Seven decades of international banking

International banking grew rapidly from the 1950s to the 2000s, propelled by banks avoiding regulations that burdened their domestic funding, by financial liberalisation that expanded investment opportunities, and by financial innovation that offered new tools to manage risks. The core of the market is offshore, where lenders and borrowers transact in currencies foreign to them both. Competition among banks for market share contributed to surges in international lending that amplified credit booms preceding major financial crises. Losses during the Great Financial Crisis, and regulatory reforms in its wake, have constrained banks' expansion, making way for non-bank financial institutions to step in as major international creditors. 1

JEL classification: F33, F34, G01, G15, G21

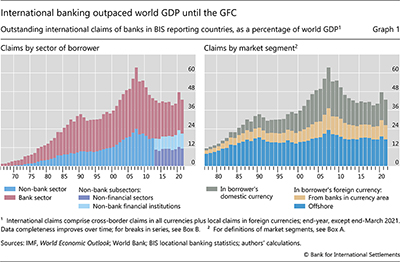

From the ashes of the Second World War, international banking re-emerged starting in the 1950s. In 1963, when the BIS started to collect data, banks' outstanding international claims amounted to less than 2% of world GDP. They grew rapidly in the following decades, peaking above 60% in 2007 before retreating to near 40% in early 2021 (Graph 1, left-hand panel). As the market expanded, the early predominance of interbank activity in a few major currencies gave way to business with non-bank financial and non-financial counterparties in a multitude of currencies. This feature explains the structural and cyclical factors behind these developments.

Regulatory arbitrage, financial innovation and financial liberalisation were key drivers. Regulations that raised the costs of domestic intermediation made it attractive for banks to borrow and lend abroad. The development of new financial products, including syndicated loans and derivatives, altered the way that banks managed risks in their international portfolios. The transition of the broader international financial system from a tightly managed one with extensive exchange controls and capital account restrictions to today's market-driven, integrated system was both a cause and a symptom of international banking's growth.

Alongside these structural factors, global financial imbalances have shaped and been shaped by international banking. Cross-border lending enabled the credit booms at the heart of several international financial crises, notably the Latin American debt crisis in the early 1980s, the Asian financial crisis in the late 1990s and the Great Financial Crisis (GFC) of 2007–09. Ahead of each crisis, competition among banks for market share contributed to surges in international credit.

Key takeaways

- International banking since the 1950s has taken place mainly offshore, where lenders and borrowers transact in currencies foreign to them both.

- Regulatory arbitrage, financial liberalisation and financial innovation drove a multi-decade expansion of international banking, which peaked at over 60% of world GDP on the eve of the Great Financial Crisis.

- Competition among banks for market share contributed to surges in international lending that amplified credit booms preceding major financial crises.

- Losses during the Great Financial Crisis, and regulatory reforms in its wake, constrained banks' expansion and accelerated the rise of non-bank financial institutions as international creditors.

The rest of this feature is organised as follows. The next section describes how segments of the international banking market have evolved since the 1950s; Box A defines those segments and Box B describes the available data. The following sections analyse how regulatory arbitrage and financial innovation shaped the market's development. The penultimate section assesses how international credit enabled booms ahead of financial crises, and the final section outlines policymakers' response to the challenges posed by international banking.

The offshore core of international banking

International banking is an amalgamation of cross-border and foreign currency business. It consists of three segments (Box A). The first two encompass traditional international banking: cross-border transactions in the domestic currency of either the lender or the borrower. For example, a US dollar loan from a bank in the United States to a borrower abroad (Graph 1, right-hand panel, brown area), or a dollar loan from a bank outside the United States to a borrower inside (grey area). The third segment is the offshore market (blue area), where business is denominated in a currency that is foreign to both the lender and the borrower.

After the Second World War, the offshore segment emerged as the core of international banking. For many centuries banks had used funds raised in their home country to finance international trade and extend loans to foreign kings and governments. In the 1950s, this traditional model started to give way to one where banks funded their international business from abroad. By the mid-1970s, the offshore market constituted the bulk of international claims (Graph 1, right-hand panel, blue area).

