Moving targets? Inflation targeting frameworks,1990–2025

Recent and upcoming reviews of monetary policy frameworks have been putting the spotlight on the evolution of inflation targeting. This article provides context by using a new database of changes to the inflation targeting frameworks of 26 central banks since 1990. We use the data to track changes in the frameworks' flexibility in terms of the specification of the inflation target and the role of other objectives, ie employment (or output) and financial stability. While the specification of the numerical targets has become stricter (eg points rather than ranges), greater flexibility has taken the form of less strict / longer horizons to achieve them and more weight on other objectives, especially employment/output. These trends are typically more pronounced in advanced economies and have widened differences with their emerging market peers.1

JEL classification: E12, E3, E52

Inflation targeting has turned 35. Since its birth, it has spread across the globe and proved remarkably durable.2 Part of its appeal is to offer central banks a form of "constrained discretion" to pursue price stability (Bernanke and Mishkin (1999)). What is much less clear is where exactly to strike the balance between constraints and discretion. Policymakers and scholars have worried about both too little flexibility (eg Alan Greenspan)3 and too much (eg Taylor (2022)). The close attention given to recent framework reviews confirms that the optimal specification remains up for debate (eg Eggertsson and Kohn (2023)).

This study aims to inform the debate. It develops a new database of changes to inflation targeting frameworks since the regime's adoption to document systematically how the flexibility of framework has evolved in a sample of 26 central banks from both advanced (AE) and emerging market economies (EMEs). Flexibility is here defined as the degree to which the framework tolerates fluctuations in (headline) inflation and allows for the pursuit of other objectives, specifically employment (or output) and financial stability.4

To measure that flexibility, we construct a range of quantitative indicators for each central bank and year. The information is drawn exclusively from official documents laying out formal objectives and how to make them operational. The documents form a kind of "constitution" that guides policymaking. The analysis is similar in spirit to the construction of de jure indices of central bank independence or exchange rate flexibility (Romelli (2022); IMF (2004)). In particular, our analysis does not examine the actual conduct of the central bank within a given framework, such as by estimating central bank reaction functions (eg Taylor (1993)). Clearly, the de facto degree of flexibility could vary depending on circumstances.

Key takeaways

- The features shaping the flexibility of inflation targeting have evolved substantially since the inception of the regime in the early 1990s.

- While numerical targets have become stricter (eg points rather than ranges), greater flexibility has taken the form of less strict / longer horizons to achieve the targets and greater weight on other objectives, especially employment/output.

- These trends have typically been stronger in advanced economies, tending to widen differences with their emerging market peers.

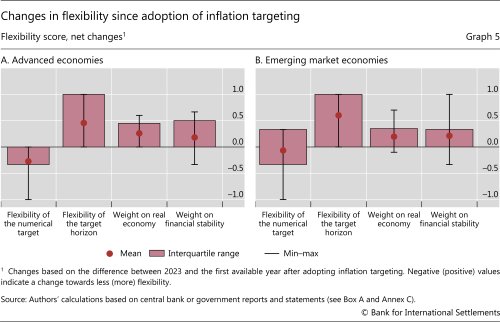

Three key findings stand out. First, while the specification of the numerical targets has become stricter (eg points rather than ranges), the horizon over which to achieve them has become less strict, ie vaguer and longer. Second, objectives other than inflation, especially employment and output, have gained ground. Third, these trends are typically stronger in AEs and have tended to widen differences with their EME peers. Overall, the pattern is consistent with the idea that stronger confidence in hitting the inflation target and in the framework's credibility, as reflected in stricter numerical targets but longer horizons, has provided the leeway to pursue other objectives.

The rest of the article is organised as follows. The first section describes the basic concepts and lays out the methodology. The second considers the current state of play, comparing the flexibility of current frameworks across countries and focusing on the distinction between AEs and EMEs. The third examines the evolution of the degree of flexibility and provides some possible explanations, laying the ground for some final considerations.

Basic concepts and methodology

Constructing indicators of an inflation targeting framework's flexibility involves a number of steps: defining the object of analysis, ie the inflation targeting framework itself, defining flexibility and developing the measurement methodology. Consider each step in turn.

The object of analysis – inflation targeting – can be somewhat fuzzy. To varying degrees, all central banks seek to achieve price stability. And views can differ on whether a central bank is operating an inflation targeting regime or not, regardless of official statements (eg Buiter (2004)). For example, views might differ on the how specifically price stability must be defined and the permissible weight attached to the exchange rate and monetary aggregates. In what follows, we define inflation targeting broadly, as a framework that specifies and announces an explicit numerical objective for inflation to be reached over a certain horizon.

The resulting sample is representative of the set of inflation targeting frameworks in both AEs and EMEs. It covers 11 AE and 15 EME central banks.5 Adoption dates range from 1990 (New Zealand) to 2016 (India). Given how infrequently regimes change, the indicators are annual.

