BIS global liquidity indicators at end-March 2024

Key takeaways

- The BIS global liquidity indicators (GLIs) show that the growth in dollar-denominated foreign currency credit to non-banks in EMDEs turned positive (1%) for the first time in nearly two years. The role of bond financing in dollar and euro credit continued to increase.

The BIS global liquidity indicators (GLIs) track total credit to non-bank borrowers, covering both loans extended by banks and funding from international bond markets. The latter is captured through the net issuance (gross issuance less redemptions) of international debt securities (IDS). The focus is on foreign currency credit denominated in the three major reserve currencies (US dollars, euros and Japanese yen) to non-residents, ie borrowers outside the respective currency areas.5

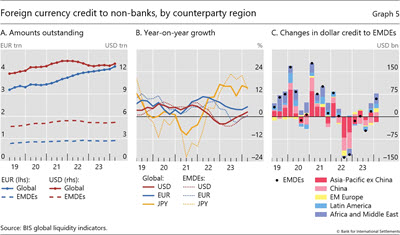

Foreign currency credit denominated in US dollars and euros inched up over Q1 2024, while yen credit barely changed. The $269 billion quarterly increase in dollar credit to non-banks outside the United States drove the outstanding stock slightly above $13 trillion (Graph 5.A, solid red line). As a result, the growth rate recovered to 2% yoy (Graph 5.B, red line). Euro credit to non-banks outside the euro area increased by €118 billion, which pushed the stock of credit just above €4.2 trillion ($4.6 trillion), or 5% higher than a year earlier (Graphs 5.A and 5.B, solid blue lines). Yen credit to non-banks outside Japan fell slightly in Q1, with the stock remaining close to ¥64 trillion ($429 billion). Nevertheless, rapid growth in previous quarters still left the stock 15% higher than a year ago (Graph 5.B, solid yellow line).

Dollar credit to non-banks in EMDEs strengthened further in Q1 2024, fuelled by an increase in bond financing. The $60 billion increase in dollar credit left the stock at $5.2 trillion (Graph 5.A). At 1%, yoy credit growth turned positive for the first time in almost two years (Graph 5.B). Looking across regions, dollar credit to non-bank borrowers in Africa and the Middle East rose the most in Q1, followed by credit to those in Latin America and emerging Europe. Dollar credit to emerging Asia-Pacific fell slightly despite an increase of $15 billion to non-banks located in China (Graph 5.C).

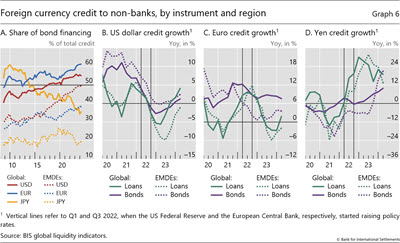

Since the Great Financial Crisis of 2007-09 non-bank borrowers have increasingly turned to international bond financing rather than to bank loans (Graph 6.A).6 The share of bond financing in dollar and euro credit has risen by 14 and 13 percentage points, respectively, since late 2008 (solid red and blue lines). By contrast, the share of bonds in outstanding yen credit on all non-bank borrowers has dropped by 18 percentage points since 2008 (solid yellow line).

These general patterns remained even during the broad monetary policy tightening observed after early 2022.7 Higher US policy rates led to a stronger dollar throughout 2022, weighing on dollar-denominated credit (Graph 6.B), but growth in bond financing (purple lines) held up better than bank lending (green lines) through mid-2023. In the euro segment, growth in bond issuance remained positive after the European Central Bank raised policy rates from July 2022 onwards (Graph 6.C). As a result, the euro bond share reached 61%, the highest on record (Graph 6.A). Only for global yen credit did loan growth consistently outpace bond issuance in recent years (Graph 6.D).

5 "Global credit" in this section refers to credit to those economies outside the respective currency area.

6 See also B Hardy and G von Peter, "Global liquidity: a new phase?", BIS Quarterly Review, December 2023, pp 21-31.

7 See also the April 2024 statistical release for a commentary on the effect of funding costs and associated exchange rate developments on credit growth.