The evolution of OTC interest rate derivatives markets

The trading of interest rate derivatives in over-the-counter (OTC) markets more than doubled between 2016 and 2019, significantly outpacing the growth of trading on exchanges. This rapid expansion was driven by three factors. First, non-market facing trades, such as back-to-back deals and compression trades, increased and were more comprehensively reported in the BIS Triennial Survey. Second, technological developments reduced transaction costs in OTC markets and spurred trading, including more trading by investment funds. And third, changing expectations about US short-term interest rates fuelled hedging and speculative activity. In general, structural developments like clearing, compression and automation remade OTC markets so that they more closely resembled exchanges and led to a relative shift in trading from exchanges to OTC markets. Further market changes due to benchmark rate reforms may be on the horizon.1

JEL classification: E43, G15, G18, G21, G23.

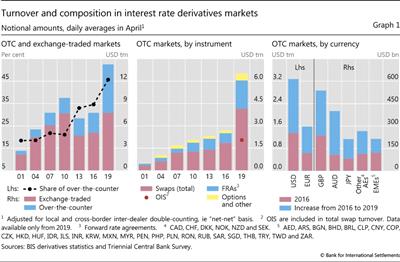

In recent years, the trading of interest rate derivatives (IRDs) in over-the-counter (OTC) markets has surged. Between April 2010 and April 2016, average daily OTC turnover trended steadily upwards from $2.1 trillion to $2.7 trillion, and then in April 2019 it jumped sharply to $6.5 trillion - an increase of 143% compared with 2016. Trading on exchanges also rose, but not as much (53% between 2016 and 2019). Consequently, whereas OTC trading accounted for only 21% of IRD trading in 2010, it accounted for 46% in 2019.

The increase in OTC trading was driven by a combination of factors. First, the amount and coverage of non-market facing trades expanded, specifically back-to-back and compression trades. Second, the proliferation of electronic trading platforms reduced transaction costs, which in turn incentivised greater trading, especially by investment funds and other asset managers. Third, greater uncertainty around US short-term interest rates fuelled hedging and speculative activity.

These developments were enabled by important structural changes in OTC markets. Regulatory changes incentivised an increase in the use of central clearing, electronic trading platforms and portfolio compression services. OTC markets thus acquired many of the same benefits as exchanges, leading to a relative shift in trading from exchanges to OTC markets.

Key takeaways

- The daily turnover of OTC interest rate derivatives more than doubled between 2016 and 2019 to $6.5 trillion, taking OTC markets' share to almost half of total trading.

- Asset managers increased their trading of interest rate derivatives.

- Structural changes including clearing, compression and automation made OTC markets more closely resemble exchanges.

Statistical data: data behind all graphs

In this feature, we use data from the 2019 BIS Triennial Central Bank Survey of Foreign Exchange and OTC Derivatives Markets to explore the evolution of OTC IRD markets.2 The first section describes the key findings of the 2019 survey. The second discusses the main factors contributing to the increase in IRD turnover. The third section explores how structural developments have affected the relative importance of OTC and exchange trading of IRDs. The final section looks forward to potential future structural changes. A box discusses the shift to central clearing in IRD markets.

A broad-based rise in turnover

Average daily turnover in OTC interest rate derivatives markets more than doubled between the BIS Triennial Surveys in April 2016 and April 2019 (Graph 1, left-hand panel). The 143% increase to $6.5 trillion per day was the highest growth rate since the inception of the surveys in 1995.3 In contrast, between 2007 and 2016, growth between surveys averaged just 17%. Turnover for exchange-traded interest rate derivatives also exhibited high growth between 2016 and 2019, but at 53% was outpaced by OTC turnover. This continued the trend shift in turnover from exchanges to OTC markets that started around 2010.

Further reading

The surge in OTC turnover was broad-based across instruments and currencies (Graph 1, centre and right-hand panels).4 Interest rate swaps as a whole, which include overnight index swaps (OIS) and basis swaps, remained the most traded instruments, accounting for 64% of the total global turnover (compared with 69% in 2016). Turnover of dollar- and euro-denominated contracts grew by 141% and 148%, respectively, maintaining their global share of OTC turnover (50% and 24%, respectively).