We define flexibility as the degree to which the framework deviates from one in which the central bank's sole objective is to target a consumer price index over a short and numerically specified horizon – one to two years. In other words, this is the (theoretical) benchmark for zero flexibility. In this case, the policymaker has little discretion to tolerate fluctuations in inflation to pursue other objectives, such as employment or financial stability, and address the associated trade-offs.6

Greater flexibility has benefits as well as possible costs. It helps to reduce the economic costs of a strict pursuit of the inflation objective. The costs may be in terms of other objectives, such as output and financial stability, or the preservation of price stability itself on a more sustainable basis. To use King's famous expression, no central bank is an "inflation nutter" (King (1997)).7 At some point, however, greater flexibility may also undermine the regime's credibility and raise its economic costs more generally. The trade-offs involved will depend on the workings of the economy, the forces driving it at any given point in time and the broader institutional context.

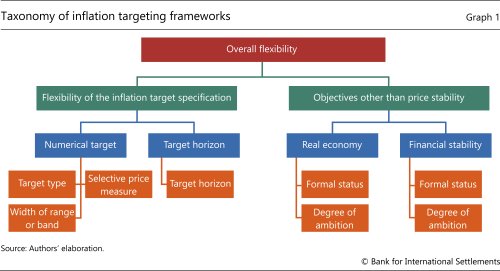

The construction of the flexibility indicators requires making several additional choices. Graph 1 outlines the structure; Box A delves into the details of the calibration.

The basic idea is to consider two key dimensions of flexibility (Graph 1, green boxes): (i) the flexibility of the specification of the inflation target itself; and (ii) the pursuit of objectives other than price stability. The specification of the target is what defines the tolerance for the dispersion of inflation outcomes and provides the leeway to pursue other objectives.

The next step in the quantification of flexibility is key (Graph 1, blue boxes). We consider two aspects of the specification of the target: (i) the definition of the numerical target itself; and (ii) the horizon over which to achieve it. And we identify two objectives other than price stability: (iii) employment or output ("real economy"); and (iv) financial stability.8 Importantly, we quantify separately the degree of flexibility for each of these four "sub-dimensions" of flexibility. The resulting core indicators are the main focus of the analysis.

To construct the four core indicators, we quantify and aggregate the impact on flexibility of a number of features of the framework that correspond to each sub-dimension (orange boxes). Consider the features related to the specification of the target and other objectives, in turn.

The specification of the target describes the level of ambition with respect to the inflation objective. Flexibility can be achieved in two non-mutually exclusive ways (left-hand side of Graph 1): through the specification of the numerical target or through the specification of the horizon over which the target is to be achieved. For instance, in the case of the numerical target, a range is less restrictive than a point. And a target defined in terms of headline inflation is more ambitious (less flexible) than one defined in terms of core inflation or with escape clauses (eg excluding changes due to taxes and volatile prices): headline is more volatile and hence harder to control. In the case of the horizon, the key distinction is between one that is short and quantitative versus one that is long and qualitative (eg "over the medium term").

The required flexibility to pursue an objective other than price stability (right-hand side of Graph 1) depends on the weight attached to that objective. Thus, for each objective, we consider its status (eg primary, secondary or merely a consideration) and the level of ambition (eg just mitigating fluctuations in output or employment or achieving its maximum level).

Taken together, the four indicators provide a multifaceted picture of a given inflation targeting framework's degree of flexibility. With each core indicator ranging from 0 (minimum flexibility) to 1 (maximum), the most flexible central bank would be one that scored 1 for each of the four core indicators. Concretely, this would correspond to a central bank that: (i) targeted a wide range for core inflation over a qualitative long horizon; and (ii) considered real activity and financial stability as objectives on a par with price stability and had ambitious goals for both. This would be the case if the central bank aimed at maximum employment and used monetary policy explicitly to lean against the build-up of financial imbalances.

While, in principle, it would be possible to aggregate across sub-dimensions and construct a single indicator of flexibility, we regard this as a step too far. For one, focusing the discussion on the four indicators highlights the richness of the various facets of flexibility. In addition, the trade-offs between objectives and the interactions of the different dimensions are too dependent on specific views about the workings of the economy and on country-specific features. Aggregation would be too subjective and give a sense of false precision.

A couple of examples illustrate the point. Consider first the interaction between the numerical specification of the target and the horizon. How does overall flexibility change when the two move in opposite directions, eg the specification becomes tighter, but the horizon lengthens?9 This requires taking a view on the effect on inflation expectations, the credibility of the regime and the economy more generally. Similarly, the trade-offs between inflation, output and financial stability depend crucially on how low inflation interacts with the build-up of financial imbalances and on the impact of monetary policy over different horizons. Views can differ substantially on all of these issues (eg Borio (2024); Svensson (2014)) as well as on which country-specific features matter most. And yet taking a stand on these issues would be critical to set the weights of the four indicators in an overall index.

