Hedge fund exposure to the carry trade

Box extracted from Overview chapter "Carry off, carry on"

The unwinding of carry trades on 5 August coincided with a widespread sell-off across global asset classes, particularly those with more concentrated hedge fund positions. Carry trades are leveraged cross-currency positions exploiting interest rate differentials and low volatility. Since many funds actively trade across asset classes, gaining an understanding of their exposure to the carry trade can provide some evidence about spillover mechanisms. We find that the hedge fund sector had become increasingly exposed to the markets that were at the epicentre of the 5 August turbulence. Though our data do not cover early August and thus cannot be used to directly assess the episode, they allow us to shed light on how vulnerabilities were building up.

We focus on the sensitivity of the returns of various hedge fund strategies to the returns on currency carry trades. This is a useful, albeit indirect, indicator of the portfolio strategy of the fund. The higher the sensitivity, the higher the likelihood that the fund is actually engaged in carry trades. And even if the fund is not engaged in a carry trade itself but some related strategy that shares similar risk characteristics, a higher sensitivity implies a higher exposure to losses should carry trade returns suddenly evaporate.

We estimate the shifting sensitivities of various hedge fund strategies to the performance of a long-short carry trade portfolio. We proxy the latter with returns to the S&P Risk Premia FX Carry G10 Index. For the performance of different hedge fund strategies, we draw on the Credit Suisse Hedge Fund Indices. Derived from a comprehensive sample of over 9,000 distinct funds, these indices report the monthly performance of hedge funds grouped by various trading strategies and are calculated as the asset-weighted averages of the returns of constituent funds. The sensitivities (betas) of hedge fund returns to carry trade returns are obtained using a rolling regression on monthly data and controlling for the overall "market beta". Our findings are as follows.

The sensitivities (betas) of hedge fund returns to carry trade returns are obtained using a rolling regression on monthly data and controlling for the overall "market beta". Our findings are as follows.

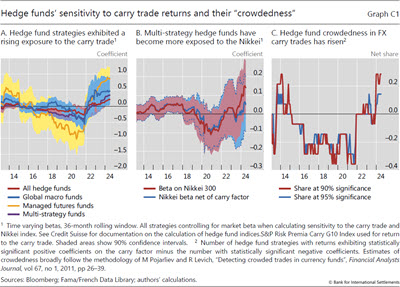

First, ahead of the August turbulence, hedge fund returns on the whole had become more sensitive to the proxies for returns on currency carry trades. Following the pandemic and the rapid yen depreciation that started in early 2022, the sensitivity of the aggregate index of hedge fund returns to carry trade returns had turned positive and continued to increase through this July (Graph C1.A, red line). This is consistent with a pre-turbulence build-up in hedge fund exposure to the risks of a reversal in carry trade returns.

Second, returns to hedge fund strategies most prone to engage in carry trades exhibited the greatest increase in sensitivity to carry trade returns. The returns of global macro and managed futures funds, both traditionally recognised as key players in carry trades, exhibited the most significant shifts in sensitivity from 2022 onwards (Graph C1.A, blue and yellow lines). This supports the notion that the increased sensitivity estimated by our methodology indeed reflected an increase in carry trades in the hedge fund community.

Third, at the same time, hedge funds with greater potential for spillovers across instruments outside of currency markets also became increasingly sensitive to the carry trade. The sensitivity to carry returns of managed futures funds, which often pursue momentum-based trading strategies and are active across a variety of derivatives markets such as equity options and VIX futures, exceeded that of global macro funds from 2023.

Fourth, hedge funds employing some of the most diversified strategies, and hence in theory less subject to the vagaries of any single strategy, increased their sensitivity to the very markets that were subsequently disrupted. We find that so-called multi-strategy funds did not just become significantly more exposed to the risks associated with FX carry trades (Graph C1.A, purple line), they also appear to have significantly increased their exposure to Japanese equities. Accordingly, the sensitivity of multi-strategy funds' returns to the Nikkei 300 index returns surged over the past year (Graph C1.B, red line), even when controlling for carry trade returns (Graph C1.B, blue line). Moreover, one popular strategy pursued by multi-strategy funds over the period profited from the discrepancy in option prices on an equity index compared with its constituents. Some specialised funds reportedly found it profitable to establish VIX short positions while purchasing options on individual S&P 500 company stocks. Our results thus suggest that the shadow of the carry trade risk factor was cast on seemingly distinct long-short equity volatility strategies.

Our results thus suggest that the shadow of the carry trade risk factor was cast on seemingly distinct long-short equity volatility strategies.

Fifth, the finding that the hedge fund sector may have been crowding into a common exposure to the carry trade is supported by other measures as well. In particular, in the lead-up to the recent volatility episode, the number of distinct hedge fund strategy classes positively exposed to the carry trade had exceeded the number with negative exposure. Specifically, the (net) number of strategies with statistically significant positive carry trade exposure turned positive and increased as a share of all strategy classes (Graph C1.C).

Crowdedness, combined with high leverage, set the stage for the amplification of stress and cross-asset spillovers. According to the SEC Private Fund Statistics, multi-strategy hedge funds entered the episode with high leverage. Their leverage ratio was 4:1 by traditional measures and 14:1 when accounting for synthetic leverage via derivatives. A jump in common risk management metrics at the fund level, notably value at risk, likely compelled these funds to reduce exposure, not just in a single affected asset class but across a broader range of assets. And when multiple strategies are effectively heavily exposed to the same risk factor, such as that underlying carry trade returns, such crowdedness can amplify the tail risk as funds scramble to exit similar positions at the same time.

A jump in common risk management metrics at the fund level, notably value at risk, likely compelled these funds to reduce exposure, not just in a single affected asset class but across a broader range of assets. And when multiple strategies are effectively heavily exposed to the same risk factor, such as that underlying carry trade returns, such crowdedness can amplify the tail risk as funds scramble to exit similar positions at the same time. During the August event, no major fund failures were reported, as hedge funds appeared to have buffers to meet margin calls and had other positions that were "in the money."

During the August event, no major fund failures were reported, as hedge funds appeared to have buffers to meet margin calls and had other positions that were "in the money."

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.  The index measures the performance of a long-short carry strategy consisting of G10 currencies (USD, EUR, GBP, JPY, AUD, NZD, CAD, CHF, NOK, SEK). The strategy maintains long exposure in the three currencies with the highest carry rankings and short exposure in those with the lowest carry rankings, while keeping the FX risk unhedged.

The index measures the performance of a long-short carry strategy consisting of G10 currencies (USD, EUR, GBP, JPY, AUD, NZD, CAD, CHF, NOK, SEK). The strategy maintains long exposure in the three currencies with the highest carry rankings and short exposure in those with the lowest carry rankings, while keeping the FX risk unhedged.  See, for example, J Lee, "A hedge-fund volatility trade risks getting crushed by the crowd", Bloomberg, 24 May 2024.

See, for example, J Lee, "A hedge-fund volatility trade risks getting crushed by the crowd", Bloomberg, 24 May 2024.  Synthetic leverage refers to the ratio of the total exposure in a derivative contract to the costs of putting on the position. A common measure is the ratio of gross notional value to the initial margin.

Synthetic leverage refers to the ratio of the total exposure in a derivative contract to the costs of putting on the position. A common measure is the ratio of gross notional value to the initial margin.  See, for example, G Brown, P Howard and C Lundblad, "Crowded trades and tail risk", Review of Financial Studies, vol 35, no 7, July 2022, pp 3231–71.

See, for example, G Brown, P Howard and C Lundblad, "Crowded trades and tail risk", Review of Financial Studies, vol 35, no 7, July 2022, pp 3231–71.