Residence and nationality in international financial statistics

Box extracted from chapter "International finance through the lens of BIS statistics: residence vs nationality"

Statistics in international finance differ in how they link financial positions to individual countries. This box provides a simple framework for understanding the country dimensions in international data and classifies benchmark statistics accordingly.

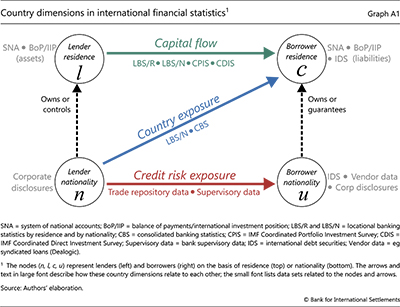

The framework is based on two economic units that transact with each other, one as a lender and one as a borrower (Graph A1). The top two nodes relate to the residence view; they identify the country in which the lender and borrower reside. The arrow (l → c) represents flows or positions between them. The key principle in the residence view is that financial positions of all units resident in the same country are aggregated, regardless of whether these units are controlled by, or otherwise connected to, parent entities located in other countries.

The bottom two nodes in Graph A1 relate to a nationality view. While nationality can be defined in various ways, the relevant criterion in international finance is often the location where corporate decision-making and control resides. The lender and borrower units in this case can be interpreted as consolidated corporate groups, each assigned the nationality of the country of their headquarters. The key principle in the nationality view is that the financial positions of all units controlled by the same headquarters are aggregated along the perimeter of their consolidated balance sheet, even if the units that comprise the group reside in different countries.

The residence and nationality views both have merit; the appropriate choice depends on the analytical question. To understand where funds are sourced and used, and how they relate to economic activity in particular countries, the geography of capital flows provided by the residence view (l → c) is most natural. By contrast, a consolidated view of the lenders' exposures to a particular country (n → c) is needed if the goal is to monitor the exposure to risks incurred there: country risk is the risk that borrowers do not fulfil their obligations for country-specific reasons beyond the counterparty's control; transfer risk stems more narrowly from policy measures such as capital controls, payment moratoriums and limitations on convertibility. Supervisory evaluation of counterparty credit risk between two entities in turn requires consolidating the borrower side too (n → u) to account for parent company guarantees and other credit risk mitigants.

How do benchmark data sets in international finance relate to the nodes and arrows in Graph A1? The small font lists data sets next to the nodes and arrows that they relate to. The SNA and BoP/IIP are compiled on a residence basis and cover the financial positions (assets and liabilities) of resident units. These statistics link units directly to economic activity in the same country and abroad, but without information about the allocation of their external positions across counterparty countries. These data sets are thus listed (in grey) next to the upper nodes in Graph A1 and not next to arrows. The BIS IDS are similarly unilateral in that they track only bond liabilities without information about lenders (bond holders). However, the IDS can be organised by both borrower residence and borrower nationality and thus are listed near nodes c and u.

Bilateral data sets, ie those that capture information about both lender and borrower units, link two nodes in Graph A1 and are thus listed next to arrows. The CPIS and CDIS are collected on a residence basis and track cross-border positions with counterparties in specific countries (l → c). By contrast, the BIS CBS consolidate positions on the lender side (n) to track banks' claims on borrowers resident in particular countries (n → c). The BIS LBS can be organised by both residence (LBS/R) and nationality (LBS/N) and thus are listed next to both the (l → c) and (n → c) arrows.

Few bilateral data sets consolidate on both the lender and borrower sides. This is the value of non-public supervisory data (eg that compiled in the BIS International Data Hub) used for monitoring counterparty credit risk exposures and funding dependencies. Some vendor data, eg syndicated loans from Dealogic, can also be consolidated by lender and borrower nationality, but the identity of lenders is typically lost once loans are traded in the secondary market. Full consolidation is also possible, in principle, in transaction-level data in trade repositories covering derivatives, repos and other financial instruments, although data aggregation remains a challenge (IFC (2017, 2018)).