Aggregation, by contrast, is more straightforward at the level of the features of each sub-dimension (eg the formal status and degree of ambition for an objective). To be sure, here, too, a degree of judgment is required to assign weights (Box A). But the features are more similar and can be more easily compared.

The final, more practical, issue concerns the choice of central bank documents used as a basis for constructing the indicators. We draw exclusively on official documents that describe the features of the regime – objectives and strategy. Objectives, which are often couched in high-level terms (eg "price stability"), are typically set in law. The strategy, which operationalises the objective(s), is more detailed and is typically contained in documents such as specific agreements with the government,10 standalone statements (eg the Federal Reserve's Statement on Long-Term Objectives of Monetary Policy) and annual or inflation reports. We do not include speeches. While relevant, they often reflect individual policymakers' views, whereas strategy statements embody a broader consensus.

The flexibility of current frameworks

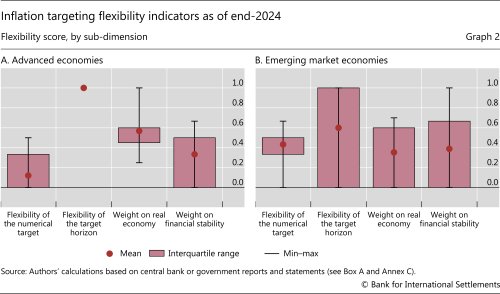

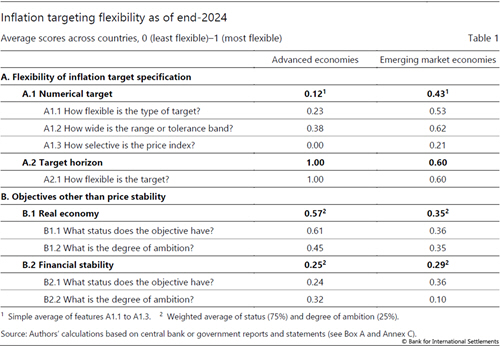

As a starting point, how do frameworks look as of end of 2024 based on the previous indicators? Table 1 lays out the cross-country average value for each of the four sub-dimensions and for the constituent features. Graph 2 portrays summary information of the cross-country dispersion.

AEs and EMEs differ systematically in terms of the specification of the target. AE central banks are significantly stricter in terms of the numerical target. More than half of AEs have the strictest specification, ie a point target for headline inflation and no escape clauses (the euro area, Iceland, Japan, the United Kingdom, Sweden, Norway and the United States). All AEs gain flexibility through the horizon, which is defined only in qualitative terms. By contrast, EMEs rely on more flexible numerical targets (eg ranges) and are more likely to have specific, shorter-term horizons. This may reflect the greater importance of highly volatile inflation components in EMEs (eg commodity and food prices) that may create large but less persistent deviations from target at any given time. It may also stem from the greater challenges faced in retaining credibility over longer horizons given the history of extended periods of higher inflation.

Another striking difference is the weight of real economy considerations. This weight is around 40% higher for AEs. In part, this is because two thirds of AE central banks have real economy formal objectives, against only one third of their EME peers. At one end of the spectrum, in Australia and the United States, these formal objectives have the same status as price stability and are specified in terms of maximum (or full) employment rather than more vaguely (eg supporting the government's economic policy objectives). At the other end of the spectrum are several EMEs for which this objective does not figure at all (Czechia, Indonesia, Peru, the Philippines and Romania). One possible reason why AEs have broader real economy mandates is that this flexibility is seen as representing a smaller threat to the credibility of the target than in EMEs given the better inflation history.

Further reading

By contrast, financial stability has a somewhat lower weight in AEs than in EMEs. One reason is that no AE central bank has a formal financial stability objective for monetary policy. Instead, AE central banks often simply have financial stability "clauses" in their strategy statement, around half of which refer to leaning against financial imbalances. In most cases, however, the clause includes significant caveats. This stands in sharp contrast to Korea, where monetary policy – not macroprudential policy – is explicitly stated as the first line of defence against such imbalances.11

The dispersion portrayed in Graph 2 shows that, across all facets of flexibility, AE frameworks tend to be more homogenous than those in EMEs. In particular, there is greater diversity across EMEs in terms of real economy and financial stability objectives and the flexibility of the target horizon. This coincides with EMEs being more diverse in terms of inflation histories.

