IV. Moving forward with macroprudential frameworks

Abstract

Since the Great Financial Crisis, both advanced and emerging market economies have made substantial progress in implementing macroprudential frameworks. Such measures have strengthened the resilience of the financial system and moderated credit growth, but they have not always prevented the build-up of financial imbalances. They are most effective as part of a broader macro-financial stability framework, involving also monetary, fiscal and even structural policies.

Full text

The Great Financial Crisis (GFC) revealed the inadequacy of pre-crisis prudential requirements and the limitations of the then existing tools to preserve financial stability. In response, authorities around the world have strengthened financial regulation and supervision (Chapter III) and adopted a macroprudential orientation to financial stability. The new macroprudential frameworks focus on the stability of the financial system as a whole and how it affects the real economy, rather than just on the stability of individual institutions.1 This is important because the GFC and previous crises have shown that vulnerabilities may build up across the system even though individual institutions may look stable on a standalone basis. Indeed, many systemic financial crises of recent decades, the GFC included, resulted from the financial system's procyclicality - its tendency to amplify financial expansions and contractions, often with serious macroeconomic costs.2

Experience indicates that substantial progress has been made, but more needs to be done. Macroprudential frameworks have been very useful as a complement to the other financial reforms put in place after the GFC. Macroprudential measures build buffers, discourage risky lending and strengthen the financial system's resilience. They can also slow credit growth but, as deployed so far, their restraining impact on financial booms has not always prevented the emergence of the familiar signs of financial imbalances. And, as with any medicine, they come with side effects. This suggests that these measures would be most effective if embedded in a broader macro-financial stability framework that includes other policies, notably monetary, fiscal and structural.

The chapter is organised as follows. The first section describes the key elements of macroprudential frameworks and the main implementation challenges. The second discusses how authorities have dealt or could deal with some of these challenges, such as risk identification, instrument choice, policy communication and governance. The third section reviews evidence on the impact of macroprudential measures. A final section explores the role of macroprudential measures in a broader macro-financial stability framework and coordination with other policies. Two boxes discuss, respectively, macroprudential approaches to capital market activities and the use of FX intervention to reduce systemic risk.

Macroprudential frameworks: elements and challenges

Although the term dates back to the 1970s, it languished for the most part in obscurity until the turn of this century, when BIS General Manager Andrew Crockett called for a "macroprudential" approach to financial stability.3 In the same speech, he differentiated the macroprudential dimension of financial stability - the stability of the financial system - from the microprudential dimension - the stability of individual institutions. What distinguishes the two perspectives is less the specific instruments - they are often the same - than why they are used and how they are calibrated.

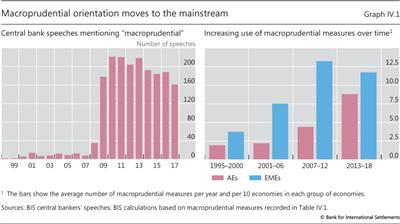

It took the GFC to expose the limitations of a microprudential perspective. After the crisis, as these limitations were recognised in policy circles, more and more countries adopted financial stability mandates and implemented macroprudential measures. As a result, the term "macroprudential" has entered the mainstream vocabulary of central banks (Graph IV.1, left-hand panel) and also of other policymakers. In addition, the average number of macroprudential measures adopted post-crisis has significantly increased for both advanced economies (AEs) and emerging market economies (EMEs) (Graph IV.1, right-hand panel).4 In particular, AEs have stepped up their use of macroprudential measures in recent years.

The FSB, IMF and BIS set out the key elements of a macroprudential framework in a series of notes prepared for the G20.5 These identified three intermediate objectives: (i) to increase the financial system's resilience to aggregate shocks by building and releasing buffers; (ii) to constrain financial booms; and (iii) to reduce structural vulnerabilities in the financial system that arise from common exposures, interlinkages and the critical role of individual intermediaries. This chapter focuses mainly on the first two objectives, which refer to the "time" dimension of systemic risk. By pursuing these objectives, macroprudential measures can build resilience and moderate financial cycles.

Adopting a macroprudential orientation to financial stability comes with a number of challenges. First, the ultimate objective - financial stability - is hard to define. For this reason, policymakers often resort to intermediate objectives, such as improving lending or risk management standards, strengthening banks' resilience and reducing fluctuations in credit.6 Such intermediate objectives can help communicate macroprudential measures and improve the coordination between different policymakers responsible for financial stability. But even they may be too vague when it comes to assessing the impact of particular measures.

Second, macroprudential goals may conflict with other policy objectives. This is an issue because macroprudential authorities typically resort to instruments that may also be used for other purposes or from different perspectives. For instance, in a boom, bank supervisors may see no need to tighten regulatory requirements since individual institutions look solid when viewed in isolation, while macroprudential authorities might be more worried about procyclicality in the financial system and aggregate risk-taking and thus wish to tighten prudential instruments. Conversely, in a generalised downturn, macroprudential authorities may wish to release buffers to smooth the impact on the real economy, while bank supervisors may prefer that institutions preserve as much capital as possible so as to better weather their losses. Tensions may also arise between macroprudential and monetary or fiscal authorities. Resolving them puts a premium on appropriate governance arrangements.

Third, it is typically difficult to identify financial vulnerabilities early enough and with sufficient certainty to take action. In some cases, it may be hard to disentangle the development of financial imbalances from welcome financial deepening and innovation. Vulnerabilities may also build up over many years, without leading to acute stress. The system may appear stable in the interim, especially since signs of low risk (eg compressed spreads) may in fact simply reflect high risk-taking. And, tightening measures when the financial system is already vulnerable could trigger the very instability one seeks to prevent.

Fourth, a bias towards inaction could result from the political economy costs of taking preventive measures, combined with difficulties in the timely identification of systemic risk. For one, policymakers are usually wary of sounding a false alarm, preferring to wait and see whether a development is actually harmful - even though prompt intervention is typically more effective. Further, the near-term costs of preventive actions are quite visible but their long-term benefits, while large,7 are harder to discern, since policymakers and their policies rarely get any credit for a crisis that did not happen. Indeed, preventive measures may be quite unpopular, as they may hamper access to credit precisely when the general picture looks good. In this context, the temptation can be strong to argue that this time really is different, and that no action is needed.8

Finally, the impact of macroprudential measures can be hard to measure, given the plethora of potential instruments, their complex interactions and, frequently, the scantiness of evidence about their effectiveness. And this may be the case even when the objective is well defined. The way in which monetary policy and macroprudential measures may interact only adds to these challenges. In fact, despite recent progress, models that link the financial sector to the real economy tend to be highly stylised.9 Thus, it could be argued that the calibration of macroprudential measures is more art than science.

When and how to act?

Ten years after the concept "macroprudential" entered the vocabulary of policymakers, there is a growing body of analytical research and practical experience on how some of these issues may be addressed. This section considers, in turn, the challenges in identifying risks, selecting and calibrating the instruments, communication and governance.

Identifying risks

Early warning indicators (EWIs) serve as a useful starting point for identifying systemic risks. Typically, they are calibrated on whether they would have been able to predict past crises. Many studies find that when credit and asset prices start deviating from long-run trends and breach certain critical thresholds, they can help to identify unsustainable booms with reasonable accuracy several years before a full-blown crisis actually develops.10 Even so, such indicators can also sound a false alarm, not least because their critical thresholds are based on averages across a wide range of countries and over extended periods. As a result, they may not sufficiently take into account country-specific features or how financial systems evolve over time, including in response to changing regulation.

