Shifting landscapes: life insurance and financial stability

The past decade's low rate environment challenged traditional life insurers' business models and has been a catalyst for ongoing shifts in the sector. To sustain profitability, life insurers have increased exposures to riskier and less liquid asset classes. Some have also offloaded risks through complex reinsurance agreements, often to offshore centres, partly with an eye to economising on capital. Private equity firms have been a driving force behind these trends. They have funnelled investment into private markets by acquiring or partnering with life insurers or assuming insurance portfolios through affiliated reinsurers. While more diversified investments and greater risk-sharing can, in principle, support insurers' resilience, losses in private markets could propagate risks across an increasingly interconnected and complex insurance landscape.1

JEL classification: G22, G28, G32.

The life insurance and annuity ("life insurance") sector plays a pivotal role in the financial landscape. Life insurers provide financial protection and savings products to households and represent a key source of funding for governments and the real economy. In 2022 they managed total assets of about $35 trillion, around 8% of global financial assets, up from $14 trillion two decades ago (FSB (2023)).

During the era of exceptionally low interest rates, from the aftermath of the Great Financial Crisis (GFC) until late 2021, life insurers' traditional business model encountered significant challenges. Low rates undermined the sustainability of legacy insurance policies that promised high guaranteed rates of return. Furthermore, subsequent reductions in guarantees, introduced to mitigate pressure on returns, dampened demand for new policies.

Pressure on traditional business lines contributed to reshaping the life insurance landscape by accelerating two interrelated trends (eg IAIS (2023, 2022)). First, by reducing profit margins, low rates intensified insurers' efforts to develop risk-sharing strategies to cut costs and economise on capital. These efforts spurred the transfer of risks to affiliated or non-affiliate insurers, often located in offshore centres, and insurers' divestment from traditional business lines (eg policies offering guarantees). Second, by intensifying investors' search for yield, low rates underpinned the growth of private markets. Life insurers increasingly invested in these markets to raise and diversify returns, investing in riskier and less liquid assets. These trends have continued, and are poised to continue, even as higher interest rates have mitigated pressure on profit margins.

Key takeaways

- Years of exceptionally low interest rates accelerated ongoing trends in the life insurance sector, raising insurers' exposure to more risky and less liquid assets.

- Offshore reinsurance, potentially leveraging regulatory differences across jurisdictions, has surged in some regions, leading to an increasingly interconnected and complex life insurance landscape.

- Private equity firms have been a driver of these trends by facilitating insurers' investment in private markets and acquiring insurance portfolios through affiliated reinsurers.

Private equity (PE) firms have been a driving force behind these trends. By acquiring or partnering with insurers, these firms have been instrumental in channelling insurers' investments into private markets and other alternative asset classes. PE firms have also contributed to insurers' rising reliance on asset-intensive reinsurance (AIR). In these complex reinsurance agreements, life insurers fully or partly owned by PE firms ("PE-linked life insurers")2 assume part of the liabilities from other life insurers in exchange for the assets backing them.

The entry of PE firms has provided an additional source of capital to the life insurance sector but the associated changes to insurers' business models also raise risks. These risks are more likely to materialise in the higher interest rate environment that has followed the recent global inflation flare-up. Over the past decade, PE firms have made significant investments in the insurance sector and have relied on their investment expertise to boost insurers' profitability. This has mitigated the impact on policyholders of traditional life insurers' divestment by allowing insurers to offer their policies at more attractive prices. However, life insurers' increased exposure to more risky and illiquid assets raises the risk of losses and vulnerability to sudden liquidity needs, while growing reliance on AIR raises concerns about interconnectedness and complexity.

This special feature discusses the above trends in the life insurance sector. The next section introduces the basic components of life insurers' balance sheets and sketches the mechanism through which low interest rates harm insurance companies' profitability. The second lays out how life insurers have employed AIR to offload risks, thereby addressing their profitability and capital challenges. The third section assesses PE firms' expanding footprint in the life insurance sector, including through reliance on AIR and increasing exposure to private markets. The fourth section discusses related concerns for financial stability, before laying out some concluding considerations.

