CoDi and Pix

CoDi in Mexico and Pix in Brazil are fast retail payment systems (FRPS) that allow users to execute and finalise payments in real time and are available 24 hours a day, every day of the year, through a platform operated by the respective central banks.

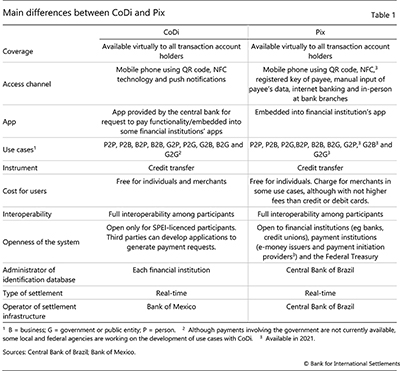

CoDi and Pix share many common features but also present some differences (Table 1). From the viewpoint of final users, coverage is identical. Both are available virtually to all transaction account holders for sending payments. However, some participating institutions cannot receive payments within CoDi. By contrast, in Pix it is compulsory for all participating PSPs to provide their customers with all the functionalities for initiating and receiving instant payments in their mobile applications. As for access channels, both systems allow payments through mobile devices when a quick response (QR) code is scanned or by using near field communication (NFC) technology.

By contrast, in Pix it is compulsory for all participating PSPs to provide their customers with all the functionalities for initiating and receiving instant payments in their mobile applications. As for access channels, both systems allow payments through mobile devices when a quick response (QR) code is scanned or by using near field communication (NFC) technology. CoDi also incorporates push notifications, while Pix allows users to start a payment by using the payee's data.

CoDi also incorporates push notifications, while Pix allows users to start a payment by using the payee's data. Use cases currently vary, although they should ultimately converge. Specifically, CoDi is currently available only for payments between persons and businesses, while Pix also enables payments to the government. In 2021 Pix will also allow payments from government agencies to persons and businesses, and in Mexico some governmental agencies are presently working to develop use cases with CoDi.

Use cases currently vary, although they should ultimately converge. Specifically, CoDi is currently available only for payments between persons and businesses, while Pix also enables payments to the government. In 2021 Pix will also allow payments from government agencies to persons and businesses, and in Mexico some governmental agencies are presently working to develop use cases with CoDi.

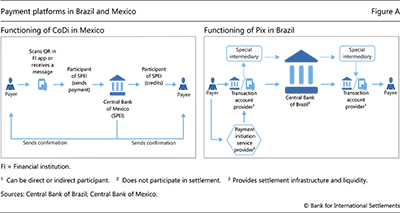

One important difference between CoDi and Pix concerns their openness (Figure A). CoDi allows participation by only financial institutions that are members of SPEI, the Bank of Mexico's real-time gross settlement (RTGS) system – but lets third parties develop applications that generate payment requests. By contrast, Pix admits three types of institutions. First are payment initiation providers – the authorised third parties that carry out payment initiation at the request of a customer but do not participate in the financial settlement of the transaction.

By contrast, Pix admits three types of institutions. First are payment initiation providers – the authorised third parties that carry out payment initiation at the request of a customer but do not participate in the financial settlement of the transaction. Second are transaction account providers, or the financial institutions and PSPs that offer accounts – deposits, savings or prepaid accounts – to final users and can participate either directly or indirectly in the settlement infrastructure. Third are special intermediaries – direct participants that do not offer transactional accounts to end users but serve indirect members of Pix by connecting them to the central bank's settlement infrastructure.

Second are transaction account providers, or the financial institutions and PSPs that offer accounts – deposits, savings or prepaid accounts – to final users and can participate either directly or indirectly in the settlement infrastructure. Third are special intermediaries – direct participants that do not offer transactional accounts to end users but serve indirect members of Pix by connecting them to the central bank's settlement infrastructure.

The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements.

The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements.  Some financial institutions do not offer CoDi for payments – that is, their clients cannot generate QR codes. In that case, payees can use a mobile application provided by the Bank of Mexico to create the QR code that initiates the payment.

Some financial institutions do not offer CoDi for payments – that is, their clients cannot generate QR codes. In that case, payees can use a mobile application provided by the Bank of Mexico to create the QR code that initiates the payment.  QR codes are a type of matrix barcode that can store a larger volume of data, be scanned from either paper or a screen, be used even if partially damaged and encrypt information. NFC is a standards-based, short-range (a few centimetres) wireless connectivity technology that enables the wireless transfer of data.

QR codes are a type of matrix barcode that can store a larger volume of data, be scanned from either paper or a screen, be used even if partially damaged and encrypt information. NFC is a standards-based, short-range (a few centimetres) wireless connectivity technology that enables the wireless transfer of data.  The payee's data can be a key or the regular bank details. In Pix, the central bank also manages the unique database that stores the payee's key that identifies their transactional account. The key can be an email address, a mobile phone number, a tax payer number or a random number generated by the system.

The payee's data can be a key or the regular bank details. In Pix, the central bank also manages the unique database that stores the payee's key that identifies their transactional account. The key can be an email address, a mobile phone number, a tax payer number or a random number generated by the system.  The Bank of Mexico will submit a public consultation to allow indirect participants in SPEI to offer CoDi functionalities.

The Bank of Mexico will submit a public consultation to allow indirect participants in SPEI to offer CoDi functionalities.  Online retailers, social media and fintechs including merchant acquirers and startups are examples of such companies.

Online retailers, social media and fintechs including merchant acquirers and startups are examples of such companies.  Participation in CoDi is compulsory for banks that are members of SPEI, with more than 3,000 customer accounts. In Pix, participation is mandatory for all financial and payment institutions licensed by the Central Bank of Brazil with more than 500,000 active customer accounts.

Participation in CoDi is compulsory for banks that are members of SPEI, with more than 3,000 customer accounts. In Pix, participation is mandatory for all financial and payment institutions licensed by the Central Bank of Brazil with more than 500,000 active customer accounts.