On balance, EWIs are a useful first step in identifying risks, but need to be complemented by more in-depth analysis. For instance, the distribution of exposures across borrowers may matter: even if the average borrower is solid, the failure of a critical mass of fragile ones could propagate through the system and cause a systemic event. Yet, on its own, analysis at the level of individual institutions will not suffice, since it cannot measure the impact of vulnerabilities on the financial system and the macroeconomy.11

A popular method for gauging financial system resilience is aggregate, or macro, stress testing. For example, major AE central banks use it, and all EME central banks responding to a recent BIS survey either used it or were planning to do so.12 The tool helps assess resilience in response to hypothetical low-probability but high-impact macroeconomic and financial shocks. Stress tests have the advantage that they are forward-looking and can cover various scenarios. This makes them a valuable instrument for assessing specific systemic vulnerabilities - for instance, to assess the amount of capital required during an ongoing financial crisis. But it makes them less useful as a tool to identify risks when the range of scenarios is more open. Stress tests have other shortcomings too. They can help assess, say, the immediate impact of declines in house prices and increased mortgage defaults on bank balance sheets. But they are less good at capturing second-round effects arising from fire sales, lower market liquidity or the weaker spending and rising unemployment that follow such financial shocks.13 Indeed, the stress tests carried out prior to the GFC gave little indication of any significant risks in the banking sector.14

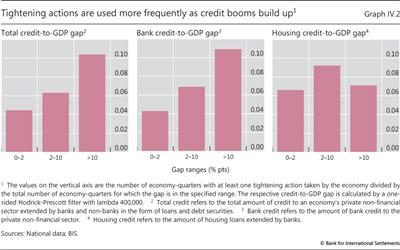

Given the difficulties in identifying risks early and sufficiently surely, authorities often wait to see whether a development will have adverse consequences. This tendency may affect the timing of tightening actions during a credit boom. For example, the frequency of tightening actions increases as the credit gap crosses the 2 percentage point lower threshold in the Basel Committee guidelines on the calibration of the countercyclical capital buffer (CCyB) (Graph IV.2, all panels). As the total credit gap and general bank credit gap increase further above the 10 percentage point upper threshold in the guidelines, tightening actions tend to be used more frequently (left-hand and centre panels). By contrast, as the housing credit gap increases above the 10 percentage point threshold, tightening actions tend to be used slightly less frequently (right-hand panel). One possible reason is that national authorities can more easily identify financial imbalances building up in the housing market and thus more promptly deploy tightening actions before the gap exceeds the threshold.

Selecting and calibrating instruments

A broad array of tools can potentially be used to reduce systemic risk, although in some jurisdictions legal impediments or coordination issues may significantly restrict those that can actually be deployed. Essentially all prudential tools, such as restrictions on particular types of lending and capital or liquidity requirements, can be used from a macroprudential perspective as well as in the more traditional microprudential sense. In addition, monetary policy tools may also be used macroprudentially, for instance in the form of reserve requirements or even foreign exchange interventions.15

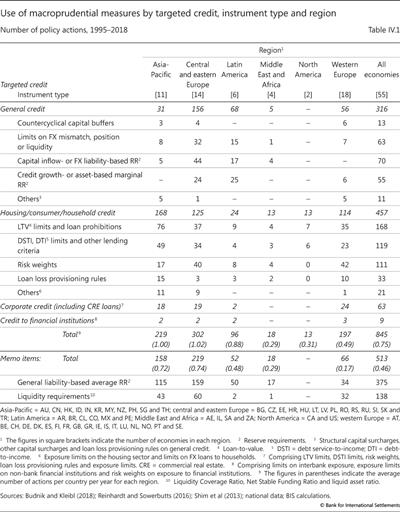

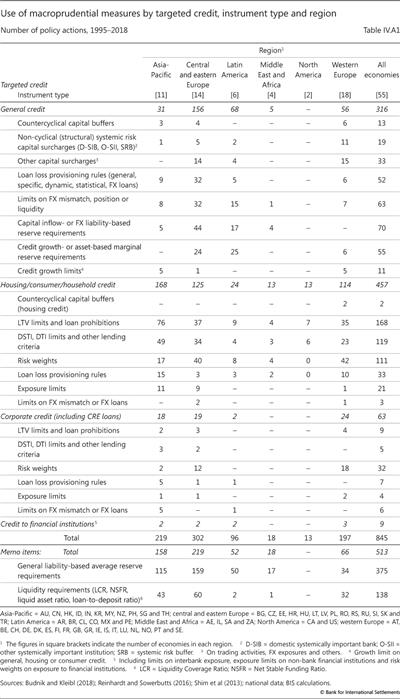

In practice, a wide range of tools has been deployed, primarily targeting various types of bank credit (Table IV.1). Authorities in both Asia-Pacific and central and eastern Europe have been the most active. Many economies have also introduced measures targeting commercial real estate mortgages and property developer loans. In particular, most EU member states have adjusted risk weights for loans collateralised with commercial property, while some EMEs have changed loan-to-value (LTV), debt service-to-income (DSTI) and exposure limits as well as loan loss provisioning rules on commercial real estate loans (Table IV.A1). Although the bulk of the measures focus on bank credit, authorities have reacted to the growing importance of market finance by also taking a macroprudential perspective on the capital market activities of asset managers and other institutional investors (Box IV.A).

The tools operate through different mechanisms. Some instruments refer to borrower characteristics, even though they are enforced on the lenders' side. Examples are caps on LTV, debt-to-income (DTI) and DSTI ratios. These increase the borrowers' resilience to house price or income fluctuations, in turn limiting the lenders' credit risk. By constraining effective credit demand, they may also put a brake on credit growth and, indirectly, on house prices too. Other tools work directly on the lender side. Examples are countercyclical capital requirements, provisioning rules and credit growth limits. Capital tools, in particular, increase banks' buffers to absorb losses, provided that they can actually be drawn down in case of stress. In addition, capital and provisioning requirements increase the cost of providing housing credit, which should slow credit growth.

The wide variety of potential tools lets authorities target specific exposures or activities.16 For example, the Central Bank of Brazil imposed restrictions on auto loans that it deemed particularly risky, but not on other types of auto loan.17 Such targeted actions can reduce the costs of intervention, but they also have drawbacks. First, they tend to have more immediate distributional consequences, which could result in greater political pressures. Second, they are more vulnerable to leakages - defined as the migration of the targeted activity outside the scope of the tool's application and enforcement.

Leakages can take many forms. At one end of the spectrum are evasive ploys that merely shift the targeted activity into a new guise, without changing the nature of its risks. For example, in Malaysia tighter LTV limits on mortgages to individuals led to a surge in home purchases by firms set up specifically to circumvent the restrictions.18 Exposures may also migrate to lending institutions that are not subject to the specific measure - for instance, to shadow banks or foreign intermediaries. Some evidence suggests that macroprudential measures implemented on bank credit have led to an expansion in the credit provided by non-banks, and that measures targeting external bank borrowing have boosted offshore corporate bond issuance.19 Such leakages may reduce the direct risk exposures of the domestic banking system but not the likelihood of corporate sector stress as such.

Partly in response to leakages, the authorities have in several cases progressively broadened the scope of the measures employed, for instance by expanding the set of activities targeted. In other cases, they have taken a relatively broad approach, applying a portfolio of measures with the aim of reducing possible channels for evasion.20

Box IV.A

Macroprudential approaches to capital market activities

As current macroprudential measures focus mainly on banks, they may be less effective in dealing with risks arising from the market-based financing that has become more prevalent post-GFC. Similarly, financial innovation and the application of new technology to the financial industry may shift the nature of risk, requiring a new set of policy responses and an expanded arsenal of instruments (Chapter III). In this context, how can macroprudential approaches help address systemic risk arising from asset management funds and other institutional investors such as insurance companies and pension funds?

Correlated and procyclical trading by asset management funds could destabilise asset markets, resulting in large losses that could propagate through the financial system. Such effects are possible even if each market participant acts prudently on a standalone basis, given the interactions between market dynamics and the collective actions of individual market participants. However, current regulation on the asset management fund industry is geared mainly towards microprudential and consumer protection objectives and thus fails to fully incorporate how actions by one player can affect the health of others via changes in asset prices, exchange rates and market liquidity. The macroprudential perspective should be extended to asset management funds to address these concerns.

However, current regulation on the asset management fund industry is geared mainly towards microprudential and consumer protection objectives and thus fails to fully incorporate how actions by one player can affect the health of others via changes in asset prices, exchange rates and market liquidity. The macroprudential perspective should be extended to asset management funds to address these concerns.

Authorities have a number of options to address these risks. For example, minimum liquidity requirements for asset management funds may allow them to meet redemptions without selling relatively illiquid assets. If so, such requirements could help increase the resilience of market liquidity. In January 2017, the US Securities and Exchange Commission (SEC) implemented new rules requiring open-end mutual funds and exchange-traded funds to establish liquidity risk management programmes.

