Monetary policy, relative prices and inflation control: flexibility born out of success

The achievement of low and stable inflation on the back of credible monetary policy frameworks has coincided with a sharp and major drop in the co-movement of prices across finely disaggregated sectors of the economy. In other words, sector-specific price developments have become much more prominent in driving fluctuations in aggregate price indices. In addition, changes in the stance of monetary policy in this environment affect a rather narrow set of prices, limiting the policy's ability to steer inflation within tight ranges as well as the desirability of doing so. All told, this highlights the importance of flexibility in the pursuit of inflation targets within a credible policy regime. 1

JEL classification: E31, E52, E58

Ever since the Great Financial Crisis (GFC), central banks have struggled to bring inflation up towards targets, despite maintaining a highly accommodative policy stance for a long period of time. More recently, however, and partly on the back of a strong post-pandemic economic rebound underpinned by highly expansionary fiscal and monetary policies as well as supply bottlenecks, there have been widespread concerns that inflation may exceed those targets by an uncomfortably large margin (BIS (2021)). This evolving picture puts a premium on understanding inflation dynamics in an environment where inflation has been enduringly low and stable within a credible monetary policy regime.

Against this backdrop, this special feature addresses a number of questions. First, what are the relative contributions to inflation of generalised (ie common) and sector-specific (ie relative) price changes in high and low inflation environments, respectively? In answering this question, we use prices for very finely defined expenditure categories ("sectors") that underlie aggregate consumer price indices. Second, how broad across such sectors is the impact of changes in the monetary policy stance in a low and stable inflation regime? Finally, what are the implications for the conduct of monetary policy?

Key takeaways

- In a regime of low and stable inflation, sector-specific price changes across finely defined sectors, rather than generalised price co-movements, account for most of the fluctuations in aggregate price indices.

- At the same time, changes in the monetary policy stance affect a rather narrow set of prices, limiting the ability of monetary policy to steer inflation within narrow ranges.

- All told, the evidence puts a premium on flexibility in pursuing inflation targets within a credible policy regime.

Unsurprisingly, several of these questions have been asked before. The main contribution of our analysis is to adopt a holistic approach, connecting the various dots and employing more flexible and robust statistical techniques.

Three takeaways are worth highlighting.

First, once the economy settles into a low and stable inflation regime, the contribution of the common component of price changes to inflation drops substantially and becomes much smaller than that of the sector-specific components. This pattern also holds for the rates of price changes for broad sectors (ie durables, non-durables and services).

Second, within a credible policy regime, changes in the stance of monetary policy affect a remarkably narrow set of prices. Most of these are in the services sector, which, on balance, is more sensitive to economic fluctuations.

Finally, all told, these findings put a premium on flexibility in the pursuit of inflation targets. Since adjustments in the policy stance operate largely through aggregate demand – a common factor underlying all price changes – they may be less powerful once sector-specific price changes play a dominant role. When this factor affects a narrow set of prices, an overly forceful monetary policy action may be required to nudge overall inflation towards target, potentially causing undesirable shifts in relative prices. Flexibility can be especially important to reduce the potentially unwelcome side effects of the extraordinarily accommodative policy that may be needed to raise inflation back to narrowly defined targets.

Put differently: just like a credible conductor of a well-rehearsed orchestra can afford to lead with minimal gestures, so a credible central bank can afford to let inflation evolve within a wider range of its target without energetic adjustments to the policy stance.

The analysis is structured as follows. The first section examines the evolution of the contributions of common and sector-specific price changes to overall inflation. The second focuses on the impact of changes in the stance of monetary policy. The third draws implications for policy.

An inflation process in flux

The analysis is based on US data – specifically, on monthly (seasonally adjusted) price indices and the corresponding expenditure weights for 131 narrowly defined sectors of personal consumption expenditures (PCE) published by the US Bureau of Economic Analysis. The main reason for focusing on the United States is data availability, ie long, granular and consistent price series, which makes it possible to go back to the high inflation era of the late 1960s and 1970s. To the extent that the forces we uncover for the inflation process in the United States are also operating in other economies, the results of our analysis would apply more broadly.2

