Mapping shadow banking in China: structure and dynamics

Summary

Focus

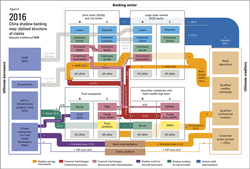

We study the structure of the shadow banking system in China, focusing on the main activities and linkages with the formal banking sector. With the help of our newly developed shadow banking map, we analyse how shadow banking activities in China have evolved and how their dynamics have changed.

Contribution

Existing research tends to focus on specific aspects of shadow banking in China. We take a broader look by developing a map of shadow banking that allows for a comprehensive and structural analysis of shadow banking activities. While the economic drivers of shadow banking in China are similar to those of the United States, our map points to several unique characteristics of the Chinese system. To measure the size and dynamics of shadow banking, we distinguish between three main stages of credit intermediation. This helps in better understanding the role, evolution and regulation of shadow banking activities in China.

Findings

Banks have been the dominant player in China's shadow banking system. This is why it is sometimes dubbed the "shadow of the banks". In contrast to shadow banking in the United States, securitisation and market-based instruments still play a rather limited role in China. As visualised in a series of maps for the period 2013-2016, the structure of the Chinese shadow banking system has been evolving rapidly.

While growth of shadow credit to ultimate borrowers has slowed, the use of shadow saving instruments (eg wealth management products, trust products) has continued to expand at a fast pace. New and more complex "structured" shadow credit intermediation aimed at reducing banks' regulatory burden has emerged and quickly reached a large scale. The bond market has become highly dependent on funding channelled through wealth management products. As a result, Chinese shadow banking is becoming slightly more similar to US shadow banking.

Abstract

We develop a stylised shadow banking map for China with the aim of providing a coherent picture of its structure and the associated financial system interlinkages. Five key characteristics emerge. One defining feature of the shadow banking system in China is the dominant role of commercial banks, true to the adage that shadow banking in China is the "shadow of the banks". Moreover, it differs from shadow banking in the United States in that securitisation and market-based instruments play only a limited role. With a series of maps we show that the size and dynamics of shadow banking in China have been changing rapidly. This reveals a marked shift in the relative importance of different shadow banking activities. New and more complex "structured" shadow credit intermediation has emerged and quickly reached a large scale, while the bond market has become highly dependent on funding channelled through wealth management products. As a result, the structure of shadow banking in China is growing more complex.

JEL classification: G2

Keywords: shadow banking, wealth management products (WMPs), investment receivables, entrusted loans, trust loans