If so, such requirements could help increase the resilience of market liquidity. In January 2017, the US Securities and Exchange Commission (SEC) implemented new rules requiring open-end mutual funds and exchange-traded funds to establish liquidity risk management programmes. Among other measures, the rules require these funds to consider current market conditions and establish appropriate liquidity risk management policies and procedures in light of both normal and reasonably foreseeable stressed market conditions. Such requirements incorporate a macroprudential perspective in that they recognise that liquidity is adversely affected by market stress.

Among other measures, the rules require these funds to consider current market conditions and establish appropriate liquidity risk management policies and procedures in light of both normal and reasonably foreseeable stressed market conditions. Such requirements incorporate a macroprudential perspective in that they recognise that liquidity is adversely affected by market stress.

Liquidity stress tests for asset management funds have also been implemented by a few other national authorities. For example, in 2015 the Bank of Mexico assessed liquidity risk in domestic mutual funds. The French market supervisory authority has also published a guidance document on stress testing for asset management funds. But, in these exercises, the authorities took a mainly microprudential approach, by focusing on fund-level liquidity risks. By contrast, in February 2018 the European Systemic Risk Board published a recommendation on action to address systemic risks related to liquidity mismatches. In particular, it explicitly considered an amplification channel whereby mismatches between the liquidity of open-end investment funds' assets and their redemption profiles could lead to fire sales to meet redemption requests in times of market stress, potentially affecting other financial market participants holding the same or correlated assets.

To deal effectively with systemic risks stemming from asset management funds and other institutional investors, close cooperation among the various authorities involved is crucial - central banks, bank regulators, insurance regulators and securities regulators. Here, differences in perspectives can complicate matters. For instance, securities regulators with responsibility for asset managers put prime emphasis on investor protection, while central banks and bank regulators focus more on financial stability and hence are more inclined to apply macroprudential approaches.

National authorities are currently making the very first steps towards a macroprudential perspective on capital market activities, as compared with the progress already made in introducing macroprudential frameworks to the banking sector. The growing importance of asset managers and other institutional investors in both domestic and cross-border financial intermediation requires national authorities to monitor potential systemic risks from these activities at both the national and global levels and to consider how best to employ macroprudential approaches to deal with such risks.

See Borio (2004) for further details of this interaction.

See Borio (2004) for further details of this interaction.  FSB (2017) provides specific policy recommendations for dealing with liquidity risks in the asset management sector.

FSB (2017) provides specific policy recommendations for dealing with liquidity risks in the asset management sector.  For details of the initial proposed rules, comments received and the final rules, see SEC (2016).

For details of the initial proposed rules, comments received and the final rules, see SEC (2016).

While a broad approach using many instruments may be more effective in targeting risks, it also has its drawbacks. It can easily become complex and difficult to communicate. In the extreme, it could result in the macroprudential authority effectively taking on the role of credit allocation.21 And it can complicate the calibration of individual instruments, by making it harder to assess their interaction and overall effect.

Macroprudential authorities have addressed the difficulties of calibrating instruments in a variety of ways. In some cases, central banks have relied on econometric estimates linking actions and outcomes. In others, they have used micro data to gauge the effects of specific measures on credit.22 In the more common complex situations, they have resorted to stress tests,23 calibrated models24 or plain judgment.

A fairly common reaction to the uncertainty about how instruments work has been to start cautiously and then increase the intensity, scope and frequency of the measures until the effects become more apparent.25 Such a gradual approach is consistent with the view that uncertainty calls for caution. But the heavy costs of a crisis could tip the scale towards more decisive action early on.26

Communication

As in many other policymaking areas, effective communication is critical for success. Communication can explain the objectives, strategy and policy process to the public, and thus build political support. In addition, it can help the authorities share their risk assessment with both the affected parties and the broader public, which can enhance effectiveness.27

For communication to achieve the desired effects, the message needs to be delivered effectively to the right audience. The primary audience largely determines the content, sophistication and channels used. Most central banks communicate financial stability risks in speeches, press conferences and their regular financial stability reviews. While such reviews are useful in communicating with specialists, they can easily prove opaque for the broader public, not least homeowners.28 Thus, several authorities also use more targeted channels. For instance, the Reserve Bank of India issues short and simplified press releases for an audience with limited financial literacy. Establishing links with the media, such as through background briefings, is another common tool.

In one sense, communication might even be viewed as a macroprudential tool in its own right.29 In theory, central bank warnings might head off adverse developments, obviating the need for any subsequent remedial action. In practice, examples of warnings that appear to have taken effect without subsequent concrete actions (or at least the threat thereof) are rather few. In Chile, warnings from the central bank in its Financial Stability Report between June and December 2012 appear to have affected bank lending practices, inducing a shift towards lower-LTV mortgages.30

Governance

The multiple purposes of the instruments, the scope for strong political pressure and the mismatch between the mandate and tools put an onus on adequate governance arrangements. This involves several aspects: having a clear operational objective; providing incentives to act and tools commensurate with that objective; ensuring accountability and transparency;31 and ensuring effective coordination across the policy areas that have a bearing on financial stability.32

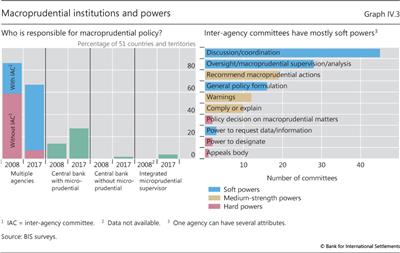

The institutional arrangements governing macroprudential frameworks vary across countries. The most common is to allocate macroprudential functions to several bodies that coordinate through a committee (Graph IV.3, left-hand panel). The second most common one is to vest both macroprudential and microprudential responsibilities in the central bank. Far less frequently adopted are other possible arrangements, such as the sharing of responsibilities without a formal coordinating committee, or giving macroprudential responsibilities to an integrated microprudential supervisor.

The jury is still out on the effectiveness of these arrangements. In particular, many of them do not fully align financial stability responsibilities with decision-making powers over the necessary instruments. Notably, many of the inter-agency committees set up after the GFC lack hard decision-making powers (Graph IV.3, right-hand panel). Moreover, very few of the post-GFC financial stability mandates explicitly mention trade-offs between different policy objectives, let alone how to resolve them. In response to a BIS survey, only six out of 14 EME central banks that participated in inter-agency committees said that these had helped coordinate policies.33 Several respondents stressed that decision-making powers remained with individual authorities, raising questions about the effectiveness of coordination. In some cases, the very inclusiveness of such committees can complicate decision-making.34 In the United Kingdom, the tripartite system that comprised the Treasury, the central bank and the supervisory authority was abandoned, with most financial stability-related tasks and responsibilities shifting to the Bank of England.

Impact: the experience so far

Ultimately, macroprudential measures are effective if they ensure that the financial system is stable. But this benchmark is too general to be useful when assessing the effectiveness of individual tools. Narrower criteria focus on more specific objectives, such as curbing the growth of a particular form of credit or increasing the resilience of the financial system to the unwinding of financial booms or adverse shocks. Effectiveness can be measured by the change in the rate of credit growth or the increase in the banking system's capital or liquidity buffers.