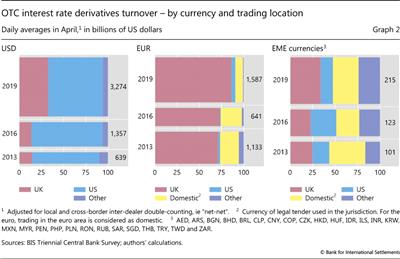

The large increase in dollar and euro IRD turnover was driven by trading in the United States and especially the United Kingdom (Graph 2). In April 2019, sales desks in the UK accounted for over half of all OTC IRD turnover and 86% of euro turnover, up from 39% and 73%, respectively, in 2016 (centre panel). The UK also strengthened its role as the key offshore trading location for emerging market currency contracts (right-hand panel). The United States remained the dominant location for US dollar turnover, expanding from $1.1 trillion to $2 trillion in turnover, though its share of the global amount fell from 80% to 61% between surveys. Dealers in the UK took a substantially larger share in 2019 (left-hand panel).

What drove the increase in turnover?

The increase in turnover was driven by a combination of factors. One factor was more turnover and more comprehensive reporting of non-market facing trades (sometimes referred to as administrative trades), such as back-to-back trades and portfolio compression trades. Yet market-facing trades also increased substantially, boosted by cyclical developments as well as structural shifts in OTC derivatives markets.

More comprehensive reporting and the rise in related party trades

Dealers in several trading jurisdictions noted an increase in related party trades in the 2019 Triennial Survey, in particular back-to-back trades. Related party trades are those between a reporting dealer's own offices and subsidiaries, or between the dealer and its parent or other affiliated entities. Back-to-back deals are linked deals where the liabilities, obligations and rights of the second deal are exactly the same as those of the original one. They are normally conducted between affiliates of the same consolidated group to facilitate either internal risk management or internal bookkeeping. Back-to-back trades should only be reported to the Triennial Survey if they transfer risk away from the reporting dealer. Feedback from central banks participating in the survey suggests that many reporting dealers that did not fully include these trades in the 2016 survey were able to report them in 2019 (in line with the survey guidelines).5

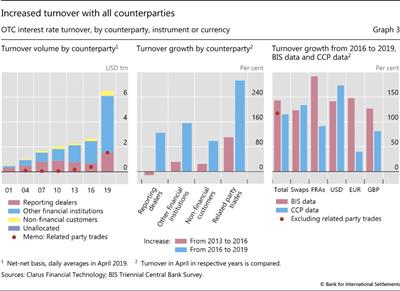

Related party trades, reported as an "of which" item (without a breakdown by counterparty sector, instrument or currency), jumped significantly, from 15% of total turnover in the 2016 survey to 24% in the 2019 one (Graph 3, left-hand panel). These trades grew by nearly 300% between surveys (centre panel). This boosted positions between reporting dealers (which grew by 124% since the last survey), but also positions between dealers and "other financial institutions" (which grew by 156%).

The pickup in related party trades accounted for about 30% of the OTC increase, or 43 percentage points out of the 143% of total turnover growth. Excluding related party trades, average daily turnover was up 117% since the 2016 survey. This still substantial growth rate is broadly in line with trends evident in other data sources, such as turnover growth at central counterparties (CCPs) (Graph 3, right-hand panel).

In addition to the increased reporting of back-to-back trades, the volume of such trades appears to have gone up. Conversations with dealers and reporting central banks suggest that banks engaged in relatively fewer trades in the inter-dealer market and kept more of their trades within their consolidated group.6 This internalisation would lead to a generic increase in back-to-back trades and contribute to the large amount of related party trades in the 2019 survey.

Portfolio compression usage expands

Portfolio compression trades were another important contributor to the large OTC turnover increase. A compression trade replaces two or more offsetting positions with a single new trade representing the net position that leaves the economic exposure materially unchanged. While the survey data exclude post-trade transactions (such as the novation of contracts to CCPs), compression trades can involve pre-existing trades and may take place well after the initial trades were booked.7

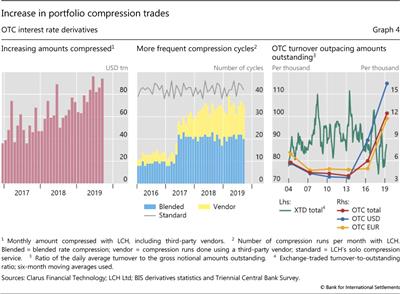

Compression has been steadily increasing in recent years (Graph 4, left-hand panel). Discussions with reporting dealers suggest that including compression trades can boost reported turnover by 40-60% for some dealers. Compression trades may thus account for a good portion of the increased turnover, though there are no hard data to provide a precise figure.8

Compression trades themselves can be large for two reasons. First, compression cycles are not always fully efficient in offsetting all possible positions. Second, compression trades can be applied to the entire stock of outstanding derivatives positions, not just the most recent trades. Thus, the resulting compression trade may have a large notional value.

