Fast payment systems and financial inclusion

Box extracted from chapter "Fast payments: design and adoption"

Fast payment systems (FPS) could be a catalyst to expand access to and use of formal transaction accounts and related financial services (eg payment cards, loans and insurance). This is broadly defined as financial inclusion (CPMI and World Bank (2020)).

FPS and financial inclusion are linked in several ways. First, they are linked due to network effects. As more individuals and businesses adopt fast payments across the economy, the unbanked may start to do so too, as a way to address the challenges and costs associated with cash management and handling. Second, because fast payments offer low-cost and immediate access to funds, underbanked end users could switch from using cash or payment cards to fast payments. Third, subject to customer consent, financial institutions can offer personalised financial products such as credit cards and loans by using the data generated from the use of fast payments.

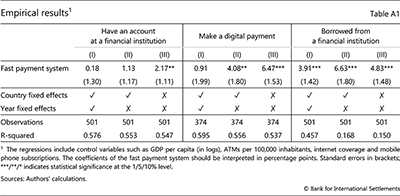

Using country-level data from 148 countries from the 2011–21 World Bank Global Findex, we assess how the presence of an FPS relates to three indicators of financial inclusion, namely access to an account at a financial institution, use of digital payments and access to a loan from a financial institution. To formally assess the role of an FPS, we run the following two-way fixed effects regression:

To formally assess the role of an FPS, we run the following two-way fixed effects regression:

,

,

where yit are the three indicators of financial inclusion (access to a bank account, use of a digital payment and access to a loan from a financial institution) for country i in period t. FPi.t is a dummy variable that takes a value of 1 if an FPS is available in country i in period t. Xi.t is a set of controls that vary across countries and over time, such as GDP per capita (in logs), automatic teller machines (ATMs) per 100,000 inhabitants, internet coverage and mobile phone subscriptions. δi and θt denote country and time fixed effects, respectively.

The regression results (Table A1) show that countries with an FPS have higher levels of access to credit from financial institutions. This is robust to different specifications and suggests that FPS may be associated with access to financial services beyond payments. Greater access to credit may relate to an individual building up a track record of formal payments. Regarding access to a financial account and the use of digital payments, the presence of an FPS becomes insignificant when we include country and time fixed effects.

Although we are trying to control for some omitted variables, this evidence is just suggestive because in some cases there could be reverse causality and co-dependence on omitted variables.

The views expressed are those of the authors and do not necessarily represent the views of the Bank for International Settlements.

The views expressed are those of the authors and do not necessarily represent the views of the Bank for International Settlements.  The 2021 Global Findex database can be downloaded at www.worldbank.org/en/publication/globalfindex. The source for the year of implementation of an FPS is Cornelli, Frost, Velasquez, Warren and Yang (2024) and central banks' websites.

The 2021 Global Findex database can be downloaded at www.worldbank.org/en/publication/globalfindex. The source for the year of implementation of an FPS is Cornelli, Frost, Velasquez, Warren and Yang (2024) and central banks' websites.