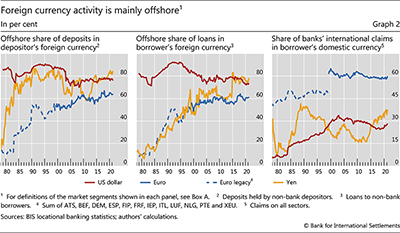

Lenders and borrowers have opted overwhelmingly to conduct their foreign currency business in the offshore market. For example, non-banks outside the United States place only a small fraction of their US dollar deposits with banks in the United States. The share of their dollar deposits in banks outside the United States was as high as 90% in the early 1990s and averaged 77% over the 2000–21 period (Graph 2, left-hand panel). Similarly, they borrow US dollars mainly from banks outside the United States (centre panel). For the euro too, the offshore market is where non-banks outside the euro area prefer to transact – to a lesser degree than for the dollar but to a greater degree than for euro legacy currencies. And non-banks outside Japan have deposited their yen mainly in banks outside Japan since the mid-1980s. Their borrowing of yen from banks outside Japan gained ground more slowly but is now mostly offshore too.

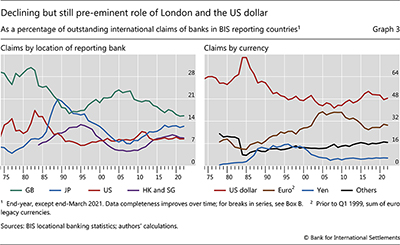

The significance of offshore banking is reflected in London's premiere position in international banking. Even though the US dollar has been the leading currency during the post-war era (Graph 3, right-hand panel), New York's pre-eminence in international banking was short-lived (Kindleberger (1974)). London came to the fore already in the 1960s, where it has remained in most years despite sterling's small share of international claims. In the 1970s, more than a quarter of international claims were booked at banks in the United Kingdom, mainly in London (left-hand panel). In the late 1980s, Japanese banks' attachment to the traditional cross-border banking model briefly put Tokyo ahead. London's share rebounded during the decade before the GFC and, while subsequently losing ground to Asian financial centres, it remained on top at end-March 2021 with a 16% share.

Origins in regulatory arbitrage

From the outset, offshore banking attracted business by avoiding some regulations that applied to domestic banking. Differences in the regulatory treatment of banks' domestic and offshore funding created the equivalent of a tax wedge, which enabled banks abroad to offer higher interest rates to depositors and lower ones to borrowers. US regulations had the greatest impact, given the dollar's dominant role in international banking. Regulations in other countries also created opportunities for the offshore market in the Deutsche mark, yen and other currencies to grow.

The most relevant regulations included ceilings on deposit rates, reserve requirements and deposit insurance premiums. As early as 1955, a London bank priced US dollar deposits at yields above the US deposit rate ceiling (Schenk (1998)). In 1966, when the deposit rate ceiling bound in the United States, the big US banks turned to their London offices to replace lost domestic deposits (Klopstock (1968)). Without the costs on intermediation imposed by reserve requirements and deposit insurance, banks outside the United States regularly offered higher rates than banks inside, and Europeans, especially central banks, quickly accepted the novelty of offshore dollar deposits (BIS (1964)). US multinationals too deposited dollars abroad, and from the 1970s US money market funds channelled US households' and corporates' dollars into offshore accounts.

Further reading

Regulations incentivised banks not only to raise dollar funding outside the United States but also to lend dollars from abroad, including to US residents (Graph 1, right-hand panel, grey area). After the US Federal Reserve extended reserve requirements to cover banks' net dollar funding from abroad in 1969, foreign banks avoided them by booking loans to US firms at affiliates outside the United States (McCauley and Seth (1992)). In 1970, with credit ceilings and reserve requirements restricting lending in much of Europe, European corporates borrowed substantial amounts of dollars offshore for the first time (BIS (1971)).

Over time, the easing of national regulations has reduced opportunities for arbitrage. For example, the United States removed the interest rate ceiling on large deposits in 1970. Also, as yields fell in the 1980s, reserve requirements imposed smaller opportunity costs, and the Fed set them to zero in 1990. However, US deposit insurance still confers an advantage on offshore dollar deposits (Kreicher et al (2014)).

More generally, financial liberalisation resulted in a gradual shift in the composition of international banking away from the offshore market. The opening of capital accounts and deregulation of financial systems by many advanced and emerging market economies (EMEs) starting in the 1980s spurred growth in other segments. The offshore segment's share thus declined from close to 70% in the late 1970s to around 40% in 2021.

