (CGFS (2021)). For example, EMEs may need to be cautious about risks from an overreliance on mutual funds given their high sensitivity to US dollar fluctuations. Developing sufficient financial market capacity to deal with large capital inflows or outflows can help EMEs to mitigate undesirable amplifications between exchange rates, local currency asset prices and capital flows triggered by global factors (Doornik et al (2024)).

References

Arnaut, Z and M Bauer (2024): "Monetary policy and financial conditions", Federal Reserve Bank of San Francisco Economic Letter, no 2024-07, March.

Avdjiev, S, W Du, C Koch and H S Shin (2017): "The dollar, bank leverage and the deviation from covered interest parity", BIS Working Papers, no 592, July.

Avdjiev, S, L Gambacorta, L Goldberg and S Schiaffi (2020): "The shifting drivers of global liquidity", Journal of International Economics, vol 125, article 103324.

Bank for International Settlements (BIS) (2022): Foreign exchange markets in Asia-Pacific, report by a study group established by the Asian Consultative Council of the BIS, October.

--- (2024): Statistical release: BIS international banking statistics and global liquidity indicators at end-December 2023, 30 April.

Bertaut, C, V Bruno and H S Shin (2024): "Original sin redux: role of duration risk", BIS Working Papers, no 1109, January.

Brandão-Marques, L, G Gelos and N Melgar (2018): "Country transparency and the global transmission of financial shocks", Journal of Banking and Finance, vol 96.

Brandão-Marques, L, G Gelos, H Ichiue and H Oura (2022): "Changes in the global investor base and the stability of portfolio flows to emerging markets", Journal of Banking and Finance, vol 144.

Bruno, V, I Shim and H S Shin (2022): "Dollar beta in stock markets", Oxford Open Economics, vol 1, pp 1–10.

Carstens, A and H S Shin (2019): "Emerging markets aren't out of the woods yet: how they can manage the risks", Foreign Affairs, 15 March.

Committee on the Global Financial System (CGFS) (2021): Changing patterns of capital flows, CGFS Papers, no 66, May.

Cristi, J, Ṣ Kalemli-Özcan, M Sans and F Unsal (2024): "Global spillovers from Fed hikes and a strong dollar: the risk channel", NBER Working Paper, no 32330, April.

Doornik, B, J Frost, R Guerra, A Tombini and C Upper (2024): "Towards liquid and resilient government debt markets in EMEs," BIS Quarterly Review, March, pp 59–72.

Driscoll, J and A Kraay (1998): "Consistent covariance matrix estimation with spatially dependent panel data", Review of Economics and Statistics, vol 80, no 4, pp 549–56.

Forbes, K and F Warnock (2020): "Capital flow waves – or ripples? Extreme capital flow movements in an era of easy monetary and tight macroprudential policy", NBER Working Paper, no 26851.

Erik, B, M Lombardi, D Mihaljek and H S Shin (2020): "The dollar, bank leverage and real economic activity: an evolving relationship", AEA Papers and Proceedings, vol 110, pp 529–34.

Hattori, M, I Shim and Y Sugihara (2021): "Cross-stock market spillovers through variance risk premiums and equity flows", Journal of International Money and Finance, vol 119.

Hofmann, B, I Shim and H S Shin (2022): "Risk capacity, portfolio choice and exchange rates", BIS Working Papers, no 1031, July.

Ichiue, H and F Lambert (2016): "Post-crisis international banking: an analysis with new regulatory survey data", IMF Working Paper, no 16/88.

Kalemli-Özcan, Ṣ and F Unsal (2024): "Global transmission of Fed hikes: the role of policy credibility and balance sheets", NBER Working Paper, no 32329.

Koepke, R (2019): "What drives capital flows to emerging markets? A survey of the empirical literature", Journal of Economic Surveys, vol 33, no 2.

Miranda-Agrippino, S and H Rey (2020): "The global financial cycle after Lehman", AEA Papers and Proceedings, vol 110, pp 523–28.

--- (2022): "The global financial cycle", in G Gopinath, E Helpman and K Rogoff (eds), Handbook of International Economics, vol 6, pp 1–43.

Miyajima, K and I Shim (2014): "Asset managers in emerging market economies", BIS Quarterly Review, September, pp 19–34.

Obstfeld, M and H Zhou (2023): "The global dollar cycle", NBER Working Paper, no 31004, March.

Onen, M, H S Shin and G von Peter (2023): "Overcoming original sin: insights from a new dataset", BIS Working Papers, no 1075, September.

Patelli, P, J Shek and I Shim (2023): "Lessons from recent experiences on exchange rates, capital flows and financial conditions in EMEs", BIS Bulletin, no 79, November.

Schmidt, R and P Yeşin (2023): "The growing importance of investment funds in capital flows", SNB Working Papers, no 13/2022.