Empirical evidence on the impact of macroprudential measures overall suggests that macroprudential measures have been generally successful in strengthening the financial system's resilience. By construction, capital and liquidity requirements increase the buffers available to, respectively, absorb future losses and bridge periods of illiquidity. That said, they can only do so if they can actually be drawn down when needed. By changing the relative price of different forms of credit, capital or reserve requirements on particular types of lending can also affect the composition of credit, reducing the riskiness of loan books.35 All of this should result in a more resilient and thus stable financial system, as suggested by the small number of econometric studies that measure the impact of macroprudential measures on bank risk.36

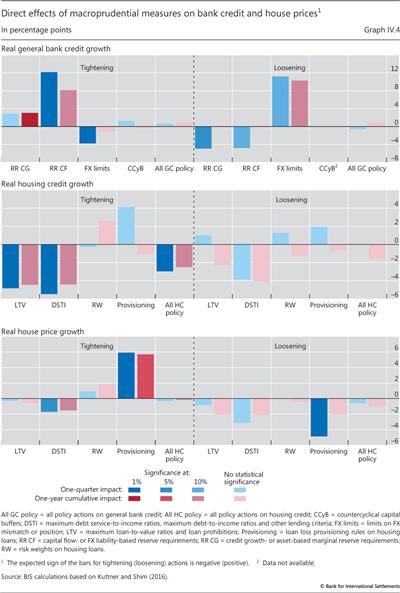

There is also evidence that certain macroprudential measures have moderated financial booms. Panel regressions across a broad set of countries indicate that tighter LTV and DSTI limits may help curb housing credit growth (Graph IV.4, middle left-hand panel).37 Tighter DSTI caps also appear to dampen house price growth (bottom left-hand panel). These results are largely in line with the empirical literature38 and many central banks' own assessments.39 Maximum LTV and DSTI ratios as well as limits on credit growth and foreign currency lending also appear to have moderating effects on bank leverage and asset growth.40 Likewise, there is some evidence that FX position limits have a measurable impact on credit growth (top left-hand panel).41 But other measures have less discernible effects or even work in the wrong direction.42

Interestingly, loosening LTV or DSTI requirements does not appear to have any effect on credit or house prices (Graph IV.4, right-hand panels). Again, such asymmetries are in line with the empirical literature. It appears that tightening measures can help discourage credit expansion but loosening does not encourage it much during financial downturns - much like pushing on a string. But looking at the impact of loosening measures on overall credit may not be the right criterion for success. A better one could be whether the measures help avoid unnecessary constraints on the supply of credit, not whether they prevent necessary deleveraging.43

Still, easing by releasing buffers is not without its problems. The market may view a discretionary release of capital or liquidity buffers during a downturn as a signal of worse to come rather than as a tool to stabilise the financial system. Thus, to be effective in a bust, buffers may need to be sufficiently large to start with and to be released in a non-discretionary fashion.44

While some macroprudential measures appear to have helped slow credit growth, their restraining impact on financial booms has not always prevented the emergence of financial imbalances.45 It remains an open issue whether this reflects inaction bias, leading to belated and overly timid action, a fear of side effects that limits the strength of the measures, evasion, or any intrinsic limitations of the instruments.

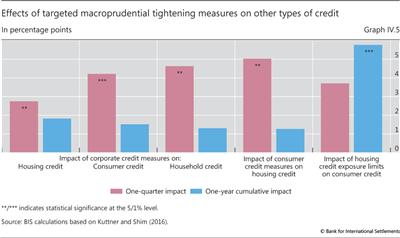

Although macroprudential measures tend to target specific activities or exposures, their effects are often much broader. For example, the activation of the CCyB on mortgages in Switzerland triggered a rise in corporate lending.46 Such a spillover is largely unavoidable and differs from evasive ploys that leave risks essentially unchanged. More generally, the same panel regression analysis on direct effects also provides evidence of spillovers and leakages. In particular, housing, consumer and household credit growth significantly increased from the quarter following the implementation of measures tightening corporate credit including commercial real estate loans (Graph IV.5). In addition, policy actions tightening consumer credit appear to have boosted housing credit, and those tightening housing credit to have encouraged consumer credit, which is likely to indicate leakages. Whether such behavioural responses should raise concerns will depend on their systemic risk impact.

Similar to monetary policy measures, macroprudential measures affect economic activity by changing the cost of borrowing or modifying households' or firms' access to finance. A relatively small number of studies find that tightening macroprudential measures tends to reduce output growth, but evidence of their effect on inflation is rather mixed.47

No analysis of policy impact would be complete without considering side effects. These can come in many guises. For instance, the measures may have undesired distributional effects, such as limiting access to finance for those who need it most and discouraging financial innovation. They may also distort credit allocation. Unfortunately, the evidence on these issues is so far limited.

In a financially integrated world, developments in one country may give rise to systemic risk in another. For example, low interest rates and unconventional monetary policy actions in the large AEs post-crisis have resulted in large capital flows to EMEs and small open AEs, fuelling domestic financial booms.48 International spillovers may also result from macroprudential measures. For instance, recent studies find that bank regulation of multinational banks in their home country affects their lending standards elsewhere.49

Towards an integrated macro-financial stability framework

The adoption of a more macroprudential approach to financial regulation and supervision represents an important step forward, in both identifying and mitigating financial stability risks. It entails a major cultural shift in the concept of risk, by acknowledging the limitations of market prices as risk indicators as well as recognising the importance of self-reinforcing financial booms and busts ("financial cycles") and financial system-wide considerations. Moreover, the implementation of macroprudential frameworks has helped strengthen the financial system's resilience and moderate financial excesses.

At the same time, such frameworks are no panacea. The task of ensuring sustainable financial stability is clearly complex. Reliance on one set of tools alone, even when based on solid arrangements, is unlikely to be enough. For instance, while macroprudential measures can mitigate credit expansion, those employed so far, in some cases quite actively, have not necessarily prevented the familiar signs of financial imbalances from manifesting themselves. Given the economic and social costs of financial crises and the macroeconomic costs of financial cycles more generally, it would be imprudent to look exclusively to macroprudential frameworks to deliver the desired results.

All this suggests that macroprudential frameworks should be embedded in a more holistic, comprehensive and balanced macro-financial stability framework. Alongside more micro-oriented financial regulation and supervision, such a framework would also encompass monetary, fiscal and structural policies. The ultimate goal would be to have the various policies work alongside each other to ensure macroeconomic and financial stability while raising long-term sustainable growth. At a minimum, such a framework would also reduce the risk that different policies work at cross purposes.

Designing such a framework raises difficult analytical and practical issues. Some general observations are offered here.

An important element of a macro-financial stability framework is monetary policy. Interest rates directly affect both asset prices and borrowers' willingness and ability to take on leverage. In addition, and partly for the same reasons, they appear to affect economic agents' risk-taking.50 As a result, monetary policy influences the financial cycle and systemic risk and, through these, macroeconomic fluctuations. This is the case whether or not it operates through interest rates, balance sheet policies or foreign exchange intervention (Box IV.B).51 At the very least, therefore, monetary and macroprudential authorities need to take into account each other's actions when making decisions.

How far monetary policy should go in taking financial stability considerations into account is controversial. The answer depends on a range of factors, including the degree to which monetary policy affects risk-taking, debt and asset prices; the effectiveness of macroprudential actions; the particular nature of the risks; and the secondary effects of taking action.52 For instance, macroprudential measures can advantageously target more granular risks, such as in the mortgage sector, while monetary policy has a more pervasive impact, thus limiting leakage and regulatory arbitrage.53 Similarly, in more open economies, higher interest rates have the disadvantage of encouraging more capital inflows and exchange rate appreciation, which could offset at least in part their restraining influence on the build-up of financial imbalances. By contrast, macroprudential measures do not suffer from this limitation. Moreover, it is precisely in this context that foreign exchange intervention can contribute to the design of a more balanced policy response. It can do so by building up buffers for use when the tide turns and by dampening the expansionary impact of an exchange rate appreciation on capital inflows and the build-up of imbalances (Box IV.B and Chapter II).54 That said, there is always some tension when operating macroprudential and monetary policy measures in opposite directions, as when interest rates are reduced to address inflation concerns while macroprudential measures are tightened to restrain the build-up of financial imbalances.