Regulation and other drivers led to an increase in portfolio compression for IRD contracts.9 Some regulations explicitly require institutions to compress trades periodically. Others, such as Basel III, base some regulatory requirements on gross notional positions rather than net positions, so firms are incentivised to reduce their gross derivatives position via portfolio compression. The drive to central clearing also facilitated an acceleration in compression. Central clearing channels liquidity in standardised OTC contracts, bringing many of the large players together (see box). These changes drove more firms to engage in portfolio compression, thus potentially contributing to greater turnover in the data.

An increase in the frequency of compression cycles also boosted turnover between surveys. Compression services for IRDs have been around since 2008, but compression cycles for OTC IRDs were somewhat infrequent.10 Cycle frequency has risen strongly in recent years, going from 13 to 35 per month just between the last two Triennial Surveys (Graph 4, centre panel).11 Runs by third-party vendors, including for multilateral compression,12 went from five to 14 per month, while those for blended rate compression increased from eight to 21. Blended rate compression replaces multiple contracts "with different fixed rates into a single contract with one blended rate".13 This is particularly notable because this type of flexibility is a relative advantage of OTC markets over the automatic reduction of gross positions (via contract cancellation) possible on exchanges. As more compression cycles are run during the month, turnover of these trades rises.

More compression boosts the turnover-to-outstanding ratio by adding more trades and reducing the notional amounts outstanding. In recent years, turnover in OTC IRD markets has dramatically outpaced the change in notional amounts outstanding (Graph 4, right-hand panel). In contrast, the trend turnover-to-open interest for exchange-traded derivatives (ETDs) has remained essentially flat, with some fluctuations, over the same period. ETDs cancel offsetting positions, which (like compression) keeps the outstanding positions down, though without any additional compression trades.

The changing interest rate environment

The evolution of policy rates and the uncertainty around possible future changes naturally affects activity in interest rate derivatives markets - in particular for short-term instruments (Upper (2006)). Turnover tends to rise if policy rates change, due to both demand for hedging against potential changes in short-term rates and speculation. In particular, if there is uncertainty around expected changes, it is more likely that speculators are willing to take positions on both sides of (typically a short-term) interest rate derivative trade. Analogously, stable and predictable rates imply low turnover (Gyntelberg and Upper (2013)).

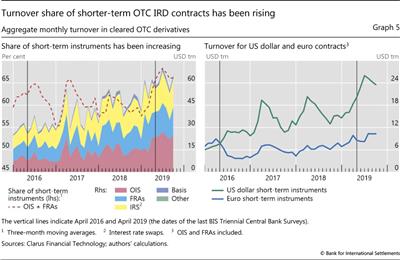

Turnover of short-term instruments rose particularly strongly between the 2016 and 2019 Triennial Surveys. OIS and forward rate agreements (FRAs), instruments of typically short maturity, accounted for 61% of the total turnover in all instruments in 2019. Turnover of OIS was reported separately for the first time in this survey, but data from CCPs show that the turnover increase was particularly marked for shorter-term instruments (Graph 5, left-hand panel). This was to a large extent driven by OIS and FRAs denominated in US dollars (right-hand panel).

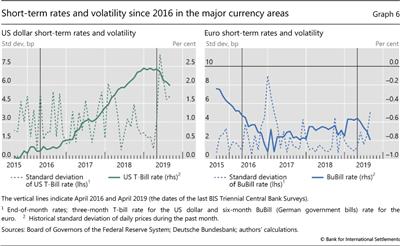

The change and increasing volatility in short-term rates in the US during April 2019 was conducive to the increase in turnover of short-term US dollar derivatives (Graph 6, left-hand panel). US monetary policy tightened gradually starting from December 2015. Over the next few years, while the timing of further expected rises probably caused some uncertainty around short rates, the expected path of future rates was clear: gradual increases. But the outlook for monetary policy changed in early 2019. April 2019 marked a turning point, as short-term rates started to decline from then on and the volatility of short rates started to rise markedly. This is indicative of both a changing and an increasingly uncertain interest rate environment.