Todorov, K and G Vilkov (2024): "What could explain the recent drop in VIX?", BIS Quarterly Review, March, pp 6–7.

Annex

This annex describes the data, empirical specification and the choice of explanatory variables for the baseline regressions.

Data on capital flows

For local currency bond and equity flows, we use monthly data on local currency bond flows to 16 EMEs and those on equity flows to 17 EMEs available from the Institute for International Finance Portfolio Flows Tracker. The data follow standard BOP definitions: a flow is recorded when there is a transfer of ownership of an EME asset between a resident and a non-resident. By contrast, fund flows only track investor flows to and from EME-dedicated mutual funds and ETFs and do not reflect the purchase and sale of EME assets by other types of investors such as institutional investors, hedge funds and sovereign wealth funds. We normalise gross bond (equity) flows to an EME's local currency bond (equity) market over a month by the total outstanding size of foreign holdings of the EME's local currency bonds (equities) at the beginning of the month, obtained from BOP data. We then subtract the 10-year moving average of the flow variable for each country to control for country-specific capital flow trends.22

We obtain data on FX-denominated bond flows from the BIS international debt securities statistics. In particular, we use the net issuance amount of bonds by entities in 15 EMEs and denominated in foreign currencies such as the US dollar, euro and Japanese yen. We use the outstanding amounts at monthly frequency, assuming that all FX-denominated bonds issued by EMEs are purchased by foreign investors. Again, we normalise FX bond flows (ie the net increase in the outstanding amount of FX bonds over a month) by the total outstanding amount of the EME's foreign currency bonds at the beginning of the month.

Finally, for FX banking flows, we employ quarterly23 FX-denominated banking flows to non-banks for 10 EMEs from the BIS global liquidity indicators. We normalise FX banking flows (ie the net increase in FX loans extended by international banks to an EME's non-banks) by the total outstanding amount of FX loans outstanding to the EME's non-banks at the beginning of the quarter.

Data on capital flow drivers

We now turn to the variables we use as main explanatory variables of capital flows.

Moving on to global risk appetite indicators, we only use the US dollar index against AE currencies to alleviate concerns over the possibility of EME fundamentals driving exchange rate movements, or capital flows to EMEs affecting a US dollar index via the bilateral EME exchange rates against the US dollar. In particular, we use the following variables: (i) AE-only US dollar index obtained from the Nominal Major Currencies USD Index in FRED (as in Kalemli-Özcan and Unsal (2024) and Cristi et al (2024)); and (ii) ICE DXY, which tracks the performance of a basket of 6 global currencies against the US dollar. We do not use the broad US dollar index because the basket includes bilateral exchange rates of the US dollar against EME currencies.

For indicators of global financial conditions, we consider: (i) the percentage change in the Goldman Sachs Global Financial Conditions Index (FCI); (ii) the change in the VIX; and (iii) the change in the MOVE index. We use the change in these variables instead of their level because we are interested in capturing the short-term or immediate impact of changing global financial conditions on capital flows to EMEs.

For interest rate differentials, we consider both the policy rate and long-term bond yields, both in level and changes. For the policy rate differential, we use the policy rate differential between an EME and the United States in percentage points. We also employ the five- and 10-year local currency government bond yield differentials between an EME and the United States.

Finally, in our empirical analysis we include inflation and industrial production in EMEs and the United States as control variables. We also include Brent oil prices as a proxy for global commodity prices, since commodity prices are important for commodity exporters. For regressions on equity flows, we also include the equity market returns in EMEs and the United States.

Towards the baseline regression specification

To arrive at our baseline specification, we first run regressions including one contemporaneous global factor or one lagged interest rate differential variable at a time, the lagged dependent variable and the set of lagged control variables, as well as country fixed effects. The frequency is monthly for portfolio flows and quarterly for FX banking flows. We include the lagged dependent variable in the regressions even though the serial correlation of monthly local currency bond, equity and FX loan inflows is small. We also focus on the contemporaneous impact of global factors, which are unlikely to be affected by capital flows to EMEs.24 We use one-period lagged interest rate differential variables because capital flows to an EME in the same period may affect the EME's policy rate decision in the current period. Finally, we use Driscoll-Kraay (1998) standard errors to correct for cross-sectional and serial correlation.