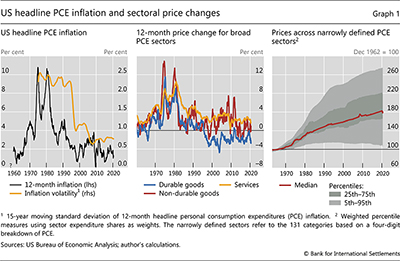

The basic features of the evolution of inflation at the aggregate level are very well documented by now (Graph 1). After being quite high and volatile during the Great Inflation era of the 1970s and early 1980s, inflation in the United States and in large parts of the world fell substantially and became much more stable starting around the mid-1980s (left-hand panel). The reduction in volatility is evident both in the trend – ie the more persistent movements that are the focus of policy – as well as in the more transitory components of inflation (not shown). At the same time, inflation has also become less persistent.3

Less well known and appreciated are the changes that took place "under the hood". Exploring them sheds important light on the aggregate behaviour of inflation.

A critical development is the striking drop in the importance of the common component of price changes relative to the sector-specific component once inflation has become low and stable.4 The shift can be documented in several ways.

First, the divergent rates of price changes point in this direction. While the average rates of price changes in three broad PCE sectors (durables, non-durables and services) moved roughly in sync prior to the mid-1980s, they have clearly become much more asynchronous since then (Graph 1, centre panel). In fact, they have diverged substantially since the mid-1980s, with the rate for the durable goods sector becoming markedly lower than that of services.5 At a more granular level, strong trends in relative prices show up in an increasing dispersion of prices for the 131 narrowly defined sectors (right-hand panel).

Second, the drop in the importance of the common inflation component also emerges from a more formal statistical analysis using price data for the 131 sectors. Specifically, we compute the time-varying share of the total variance of the 12-month percentage change in prices for each broad sector explained by the first principal component – an estimate of the common inflation component – using a rolling 15-year window.6 The fraction of the overall inflation variability attributable to the common inflation component drops sharply, from over 50% to between 15 and 30%, once the pre-1980 period of high and volatile inflation drops out of the estimation window (Graph 2, left-hand panel, black line). In fact, the decline is pervasive as it also applies to the rates of price changes measured at the level of the 131 expenditure sectors (middle panel). Moreover, the drop is also evident in both the trend and transitory components (not shown separately).

Finally, the footprint of the drop in the role of the common component is also visible in the smaller pass-through over time of "salient" price increases at the sector level into increases in core PCE inflation (ie inflation that excludes the volatile food and energy items). In other words, the so-called second-round effects, which would boost the importance of the common inflation component, appear to have become much smaller since the mid-1980s (see Box for details).

The striking decline in the importance of the common inflation component is largely responsible for another stylised fact: the significant reduction in the volatility of inflation documented previously. The bulk of the drop in the volatility of overall inflation does not reflect the decline in volatility within finely defined sectors but rather reflects the decline in the co-movement (covariance) of price changes across those sectors (Graph 2, right-hand panel).7 This pattern is analogous to the behaviour of the volatility of the yield on a portfolio of securities, where the co-movement of yields matters much more than the volatility of yields on individual securities. The timing of the change in the volatility of inflation is equally noteworthy. Given the 15-year rolling window, the sharp drop around 1995 again reflects the effect of the pre-1980 data dropping out of the estimation window.8

The impact of changes in the monetary policy stance

What has the role of monetary policy been in the large drop in the importance of the common component of inflation? And what are the implications for the policy's ability to steer inflation once inflation is low and stable?

In answering these questions, it is essential to make a distinction between the monetary policy regime and changes in the stance of policy within the regime. The regime involves the more systematic aspects of the response of policy to economic conditions (the central bank's "reaction function"). Among other things, a well-understood and credible reaction function is important in shaping inflation expectations of workers, firms and other market participants. Changes in the policy stance, on the other hand, are better regarded as marginal adjustments to policy settings.

There is no doubt that the change in the policy regime has been the critical force bringing inflation down and hence reducing the importance of the common component, not least by mitigating second-round effects from sector-specific price shocks. The timing of the drop in its importance is quite telling: it coincides with the impact of the sharp monetary tightening in the late 1970s and early 1980s (the "Volcker shock"), in response to an inflation rate that was becoming increasingly unmoored.

What about the power of changes in the policy stance within a regime? To formally examine this issue, we first need to identify marginal adjustments in policy settings (or "shocks"). The idea is to capture shifts in the stance of policy that are both unforeseen by market participants and not due to the Fed's concerns about either current or anticipated economic conditions. We do so very precisely, using high-frequency minute-by-minute financial data, while controlling for the Fed's own assessment of the macroeconomic outlook, as summarised by "Greenbook/Tealbook" forecasts.9 The price to be paid for such finely calibrated analysis is that estimates of the shocks are only available from mid-1992, ie for the low inflation period.