What displaced offshore banking was cross-border business in the borrower's domestic currency. Whereas such activity accounted for slightly more than 10% of international claims in the late 1970s, it accounted for almost 40% in early 2021 (Graph 1, right-hand panel, grey area). For the US dollar, cross-border claims on US residents expanded more rapidly than those on non-US residents until the mid-2000s (Graph 2, right-hand panel). For the euro, cross-border claims on euro area residents – which account for a majority of euro-denominated claims – rose rapidly after the currency's launch. Their growth propelled the euro's share of international claims to nearly 40% in the mid-2000s, although it then fell in the wake of the GFC and European sovereign debt crisis of 2010–12 (Graph 3, right-hand panel).

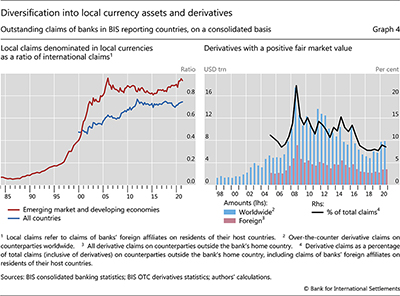

In effect, financial liberalisation reduced the scope for regulatory arbitrage and broadened investment opportunities. Whereas in the 1960s and 1970s banks had mainly extended foreign currency credit to other banks that subsequently onlent the funds, starting in the 1980s they increasingly extended credit directly to the final borrower in the borrower's currency. The share of international credit denominated in a currency other than the US dollar, yen or euro has risen steadily since the mid-1980s, from 10% to 17% at end-March 2021 (Graph 3, right-hand panel). Moreover, financial liberalisation led to an expansion of multinational banking, where banks fund their activities locally in the currency of the country where their affiliates operate (McCauley et al (2010)). In early 2021, foreign banks' local claims in EMEs were almost as large as their international claims, and globally their local claims were about three quarters as large (Graph 4, left-hand panel).

Propagator of financial innovation

International banking was sometimes an incubator and more often a propagator of financial innovation. New or enhanced financial products, notably syndicated loans and derivatives, significantly altered the way that banks managed the risks associated with their international portfolios.

The development in the late 1960s of syndicated loans made it easier for banks to manage their credit risk exposures. The syndication process enabled smaller banks to participate in international loans and facilitated the trading of loans in the secondary market. It also increased the size of loans available, which attracted a wider range of borrowers, including sovereigns, who might otherwise have tapped bond markets. Syndicated loans typically took the form of medium-term floating rate loans, with interest rate risk that matched banks' short-term deposits. Owing to London's pre-eminent role in the offshore market, the London interbank offered rate (Libor) emerged in the 1970s as the standard reference rate for floating rate contracts.

Innovations in derivatives markets further reshaped banks' international business. Prior to the 1980s, banks had hedged risks or taken positions by transacting in the interbank market at different maturities and in different currencies (CGFS (1986)). This had inflated interbank positions on their balance sheet. The development of interest rate, foreign exchange (FX) and credit derivatives enabled banks to shift risk management activities off their balance sheets. In effect, derivatives made it easier for banks to decouple the risk profile of their portfolios from their origination business. Banks' worldwide derivative assets increased from about $1 trillion in the late 1990s to $8 trillion at end-2020, with considerable variation during the intervening period (Graph 4, right-hand panel, blue bars). Over one third of their derivative assets have been with foreign counterparties (red bars), and at end-2020 these assets accounted for around 8% of total foreign exposures (black line).

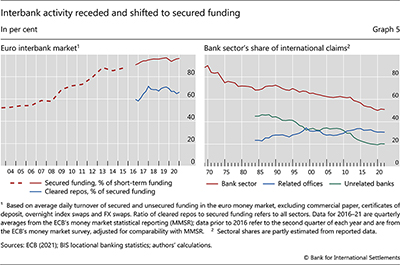

The expansion of secured funding markets also changed banks' management of credit exposures. As well as broadening banks' access to money market investors, repos further reduced their interbank exposures, albeit by increasing exposures to central counterparties. For example, in the euro money market, unsecured funding dwindled to a small fraction of short-term funding after the GFC (Graph 5, left-hand panel). In turn, the growing share of repos backed by high-quality collateral underpinned higher standardisation and thus greater use of central clearing.

The expansion of derivatives and cleared repos has made interbank links more complex and opaque. Specifically, while transactions among banks remain an integral part of international banking, fewer of them appear as such on banks' balance sheets than in the past.2 The BIS locational banking statistics, which track on-balance sheet positions, indicate that interbank assets peaked in 1989 at 73% of international claims, but had fallen to around 50% by early 2021 (Graph 5, right-hand panel). Excluding intragroup positions – ie business between offices of the same banking group – the decline is even more pronounced, from 44% in 1989 to 20% in 2021.