Evolution of the flexibility of the frameworks

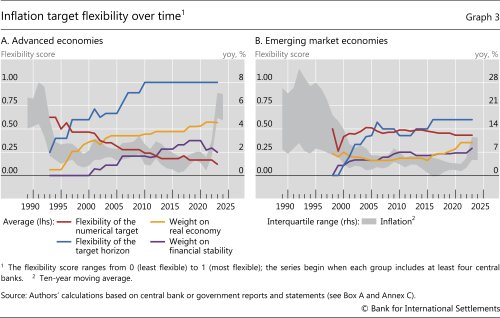

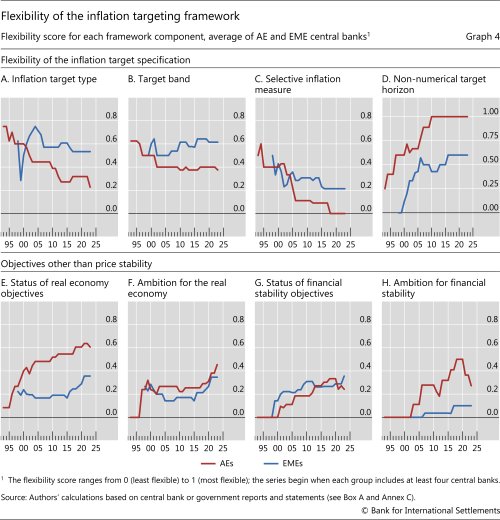

While the previous section describes the most recent snapshot, how did the flexibility of the frameworks evolve to reach the current state? In the big picture, three stylised facts stand out. First, the flexibility of numerical targets has declined while that of the horizons has increased. Second, flexibility has grown with respect to objectives other than price stability – real economy and financial stability. Third, these trends are typically starker in AEs.

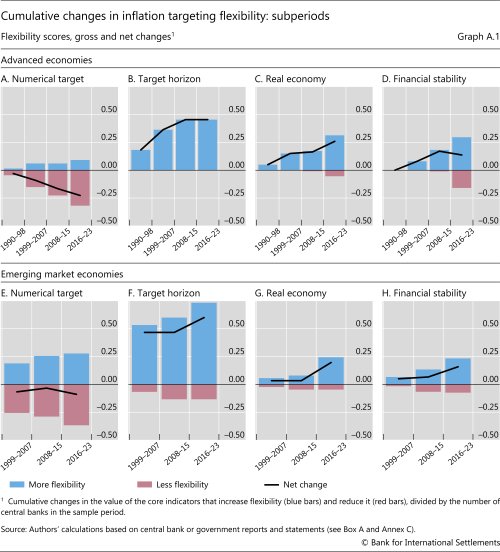

Delving further into the timing and nature of the changes holds clues about the possible driving forces. The pattern is generally consistent with the idea that stronger confidence in hitting the inflation target and in the framework's credibility, as reflected in stricter numerical targets and longer horizons, has provided more leeway to pursue other objectives and address trade-offs. In addition, the Great Financial Crisis (GFC) seems to have left a significant mark, at least in AEs, which bore the brunt of it. To illustrate these ideas, we inspect average indicator values over time (Graphs 3 and 4). To take into account the possible impact of changes in the composition of the sample, we also consider overall changes in core indicators since inflation targeting was adopted (Graph 5) and over subperiods (Annex Graph A.1).12 Consider the specification of the target and objectives, in turn.

Growing confidence in the ability to control inflation and in the frameworks' credibility, as reflected in benign outcomes, was probably the main factor shaping changes in the target specification until at least the GFC. In AEs, by 2008 core inflation targets and escape clauses had largely been dispensed with, and less well specified / longer-term horizons had been established (Graphs 4.C and 4.D). Moreover, if ranges or intervals applied at all, they had mostly become quite narrow (+/–1%) (Graph 4.B).13 As a result, numerical targets had already lost significant flexibility pre-GFC. The picture is less stark in EMEs, where the decline in the level and volatility of inflation generally occurred later. On the eve of the GFC, several (but not all) EMEs had already done away with specific horizons (Graph 4.D), but looser target types (eg ranges) and selective price measures were still relatively common.

The post-GFC phase had a stronger impact on AEs, as policy frameworks adjusted with some delay to certain de facto changes in the conduct of policy. As central banks often struggled to push stubbornly low inflation back to target, the frameworks in AEs often sought to further emphasise a focal point for expectations. This is visible in the continuous fall in the flexibility of AE target types (Graph 4.A). Examples of this trend include dropping ranges (eg euro area) or tolerance intervals (eg Sweden) and adding midpoints (eg Australia). This is consistent with concerns about possible deanchoring of expectations at a time of persistent shortfalls of inflation from target, including with the possibility of costly deflation.14 Better anchoring could be seen as yielding greater leeway to put weight on real economy, at least in the near term. By contrast, in EMEs, while some further adjustment did take place, it was more muted and took place from a considerably more flexible score. This is consistent with the countries not having been at the heart of the GFC, having less concern about inflation shortfalls and, in some cases, having greater concerns about the longer-term implications of very low interest rates for financial stability.