These are just some of the many considerations that need to be taken into account when evaluating the role of monetary policy and macroprudential measures in a macro-financial stability framework. They help explain the range of possible roles monetary policy can in principle play, from serving simply as a backstop for more targeted macroprudential measures to playing a much more prominent part. What is clear is that a more active role for monetary policy requires a flexible interpretation of inflation objectives, so as to better reconcile near-term stabilisation objectives with longer-run financial and hence macroeconomic stability. This, in turn, calls for longer horizons than the widely adopted two-year ones. These refinements would provide necessary room for manoeuvre to address the slower-moving build-up of financial vulnerabilities linked to the financial cycle (Chapter I).55

Fiscal policy is another key element of a broader macro-financial stability framework.56 Relatively tight fiscal policy may help restrain the build-up of imbalances during financial booms. More importantly, it will build buffers that can be drawn upon to dampen the real effects of financial downturns. For example, the loosening of fiscal policy was crucial in supporting output during the GFC. Sufficiently large fiscal buffers can also help prevent the sovereign itself being a source of financial instability, as has happened recently in several European economies. But running a sound fiscal policy during a financial boom is challenging for a number of reasons.57 First, financial booms create revenues that will not be there when the boom stops. Second, financial booms also result in an overestimation of potential output and growth. It is therefore very important, when assessing structural deficits, to allow for the flattering effect of financial booms on public finances. Third, financial booms may create hidden contingent liabilities, including the fiscal costs of dealing with financial instability, or lower revenues and higher expenditures from an ensuing recession.

Often financial imbalances result at least in part from distortions in the tax system or the real sector. For example, the tax codes of most economies favour debt over equity, creating incentives for leverage.58 Changing the tax code to reduce this bias could result in less vulnerable funding structures. In the case of housing booms, measures that expand the supply of land or encourage construction could have a more lasting impact on property prices and, indirectly, mortgage credit than higher interest rates or tighter macroprudential measures. Similarly, authorities may limit speculative activity in the shape of rapid turnover (or "flipping") in the housing market by raising transaction taxes or stamp duties, rather than through macroprudential or monetary policy measures.59

Putting together a comprehensive macro-financial stability framework naturally raises coordination issues. In some cases, it might be enough to merely take into account decisions in other policy spheres, just as monetary policymakers take the fiscal stance as given when deciding on interest rates. In other instances, the case for coordination is stronger. Coordination between the monetary authority and other authorities, such as macroprudential and fiscal, may also broaden political and social support.

Coordination may become even more difficult when it has to take place across borders. While the literature rightly cautions that not all forms of cross-border spillover call for policy intervention,60 they sometimes do. For macroprudential measures, the case for international coordination is perhaps easiest to make in preventing cross-border arbitrage, ie "leakages". The Basel agreement on reciprocity in the implementation of the Basel III CCyB is one such example. Designed to overcome the problems associated with global banks bypassing national regulations on capital requirements, this agreement stipulates that when the CCyB is activated in any given country, all countries are expected to apply the same buffer on exposures to that country from banks in their jurisdiction.61 But there may be other cases too. For example, when a country introduces prudential measures to reduce systemic risks related to FX borrowing, capital flows may be diverted to another country in the same region. In this case, coordination would mean that both countries tighten such prudential measures, ie that their actions complement each other.62

Box IV.B

FX interventions in a macroprudential context

The frequency and size of capital flow surges and reversals in EMEs have increased over the past three decades. Such surges and reversals pose macro-financial stability risks by significantly raising the volatility of exchange rates and interest rates as well as the risk of financial crises. This raises the questions of how to respond, and how best to combine policies as part of a holistic macro-financial stability framework. This box considers what role foreign exchange intervention can play.

FX intervention can help underpin financial stability in two ways. First, intervening in response to capital inflows can help build international reserves that can be deployed when tides turn. Second, intervention may constrain the build-up of financial imbalances. All else equal, an appreciating exchange rate tends to improve the creditworthiness of domestic borrowers and thus open the door for more borrowing. This is most obvious if debt is denominated in foreign currency and assets are denominated in the domestic currency. In this case, an appreciation of the exchange rate reduces the value of this debt relative to domestic assets and income. But the effect may also be felt even in the absence of currency mismatches. An exchange rate appreciation tilts the relative value of domestic versus foreign assets that could serve as collateral, thus making international banks and institutional investors more willing to lend.

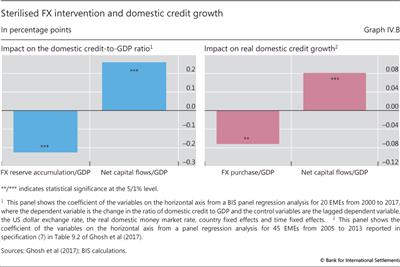

EMEs have frequently used FX intervention to mitigate the effects of external conditions on the domestic economy, especially those of exchange rate and capital flow volatility. Many cross-country studies on the effectiveness of sterilised FX intervention in EMEs find evidence that it has tempered exchange rate appreciation in response to gross inflows. By doing so, intervention can also weaken the impact of foreign financial conditions on domestic credit and thus reduce systemic risk. Indeed, Graph IV.B shows that sterilised FX intervention tends to offset the impact of capital inflows on domestic credit growth.

By doing so, intervention can also weaken the impact of foreign financial conditions on domestic credit and thus reduce systemic risk. Indeed, Graph IV.B shows that sterilised FX intervention tends to offset the impact of capital inflows on domestic credit growth.

In contrast to restrictions on capital flows, FX intervention works directly on the source of shocks, ie the exchange rate, rather than directly discouraging inflows. However, FX intervention does not always work well. While it helps build buffers and neutralise the exchange rate channel, it does not offset the direct effect of inflows on debt. In general, intervention works better when the inflow is less persistent and less sensitive to return differentials. Therefore, FX intervention could be best regarded as a complement to other policies, such as interest rate policy and domestic macroprudential measures that EMEs can use to maintain macro-financial stability.

Therefore, FX intervention could be best regarded as a complement to other policies, such as interest rate policy and domestic macroprudential measures that EMEs can use to maintain macro-financial stability.

FX intervention to smooth a depreciation of the domestic currency in the face of capital outflows has to be communicated properly in order to be effective. In particular, national authorities should emphasise the macroprudential objective of such actions, making sure that they are not interpreted as a lack of conviction on the part of the authorities to make other, more fundamental policy adjustments when they are required, as in the monetary or fiscal space.

See Bruno and Shin (2015a,b).

See Bruno and Shin (2015a,b).  See Blanchard et al (2015) and Daude et al (2016). Fratzscher et al (2017) examine foreign exchange intervention based on daily data covering 33 AEs and EMEs from 1995 to 2011, and find that intervention works well in terms of smoothing the path of exchange rates, and stabilising the exchange rate in countries with narrow band regimes.

See Blanchard et al (2015) and Daude et al (2016). Fratzscher et al (2017) examine foreign exchange intervention based on daily data covering 33 AEs and EMEs from 1995 to 2011, and find that intervention works well in terms of smoothing the path of exchange rates, and stabilising the exchange rate in countries with narrow band regimes.  This is in line with recent studies using a variety of methodologies, For cross-country evidence, see Ghosh et al (2017). Hofmann et al (2018) look at the micro data of Colombia and find that sterilised FX interventions counter the procyclical effects of capital inflows on bank lending. Using Korean bank-level data, Yun (2018) finds that, facing reserve accumulation, primary dealer banks and foreign bank branches reduced lending more than non-primary dealer banks and domestic banks, respectively.

This is in line with recent studies using a variety of methodologies, For cross-country evidence, see Ghosh et al (2017). Hofmann et al (2018) look at the micro data of Colombia and find that sterilised FX interventions counter the procyclical effects of capital inflows on bank lending. Using Korean bank-level data, Yun (2018) finds that, facing reserve accumulation, primary dealer banks and foreign bank branches reduced lending more than non-primary dealer banks and domestic banks, respectively.  For details, see Ghosh et al (2017).

For details, see Ghosh et al (2017).

Endnotes

1 In line with agreed terminology, this chapter defines macroprudential frameworks as those that use (primarily) prudential tools to target specifically systemic risk and thus mitigate the impact of systemic events on the macroeconomy. The operational objectives of existing macroprudential frameworks have been to strengthen the resilience of financial systems and dampen the financial booms and busts at the heart of much of the financial instability seen historically. For more details, see FSB-IMF-BIS (2011a,b, 2016).

2 For an early in-depth analysis of the concept of procyclicality and its implications, see Borio et al (2001).

3 See Crockett (2000). Clement (2010) traces the term "macroprudential" back to a submission of the Bank of England to the Cooke Committee, the precursor of the Basel Committee on Banking Supervision. Borio (2003) sought to clarify its contours more precisely.