Based on this identification strategy, we argue that monetary policy may face significant limitations when seeking to steer inflation within relatively narrow ranges in a low and stable inflation regime.10 Two pieces of evidence justify this argument.

For one, given that monetary policy – as a tool influencing aggregate activity – transmits mainly through the common component of price changes, one possible implication of the observed decline in the importance of the common component is a diminished ability of marginal adjustments to the policy stance to steer inflation.11 This would be so, for example, if the reduced role of the common component reflected more muted second-round effects.

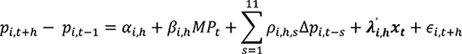

In addition, armed with the measure of marginal adjustments in the policy stance, we consider their price impact on each of the 131 narrowly defined sectors over different horizons during the period July 1992–December 2018. Specifically, we use the standard local projections method proposed by Jordà (2005) and run the following regression for each sector i and horizon h=1,-,48 months:

where pi,t+h is the log price level for sector i in month t+h, MPt is the monetary policy shock in month t and xt is a vector of aggregate controls included to filter out the impact of macroeconomic conditions on price changes within each sector.12

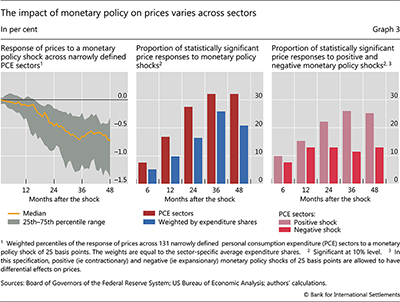

Over a period that witnessed a diminished role for the common component in price fluctuations, we find that the response of prices to monetary policy shocks appears limited to a few sectors (Graph 3).13 This is so even if one allows for natural lags in the policy's impact, as shown by the increasing (absolute) size of the point estimates (βi,h in the equation above) as time unfolds (left-hand panel).14

Specifically, it is striking that the impact on prices is statistically significant at conventional levels for only a small fraction of narrowly defined sectors – less than 20% at the 10% significance level after 12 months (Graph 3, centre panel). Even after 36 months, the fraction of sectors for which the price response is statistically significant rises to only about a third. Moreover, in terms of expenditure shares, the proportion is even lower across all horizons. In other words, the sectors whose prices are responsive to marginal adjustments in the stance of policy have a relatively small weight in the overall price index. Finally, the impact of monetary policy appears to be asymmetric: the fraction of sectors with statistically significant price responses is noticeably lower for expansionary monetary shocks across all horizons, compared with contractionary shocks (right-hand panel).

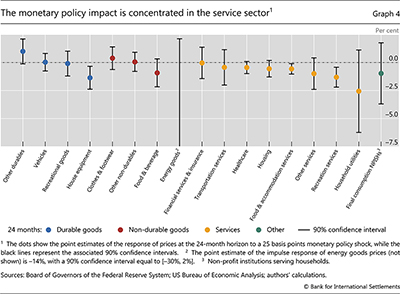

Which sectors are relatively more responsive to changes in the policy stance? Not surprisingly, the bulk are in services, which on balance tend to be more sensitive to economic fluctuations ("cyclically sensitive"). This is the message of an analysis based on 17 sectors and the cumulative price impact of monetary policy shocks after two years (Graph 4).15

Monetary policy amidst sector-specific price changes

The previous empirical findings raise important considerations for the conduct of monetary policy. In particular, they favour flexibility in the pursuit of inflation targets within a credible policy regime. This may be especially so when inflation is hovering persistently below target, calling for a monetary easing.

There are two sets of reasons for this conclusion.

The first has to do with the central bank's ability to steer inflation. When sector-specific price changes account for the bulk of variations in the general price index, monetary policy may face headwinds in moving inflation in the desired direction. One reason is that idiosyncratic price changes are less responsive to fluctuations in aggregate demand. In addition, adjustments in the policy stance affect only a narrow set of prices that together have a relatively small weight in the overall index.16 All told, this increases the need for large shifts in the stance to achieve a given target.

The second set of reasons has to do with the desirability of seeking to steer inflation precisely or the need to do so.