The influence of confidence in inflation targeting frameworks' credibility and of the GFC is also visible in the growing weight of real economy considerations. As inflation performance improved, by the mid-2000s real economy concerns had already risen substantially (Graph 4.E). And the trend continued after the GFC. The set of central banks with formal real economy objectives (or assigning a higher standing to them) includes several AEs, such as Sweden (1997), the United Kingdom (1997), Switzerland (2004), New Zealand (2019) and Australia (2023), but also some EMEs – Thailand (2020) and Brazil (2021).15 Moreover, in AEs the degree of ambition also increased markedly, with a greater concerns about levels or rates of growth or employment (rather than just volatility), eg in Australia, Canada and the United States (Graph 4.F). This is less the case for EMEs.

The evolution of the weight of financial stability follows a broadly similar pattern to that of the real economy. In this case, however, the upward trend and apparent impact of the GFC is more muted overall. Formal financial stability objectives are relatively common in Asia (eg Indonesia, Korea, the Philippines and Thailand), but only Indonesia added it post-GFC. The weight on financial stability among Asian central banks may reflect the experience with the Asian financial crisis in the mid-1990s. Some adjustments also included clauses explicitly mentioning the "leaning against financial imbalances" option (eg Thailand, joining Korea).

In AEs, no central bank in our sample took on a formal financial stability objective for monetary policy after the GFC. Instead, almost all AE central banks added financial stability "clauses" to their strategy statements. Pre-GFC, only Canada and Sweden had adopted such clauses (both in 2006), allowing for leaning against financial imbalances in both cases. In the mid-2010s, clauses spread to eg New Zealand, Norway and the United Kingdom. That said, such clauses lost bite as macroprudential instruments gained ground and became a key tool to fulfil central banks' growing financial stability responsibilities. In Australia, while such a clause was added in 2016, it was removed in 2023 following the Reserve Bank of Australia review.16 Similarly, monetary policy in Iceland no longer has a financial stability mandate since 2022, perhaps reflecting in part the creation of a separate Financial Stability Committee two years earlier. This ebbing of financial stability concerns is visible in a decline in AE financial stability scores in the last part of the sample (Graphs 4.G and 4.H).

Conclusion

Inflation targeting has become the favoured global monetary framework and has proved remarkably durable (Rose (2020)). This study has documented a less well known fact. Under the surface, such frameworks' flexibility has evolved significantly. On the one hand, the explicit weight on objectives other than inflation – real economy objectives such as output and employment and, to a lesser extent, financial stability – has grown. On the other hand, the pursuit of those objectives has been facilitated through greater flexibility of the horizon over which the target is to be achieved even as the target itself has become less flexible. These developments, which are typically more marked among AEs, appear to reflect primarily a mix of considerations: greater confidence in the credibility of the frameworks; what, until recently, has been a benign inflation environment; and the impact of the GFC.

The adaptability of the inflation targeting framework has no doubt been one factor behind its durability. The changes have increased the regime's acceptability. Given past experience, it will be especially interesting to see how the recent surprising surge in inflation will influence the next adjustments. Forthcoming reviews offer a valuable opportunity to further refine the framework.17

The analysis of this study has been purely positive, not normative. The objective has simply been to document the evolution of the flexibility of the framework, not to assess the validity of the changes and their impact on the effectiveness of the regime.18 At the same time, the analysis can inform such an evaluation by providing a systematic cross-country treatment. With that goal in mind, the indicators underlying the study are being made available on the BIS website.

References

Bernanke, B and F Mishkin (1997): "Inflation targeting: a new framework for monetary policy?", Journal of Economic Perspectives, vol 11, no 2, pp 97–116.

Bank for International Settlements (BIS) (2024): "Monetary policy in the 21st century: lessons learned and challenges ahead", Annual Economic Report 2024, June, Chapter II.

Blanchard, O and J Galí (2007): "Real wage rigidities and the New Keynesian model", Journal of Money, Credit and Banking, vol 39, pp 35–65.

Blinder, A (2006): "Commentary: inflation targeting for the United States – comments on Meyer", Inflation targeting: problems and opportunities, papers from a conference at the Bank of Canada, Ottawa, 1 February.

Borio, C (2024): "Whither inflation targeting as a global monetary standard?", BIS Working Papers, no 1230, December.

Borio, C and P Lowe (2002): "Asset prices, financial and monetary stability: exploring the nexus", BIS Working Papers, no 114.

Buiter, W (2004): "The elusive welfare economics of price stability as a monetary policy objective: Should new Keynesian central bankers pursue price stability?", CEPR Discussion Paper, no 4730.

Cecchetti, S, H Genberg and S Wadhwani (2002): "Asset prices in a flexible inflation targeting framework", NBER Working Papers, no 8970.