Life insurers' profitability and interest rates – a primer

Life insurance companies offer a range of contracts (insurance policies) that allow policyholders to hedge primarily against the financial impact of mortality and longevity risk. Term life insurance, for example, offers financial protection against mortality risk by paying a benefit upon the death of the insured during the coverage period. Life fixed annuities, in turn, guarantee annuity payments for the lifetime of the policyholder to cover the financial risk associated with longevity.3

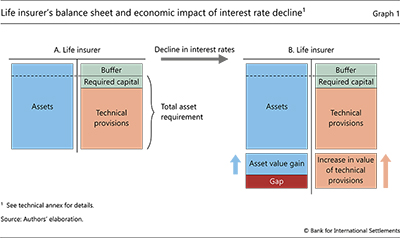

Policyholders agree to pay premiums for these insurance policies as determined in the contract. If a policyholder stops paying the agreed premiums, the insurer's future payment obligations are lowered or the policy lapses (ie it is no longer in effect). When initiating the contract, the insurer sets the premiums as a function of several factors: the actuarial value of the policy (ie the present value of expected future cash flows, including premiums, benefits and other policy-related payments), servicing costs, capital requirements and a profit markup (Koijen and Yogo (2016, 2023)). The collected premiums are pooled and invested in various financial instruments, such as bonds, stocks and real estate, which constitute the asset side of the insurer's balance sheet (Graph 1.A). These assets are managed with an eye to the insurer's liquidity and solvency, with an allocation that seeks to match the duration and cash flow characteristics of the liabilities.

"Technical provisions" represent the bulk of life insurers' liabilities (Graph 1.A). These provisions comprise so-called "policy reserves", which reflect the expected net present value of the policies, and other reserves or provisions that may be required by regulatory or accounting standards. Technical provisions and capital requirements often exceed the amount of funds received from the policyholder at the start of the life insurance policy. This is because life insurers must be able to meet any payment obligations as of the initiation of the contract while they typically receive premiums in instalments over the course of multiple years. Life insurers cover this gap using their own equity capital, which may require a substantial upfront commitment for some policies ("capital-intensive" business).4 Capital buffers are also held to cover unexpected losses. In this context, regulation plays an important role by determining minimum standards for the calculation of technical provisions, capital requirements (eg for credit risk and interest rate risk) and the investment policy to match liability cash flows.

The interest rate environment impacts the financial condition of life insurers in important ways. Life insurers are typically exposed to a decline in interest rates due to a negative duration gap (Farkas et al (2023b)): the duration of their assets is generally shorter than that of their liabilities. The duration gap fluctuates with movements in long-term interest rates due to negative convexity (eg Domanski et al (2017)). A fall in interest rates raises the value of the technical provisions by more than that of the assets.5 This leads to a gap on the asset side (Graph 1.B, red "gap") that depletes capital, even though accounting rules may shield insurers from having to recognise the loss immediately in the balance sheet (eg Ellul et al (2015)). In addition, persistently low interest rates reduce insurers' future revenue from new fixed income investments that they make to match their liabilities, weighing on life insurers' profit margins.

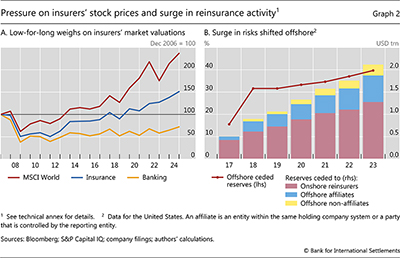

Accordingly, stock market valuations of many life insurers underperformed relative to the broader market throughout much of the low-for-long era. This put pressure on insurers to adjust their business models (Graph 2.A).

Adjustments to sustain return-on-equity focused on intensifying efforts to reduce technical provisions and economise on capital, especially for capital-intensive businesses. In this context, some life insurers have increased offerings of unit-linked products,6 which shift the investment risk to the policyholders and reduce technical provisions while generating fee-based income ("capital-light" business). Importantly, some have also relied on AIR.

Asset-intensive reinsurance – risk-sharing and other incentives

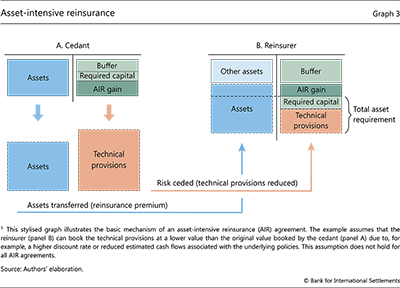

AIR – also sometimes referred to as "funded reinsurance" – seeks to free up capital of life insurers by transferring risks associated with capital-intensive policies to other insurers. Under an AIR agreement, the reinsurer (ie the insurer providing reinsurance) assumes all risks from the cedant (ie the insurer obtaining reinsurance). These risks comprise those inherent in the issued policies (eg mortality, longevity, contractual guarantees)7 and those related to the assets (eg credit risk, market risk) that back the policies. Following mutually agreed investment guidelines, the reinsurer manages the assets, which are typically held in a custody account and pledged as collateral to the cedant.8