Competition for market share and credit booms

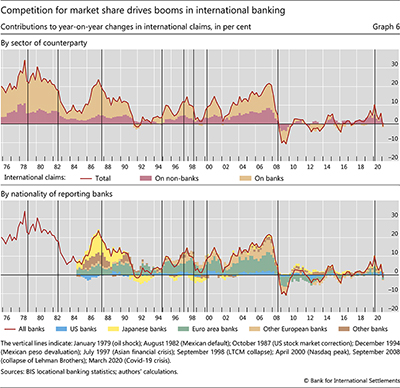

The combination of regulatory arbitrage and financial innovation had, by the 1970s, transformed international banking into a powerful machine to extend credit. Financial liberalisation and competition among banks for market share fuelled the machine and provided a further impetus to growth. US banks were the dominant international lenders in the 1970s. Japanese banks replaced them in the 1980s (Graph 6, bottom panel). Throughout the 1990s and 2000s, European banks gained market share, which they then ceded after the GFC.

International bank credit has tended to grow faster than domestic credit, driving the build-up of financial imbalances during booms in borrower countries (CGFS (2011); Borio et al (2011)). Its interbank component is especially volatile, swinging in sync with global booms and busts (Graph 6, top panel). Indeed, financial crises became more frequent after the 1970s owing in part to the credit excesses enabled by international banking. Three peaks in the growth of international claims after 1980 coincided with post-war crises: the Latin American debt crisis in 1982, the Asian financial crisis in 1997, and the GFC in 2007–09 (top panel). The ascendant national banking systems of the day played a key role (bottom panel).

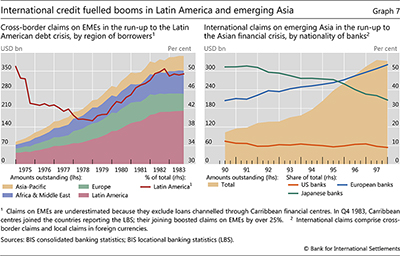

The 1982 crisis came on the back of a decade-long expansion in international bank credit to EMEs. By the late 1960s, competition among banks had driven down margins on cross-border loans to advanced economies. Seeking higher returns, banks expanded their lending to EMEs, mainly to sovereign borrowers. While US banks dominated lending to EMEs in the early 1970s, Japanese and European banks made inroads as the decade wore on (Devlin (1989)).3 Following the 1973 rise in oil prices, deposits from oil-producing states further boosted lending to EMEs by easing banks' funding conditions, especially for banks outside the United States.

Banks found eager borrowers in Latin America, who initially sought financing for industrialisation and imports and later borrowed to cover the costs of servicing their growing debts. Competition to meet this demand, coupled with a perception that sovereign borrowers were low-risk, resulted in an easing of lending terms amid high volumes (BIS (1979)). Banks' cross-border claims on the region more than quadrupled between end-1974 and mid-1982, from $43 billion to $197 billion, far outpacing the growth of international bank credit to other regions (Graph 7, left-hand panel). However, after Mexico announced in August 1982 that it could not meet its foreign currency debt obligations, international banks found that interest and exchange rate risks, which syndicated loans had in the first instance transferred to borrowers, ultimately emerged as higher credit risk on their own balance sheets.

Competition for market share also featured in the run-up to the Asian financial crisis in 1997. In the 1980s, low capital costs enabled Japanese banks to lever up and expand internationally (Graph 6, bottom panel). In particular, they drove a boom in interbank lending in the second half of the 1980s (top panel). Concerns that Japanese banks were undercapitalised during this period were an impetus for the first Basel capital accord in 1988 (Ito and Hoshi (2020)).

The bursting of Japan's asset price bubble starting in 1990 ushered in an extended period of retrenchment for Japanese banks, but not from everywhere. Japanese banks' claims on emerging Asia doubled between end-1990 and mid-1997, from $60 billion to $124 billion. They were by far the largest foreign creditors to the region, accounting for about one third of international credit on the eve of the Asian financial crisis (Graph 7, right-hand panel). The credit boom in emerging Asia also brought in European banks, whose combined share of claims on the region rose from 35% at end-1990 to 51% in mid-1997.