For one, not surprisingly, a substantial fraction of sector-specific price changes are transitory. Central banks can thus look through them. Responding to them can easily lead to an overreaction, as such changes are self-correcting. The justification for looking through such changes would be especially strong if their transitory nature reflected not just regime-induced well-anchored inflation expectations, but also, or even primarily, economic agents' "rational inattention";17 ie their tendency to pay little attention to inflation when it is low and stable since it makes little difference to their well-being – a kind of self-correcting mechanism.

In addition, and arguably less prominent in the policy debate, the still important role of trend changes in sector-specific prices gives rise to tougher challenges. In a low and stable inflation environment, such changes in relative prices tend to reflect the fundamental evolution of demand patterns – preferences reflect income levels – and technology – productivity growth differs across sectors. As a result, they provide critical signals for the efficient allocation of resources and, short-term influences aside, are beyond monetary policy's reach.18 Seeking to compensate for such changes in sector-specific prices to achieve a specific inflation target may be counterproductive.

Further reading

To illustrate this more concretely, consider the economic environment that has emerged since the 1990s. Not least under the influence of globalisation, (eg Auer et al (2017)), most economies have seen muted increases, if not declines, in the prices of many tradeable goods, especially durables (recall middle panel of Graph 1). These have kept a lid on overall inflation, which on average has hovered below central banks' objectives. The prices of these tradeable goods have also lagged behind those in the services sector, resulting in a large change in relative prices. To raise inflation in this environment, monetary policy would have to lean harder on those prices over which it has greater influence, largely those in the service sector, which also tend to be less flexible. All else equal, this would call for stronger and possibly more persistent easing.19 In turn, this would increase the likelihood of hitting the effective lower bound for policy rates and exacerbate any potential side-effects of keeping interest rates low for long (eg BIS (2020), Borio (2021)).20

All told, the success of credible monetary frameworks in ushering in a low and stable inflation regime goes hand-in-hand with pervasive changes in price dynamics, which puts a premium on flexibility in the pursuit of narrowly defined inflation targets. This underlines the importance of a degree of tolerance for deviations of inflation from targets within certain ranges and of longer horizons to bring inflation back within those ranges. Such fluctuations, for example those that reflect fundamental sector-specific developments, may pose less of a concern, and offsetting them could require large policy adjustments that entail the risk of undesired side effects, notably when seeking to raise inflation. If so, the need for greater flexibility would be akin to a Goodhart's law: once inflation has been successfully anchored, its role as a gauge for policy action may be diminished.

Conclusion

This special feature has highlighted the importance of flexibility in the pursuit of narrowly defined inflation targets in an environment of low and stable inflation, owing to pervasive changes in the dynamics of price movements. Recent modifications to the monetary policy frameworks of the Federal Reserve and the ECB, albeit quite different, have moved in this direction. Our analysis suggests that, all else equal, such flexibility is especially warranted when inflation undershoots targets.

If applied to the current context, in which inflation concerns have become more prominent, our analysis also speaks in favour of flexibility in the response. This is not least because a small number of sector-specific components of inflation have seen especially large increases in recent months. That said, the inference from our analysis is just one piece of information that needs to be part of a more holistic assessment examining the underlying forces at work (eg BIS (2021)). It is most critical to ensure – taking whatever actions are needed – that inflation remains low and stable, anchored to a credible monetary policy framework.

At a more general level, the analysis highlights the merits of examining the inflation process at a disaggregated, granular level. Understanding the evolution of relative prices, particularly persistent ones, is key and is likely to be especially useful to policymakers. By the same token, inferences from economic models that eschew such considerations can be materially misleading.

References

Adam, K and H Weber (2019): "Optimal trend inflation", American Economic Review, vol 103, no 2, pp 702-37.

Altissimo, F, B Mojon, and P Zaffaroni (2009): "Can aggregation explain the persistence of inflation?", Journal of Monetary Economics, vol 56, no 2, pp 231-241.

Aoki, K (2001): "Optimal monetary policy responses to relative-price changes", Journal of Monetary Economics, vol 48, no 1, pp 55–80.

Auer, R, C Borio and A Filardo (2017): "The globalisation of inflation: the growing importance of global value chains", BIS Working Papers, no 602.

Bank for International Settlements (BIS) (2020): Annual Economic Report, Basel.

----- (2021): Annual Economic Report, Basel.

Boivin, J, M P Giannoni and I Mihov (2009): "Sticky prices and monetary policy: evidence from disaggregated US data", American Economic Review, vol 99, no 1, pp 350-84.