Consistent with life insurers' incentives to divest from capital-intensive business, reinsurance activity has grown significantly in major insurance markets over the past decade (IAIS (2023), Moody's (2023)). In the United States, where detailed data are available, major life insurers had ceded reserves to the tune of $2.1 trillion at end-2023, roughly equivalent to no less than one quarter of their total assets, and up from around $500 billion in 2017 (Graph 2.B). Around 40% of ceded risks were assumed by reinsurers in offshore centres, nearly three times the share reported in 2017 (see also Graph 5).

AIR can serve several objectives (IAIS (2023)). First, when the risk is transferred across affiliates of the same group, it allows the group to centralise asset and capital management. This, in turn, can help cut costs and enhance operational efficiency. Moreover, groups may wish to bundle risks at entities that operate in financial hubs with significant insurance activity, helping the group in raising capital to support its reinsurance activities more efficiently.

Further reading

Second, cross-jurisdictional AIR can leverage differences in corporate and dividends taxation, valuation of technical provisions and capital requirements. An illustrative example lays out the mechanism. Building on the stylised balance sheet in Graph 1.A, consider a hypothetical life insurer that holds a block (portfolio) of life insurance policies, for which it books technical provisions and holds capital to meet regulatory requirements. The sum of technical provisions and capital requirements determines the amount of assets the insurer needs to hold to back these liabilities (so-called "total asset requirement", see Graph 1.A). In some jurisdictions, as in the illustrative example, the regulatory framework may prescribe a lower valuation of technical provisions for the same block, due to lower assumptions on expected cash flows and/or a higher discount rate. In addition, regulation may also grant greater investment flexibility, imposing less stringent constraints on insurers with regard to investments in riskier assets with higher expected yields (eg American Academy of Actuaries (2024)). This, in turn, could also raise the discount rate applied to the calculation of technical provisions.9 Additionally, the reinsurer's jurisdiction might mandate lower capital requirements.10

Under these assumptions, the cedant and reinsurer could agree on a transfer of assets and risks that creates a gain for both parties. The cedant transfers assets (reinsurance premium) that amount to less than the technical provisions associated with the block of policies (the dashed blue box is smaller than the dashed orange box for the cedant in Graph 3.A). This transfer also reduces the cedant's required capital, although some capital will be necessary to protect against the counterparty credit risk arising from the agreement (the light green box for the cedant is smaller in Graph 3.A compared to Graph 1.A).11 As a result, the cedant frees up some capital, which creates an "AIR gain" (the dark green box in Graph 3.A). The reinsurer, in turn, receives the assets, which exceed its total asset requirement because of the lower technical provisions (the orange box in Graph 3.B) and required capital (light green box in Graph 3.B) that apply in its jurisdiction. This difference creates an "AIR gain" for the reinsurer (dark green box in Graph 3.B).

Third, AIR agreements can be motivated by the reinsurer's ability to generate higher returns on the assets that back the deal compared to the cedant. Reinsurers stress this greater ability as a key profit driver (IAIS (2023)). In this regard, AIR differs from more conventional reinsurance in the life insurance sector, which focuses on assuming mortality and longevity risks (ie is driven by the liability side) to leverage diversification benefits for the reinsurer. It is in this context that PE firms have greatly expanded their footprint in the life insurance sector.

Expanding footprint of private equity (PE) firms in life insurance

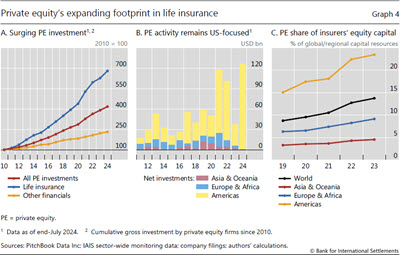

PE firms' investment in the life insurance sector has surged over the past 14 years. Cumulative investment has grown nearly sevenfold since 2010, outpacing by a large margin the growth rates of total PE investment in other firms, including financials (Graph 4.A). Investment activity has remained concentrated in the US market (Graph 4.B), consistent with the dominance of US-based PE firms (Cortes et al (2023)). Investment in other regions has expanded more gradually, with the share of PE firms' ownership of life insurers' equity still lagging behind the levels prevailing in the United States (Graph 4.C).