In the euro area, on the other hand, the continued accommodative monetary policy in the currency zone kept shorter-term rates low and more stable, with subdued short-term rate volatility during both April 2016 and April 2019 (Graph 6, right-hand panel). This is consistent with the much smaller level and increase in activity in short-term euro contracts (Graph 5, right-hand panel).

The shift to central clearing of OTC interest rate products

The shift to central clearing has been an important structural change for OTC interest rate derivatives markets. The move was spurred in large part by a concerted regulatory push in response to the 2007-09 financial crisis (Domanski et al (2015)). The strong regulatory incentives developed led to a surge in IRD trades cleared with central counterparties. These include clearing requirements for some products, preferential capital treatment for cleared derivatives and higher margin requirements for uncleared derivatives. The move to clearing also brought other benefits, such as reduced counterparty risk, more netting opportunities for cleared contracts and increased compression opportunities (BCBS et al (2018), Bellia et al (2019)).

These include clearing requirements for some products, preferential capital treatment for cleared derivatives and higher margin requirements for uncleared derivatives. The move to clearing also brought other benefits, such as reduced counterparty risk, more netting opportunities for cleared contracts and increased compression opportunities (BCBS et al (2018), Bellia et al (2019)).

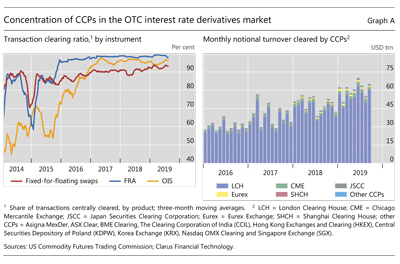

The rise in central clearing can be self-reinforcing, as liquidity shifts to CCPs and incentivises other traders to move likewise. As a result of both the regulatory push and more incentives to clear, clearing rates have increased substantially (Graph A, left-hand panel). In the US market, over 90% (in terms of notional turnover) of fixed-for-floating swaps, forward rate agreements (FRAs) and OIS transactions are now cleared, up from 79% for OIS and 86% for fixed-for-floating swaps in April 2016.

The inherent network effects of clearing lead to a high concentration in CCP activity. Concentration helps to deepen liquidity and facilitates portfolio compression, which in turn incentives even more trades to move to the core CCPs. The London Clearing House (LCH) is the dominant CCP for clearing interest rate derivatives (Graph A, right-hand panel). Other CCPs play larger roles for currencies other than the dollar, the euro or sterling (eg JSCC for the Japanese yen, or Shanghai Clearing House for the Chinese renminbi).

Concentration helps to deepen liquidity and facilitates portfolio compression, which in turn incentives even more trades to move to the core CCPs. The London Clearing House (LCH) is the dominant CCP for clearing interest rate derivatives (Graph A, right-hand panel). Other CCPs play larger roles for currencies other than the dollar, the euro or sterling (eg JSCC for the Japanese yen, or Shanghai Clearing House for the Chinese renminbi).

See Aramonte and Huang (2019) in this issue for a more general discussion of clearing in derivative markets.

See Aramonte and Huang (2019) in this issue for a more general discussion of clearing in derivative markets.  A network effect refers to the effect that an additional participant in the network has on others in the network. In the case of central clearing, each additional clearing participant increases the benefit of central clearing by increasing the liquidity of the products cleared, enabling multilateral compression opportunities and allowing any common counterparties to remove counterparty risk by novating their contracts to the CCP.

A network effect refers to the effect that an additional participant in the network has on others in the network. In the case of central clearing, each additional clearing participant increases the benefit of central clearing by increasing the liquidity of the products cleared, enabling multilateral compression opportunities and allowing any common counterparties to remove counterparty risk by novating their contracts to the CCP.