Ciżkowicz-Pękała, M, W Grostal, J Niedźwiedzińska, E Skrzeszewska-Paczek, E Stawasz-Grabowska, G Wesołowski P and Żuk (2019): Three decades of inflation targeting, Narodowy Bank Polski.

Eggertsson, G and D Kohn (2023): "The inflation surge of the 2020s: the role of monetary policy", presentation at Hutchins Center, Brookings Institution, 23 May.

Ehrmann, M (2021): "Point targets, tolerance bands or target ranges? Inflation target types and the anchoring of inflation expectations", Journal of International Economics, vol 132, p 103514.

Hofmann, B, C Manea and B Mojon (2024): "Targeted Taylor rules: monetary policy responses to demand-and supply-driven inflation", BIS Quarterly Review, December, pp 19–35.

International Monetary Fund (IMF) (2004) "Classification of exchange rate arrangements and monetary policy frameworks", www.imf.org/external/np/mfd/er/2004/eng/0604.htm.

King, M (1997): "Changes in UK monetary policy: Rules and discretion in practice", Journal of Monetary Economics, vol 39, no 1, pp 81–97.

Mishkin, F and K Schmidt-Hebbel (2007): "A decade of inflation targeting in the world: what do we know and what do we need to know?", in F Mishkin (ed), Monetary policy strategy, MIT Press.

Niedźwiedzińska, J (2021): Inflation targeting and central banks: institutional set-ups and monetary policy effectiveness, Routledge.

Romelli, D (2022): "The political economy of reforms in Central Bank design: evidence from a new dataset", Economic Policy, vol 37, no 112, pp 641–88.

Rose, A (2020): "iPhones, iCrises and iTargets: inflation targeting is eradicating international financial crises in the iPhone era", CEPR Policy Insights, no 100.

Rose, A and A Rose (2024): "A presence of absence: The benign emergence of monetary stability", Journal of International Money and Finance, vol 146, p 103–25.

Svensson, L (1997): "Inflation targeting in an open economy: strict or flexible inflation targeting?", Reserve Bank of New Zealand Working Paper, no G97/8.

Svensson, L (2014): "Inflation targeting and "leaning against the wind"", International Journal of Central Banking, vol 10, no 2, pp 103–14.

Taylor, J (1993): "Discretion versus policy rules in practice", Carnegie-Rochester Conference Series on Public Policy, vol 39, pp 195–214.

Taylor, J (2022): "It's time to get back to rules-based monetary policy", Hoover Economics Working Papers, no 22111.

Unsal, D, C Papageorgiou and H Garbers (2022): "Monetary policy frameworks: an index and new evidence", IMF Working Papers, no 22/22.

Woodford, M (2012): "Inflation targeting and financial stability", NBER Working Papers, no 17967.

Annex A

Annex B

Changes in monetary policy frameworks: what, who and when

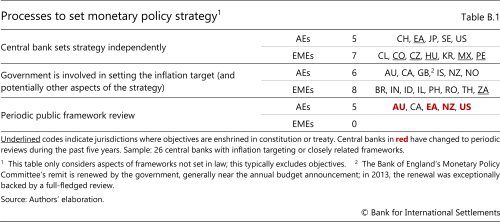

Whether and how changes to frameworks occur depends on the institutional context and the specific adjustment.

Objectives for monetary policy are often enshrined in law (or more rarely in constitution or treaty). Therefore, changing them is generally up to government or parliament. For the strategy (ie the operationalisation of the objectives), there are two main cases (first two rows of Table B.1). In the first group of jurisdictions, the central bank sets the strategy independently and can therefore take the initiative to make changes on its own. This was the case, for instance, of the recent changes to the strategies of the Federal Reserve (2020) and ECB (2021).

In the second group, the government is involved in setting key aspects of the strategy. Therefore, adjustments are initiated by the central bank alone or together with the government depending on the aspect in question. In Australia, Canada, Iceland and New Zealand, the government and central bank sign a joint agreement covering the numerical inflation target and other aspects (eg trade-offs between objectives). In the United Kingdom, the government sets the strategy independently. Among EMEs, when the government is involved, it typically focuses on setting the numerical inflation target (alone or jointly with the central bank).

The frequency and incidence of changes also differ. Since changing objectives requires a parliamentary process, this happens relatively infrequently on an ad hoc basis. The strategy can potentially change more frequently and regularly. Recently, the Reserve Bank of Australia, ECB, Reserve Bank of New Zealand and Federal Reserve have announced the intention to review their strategy every five years. This follows the Canadian practice since 1998.19 Other central banks have occasionally reviewed their strategy on an ad hoc basis (eg those of Chile, Japan, Norway, Switzerland and Thailand). Yet another case is for the government to set the inflation target on a regular basis – eg every year for Brazil, and every three years for Korea – typically without changing other aspects of the strategy.