PE firms' entry into the insurance sector has followed different strategies. One strategy has been acquiring primary life insurers or an equity stake therein. Another has been to invest in existing reinsurers or establish new ones to take over blocks of policies, eg via AIR agreements. A third strategy is providing asset management and origination services in private markets for insurers to generate fee income. Some PE firms have also chosen combinations of these strategies (Swiss Re Institute (2024)).

A range of factors have driven PE firms' greater involvement in the sector. One, as discussed above, has been traditional life insurers' efforts to divest from their capital-intensive business, providing an ample supply of blocks of legacy policies to take over. Related to this, many life insurers' depressed stock market valuations offered attractive investment opportunities. At the same time, PE firms benefited from large inflows of funds, which, combined with cheap leverage, provided them with the financial capacity to invest at scale. The widespread search for yield, including by institutional investors such as life insurance companies themselves (Kaufmann et al (2024), Farkas et al (2023a)), strengthened this trend.

There are three main benefits to be gained by PE firms acquiring or partnering with life insurance companies. First, PE firms can channel the largely predictable cash flows from insurance premiums into assets originated by PE firms, such as structured credit, direct lending and infrastructure. For PE firms, this generates fixed income from fees related to originating and managing the assets. In line with this benefit, PE-linked insurers were twice as likely to invest in assets originated by PE firms compared to other insurers.12

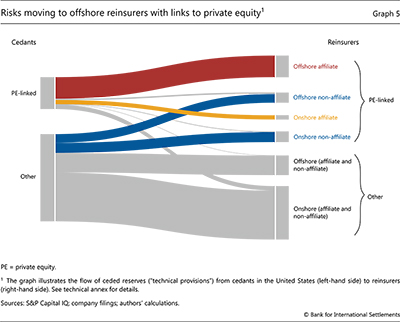

Second, PE firms have proven more effective in exploiting opportunities arising from cross-jurisdictional differences in regulatory frameworks and corporate taxation to boost life insurers' profits (Kirti and Sarin (2024)). One way to capitalise on these opportunities is by ceding risk from affiliated life insurance companies (ie entities that are part of the same group) to an affiliated reinsurer located in a jurisdiction with lower technical provisioning and capital requirements, or more favourable tax rules. Consistent with this, PE-linked life insurers in the United States had ceded risk to affiliated insurers equivalent to almost half of their total assets (or nearly $400 billion) by the end of 2023, compared to less than 10% of total assets for other US life insurers. About two thirds of the risks ceded by PE-linked life insurers were assumed by affiliate reinsurers with links to PE located in offshore centres (indicated by the red flow in Graph 5 from PE-linked cedants to offshore affiliate reinsurers). Onshore affiliates assumed only about 10% (yellow flow from PE-linked cedants to onshore affiliate reinsurers). Other reinsurers, predominantly companies in onshore locations without links to PE firms, accounted for most of the remainder. Moreover, reinsurers with links to PE firms assumed more than 20% of the risks ceded by other US life insurers, of which half was moved offshore (blue flows from other cedants to PE-linked offshore or onshore non-affiliate reinsurers, respectively).

Third, PE firms can leverage their investment expertise and management capacity. This allows them to give a boost to life insurers' returns. They do so by directing their investment in often opaque private markets, where they have a comparative advantage in assessing credit and liquidity risks. In line with this, PElinked insurers' investments are often less liquid and more difficult to value, with notably larger shares allocated to structured credit (IMF (2024), Cortes et al (2023)). Granted, these investments may be well suited to match the long-term commitments to policyholders. Even so, valuation uncertainty could mask the accumulation of unrealised losses. Furthermore, elevated exposure to liquidity risk could raise these insurers' vulnerability to unexpected outflows. A prominent example was the self-reinforcing acceleration of surrenders that followed the rise in interest rates and resulted in the failure of a PE-linked European life insurer in early 2023 (BIS (2024)).

