FX settlement risk remains significant

The settlement of FX trades can lead to significant risk exposures when one counterparty to a trade sends a currency payment to the other and needs to wait before receiving the currency it is buying. Over the past two decades, market participants have made significant progress in reducing FX settlement risk. Nevertheless, due in part to higher trading activity, the 2019 Triennial Survey indicates that close to $9 trillion of payments remain at risk on any given day.

The bankruptcy of Bankhaus Herstatt in 1974 demonstrated how FX settlement risk can undermine financial stability. Herstatt was a medium-sized German bank active in FX markets. At 15:30 CET on 26 June 1974, the German authorities closed the bank down. While Herstatt had already received Deutsche marks from its counterparties, it had not yet made the corresponding US dollar payments in New York. Herstatt's failure to pay led banks more generally to stop outgoing payments until they were sure their countervalues had been received. The international payment system then froze, and the erosion of trust caused lending rates to spike and credit to be curtailed.

Herstatt was a medium-sized German bank active in FX markets. At 15:30 CET on 26 June 1974, the German authorities closed the bank down. While Herstatt had already received Deutsche marks from its counterparties, it had not yet made the corresponding US dollar payments in New York. Herstatt's failure to pay led banks more generally to stop outgoing payments until they were sure their countervalues had been received. The international payment system then froze, and the erosion of trust caused lending rates to spike and credit to be curtailed.

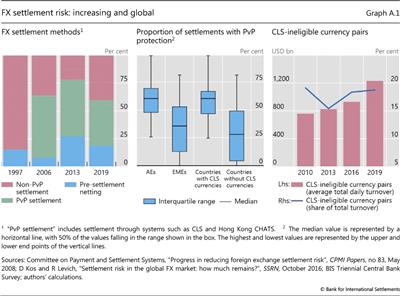

In 1996, G10 central banks endorsed a strategy to reduce FX settlement risk. The strategy involved actions to be taken by banks to control their exposures, actions to be taken by industry groups to provide services and actions to be taken by central banks to induce progress. In response, in 2002 market participants set up Continuous Linked Settlement (CLS), a specialist institution that settles FX transactions on a payment-versus-payment (PvP) basis. PvP eliminates FX settlement risk by ensuring that a payment in a currency occurs if and only if the payment in the other currency takes place. The establishment of CLS and other actions led to a big reduction in FX settlement risk. Even at the height of the Great Financial Crisis, FX markets remained resilient. However, FX settlement risk appears to have increased since 2013 in both relative and absolute terms (Graph A.1, left-hand panel).

The strategy involved actions to be taken by banks to control their exposures, actions to be taken by industry groups to provide services and actions to be taken by central banks to induce progress. In response, in 2002 market participants set up Continuous Linked Settlement (CLS), a specialist institution that settles FX transactions on a payment-versus-payment (PvP) basis. PvP eliminates FX settlement risk by ensuring that a payment in a currency occurs if and only if the payment in the other currency takes place. The establishment of CLS and other actions led to a big reduction in FX settlement risk. Even at the height of the Great Financial Crisis, FX markets remained resilient. However, FX settlement risk appears to have increased since 2013 in both relative and absolute terms (Graph A.1, left-hand panel).

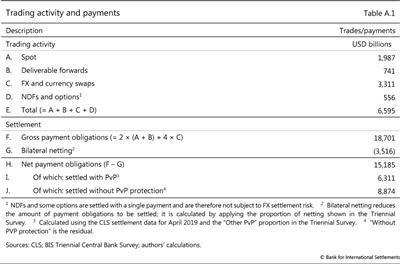

To help assess progress in reducing FX settlement risk, the Triennial Survey was expanded in 2019 to collect data on FX settlement. Different FX instruments give rise to different numbers of payments. For example, spot and outright forwards result in two payment obligations, whereas swaps result in four payments of principal (two at inception and two at repayment). Some FX transactions, such as non-deliverable forwards, are settled with a single payment and are therefore not subject to FX settlement risk. FX trades can also be bilaterally netted, which eliminates a need for settlement.

After taking account of the number of payments for each instrument, in April 2019 daily global FX trading of $6.6 trillion translated into gross payment obligations worth $18.7 trillion (Table A.1). Bilateral netting reduced the payment obligations to $15.2 trillion. About $6.3 trillion was settled on a PvP basis using CLS or a similar settlement system. This left an estimated $8.9 trillion worth of FX payments at risk on any given day. The proportion of trades with PvP protection appears to have fallen from 50% in 2013 to 40% in 2019, although available data are not fully comparable across time (Graph A.1, left-hand panel).

One reason for the relative decline in PvP protection is the growth of trading in currencies not eligible for CLS settlement. In absolute terms, 90% of FX settlement risk is in the top 10 jurisdictions. However, these advanced economies settle a higher proportion of their FX with PvP protection than emerging market economies (EMEs) do, many of which have currencies that are not included in CLS (Graph A.1, centre panel). Nonetheless, CLS-eligible currency pairs still make up about 80% of total global trading activity (Graph A.1, right-hand panel). To reduce global risk, it may therefore be necessary to both encourage FX market participants to use PvP where available and widen that availability to include EME currencies. The task of reducing global risk is now firmly on the agenda of bank supervisors.

G Galati, "Settlement risk in foreign exchange markets and CLS Bank", BIS Quarterly Review, December 2002, pp 55-65.

G Galati, "Settlement risk in foreign exchange markets and CLS Bank", BIS Quarterly Review, December 2002, pp 55-65.  Committee on Payment and Settlement Systems, "Settlement risk in foreign exchange transactions", CPMI Papers, no 17, March 1996.

Committee on Payment and Settlement Systems, "Settlement risk in foreign exchange transactions", CPMI Papers, no 17, March 1996.  Basel Committee on Banking Supervision, "Basel Committee discusses policy and supervisory initiatives and approves implementation reports", press release, October 2019.

Basel Committee on Banking Supervision, "Basel Committee discusses policy and supervisory initiatives and approves implementation reports", press release, October 2019.