The approach to conducting reviews also differs widely. In AEs, it has become commonplace for central banks and/or governments to conduct public framework reviews. These can cover a range of aspects, including objectives and/or the strategy. It is also frequent for reviews to be led by external experts, typically academics or ex-central bankers, especially when the government commissions the review. In EMEs, public reviews led by experts are rare (Chile and Thailand are two exceptions). In most cases, target changes happen without reviews.

Annex C. Data notes and sources

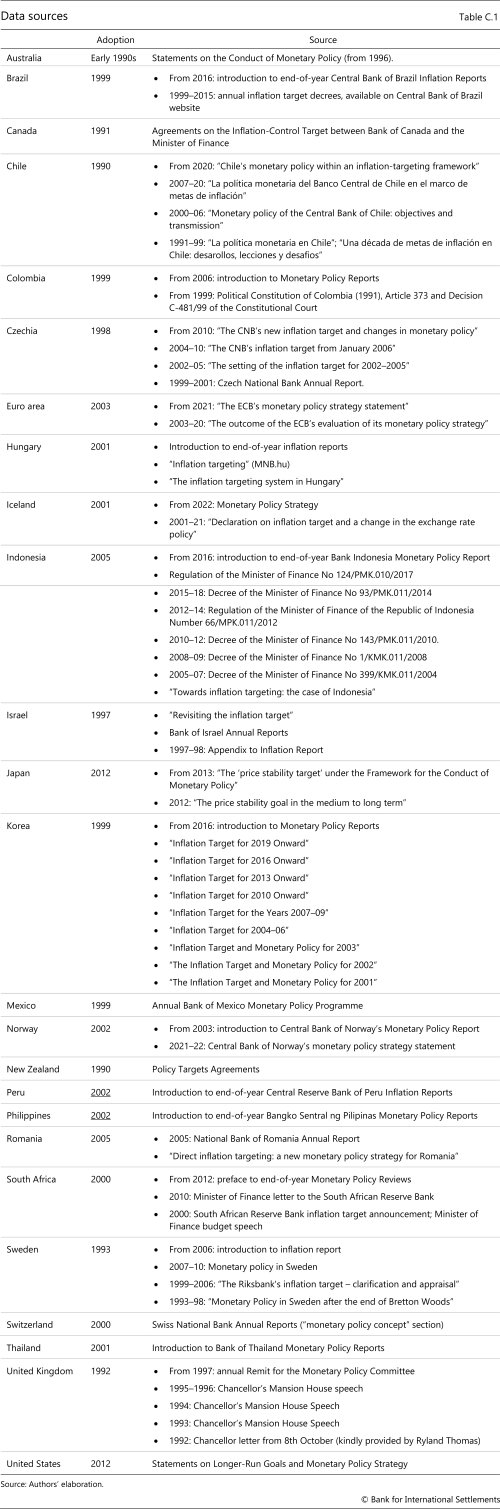

The data are collected manually from publicly available sources. Table C.1 lists the official sources used. Whenever available, we use the English language version of the source material. Central banks sometimes specify that English language material does not constitute official publications. In a handful of cases, we have used online tools to translate original language sources.

The codification of source material reflects the authors' judgment only and is done on a best efforts basis. Some codification choices are worth highlighting, even if they concern only a handful of observations.

When source material is unavailable for a given jurisdiction and year (or for a specific framework feature), we assume that the latest available source remains valid.

In a few cases, the central bank has both a short-term and a medium-term inflation target. We consider only the former. In terms of escape clauses, we only consider instances when specific items are explicitly excluded from the price measure targeted, or when the statement explicitly says that the central bank does not respond to some specific shocks. We ignore cases when the strategy statement merely specifies that the central bank responds differently to some shocks, or that it expects inflation to deviate from target in the short term.

In a few cases, there is a discrepancy between the horizon for the inflation target set out in the strategy statement and the formal announcement of the target (typically made by the government alone or jointly with the central bank). In such cases we consider the information in the strategy statement.

For the target price measure, for simplicity we also consider that the central bank targets CPI inflation when it uses a measure that strips out the direct effect of changes in policy rates.

We do not consider that the central bank has an objective for the real economy or financial stability when its strategy statement merely specifies that price stability is a precondition or key factor for eg growth or financial stability (or the reverse). We do not consider as a financial stability objective instances of objectives for eg development of the financial system or the functioning of the payment system. Even when the statement mentions a financial stability objective, it is not always clear to what extent it applies to monetary policy, as opposed to being only an institution-wide objective. In such cases, absent a clear indication that financial stability is relevant to monetary policy, we consider that the central bank has a consideration for financial stability rather than an objective.

In a few cases, the formulation of the central bank's objective for the real economy or financial stability differs from the formulation in law. In these cases, we use the strategy statement, since it is typically timelier. In the few cases of objectives to support economic growth, we give the same score as for objectives to dampen economic volatility. When the objective is for full potential growth, we give the same score as objectives for full employment.