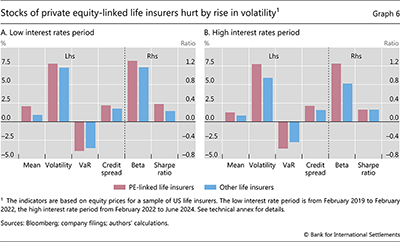

The ability of PE-linked life insurers to generate excess returns for their shareholders has depended on the interest rate environment. While interest rates were low, the mean returns of shares of PE-linked insurers were more than twice as large as those of their peers (Graph 6.A). Their risk-adjusted returns were also higher, with Sharpe ratios around 50% larger. However, PE-linked insurers had larger market betas, indicating higher exposure to market downturns.13 This is also consistent with their greater risk appetite and funding cost on their issued bonds as well as the assumption of higher tail risks, as indicated by their stock price VaR.

Accordingly, the higher risk of PE-linked insurers' assets started to become more visible when interest rates rose. In contrast to their peers, the volatility and betas of PE-linked insurers stayed elevated, and their risk-adjusted returns fell while still exhibiting larger tail risks (Graph 6.B).

Financial stability considerations

Life insurers' rising reliance on AIR, increased exposure to private markets and growing interconnections with PE firms raise several concerns for financial stability and challenges for supervision.

Reinsurance chains have become more complex. The life insurance sector has become more interconnected, with rising amounts of risks migrating across entities and jurisdictions.14 It has therefore become more difficult to assess how risks could propagate through the system, highlighting the importance of rigorous group-wide supervision, systemic risk analysis and international cooperation.

If unaddressed by group-wide supervision, cross-border AIR could raise particular challenges. For one, differences in legal or regulatory frameworks across jurisdictions could represent obstacles for cedants (who remain liable to policyholders) in recapturing assets if the AIR contract is terminated or the reinsurer fails.15 The reversion of assets and risks to the cedant also weakens its capital ratio as the agreement's capital relief is undone. And the cedant could be left with assets for which it lacks management capabilities or which do not comply with internal or regulatory requirements. Both these effects could prompt cedants to dispose of such assets at scale.

In addition, AIR agreements may result in the same amount of risk being backed by less capital and in riskier assets. Reinsurers that benefit from lower total asset requirements (recall Graph 3) enjoy a competitive advantage because they can offer lower reinsurance premiums. Moreover, reinsurers have an incentive to back the assumed blocks with assets that promise higher yields but are potentially riskier if they are allowed to use a discount rate for their liabilities that corresponds to these higher asset yields, thereby further lowering the present value of the technical provisions.

Risks could also arise from increasing concentration. The complexity of AIR suggests that these agreements are most economically viable when conducted at significant scale. As a result, AIR-related risks could be concentrated in a comparatively limited number of reinsurers and jurisdictions (IAIS (2023)). Yet, in sharp contrast to the diversification benefits derived from conventional life reinsurance by pooling mortality and longevity risk, returns on invested assets could prove highly correlated in the event of widespread market downturns.

Conflicts of interest, if unaddressed by robust governance frameworks, could raise additional risks. Such conflicts loom large where asset managers, including PE firms, have an incentive to allocate insurers' funds to assets they originate. The risks are magnified given the potential for strategic mispricing of illiquid and hard-to-value assets.

Some PE-linked life insurers' greater exposure to widespread market downturns could represent an additional risk for financial stability. To the extent that higher returns under favourable market conditions are predicated on gaining exposure to systematic risk, these insurers could face significant valuation pressures during times of stress.

Conclusion

The life insurance sector has undergone significant structural changes over the past decade. The migration of risks from life insurers' balance sheets and the increasing involvement of PE firms in some regions have sustained the sector's growth and relieved capital constraints during a phase of significant challenges to traditional life insurers' business models, most notably when interest rates remained exceptionally low.

These developments have been underpinned by life insurers seeking opportunities to raise returns. Leverage in the system, while inherently challenging to measure, has increased. Insurance risk is now backed by fewer, less liquid and riskier assets. Although the growth of PE firms started on the back of the low rate environment, this expansion has continued even as rates have risen. PE activity, while still concentrated in some regions, has rebounded strongly in the past few years.

Policy challenges arise in various areas. Supervisory monitoring has become more complex owing to cross-border risk-sharing arrangements among or within large (re)insurance companies and their connections with PE firms. Gaps in data availability hinder this task further. These developments also underscore the importance of international supervisory cooperation and internationally agreed regulatory standards. Finally, the resilience of the private markets, which expanded rapidly under ample global funding conditions, remains to be tested. The higher tail risk of PE-linked insurers, coupled with greater investment in less liquid assets, suggests that these firms could prove more vulnerable than peers in difficult market conditions.

