NDF markets thrive on the back of electronification

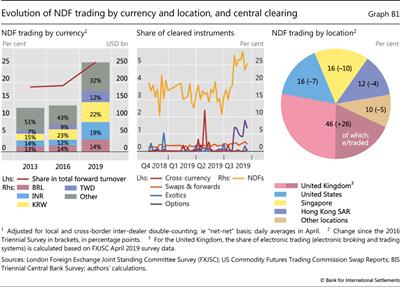

Trading of NDFs has almost doubled over the past three years, contributing significantly to the substantial increase in the trading of forwards recorded in the 2019 Triennial Survey. NDFs are contracts that, unlike their deliverable counterparts, settle in the same currency (typically the US dollar) at maturity, based on the movement of the underlying exchange rate. NDFs are particularly popular for trading non-convertible currencies. The key currencies behind the NDF surge include the Korean won, Brazilian real, Indian rupee and New Taiwan dollar (Graph B1, left-hand panel).

Hedge funds and PTFs can trade NDFs to arbitrage or take directional bets. In the process, they serve as natural counterparties to market participants who need to hedge currency exposures. NDFs exemplify two main trends in the structure of global FX markets, as highlighted in the main text: (i) electronification of trading with other financial institutions, and (ii) concentration of trading activity in the largest FX centres.

The trend towards electronification in NDF markets rides on the inclusion of these instruments among those traded on the main electronic broking platforms: EBS emerged as the electronic venue for NDF trading, while Reuters (Refinitiv) Matching plans to launch NDF trading in 2020. Electronification has also benefited from central clearing, which enables multilateral netting and reduces the need to post margins. As highlighted in McCauley and Shu (2016), the NDF market microstructure has started evolving rapidly on the back of global legal and regulatory reforms for derivatives markets. Since 2015, NDFs have started the transition from a decentralised, bilateral microstructure to one characterised by centralised trading, disclosure and clearing. The gradual phase-in of uncleared margin rules, requiring firms to post initial margins for certain uncleared derivatives, has incentivised greater central clearing of NDFs. To date, NDFs represent the only type of FX derivative with any meaningful share of centrally cleared transactions (Graph B1, centre panel).

These forces have naturally led to a further concentration of trading in the main FX hubs, with the share of NDF trading in the United Kingdom more than doubling from 20% in 2016 to 46% in 2019 (Graph B1, right-hand panel). Given the popularity of NDF trading in Asian currencies, London's overlap with the trading hours of Hong Kong SAR and Singapore puts the city in an advantageous position.