Thailand's abandonment of its currency peg in July 1997 triggered a pullback by banks, initially from Asia but by 1998 globally. The growth of international bank claims slowed from 15% in late 1997 to 10% in mid-1998 and, following the collapse of the hedge fund Long-Term Capital Management in October 1998, to 1% in mid-1999 (Graph 6, top panel).

Competition for market share and the resultant lowering of credit standards again came into play in the build-up to the GFC. With few regulatory limits on overall leverage, European banks, in particular Belgian, Dutch, German, Swiss and UK institutions, as well as US investment banks geared up their balance sheets. In doing so, they drove the growth of international bank credit above 20% in mid-2007 (Graph 6, bottom panel).

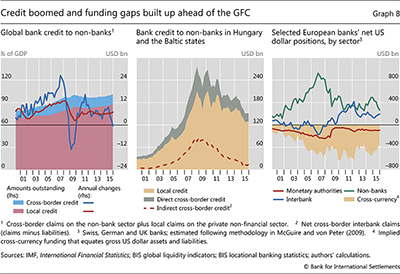

The accelerating growth in international credit during this period enabled – both directly and indirectly – credit booms in many borrower countries, advanced economies and EMEs alike. Banks' direct cross-border credit to non-banks grew at a much faster clip in the run-up to the GFC than did local bank credit (Graph 8, left-hand panel) (CGFS (2011)). Banks also lent cross-border to local banks that then channelled the funds to resident non-bank borrowers. This indirect channel allows credit growth to outrun domestic deposit growth. As cases in point, direct and indirect cross-border credit to non-banks in Hungary and the Baltic states grew rapidly in the years preceding the GFC, and by 2008 accounted for more than half of the outstanding bank credit in those countries (centre panel).

The development of collateralised debt obligations and credit derivatives linked to them enabled European banks to participate in the US housing boom in the mid-2000s even in the absence of any US mortgage origination business. Their dollar assets increased more quickly than their dollar liabilities, leaving them with a large funding gap – an excess of dollar assets over dollar liabilities – that is typically hedged through FX swaps (Graph 8, right-hand panel, shaded area). The bursting of the US house price bubble in 2008 and the seizing-up of dollar funding markets following the collapse of Lehman Brothers compelled banks to deleverage, which pushed the growth in international claims far into negative territory in 2009 (Graph 6, top panel).

Following the GFC, the growth in international banking has been subdued. After suffering big losses, European banks shrank their balance sheets by retreating from international markets. At the same time, the Canadian, Chinese, Japanese and several smaller banking systems have expanded their global reach. Nevertheless, since 2008 banks' international claims have not kept pace with global economic activity (Graph 1, left-hand panel). International banking has been constrained in part by the post-GFC reforms in bank regulation, which raised banks' risk-based capital requirements, tightened leverage limits, and placed controls on the mix of funding instruments to contain liquidity risk. These measures have increased banks' shock-absorbing capacity but have also raised the cost of balance sheet space (Borio et al (2020)).

In banks' place, non-bank creditors have stepped in. The BIS global liquidity indicators show that outstanding dollar credit to non-bank borrowers outside the United States more than doubled between mid-2008 and end-March 2021 to $13 trillion. Yet over this period the share of bank loans fell from 60% to only 47%. Non-bank borrowers have increasingly turned to bond markets for foreign currency funding instead of banks, giving a more prominent role to asset managers and other non-bank financial institutions as suppliers of credit (McCauley et al (2015)).

Policy responses

Policymakers responded to the challenges posed by international banking in three ways. First, they shone a spotlight on them. Improvements in BIS international banking and financial statistics followed each crisis (Box B). International banking has been a regular topic of discussion at BIS meetings, notably at the Eurocurrency Standing Committee established in 1971 (later renamed the Committee on the Global Financial System). Discussions in the 1960s and 1970s focused on the implications for monetary stability, while later ones turned to financial stability.

The second response was to strengthen international supervisory and regulatory standards for banks. The Basel Committee on Banking Supervision, formed in 1974, promoted consolidated supervision of banks' worldwide operations and, following the 1982 crisis, agreed on a framework for minimum capital adequacy. The framework has been expanded and revised over the years, most recently following the GFC, when Basel III not only tightened capital constraints but also provided for tightening them further in a boom.