4 This graph is based on 845 macroprudential measures taken by 55 economies over 1995-2018.

5 At their meeting in Seoul in November 2010, G20 leaders asked the FSB, the IMF and the BIS to undertake further work on macroprudential policy. See FSB-IMF-BIS (2011a,b, 2016) for summaries of this work.

6 For examples, see Table 3 in CGFS (2016).

7 See Fender and Lewrick (2016) for a recent review of estimates of the costs of financial distress.

8 See Reinhart and Rogoff (2009).

9 For an overview, see Claessens and Kose (2018).

10 See Aldasoro et al (2018) for a recent contribution and further references. While credit gaps also have predictive power for EMEs, the case where credit grows exponentially over an extended period starting from a very low level may not be comparable with the deviation of credit in an advanced economy, which tends to behave more cyclically.

11 Moreover, the complexity and interconnections that give rise to systemic risk are often the result of financial intermediation having grown large. See Shin (2017).

12 See Anderson et al (2018) for details on the macroprudential stress tests conducted by major advanced economy central banks and international organisations; and Arslan and Upper (2017) for the BIS survey on practices in EMEs.

13 Over time, testing methodologies have started to incorporate feedback effects through contagion between firms, or through the interaction between the economy's financial and real sectors. But these second-round effects tend to be mechanistic, failing to capture the behaviour of firms or banks.

14 For a critical assessment of stress tests, see Borio et al (2014).

15 Non-prudential instruments need to be specifically targeted at systemic risk and underpinned by governance arrangements that prevent any slippage in order to be considered macroprudential. See FSB-IMF-BIS (2011b).

16 See CGFS (2010), especially Table 1, Crowe et al (2013) and Claessens (2015) for mappings from particular vulnerabilities to tools.

17 The restrictions were applied to auto loans with long maturities and high loan-to-value ratios. See Costa de Moura and Martins Bandeira (2017) for more details.

18 The central bank responded by introducing tighter loan-to-value caps on housing loans to firms too. See Central Bank of Malaysia (2017).

19 See Cizel et al (2016) and Bruno et al (2017).

20 A multi-instrument approach is also consistent with the theory of policymaking under uncertainty developed by Brainard (1967), which suggests that policymakers should use all available tools - but cautiously - to mitigate the effects of uncertainty.

21 Indeed, some of the measures used for macroprudential purposes, for instance some credit restrictions, were originally introduced to allocate credit.

22 See eg Allen et al (2017).

23 For example, the Bank of England set the countercyclical capital buffer (CCyB) so that the sum of the 2.5% Basel III capital conservation buffer and the CCyB was equivalent to the average loss of 3.5% of banks' risk-weighted assets as revealed by the Bank's stress test. See Bank of England (2017).

24 For example, the Bank of France uses dynamic stochastic general equilibrium models with several macro-financial variables to calibrate a rule that links the CCyB to macroeconomic developments.

25 The country studies in BIS Papers, no 94, provide many examples.

26 See Bahaj and Foulis (2017), who relax Brainard's (1967) assumptions that the costs of missing the target are symmetrical.

27 See CGFS (2016) and Patel (2017).

28 The inaccessibility is only partly due to the nature of the issues. Textual analysis finds that many central banks use overly complex language. See Patel (2017).

29 CGFS (2016) provides extensive discussion of communication as an instrument, including many practical examples.

30 See Alegría et al (2017). For counterexamples, see CGFS (2016).

31 See Powell (2018) for discussions on the role of public transparency and accountability for both financial stability and monetary policy.

32 See FSB-IMF-BIS (2011b).

33 See Villar (2017).

34 At one extreme, the European Systemic Risk Board (ESRB) has 78 member institutions and three observers, although the ESRB has formal procedures for conducting macroprudential policies.

35 For examples, see Gambacorta and Murcia (2017) and the country studies in BIS Papers, no 94.

36 See eg Aguirre and Repetto (2017), Altunbas et al (2018) and Gómez et al (2017).

37 The analysis uses the sample of macroprudential measures described in Table IV.A1. In line with most other cross-country studies, it defines dummy variables for tightening (+1) and loosening (-1) actions. Recently, a small number of papers have attempted to capture the intensity of policy actions considering the size (and sometimes even the scope) of changes in regulatory ratios. See Glocker and Towbin (2015), Vandenbussche et al (2015) and Richter et al (2018). See Galati and Moessner (2017) for a recent review of the effectiveness of macroprudential measures.

38 See eg Cerutti et al (2017), Gambacorta and Murcia (2017), Kuttner and Shim (2016) and Lim et al (2011). Many country-level studies also reach similar conclusions. For example, see Igan and Kang (2011) for Korea and Wong et al (2011) for Hong Kong SAR.

39 See Arslan and Upper (2017).

40 For example, Claessens et al (2013) use a sample of around 2,800 banks in 48 countries over the period 2000-10 and find that maximum LTV and DSTI ratios as well as limits on credit growth and foreign currency lending have reduced bank leverage and asset growth during booms. By contrast, they find that few policies have helped to stop declines in bank leverage and assets during downturns.

41 Lim et al (2011) obtain similar results.

42 In particular, the top left-hand panel of Graph IV.4 shows that policy actions which tighten capital flow- or FX liability-based reserve requirements or credit growth- or asset-based marginal reserve requirements significantly increased real general bank credit growth. Empirical studies on the impact of reserve requirements also show mixed results.

43 See Takáts and Upper (2013).

44 For the discussion on the appropriate criteria, see Borio (2014). Jiménez et al (2017) find that the ability of Spanish banks to keep lending during the GFC depended on how much capital they had put aside under the automatic dynamic provisioning programme.

45 See Aldasoro et al (2018).

46 See Auer and Ongena (2016).

47 For country-specific studies, see Kelber and Monnet (2014), Aikman et al (2016) and Monnet (2014). For cross-country studies, see Sánchez and Röhn (2016), Boar et al (2017), Kim and Mehrotra (2018) and Richter et al (2018).

48 See Agénor and Pereira da Silva (2018) for a review.

49 See eg Buch and Goldberg (2017), Hoggarth et al (2013), Ongena et al (2013), Reinhardt and Sowerbutts (2015) and Tripathy (2017).

50 This is the risk-taking channel of monetary policy first introduced by Borio and Zhu (2012). For further evidence, see Jiménez et al (2012). For a critique, see Svensson (2017).

51 To illustrate the use of two monetary policy tools - the policy rate and sterilised FX intervention - under imperfect capital mobility to stabilise inflation, the output gap and the exchange rate, see Blanchard (2012).

52 The strength of the risk-taking channel of monetary policy is controversial. This is important because models in which this channel is strong tend to indicate that monetary policy should include a financial stability objective, while models in which it is absent tend to suggest that it should not (Adrian and Liang (2018)). For an overview of the arguments of whether monetary policy should lean against the development of financial imbalances, see IMF (2015), Filardo and Rungcharoenkitkul (2016) and Adrian and Liang (2018) as well as references therein.

53 As succinctly put by former US Federal Reserve Governor Jeremy Stein, "monetary policy gets into all the cracks" (Stein (2013)). See also Crockett (2000), Borio and Lowe (2002), Crowe et al (2013) and Blanchard et al (2013).

54 Capital flow management (CFM) tools used for prudential purposes can complement FX intervention in dealing with capital flows and thus financial imbalances. Recent empirical studies generally show that CFM tools are sometimes effective in slowing down targeted flows but that the effects tend to be temporary and leakages abound. Such CFM tools are often used when other types of tool do not successfully moderate capital flows. Moreover, there is no consensus on which types of CFM tool are macroprudential and which are not.

55 For instance, Drehmann et al (2012) document how the equity price crashes in 1987 and 2001, and the associated economic slowdowns or mild recessions, did not stop the expansion of the financial cycle, as credit growth and property price increases continued. When the financial cycle turned a few years later, it ushered in financial stress and a more severe recession - what the authors term the "unfinished recession" phenomenon. Presumably, the monetary policy easing in response to the equity crashes and economic slowdowns contributed to the financial cycle expansion at the time. See also eg Borio and White (2004) and Beau et al (2014). In turn, Juselius et al (2017), by estimating a model of the economy that embeds an articulated version of the financial cycle (Juselius and Drehmann (2015)), find that an augmented Taylor rule which also includes a financial cycle proxy could have improved both output and inflation performance over longer horizons since the 1990s.