When there are more than two options for one framework feature, we set scores so that there is an equal increment between each option. One exception is for the ambition for the real economy (B1.2). The highest-scoring option for that feature is an objective to miminise shortfalls from full employment. The second highest ranking option is to achieve full employment. These two options would differ when employment is above estimated full employment, but not when it is below. Therefore, we set the increment between these two options to half of the increment between the other options for that feature.

Some choices about the sample are also worth discussing. In general, a central bank is included in the sample from the year when it adopts inflation targeting. In a few cases, however, there are missing data for some years after adoption. For instance, the Reserve Bank of Australia considers that it adopted inflation targeting "in the early 1990s". Until 1996, however, the inflation target was only set out in vague terms in the Governor's speeches. Therefore, Australia only enters the data set in 1996. The euro area counts as one observation. We include the ECB from 2003, when it clarified that it did not tolerate deflation.

1 The views expressed do not necessarily reflect those of the Bank for International Settlements. We thank Sarah Bell, Blaise Gadanecz, Gaston Gelos, Boris Hoffman, Benoît Mojon, Piti Disyatat, Tom Rosewall, Phurichai Rungcharoenkitkul, Andreas Schrimpf, Hyun Song Shin and Frank Smets for helpful comments and suggestions. We are also grateful to Albert Pierres Tejada for excellent research assistance, and for colleagues at several central banks for their help in locating sources.

2 Inflation targeting – a price-stability-oriented monetary policy framework that sets specific and publicly known numerical targets – was first adopted in New Zealand in 1990. See Rose and Rose (2024) and Borio (2024).

3 See eg Blinder (2006).

4 The present analysis complements other descriptive studies documenting the features of inflation targeting regimes but without focusing on flexibility (Mishkin and Schmidt-Hebbel (2007); Niedźwiedzińska (2021); Ciżkowicz-Pękała et al (2019); Unsal et al (2022)).

5 We cover BIS member central banks only. The grouping follows BIS convention. AEs are Australia, Canada, the euro area, Iceland, Japan, New Zealand, Norway, Sweden, Switzerland, the United Kingdom and the United States. EMEs are Brazil, Chile, Czechia, Hungary, Indonesia, India, Israel, Korea, Mexico, Peru, Romania, the Philippines, South Africa and Thailand. See Annex C for additional details.

6 In modern macroeconomic parlance, flexibility is key when the central bank faces shocks that create policy trade-offs. In this context, flexibility is not relevant when there is a "divine coincidence" between objectives, eg after a demand-driven inflation shock (Blanchard and Galí (2007)).

7 For instance, flexibility allows policymakers to respond less strongly to supply-driven inflation "shocks", as AE central banks often do (Hofmann et al (2024)). See Svensson (1997) for an early elaboration of the concept of "flexible inflation targeting".

8 We chose the two objectives at the heart of central bank functions. The real economy has been central to discussions of the merits of inflation targeting from the very beginning, as exemplified in the Taylor (1993) rule. Financial stability emerged around the early 2000s, linked to the possible build-up of financial imbalances (Borio and Lowe (2002); Cecchetti et al (2002)), and became more prominent in the debate following the Great Financial Crisis (eg Woodford (2012)). Objectives around eg climate and inequality have been discussed recently, but without affecting inflation targeting frameworks.

9 Over a certain range, tightening the numerical target while lengthening the horizon can, on balance, increase flexibility, by better anchoring expectations while simultaneously making the target more achievable. But, after a point, the same shift could de-anchor expectations and reduce flexibility.

10 See Box B for a discussion of the roles of the government and the central bank in shaping the strategy.

11 The financial stability weights are highest in Korea and Indonesia. The Bank of Korea has a statutory financial stability objective, but no formal macro- or microprudential responsibilities.

12 The composition of the sample changes over time as more jurisdictions adopt inflation targeting. By 2005, around 90% of central banks in the sample had adopted inflation targeting. The graphs indicate that compositional effects are generally not significant.

13 The switch away from selective price measures might also have been relatively inconsequential, since in practice decision-making often puts significant weight on core inflation.

14 See eg the 2023 review of the Reserve Bank of Australia.

15 In 2023, however, upon the election of a new (conservative) government, the Reserve Bank of New Zealand lost the dual mandate it had been given in 2019 by the previous (Labour) government.

16 After the review, the joint agreement between the Australian government and the Reserve Bank of Australia still featured a section on financial stability objectives for the central bank, but financial stability was no longer mentioned in the monetary policy section of the agreement.

17 The Federal Reserve and ECB are conducting monetary policy framework reviews in 2025.

18 For two such recent assessments, see eg BIS (2024) and Borio (2024).

19 Before then, the Reserve Bank of Australia and Reserve Bank of New Zealand renegotiations of the agreement typically coincided with new governments or Governor tenures.