References

American Academy of Actuaries (2024): "Asset-intensive reinsurance ceded offshore from U.S. life insurers", Issue Brief, February.

Bank for International Settlements (2024): "Laying a robust macro-financial foundation for the future", Annual Economic Report 2024, Chapter I.

Comerford, E, P Fulcher, R van Beers and R Maher (2020): "Reinsurance as a capital management tool for life insurers", Milliman Research Report, June.

Cortes, F, M Diaby and P Windsor (2023): "Private equity and life insurers", IMF Global Financial Stability Note, December.

Domanski, D, H S Shin and V Sushko (2017): "The hunt for duration: not waving but drowning?", IMF Economic Review, vol 65, no 1, pp 113–53.

Ellul, A, C Jotikasthira, C Lundblad and Y Wand (2015): "Is historical cost accounting a panacea? Market stress, incentive distortions, and gains trading", Journal of Finance, vol 70, no 6, December.

Farkas, B, U Lewrick, T Stastny and N Tarashev (2023a): "Life insurance companies – the missing relief from rising interest rates", BIS Quarterly Review, December, pp 14–16.

--- (2023b): "Insurance companies' holdings of sovereign debt", BIS Quarterly Review, March, pp 58–60.

Financial Stability Board (FSB) (2023): Global monitoring report on non-bank financial intermediation 2023, December.

Foley-Fisher, N, N Heinrich and S Verani (2023): "Are US life insurers the new shadow banks?", mimeo.

International Association of Insurance Supervisors (IAIS) (2022): Global Insurance Market Report, December.

--- (2023): Global Insurance Market Report, December.

--- (2024): Global Insurance Market Report Mid-Year Update, July.

International Monetary Fund (IMF) (2000): "Offshore financial centers", IMF Background Paper, June.

--- (2024): Global Financial Stability Report, Chapter 2, April.

Kaufmann, C, J Leyva and M Storz (2024): "Insurance corporations' balance sheets, financial stability and monetary policy", ECB Working Paper Series, no 2892.

Kirti, D and N Sarin (2024): "What private equity does differently: evidence from life insurance", Review of Financial Studies, vol 37, no 1, January, pp 201–30.

Koijen, R and M Yogo (2016): "Shadow insurance", Econometrica, vol 84.

--- (2023): Financial economics of insurance, Princeton University Press.

Moody's (2023): "The rising tide of offshore life reinsurance raises yellow caution flag", Moody's Investors Service – Financial Institutions, May.

Swiss Re Institute (2024): "Life insurance in the higher interest rate era: asset-savvy is the new asset-light", sigma, no 2/2024.

Technical annex

PE = private equity.

Graph 1: This example illustrates a stylised life insurer balance sheet and the impact of a decline in interest rates on its economic value. The illustration abstracts from accounting rules or regulatory requirements, which can affect the recognition of valuation gains and losses in practice. It also abstracts from changes in capital requirements resulting from a decline in interest rates.

Graph 2.A: Data up to mid-2024.

Graph 2.B: Following Koijen and Yogo (2016), reserves (technical provisions) ceded to reinsurers are approximated by the sum of US life insurers' reserve credit taken and modified coinsurance reserves. The sample includes all reinsurance relationships involving coinsurance arrangements associated with annuities, life insurance and long-term care insurance policies. The classification of offshore financial centres is based on Groups II and III from IMF (2000).

Graph 5: The graph distinguishes flows between (i) PE-linked life insurance companies in the United States and other US life insurers that cede the reserves; (ii) reinsurers with links to PE and other reinsurers; (iii) reinsurers affiliated or not affiliated with the cedant that assume the reserves; and (iv) reinsurers located in onshore and offshore financial centres, respectively. Following Koijen and Yogo (2016), reserves (technical provisions) ceded to reinsurers are approximated by the sum of US life insurers' reserve credit taken and modified coinsurance reserves. The sample includes all reinsurance relationships involving coinsurance arrangements associated with annuities, life insurance and long-term care insurance policies. The sample comprises major life insurers, which together account for 90% of the total assets of the US life insurance sector. The classification of offshore financial centres is based on Groups II and III from IMF (2000). Affiliates are entities within the same holding company system or a party that is controlled by the reporting entity.