Based on the size and statistical significance of the coefficients reported in Graph A1, we choose the key explanatory variables in the baseline specification. First, the AE-only dollar index has consistently larger effects on capital flows than the ICE DXY. Therefore, we use the AE-only dollar index as the first global factor. Between the FCI, the VIX and the MOVE index, we use the VIX as the second global factor because it has been widely used as an indicator of global risk appetite. When we use the FCI instead of the VIX, the FCI has a significant impact on equity flows and is the most important driver of equity flows (Graph A2). Finally, among interest rate differential variables, the level of the three interest rate differentials is statistically insignificant for all types of flow. Among the change in interest differentials, the change in policy rate differential is significant for FX loan and local currency bond flows. Therefore, we choose the change in the policy rate differential for our baseline specification.25

1 The authors thank Claudio Borio, Egemen Eren, Benoît Mojon, Damiano Sandri, Andreas Schrimpf, Hyun Song Shin and Goetz von Peter for helpful comments and discussions. The views expressed in this article are those of the authors and do not necessarily reflect those of the Bank for International Settlements.

2 Foreign investors in EME equities typically do not hedge currency exposure, and those in EME local currency bonds overall hedge only partially. For example, BIS (2022) reports that the extent of FX hedging by non-residents investing in emerging Asia is still relatively low.

3 A popular product is so-called covered call ETFs. A covered call involves a purchase of the S&P 500 index and a simultaneous sale of a one-month call option on the index (Todorov and Vilkov (2024)).

4 To the extent that the proceeds from foreign currency bonds issued offshore are repatriated to the issuer's home country, we can view the change in the outstanding amount of bonds as capital inflows.

5 In our empirical specification, we include other push and pull factors as control variables.

6 As an intermediate case, if a global investor holds both FX- and local currency-denominated EME assets, a relaxation of VaR constraints after a dollar depreciation could allow for more investment in both FX and local currency. However, in practice there is a segmentation between EME FX and local currency bond investors, driven by their mandates. For example, insurance companies and pension funds tend to have a stronger preference for US dollar-denominated EME bonds (Bertaut et al (2024)).

7 Avdjiev et al (2017) and BIS (2024) show that a stronger dollar measured by the broad US dollar index is associated with lower growth in US dollar-denominated cross-border bank lending. In addition, for global banks, especially non-US banks, whose assets are denominated in multiple currencies, changes in the US dollar can have a first-order impact on their capital measured in their accounting or performance currency even if there is no currency mismatch in the banks' assets and liabilities.

8 Miyajima and Shim (2014) find that retail and institutional investor flows to mutual funds investing in EME assets and the total returns on these assets in US dollar terms reinforce each other. See also Brandão-Marques et al (2022) for evidence on return-chasing by EME mutual funds.

9 Neither the level of the policy differential nor the level of the five- or 10-year yield differentials and their changes seem to be strongly correlated with any of the four types of flows considered here.

10 The higher sensitivity of bond flows to global factors compared with equity flows is in line with the findings reported by Brandão-Marques et al (2022).

11 When we consider the broad US dollar index instead of the AE-only dollar index, we find a significant impact on FX loan flows to EMEs, in line with Avdjiev et al (2017).

12 This may be explained by the limited valuation effect of fluctuations in the US dollar on the balance sheet of US dollar-based lenders and the clientele effect that dollar-denominated bonds are held by more stable insurance companies and pension funds.

13 A one standard deviation decrease in the US policy rate increases FX loan flows by 1.3 percentage points. This result confirms that the impact of changes in the policy rate differential on FX loan flows is driven by changes in the US policy rate.

14 When we consider the impact of an increase in the five- or 10-year bond yield differential, instead of that in the policy rate differential, on local currency bond flows, we do not find a significant impact.

15 Our estimates can be regarded as a lower bound of the true effects of fluctuations in the US dollar given that we focus on the AE-only US dollar index.

16 The coefficient on the VIX (−0.59) is also larger for bond fund flows than for overall BOP bond flows (−0.08).

17 For example, US-domiciled investors increased their holdings of EME local currency bonds from $30 billion to $155 billion (Bertaut et al (2024)).

18 Between end-2015 and end-2021, foreign holdings of EME local currency bonds rose 1.7 times from about $651 billion to about $1,123 billion (Onen et al (2023)). Over the same period, the total amount of assets managed by global and regional EME local currency bond funds in the Lipper database increased 2.1 times from $79 billion to $167 billion.

19 See also Erik et al (2020) for discussions on a weakened relationship between the VIX and capital flows to EMEs. In addition, Todorov and Vilkov (2024) shows that equity index option dealers effectively dampened the VIX in 2023 when they hedged option sales linked to the issuance of structured products.

20 See Brandão-Marques et al (2018).

21 Patelli et al (2023) provide an account of how EME regions deployed different sets of policy mixes in response to rapid increases in inflation and tight global financial conditions in 2022–23.

22 We obtain similar results when we use the percentage flow variable without adjusting for the trend.

23 Because monthly data on FX loans are unavailable, we use quarterly data for FX loan flow regressions.

24 The main results hold when we consider the lagged global factors instead.

25 Low correlation among the three explanatory variables implies that collinearity is not a concern.