The third response was to set up central bank swap lines to backstop funding liquidity during periods of turmoil. Already in the 1960s, central banks had coordinated injections of dollar funding to reduce strains in offshore markets (McCauley and Schenk (2020)). These operations anticipated the use of central bank swap lines during the GFC and the Covid-19 crisis to alleviate pressures arising from non-US banks' short-term dollar funding needs (Aldasoro et al (2020)).

The shift to non-bank finance in recent years brings its own challenges, but the responses under discussion are similar in form: more transparency about non-bank finance, revised regulation and liquidity backstops (FSB (2020)). While today banks are perceived as a source of strength for the financial system, past episodes of turmoil demonstrate how the troubles of non-bank financial institutions can spill over to banks in unforeseen ways.

References

Aldasoro, I, T Ehlers, P McGuire and G von Peter (2020): "Global banks' dollar funding needs and central bank swap lines", BIS Bulletin, no 27, July.

Aliber, R (1980): "The integration of the offshore and domestic banking system", Journal of Monetary Economics, vol 6, issue 4, pp 509–26.

Bank for International Settlements (1964): 34th Annual Report.

----- (1971): 41st Annual Report.

----- (1979): 49th Annual Report.

----- (2019): Reporting guidelines for the BIS international banking statistics, July.

Borio, C, R McCauley and P McGuire (2011): "Global credit and domestic credit booms", BIS Quarterly Review, September, pp 43–57.

----- (2017): "FX swaps and forwards: missing global debt?", BIS Quarterly Review, September, pp 37–54.

Borio, C, M Farag and N Tarashev (2020): "Post-crisis international financial regulatory reforms: a primer", BIS Working Papers, no 859, April.

Committee on the Global Financial System (CGFS) (1986): Recent innovations in international banking, CGFS Papers, no 1, April.

----- (2011): Global liquidity – concept, measurement and policy implications, CGFS Papers, no 45, November.

Devlin, R (1989): Debt and crisis in Latin America: the supply side of the story, Princeton University Press.

European Central Bank (ECB) (2021): Euro money market study 2020, April.

Financial Stability Board (FSB) (2020): Holistic Review of the March Market Turmoil, November.

Ito, T and T Hoshi (2020): The Japanese Economy, second edition, MIT Press.

Kindleberger, C (1974): "The formation of financial centers: a study in comparative economic history", Princeton Studies in International Finance, no 36.

Klopstock, F (1968): "Euro-dollars in the liquidity and reserve management of United States banks", FRBNY Monthly Review, July, pp 130–38.

Kreicher, L, R McCauley and P McGuire (2014): "The 2011 FDIC assessment on banks managed liabilities: interest rate and balance-sheet responses", in R de Mooij and G Nicodeme (eds), Taxation of the financial sector.

McCauley, R, P McGuire and V Sushko (2015): "US monetary policy, leverage and offshore dollar credit", Economic Policy, vol 30, no 82, pp 187–229.

McCauley, R, P McGuire and G von Peter (2010): "The architecture of global banking: from international to multinational?", BIS Quarterly Review, March, pp 25–37.

McCauley, R and C Schenk (2020): "Central bank swaps then and now: swaps and dollar liquidity in the 1960s", BIS Working Papers, no 851, April.

McCauley, R and R Seth (1992): "Foreign bank credit to US corporations: the implications of offshore loans", Federal Reserve Bank of New York Quarterly Review, vol 17, Spring 1992, pp 52–65.

McGuire, P and G von Peter (2009): "The US dollar shortage in global banking", BIS Quarterly Review, March.

Schenk, C (1998): "The origins of the eurodollar market in London: 1955–1963", Explorations in Economic History, vol 35, pp 221–38.

1 The authors thank Iñaki Aldasoro, Claudio Borio, Stijn Claessens, Bryan Hardy, Wenqian Huang, Benoit Mojon, Hyun Song Shin, Nikola Tarashev and Goetz von Peter for helpful comments and discussion, and Swapan-Kumar Pradhan for excellent research assistance. The views expressed in this article are those of the authors and do not necessarily reflect those of the Bank for International Settlements.

2 One example is the clearing of derivatives and repos, which replaces a position between two banks with a position between each bank and a central counterparty. Another is FX swaps, which are a key funding tool although their principal value does not appear on-balance sheet (Borio et al (2017)).

3 According to the BIS consolidated statistics, at end-1984 US banks accounted for 41% of the $227 billion stock of international claims on Latin America, Japanese banks 18%, UK banks 10% and French banks 8%. Comparable data are not available for earlier years.