New players and automated trading

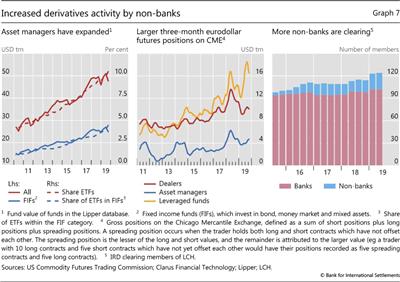

Investment funds and other asset managers have become more and more important as sources of demand for interest rate derivatives.14 They have substantially increased their assets under management (AUM) in the past decade (Graph 7, left-hand panel). This was especially the case for exchange-traded funds (ETFs), which accounted for 10% of AUM in the third quarter of 2019, up from 4% in 2010.

Some asset managers use derivatives to manage their risk or replicate a portfolio. For instance, ETFs may use derivatives to help their return track a particular target.15 Funds which invest in fixed income securities may naturally have use for IRD products. Such funds have also been expanding in terms of AUM, with an increasing share of them in the form of ETFs.

Gross derivatives positions for asset managers and leveraged funds are increasing faster than those of dealers. They were 37% larger from April 2016 to April 2019 for three-month eurodollar contracts on the Chicago Mercantile Exchange, as compared with 18% for dealers (Graph 7, centre panel). This trend indicates greater demand by funds for IRDs more broadly, which implies a rise in demand for OTC IRDs as well. This increase in demand contributed to the growth in OTC turnover with "other financial institutions" (Graph 3, centre panel), as well as the rise seen in the exchange-traded data.

Participation in central clearing highlights the importance of OTC IRD products for the overall strategies and business models of asset managers and other non-dealers. Many asset managers access CCP clearing services through affiliated banks or as clients to CCP members. Some non-banks have also started to directly clear their own positions by becoming clearing members with CCPs (Graph 7, right-hand panel). At end-March 2016, 96 bank members and five non-bank members cleared IRDs with LCH. By end-June 2019, the number of non-bank members jumped to 22 (with 102 bank members).

Another factor that bolstered the presence of asset managers and other new players in derivatives markets was a fall in transaction costs. Technological advances, including electronification, automation and algorithmic trading, have reduced these costs for trading in both OTC and exchange derivatives markets. They have also facilitated new investment strategies, in particular those using algorithmic trading.16

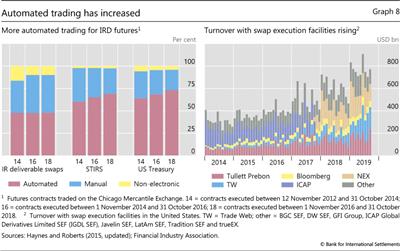

Automated trading has been on the rise across all derivatives markets in recent years. A trade is considered automated if it is "generated and/or routed without human intervention" (Haynes and Roberts (2015)).17 Its adoption has been steadily increasing on exchanges (Graph 8, left-hand panel). The implementation of swap execution facilities (SEFs) in the US (spurred in part by mandatory execution requirements for swap trades in the Dodd-Frank Act) indicates that automated trading is generally spreading through the OTC market as well (right-hand panel).18 By providing the infrastructure, SEFs make it easier to engage in algorithmic trading strategies in OTC markets. IRD turnover via SEFs increased from $391 billion in April 2016 to $710 billion in April 2019.

The increasing importance of OTC markets

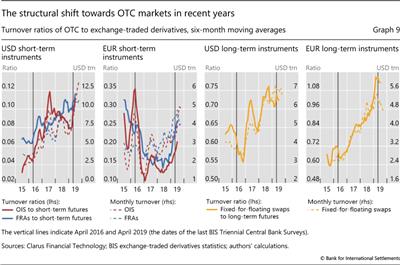

While the factors discussed above help to explain the rise in turnover in IRD markets, they cannot fully explain the significant structural shift towards OTC markets from exchanges. Graph 9 highlights that the shift has been broad-based across the major currencies and both short-term and long-term instruments. The graph is based on turnover data from CCPs, which are not affected by the increase in related party trades or portfolio compression discussed above.

The relative attractiveness of OTC markets can - at least partly - be ascribed to the fact that OTC markets now yield many of the benefits of exchanges (Ehlers and Eren (2016), Hull (2014)). The move to central clearing and electronic trading platforms - two key pillars of the OTC derivatives market reforms promoted by the G20 - resulted in a decline in counterparty risks, a reduction in transaction costs and increased speed of trading. More effective and speedy compression on OTC markets minimises the notional amounts of outstanding contracts and thereby regulatory costs. These benefits appear to have outweighed the costs related to margining and collateral requirements for cleared and uncleared derivatives, implemented in most jurisdictions including the United States and the European Union (FSB (2019)).