56 See Chapter V of BIS (2016).

57 See eg Borio et al (2016).

58 See Box V.C in BIS (2016).

59 Crowe et al (2013) and Kuttner and Shim (2016) find that such measures tend to have a sizeable impact on both housing credit and house prices.

60 Korinek (2017) sets out three conditions of which at least one needs to be violated to generate inefficiency and scope for cooperation: (i) policymakers act competitively in the international market; (ii) they have sufficient external policy instruments; and (iii) international markets are free of imperfections. If one of these conditions is violated, then international cooperation can improve welfare. For a discussion of the need for international cooperation on monetary policy, see BIS (2015).

61 A special case is coordination in multilayered jurisdictions such as the European Union, where multilateral institutions such as the European Systemic Risk Board and the Single Supervisory Mechanism have some directive powers over national bodies.

62 See Agénor and Pereira da Silva (2018) and Agénor et al (2017).

References

Adrian, T and N Liang (2018): "Monetary policy, financial conditions, and financial stability", International Journal of Central Banking, vol 14, no 1, January, pp 73-131.

Agénor, P-R, E Kharroubi, L Gambacorta, G Lombardo and L Pereira da Silva (2017): "The international dimensions of macroprudential policies", BIS Working Papers, no 643, June.

Agénor, P-R and L Pereira da Silva (2018): "Financial spillovers, spillbacks and the scope for international macroprudential policy coordination", BIS Papers, no 97, April.

Aguirre, H and G Repetto (2017): "Capital and currency-based macroprudential policies: an evaluation using credit-registry data", BIS Working Papers, no 672, November.

Aikman, D, O Bush and A Taylor (2016): "Monetary versus macroprudential policies: causal impacts of interest rates and credit controls in the era of the UK Radcliffe Report", Bank of England, Staff Working Papers, no 610.

Aldasoro, I, C Borio and M Drehmann (2018): "Early warning indicators of banking crises: expanding the family", BIS Quarterly Review, March, pp 29-45.

Alegría, A, R Alfaro and F Córdova (2017): "The impact of warnings published in a financial stability report on loan-to-value ratios", BIS Working Papers, no 633, May.

Allen, J, T Grieder, T Roberts and B Peterson (2017): "The impact of macroprudential housing finance tools in Canada", BIS Working Papers, no 632, May.

Altunbas, Y, M Binici and L Gambacorta (2018): "Macroprudential policy and bank risk", Journal of International Money and Finance, vol 81, pp 203-20.

Anderson, R, C Baba, J Danielsson, U Das, H Kang and M Segoviano (2018): Macroprudential stress tests and policies: searching for robust and implementable frameworks, London School of Economics Systemic Risk Centre.

Arslan, Y and C Upper (2017): "Macroprudential frameworks: implementation and effectiveness", BIS Papers, no 94, December, pp 25-47.

Auer, R and S Ongena (2016): "The countercyclical capital buffer and the composition of bank lending", BIS Working Papers, no 593, December.

Bahaj, S and A Foulis (2017): "Macroprudential policy under uncertainty", International Journal of Central Banking, vol 13, no 3, pp 119-54.

Bank for International Settlements (2015): 85th Annual Report, June, Chapter V.

--- (2016): 86th Annual Report, June.

Bank of England (2017): "Overview of risks to UK financial stability and UK countercyclical capital buffer", Financial Stability Review, November, pp 1-7.

Beau, D, C Cahn, L Clerc and B Mojon (2014): "Macro-prudential policy and the conduct of monetary policy", in S Bauducco, L Christiano and C Raddatz (eds), Macroeconomic and financial stability: challenges for monetary policy, Central Bank of Chile.

Blanchard, O (2012): "Monetary policy in the wake of the crisis", in O Blanchard, D Romer, M Spence and J Stiglitz (eds), In the wake of the crisis: leading economists reassess economic policy, MIT Press.

Blanchard, O, G Adler and I de Carvalho Filho (2015): "Can foreign exchange intervention stem exchange rate pressures from global capital flow shocks?", NBER Working Papers, no 21427, July.

Blanchard, O, G Dell'Ariccia and P Mauro (2013): "Rethinking macro policy II: getting granular", IMF Staff Discussion Notes, no 13/03, April.

Boar, C, L Gambacorta, G Lombardo and L Pereira da Silva (2017): "What are the effects of macroprudential policies on macroeconomic performance?", BIS Quarterly Review, September, pp 71-88.

Borio, C (2003): "Towards a macroprudential framework for financial supervision and regulation?", BIS Working Papers, no 128, February.

--- (2004): "Market distress and vanishing liquidity: anatomy and policy options", BIS Working Papers, no 158, July.

--- (2014): "Macroprudential frameworks: (too) great expectations?", Central Banking Journal, 25th anniversary issue, August.

Borio, C, M Drehmann and K Tsatsaronis (2014): "Stress-testing macro stress testing: does it live up to expectations?", Journal of Financial Stability, vol 12, pp 3-15.

Borio, C, C Furfine and P Lowe (2001): "Procyclicality of the financial system and financial stability: issues and policy options", BIS Papers, no 1, March, pp 1-57.

Borio, C, M Lombardi and F Zampolli (2016): "Fiscal sustainability and the financial cycle", BIS Working Papers, no 552, March.

Borio, C and P Lowe (2002): "Asset prices, financial and monetary stability: exploring the nexus", BIS Working Papers, no 114, July.

Borio, C and W White (2004): "Whither monetary and financial stability: the implications for evolving policy regimes", BIS Working Papers, no 147, February.

Borio, C and H Zhu (2012): "Capital regulation, risk-taking and monetary policy: a missing link in the transmission mechanism?", Journal of Financial Stability, vol 8, no 4, pp 235-51.

Brainard, W (1967): "Uncertainty and the effectiveness of policy", American Economic Review Papers and Proceedings, vol 57, pp 411-25.

Bruno, V, I Shim and H S Shin (2017): "Comparative assessment of macroprudential policies", Journal of Financial Stability, vol 28, pp 183-202.

Bruno, V and H S Shin (2015a): "Cross-border banking and global liquidity", Review of Economic Studies, vol 82, no 2, pp 535-64.

--- (2015b): "Capital flows and the risk-taking channel of monetary policy", Journal of Monetary Economics, vol 71, pp 119-32.

Buch, C and L Goldberg (2017): "Cross-border prudential policy spillovers: how much? how important? Evidence from the international banking research network", International Journal of Central Banking, vol 13, no 2, pp 505-58.

Budnik, K and J Kleibl (2018): "Macroprudential regulation in the European Union in 1995-2014: introducing a new data set on policy actions of a macroprudential nature", ECB Working Papers, no 2123, January.

Central Bank of Malaysia (2017): "Macroprudential frameworks: implementation, and relationship with other policies - Malaysia", BIS Papers, no 94, December, pp 231-8.

Cerutti, E, S Claessens and L Laeven (2017): "The use and effectiveness of macroprudential policies: new evidence", Journal of Financial Stability, vol 28, pp 203-24.

Cizel, J, J Frost, A Houben and P Wierts (2016): "Effective macroprudential policy: cross-sector substitution from price and quantity measures", IMF Working Papers, no 16/94.

Claessens, S (2015): "An overview of macroprudential policy tools", Annual Review of Financial Economics, vol 7, no 1, December, pp 397-422.

Claessens, S, S Ghosh and R Milhet (2013): "Macro-prudential policies to mitigate financial system vulnerabilities", Journal of International Money and Finance, vol 39, pp 153-85.

Claessens, S and M Kose (2018): "Frontiers of macro-financial linkages", BIS Papers, no 95, January.

Clement, P (2010): "The term 'macroprudential': origins and evolution", BIS Quarterly Review, March, pp 59-67.

Committee on the Global Financial System (2010): "Macroprudential instruments and frameworks: a stocktaking of issues and experiences", CGFS Papers, no 38.