Borio, C (2021): "When the unconventional becomes conventional", remarks at "The ECB and Its Watchers XXI", 30 September 2020, Frankfurt.

Borio, C, P Disyatat, D Xia and E Zakrajšek (2021): "Inflation, relative prices and monetary policy: success allows flexibility" BIS Working Papers (forthcoming).

Eo, Y, L Uzeda and B Wong (2020): "Understanding trend inflation through the lens of the goods and services sectors", Bank of Canada Staff Working Paper, 2020-45.

Foerster, A T, P D G Sarte and M W Watson (2011). "Sectoral versus aggregate shocks: a structural factor analysis of industrial production." Journal of Political Economy, vol 119, no 1, pp. 1-38.

Greenspan, A (1994): Testimony before the Subcommittee on Economic Growth and Credit Formation of the Committee on Banking, Finance and Urban Affairs, U.S. House of Representatives, February 22.

Hamilton, J D (2018): "Why you should never use the Hodrick–Prescott filter," Review of Economics and Statistics, vol 100, no 5, pp 831–843.

----- (2003): "What is an oil shock?" Journal of Econometrics, vol 113, no 2, pp 363–98.

Jordà, O (2005), "Estimation and inference of impulse responses by local projections", American Economic Review, vol 95, no 1, pp 161-182.

Maćkowiak, B, F Matějka and M Wiederholt (2021): "Rational inattention: a review", ECB Working Paper, no 2570, June.

Miranda-Agrippino, S and G Ricco (2021): "The transmission of monetary policy shocks", American Economic Journal: Macroeconomics, vol 13, no 3, pp 74-107.

Quast, J and M Wolters (2020): "Reliable real-time output gap estimates based on a modified Hamilton Filter", Journal of Business and Economic Statistics.

Reis, R and M W Watson (2010): "Relative goods' prices, pure inflation, and the Phillips correlation", American Economic Journal Macroeconomics, vol 2, no 3, pp 128-157.

Stock, J H and M W Watson (2002): "Macroeconomic forecasting using diffusion indexes", Journal of Business and Economic Statistics, vol 20, no 2, pp 147-62.

Stock, J H and M W Watson (2019): "Slack and cyclically sensitive Inflation", NBER Working Paper, no 25987.

Wolman, A (2011): "The optimal rate of inflation with trending relative prices", Journal of Money, Credit, and Banking, vol 43, no 2–3, pp 355–84.

1 We thank David Archer, Flora Budianto, Stijn Classsens, Benoit Mojon, Daniel Rees, Phurichai Rungcharoenkitkul, Hyun Song Shin and Nikola Tarashev for helpful comments and suggestions. We are also grateful to Alberto Americo for excellent research assistance. The views expressed are those of the authors and do not necessarily reflect the views of the Bank for International Settlements or the Bank of Thailand.

2 This is likely to be the case, as the broad evolution of inflation has been quite similar across many countries.

3 The reduction in volatility for both trend and transitory components and the decline in inflation persistence at the disaggregated level is documented in Borio et al (2021). Our estimates of the trend and transitory components are based on a modified version of the Hamilton filter (Hamilton (2018)) proposed by Quast and Wolters (2020).

4 In fact, the common component of price changes is arguably closer to the theoretical definition of inflation, which refers to a generalised increase in prices. Relatedly, in the context of US industrial production, Foerster et al (2011) document the fall in the importance of aggregate shocks and the concomitant rise in the role of sector-specific shocks since the mid-1980s.

5 Put differently, the well-known Balassa-Samuelson effect has become stronger.

6 The first principal component is the linear combination of the underlying sectoral price changes that explains the highest fraction of the variance of overall inflation. It can be used as a proxy for the unobserved common component of all price changes. Dynamic factor model is another way to estimate the unobserved common inflation component (see Altissimo et al (2009) and Reis and Watson (2010)). Our more straightforward approach defines sector-specific price changes simply as idiosyncratic movements in sectoral prices that are unrelated to the common inflation component. Compared to dynamic factor models, our approach is easy to implement and computationally simple. As discussed in Stock and Watson (2002), the principal components consistently recover the space spanned by the factors when the cross-section is large, and the number of principal components used is at least as large as the true number of factors. Moreover, the principal component approach imposes fewer distributional assumptions on the data.