Graph 6: Based on a sample of 93 US life insurance companies, of which 16 were categorised as linked to PE firms. Beta is with respect to the S&P 500 index. Value-at-risk (VaR) is 5% historical VaR calculated from stock prices. Credit spread is calculated from PE-linked and other life insurers' bonds outstanding.

1 The views expressed are not necessarily those of the BIS or the International Association of Insurance Supervisors (IAIS). We thank Ilaria Mattei as well as Giulio Cornelli, Sjur Nilsen and José Maria Vidal Pastor for excellent research assistance. For helpful comments, we are also grateful to Matteo Aquilina, Claudio Borio, Nicolas Colpaert, Gaston Gelos, Dieter Hendrickx, Laura Languedoc, Benoît Mojon, Frank Packer, Romain Paserot, Gabor Pinter, Andreas Schrimpf, Hyun Song Shin, Nikola Tarashev and Daniel Weijand. All remaining errors are ours.

2 For the purposes of the analysis in this special feature, PE-linked life insurers are defined as insurers which operate predominantly in the life and annuity business and in which PE firms have a controlling stake. Data on PE firms' ownership has been sourced from S&P Capital IQ Pro and authors' compilations based on market reports, company filings, public announcements and news articles.

3 Life insurers also offer other savings products such as term fixed annuities, which provide the holder with a fixed stream of cash flows for a predetermined number of years, or variable annuities with minimum return guarantees on the investments funding the annuity. Other products combine the savings and life insurance aspects, such as whole life insurance (which provides lifetime coverage and accumulates cash value) or expand the coverage to include health and disability risks.

4 Capital-intensive or asset-intensive products are types of insurance products that require significant capital reserves or assets to support the associated liabilities.

5 Domanski et al (2017) provide empirical evidence that is consistent with German life insurers' balance sheets giving rise to negative convexity. In this case, the duration and value of the insurers' liabilities increases by more than that of their fixed income assets in response to a decline in interest rates. As a result, insurers that aim to adjust the duration gap to its initial level may engage in procyclical trading and buy fixed income assets when the prices of these assets increase.

6 Unit-linked products combine life insurance coverage with investment services. When a unit-linked product is purchased, only a fraction of the premium is used to obtain life insurance coverage. The remainder is invested in fund shares ("units"). The policyholder bears the associated investment risk since the value of the investment depends on the units' performance. From the insurers' perspective, the value of the assets and liabilities associated with these products is highly correlated and thus requires very little regulatory capital.

7 From the insurer's perspective, mortality risk refers to the potentiality of policyholders dying prematurely, while longevity risk relates to the potentiality of policyholders living longer than expected, impacting insurance liabilities.

8 The assets can also be held in a segregated account on the cedant's balance sheet.

9 Indeed, reinsurers to AIR agreements are typically domiciled in jurisdictions that allow insurance companies to make more favourable assumptions about the cash flows of the block. For example, the reinsurer could assume that policyholders are more likely to let the policy lapse, which would lead to the termination of the policy and decrease expected cash flows.

10 For internationally active insurance groups, a designated regulatory authority takes the lead for the group-wide supervision within the IAIS framework. This authority, following IAIS standards, is tasked with imposing supervisory requirements so that cross-border activities such as AIR do not undermine the protection of policyholders and the solvency or liquidity position of the ceding company.

11 In practice, AIR agreements usually have several safeguards in place designed to ensure that reinsurers can meet payment obligations to the primary insurers' policyholders. AIR agreements tend to be backed by collateral to mitigate counterparty risk. Additionally, the parties determine investment guidelines for the assets, such as portfolio limits for asset classes, collateral levels and valuation methods, credit enhancements and contract termination. Agreements can also be based on funds-withheld structures, whereby the assets remain with the primary insurer while allowing the reinsurer to change the asset allocation as per the agreed investment guidelines (eg Comerford et al (2020)).

12 Based on the authors' comparison of more than 21,000 private market deals from 2006 to mid-2024.

13 This tallies with findings for US life insurance during the Covid-19 pandemic as analysed in Foley-Fisher et al (2023).

14 Interconnections also arise with other market participants, such as banks, which obtain insurance against losses (eg through synthetic risk transfers) from insurance companies.

15 Recapture refers to the process whereby the original insurer (cedant) reclaims the liabilities and the assets backing them. This can occur under specific contractual conditions or due to regulatory changes or the reinsurer's failure.