Exchanges have attempted to lure activity back from OTC markets by offering new instruments, such as swap futures. Zazzara (2019) dubs this the "futurisation of OTC markets". While swap futures have been launched at various points in time, in part to capture increasing demand for longer-term IRDs referencing private benchmark rates (Kreicher et al (2017)), their success thus far has been limited. The dedicated futures exchange Eris, for instance, introduced a deliverable swap future in February 2013. Even though turnover in these contracts picked up in recent months as trading moved to CME in December 2018, it is still less than 0.5% of turnover in US dollar OTC swaps.

Conclusion

Turnover in interest rate derivatives markets has increased substantially over the last three years, particularly in OTC markets. A rise in non-market facing trades, such as compression and back-to-back trades, helped boost turnover in OTC markets. The change in the US monetary policy outlook and the move to shorter-maturity instruments also played a role. Further, continuing structural changes have been important in driving up IRD turnover, especially in OTC markets. Automated trading has expanded access and reduced transaction costs, as new players have moved into the market.

The regulatory push towards central clearing and electronic trading, as well as the evolution of compression services, has led to a relative shift from exchanges to OTC markets. OTC markets now offer many of the attractive features that exchanges held, while also maintaining a wider range of products and contracts and the ability to meet customised demands. These factors have led turnover growth in OTC markets to significantly outpace that in exchanges.

Looking forward, more structural changes may be on the horizon. The prospect of the United Kingdom leaving the European Union may influence the structure of OTC markets, especially with so much activity based in London. Moreover, the transition of benchmark rates to new overnight risk-free rates (RFRs) foreshadows significant changes in both the type of traded instruments and the relative importance of OTC versus exchange-traded markets. The range of derivative instruments will expand as debt contracts start to reference the new RFRs. Term benchmarks beyond overnight rates are needed to, for instance, determine interest obligations in cash instruments (eg bonds). Therefore, new instruments, such as OIS with RFRs as the floating rate or longer-term RFR futures, are likely to be developed. Depending on which instruments prevail, this could again shift trading between OTC markets and exchanges. Whether these new contracts will gain a significant market share or even replace existing ones is unclear, as multiple benchmarks may emerge to serve different purposes and fulfil different market needs (Schrimpf and Sushko (2019a)).

References

Aramonte, S and W Huang (2019): "OTC derivatives: euro exposures rise and central clearing advances", BIS Quarterly Review, December, pp 83-93.

Basel Committee on Banking Supervision, Financial Stability Board, Committee on Payments and Market Infrastructures and International Organization of Securities Commissions (2018): Incentives to centrally clear over-the-counter (OTC) derivatives: a post-implementation evaluation of the effects of the G20 financial regulatory reforms - final report, November.

Bellia, M, G Girardi, R Panzica, L Pelizzon and T Peltonen (2019): "The demand for central clearing: to clear or not to clear, that is the question", SAFE Working Paper, no 193, June.

Domanski, D, L Gambacorta and C Picillo (2015): "Central clearing: trends and current issues", BIS Quarterly Review, December, pp 59-76.

Ehlers, T and E Eren (2016): "The changing shape of interest rate derivatives markets", BIS Quarterly Review, December, pp 53-65.

Financial Stability Board (2019): OTC derivatives market reforms: 2019 progress report on implementation, October.

Gyntelberg, J and C Upper (2013): "The OTC interest rate derivatives market in 2013", BIS Quarterly Review, December, pp 69-82.

Haynes, R and J Roberts (2015): "Automated trading in futures markets", white paper, Office of the Chief Economist, Commodity Futures Trading Commission. See also Update #1 and Update #2.

Hull, J (2014): "The changing landscape for derivatives", Journal of Financial Engineering, vol 1, no 3.

Kreicher, L and R McCauley (2016): "Asset managers, eurodollars and unconventional monetary policy", BIS Working Papers, no 578, August.

Kreicher, L, R McCauley and P Wooldridge (2017): "The bond benchmark continues to tip to swaps", BIS Quarterly Review, March, 69-79.

Patel, N and D Xia (2019): "Offshore markets drive trading of emerging market currencies", BIS Quarterly Review, December, pp 53-67.