7 During this period of falling co-movement, the average bilateral correlation between sectoral price changes – which strips out the impact of the variance of sectoral price changes from the covariance – dropped from 0.5 to 0.1. In other words, the decline in correlation alone accounts for roughly 80% of the reduction in the covariance between sectoral price changes.

8 Eo et al (2020) document the divergent dynamics of goods and service prices in the United States, Australia and Canada, with the correlation between the two falling to essentially zero since the 1990s in all three countries. Moreover, they find that variations in trend inflation are now entirely dominated by fluctuations in trend prices in the service sector.

9 These high-frequency monetary policy shocks are constructed using the methodology developed by Miranda-Agrippino and Ricco (2021). We are grateful to Andrea Ajello and Giovanni Favara for providing us with an updated series of the original shocks, using the Fed's publicly available forecasts through December 2014.

10 Thus, the evidence in this section is consistent with the well known decline in the sensitivity of inflation to pressure on an economy's productive capacity, ie the so-called flattening of the Phillips curve.

11 Our results (not shown) confirm the key role of the common component in the transmission of monetary policy. Using the empirical framework below, we separately examine the impact of marginal adjustments in the monetary policy stance on the common and sector-specific components of price fluctuations. We indeed find that the impact on the common component is economically and statistically significant. By contrast, the impact on the various sector-specific price fluctuations is largely insignificant; see Borio et al (2021). Moreover, an analysis therein based on a less satisfactory but standard identification strategy that covers a longer time span also suggests a reduction in the impact of monetary policy shocks across regimes.

12 The set of control variables includes: a survey-based measure of long-term PCE inflation expectations; the unemployment gap; the 12-month log-difference in average hourly earnings; the 1-month log-difference in the WTI spot price; and the 1-month difference in the Baa-Aaa corporate bond credit spread.

13 Note that because of its wide reach, the effects of monetary policy shocks transmit mainly through the common component of price changes. That said, the importance of the common component ("factor loadings") varies across sectors. Hence monetary policy affects each sector differently despite its generalised impact.

14 The sluggish response of prices to a monetary policy shock is in line with those of Boivin et al (2009), who examine the impact of such shocks on disaggregated PCE sectors using a factor-augmented vector auto-regression (FAVAR) model. In their framework, monetary policy shocks are identified recursively, ie monetary policy is assumed to respond to contemporaneous fluctuations in the macroeconomic factors, whereas policy shocks are assumed to affect the economy with a lag. By comparison, our high-frequency identification approach, making use of movements in interest rates in a narrow window around policy meetings, is less prone to the endogeneity problem (see Miranda-Agrippino and Ricco (2021) for extensive discussion).

15 These sectors correspond to those that Stock and Watson (2019) use when considering whether the impact of monetary policy differs between cyclically sensitive and cyclically insensitive sectors. In fact, there is a reasonable correspondence between the sectors that they deem to be cyclically sensitive and those whose price responses are statistically significant in our analysis: across various horizons, around two thirds of the sectors for which we find significant responses are also cyclically sensitive according to their terminology.

16 Indeed, from this perspective, relying on US data would tend to overestimate the share of price categories over which monetary policy exerts influence. This is because the US economy is relatively closed, and the share of the service sector (60%) tends to be larger than elsewhere.

17 See Maćkowiak et al (2021) for a review of the concept. Indeed, as noted by Greenspan (1994), price stability can be defined as an environment in which inflation does not materially influence the behaviour of economic agents.

18 The importance of allowing for rich heterogeneity across sectors in assessing inflation outcomes is emphasised in Aoki (2001) and Wolman (2011), while Adam and Weber (2019) extend the analysis to consider firm heterogeneity. Conceptually, it would be optimal for monetary policy to target a narrower set of prices – namely those that display the highest degree of stickiness – than those contained in the CPI. In practice, communication challenges in doing so are formidable. The use of core inflation, eg excluding the change in especially volatile items such as food and energy, offers the simplest way of moving in this direction.

19 The evidence that an easing of the policy stance impacts a narrower set of prices than a tightening strengthens this inference.

20 Among the marginally statistically significant sectors, housing services have a particularly high weight (14%) in the total PCE basket, and this category contributes substantially to the shape of the overall price response. The sector is also by far the most cyclically sensitive. To the extent that monetary policy needs to lean heavily on the housing sector to move overall prices, aggressive policy actions may give rise to financial stability concerns, given that the sector is closely linked to asset prices and can also be highly leveraged. For current concerns in this respect, see BIS (2021).