--- (2016): "Objective-setting and communication of macroprudential policies", CGFS Papers, no 57.

Costa de Moura, M and F Martins Bandeira (2017): "Macroprudential policy in Brazil", BIS Papers, no 94, December, pp 77-86.

Crockett, A (2000): "In search of anchors for financial and monetary stability", speech at the SUERF Colloquium in Vienna, 27-29 April.

Crowe, C, G Dell'Ariccia, D Igan and P Rabanal (2013): "How to deal with real estate booms: lessons from country experiences", Journal of Financial Stability, vol 9, pp 300-19.

Daude, C, E Levy-Yeyati and A Nagengast (2016): "On the effectiveness of exchange rate interventions in emerging markets", Journal of International Money and Finance, vol 64, pp 239-61.

Drehmann, M, C Borio and K Tsatsaronis (2012): "Characterising the financial cycle: don't lose sight of the medium term!", BIS Working Papers, no 380, June.

Fender, I and U Lewrick (2016): "Adding it all up: the macroeconomic impact of Basel III and outstanding reform issues", BIS Working Papers, no 591, November.

Filardo, A and P Rungcharoenkitkul (2016): "A quantitative case for leaning against the wind", BIS Working Papers, no 594, December.

Financial Stability Board (2017): Policy recommendations to address structural vulnerabilities from asset management activities, 12 January.

Financial Stability Board, International Monetary Fund and Bank for International Settlements (2011a): Macroprudential policy tools and frameworks: update to G20 Finance Ministers and Central Bank Governors, February.

--- (2011b): Macroprudential policy tools and frameworks, progress report to the G20, October.

--- (2016): Elements of effective macroprudential policies: lessons from international experience, report to the G20, August.

Fratzscher, M, O Gloede, L Menkhoff, L Sarno and T Stöhr (2017): "When is foreign exchange intervention effective? Evidence from 33 countries", CEPR Discussion Papers, no 12510.

Galati, G and R Moessner (2017): "What do we know about the effects of macroprudential policy?", Economica, February, pp 1-36.

Gambacorta, L and A Murcia (2017): "The impact of macroprudential policies and their interaction with monetary policy: an empirical analysis using credit registry data", BIS Working Papers, no 636, May.

Ghosh, A, J Ostry and M Qureshi (2017): Taming the tide of capital flows: a policy guide, MIT Press.

Glocker, C and P Towbin (2015): "Reserve requirements as a macroprudential instrument: empirical evidence from Brazil", Journal of Macroeconomics, vol 44 (Supplement C), pp 158-76.

Gómez, E, A Lizarazo, J Mendoza and A Murcia (2017): "Evaluating the impact of macroprudential policies on credit growth in Colombia", BIS Working Papers, no 634, May.

Hofmann, B, H S Shin and M Villamizar-Villegas (2018): "Sterilised foreign exchange intervention as reverse QE", unpublished manuscript.

Hoggarth, G, J Hooley and Y Korniyenko (2013): "Which way do foreign branches sway? Evidence from the recent UK domestic credit cycle", Bank of England, Financial Stability Papers, no 22, June.

Igan, D and H-D Kang (2011): "Do loan-to-value and debt-to-income limits work? Evidence from Korea", IMF Working Papers, no 11/297.

International Monetary Fund (2015): "Monetary policy and financial stability", Staff Report, August.

Jiménez, G, S Ongena, J-L Peydró and J Saurina (2012): "Credit supply and monetary policy: identifying the bank balance-sheet channel with loan applications", American Economic Review, vol 102, no 5, pp 2301-26.

--- (2017): "Macroprudential policy, countercyclical bank capital buffers, and credit supply: evidence from the Spanish dynamic provisioning experiments", Journal of Political Economy, vol 125, no 6, pp 2126-77.

Juselius, M, C Borio, P Disyatat and M Drehmann (2017): "Monetary policy, the financial cycle, and ultra-low interest rates", International Journal of Central Banking, vol 13, no 3, September, pp 55-89.

Juselius, M and M Drehmann (2015): "Leverage dynamics and the real burden of debt", BIS Working Papers, no 501, May.

Kelber, A and E Monnet (2014): "Macroprudential policy and quantitative instruments: a European historical perspective", Bank of France, Financial Stability Review, April, pp 165-74.

Kim, S and A Mehrotra (2018): "Effects of monetary and macroprudential policies - evidence from four inflation targeting economies", Journal of Money, Credit and Banking, forthcoming.

Korinek, A (2017): "Currency wars or efficient spillovers? A general theory of international policy cooperation", BIS Working Papers, no 615, March.

Kuttner, K and I Shim (2016): "Can non-interest rate policies stabilize housing markets? Evidence from a panel of 57 economies", Journal of Financial Stability, vol 26, pp 31-44.

Lim, C, F Columba, A Costa, P Kongsamut, A Otani, M Saiyid, T Wezel and X Wu (2011): "Macroprudential policy: what instruments and how to use them", IMF Working Papers, no 11/238.

Monnet, E (2014): "Monetary policy without interest rates: evidence from France's Golden Age (1948 to 1973) using a narrative approach", American Economic Journal: Macroeconomics, vol 6, no 4, pp 137-69.

Ongena, S, A Popov and G Udell (2013): "When the cat's away the mice will play: does regulation at home affect bank risk-taking abroad?", Journal of Financial Economics, vol 108, no 3, pp 727−50.

Patel, N (2017): "Macroprudential frameworks: communication", BIS Papers, no 94, December, pp 49-56.

Powell, J (2018): "Financial stability and central bank transparency", speech at 350 years of central banking: the past, the present and the future, Sveriges Riksbank anniversary conference, Stockholm, 25 May.

Reinhardt, D and R Sowerbutts (2015): "Regulatory arbitrage in action: evidence from banking flows and macroprudential policy", Bank of England, Staff Working Papers, no 546, September.

--- (2016): "Macroprudential policies: a granular database", unpublished manuscript.

Reinhart, C and K Rogoff (2009): This time is different: eight centuries of financial folly, Princeton University Press.

Richter, B, M Schularick and I Shim (2018): "Output effects of macroprudential policy", unpublished manuscript.

Sánchez, A and O Röhn (2016): "How do policies influence GDP tail risks?", OECD Economics Department Working Papers, no 1339.

Securities and Exchange Commission (2016): Final Rule: Investment Company Liquidity Risk Management Programmes, release no 33-10233, 13 October.

Shim, I, B Bogdanova, J Shek and A Subelyte (2013): "Database for policy actions on housing markets", BIS Quarterly Review, September, pp 83-91.

Shin, H S (2017): "Leverage in the small and in the large", panel remarks at the IMF Annual Meeting seminar on systemic risk and macroprudential stress testing, Washington DC, 10 October.

Stein, J (2013): "Overheating in credit markets: origins, measurement and policy responses", speech at the research symposium on Restoring household financial stability after the Great Recession: why household balance sheets matter sponsored by the Federal Reserve Bank of St Louis, St Louis, Missouri, 7 February.

Svensson, L (2017): "The relation between monetary policy and financial stability policy", paper presented at the XXI Annual Conference of the Central Bank of Chile on Monetary policy and financial stability: transmission mechanisms and policy implications, November.

Takáts, E and C Upper (2013): "Credit and growth after financial crises", BIS Working Papers, no 416, July.

Tripathy, J (2017): "Cross-border effects of regulatory spillovers: evidence from Mexico", Bank of England, Staff Working Papers, no 684.

Vandenbussche, J, U Vogel and E Detragiache (2015): "Macroprudential policies and housing prices: a new database and empirical evidence for central, eastern, and southeastern Europe", Journal of Money, Credit and Banking, vol 47 (S1), pp 343-77.

Villar, A (2017): "Macroprudential frameworks: objectives, decisions and policy interactions", BIS Papers, no 94, December, pp 7-24.

Wong, E, T Fong, K Li and H Choi (2011): "Loan-to-value ratio as a macroprudential tool: Hong Kong's experience and cross-country evidence", Hong Kong Monetary Authority, Working Papers, no 01/2011.

Yun, Y (2018): "Reserve accumulation and bank lending: evidence from Korea", Bank of Korea, Working Papers, no 2018-15.