Geographic dimensions in BIS international banking statistics

Box extracted from chapter "International finance through the lens of BIS statistics: the geography of banks' operations"

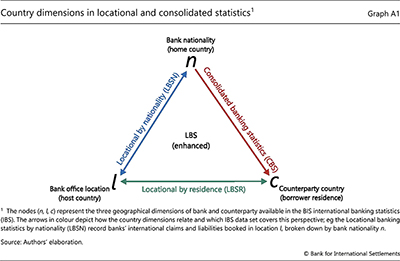

The BIS international banking statistics (IBS) provide several complementary perspectives on international banking activity. This box puts the locational (LBS) and consolidated (CBS) versions of the IBS in their geographical context, using the country dimensions introduced in McGuire et al (2024a).

Consider a bank (eg lender l) that transacts with a borrower in country c (Graph A1). The arrow (l → c) represents positions between them based on the residence view, ie the countries in which the lender and borrower reside. By contrast, viewing banks from a nationality perspective (n→ c) yields a consolidated view of the lenders' exposures to a particular country (Hardy et al (2024)). The nationality view groups the balance sheets of resident units with those of the non-resident affiliates they control (with intragroup positions netted out).

The IBS capture all three dimensions at the country level. To illustrate, suppose a German bank books cross-border claims in its London office on counterparties in Brazil. How are these claims reflected in IBS data sets?

-

The CBS track banks' worldwide consolidated claims on counterparties in a particular country. The CBS thus capture the bank nationality and counterparty country dimensions (red in Graph A1). The claims of the German bank in London on borrowers in Brazil are aggregated with German banks' total consolidated claims on Brazil, regardless of where the claims are booked (no bank location dimension).

-

The LBS by residence (LBSR) track the claims of all bank affiliates located in one jurisdiction on counterparties in each country; the LBS capture the bank location and counterparty country dimensions (green). The German bank's claims on Brazil booked in London appear together with those of all banks in the United Kingdom, regardless of where they are headquartered (no bank nationality dimension).

-

The LBS by nationality (LBSN) in every country record bank balance sheets grouped by their home country; they capture the bank location and nationality dimensions (blue). The German bank's claims booked in London on borrowers in Brazil are aggregated with all cross-border claims that German affiliates book in the United Kingdom, regardless of where the borrower abroad resides (no counterparty country dimension).

-

The enhanced LBS available since 2013 combine LBSR and LBSN to capture all three dimensions simultaneously: bank nationality, bank location and counterparty country.