Schrimpf, A and V Sushko (2019a): "Beyond LIBOR: a primer on the new benchmark rates", BIS Quarterly Review, March, pp 29-52.

--- (2019b): "Sizing up global foreign exchange markets", BIS Quarterly Review, December, pp 21-37.

Upper, C (2006): "Derivatives activity and monetary policy", BIS Quarterly Review, September, pp 65-76.

Zazzara, C (2019): "The new OTC derivatives landscape: (more) transparency, liquidity, and electronic trading", Journal of Banking Regulation, pp 1-18, May.

1 The views expressed in this article are those of the authors and do not necessarily reflect those of the Bank for International Settlements. We thank Yifan Ma for excellent research assistance, Giulio Cornelli for help with the Lipper data, and LCH Ltd and ClarusFT for providing data. We thank Sirio Aramonte, Claudio Borio, Christian Cabanilla, Stijn Claessens, Wenqian Huang, Patrick McGuire, Denis Pêtre, Vladyslav Sushko, Christian Upper and Philip Wooldridge for helpful comments. We benefited from discussion with numerous market participants and individuals at central banks.

2 The Triennial Survey provides comprehensive information on the size and structure of OTC derivatives markets. The survey captures, among other things, the aggregate turnover of OTC interest rate derivatives from nearly 1,300 dealers in 53 different jurisdictions. In complement with BIS exchange-traded derivatives (ETD) statistics, they capture activity for interest rate derivatives globally.

3 Compared with monthly data from other sources, April 2019 does not appear to be an exceptional month in terms of OTC turnover. Also, exchange rate movements played a minor role in determining this growth rate. After adjusting for them, the increase was actually a little larger at 147%. Turnover with central counterparties also rose at a very high rate over the same period (115%; see Box A).

4 See also Patel and Xia (2019) in this issue.

5 Many dealers began reporting these trades for the first time in 2019. The increased reporting may be due in part to greater use of electronic trading platforms. The move from voice to electronic booking improved the recording of the details of each trade and made it easier to flag and report back-to-back trades in line with the survey guidelines. Greater emphasis in the reporting guidelines themselves on how such trades should be reported may also have spurred better reporting.

6 This is not to say that inter-dealer trades declined, just that the propensity to internalise a given trade increased. Turnover with other reporting dealers also exhibited high growth (Graph 3, centre panel).

7 The reporting guidelines do not specifically mention compression trades. Thus some dealers added those trades to the turnover they reported, while others did not. Not all reporting dealers had compression trades to report.

8 Based on compression data from LCH, we estimate that compression explains no more than one quarter of the overall increase in turnover between 2016 and 2019 and probably less. In other words, a generous estimate of compression trades would lower the growth of IRD turnover between 2016 and 2019 from 143% to around 110%.

9 The Dodd-Frank Act in the United States (Title VII implemented in July 2011) requires dealers and other major swap participants to engage in periodic bilateral and multilateral compression. The European Market Infrastructure Regulation (EMIR, implemented in September 2013) requires European institutions which trade more than 500 contracts with each other to compress their trades at least twice per year. The Basel III leverage ratio requirements (which became mandatory in 2018) account for derivatives on a gross rather than a net basis, further incentivising banks to reduce the size of their balance sheets via compression.

10 For cleared swaps, there were nine cycles in 2010 and 10 in 2011. See https://newsroom.nex.com/contents/pressrelease/press_release_973591527086833.pdf.

11 This excludes unilateral netting done for clearing members by LCH. These standard compression cycles have held roughly constant over the past three years at around 42 per month (about twice per day). See also the centre panel of Graph 4. Bilateral compression is probably also important, though data on frequency and size are not available.

12 Offsetting trades become more likely and more effective with a larger pool of traders with similar products. Multilateral compression is more complicated, but can be more efficient at reducing the gross notional exposures of the parties involved.

13 https://www.lch.com/services/swapclear/enhancements/compression.

14 Due to their size, their dynamics can be important for how IRD markets behave (Kreicher and McCauley (2016)).

15 Note that synthetic ETFs typically use total return swaps (TRS) to generate many of their positions. TRS derivatives are classified as credit derivatives in the BIS derivatives statistics, so their developments are not captured in the IRD turnover discussed in this article. The use of IRDs by synthetic ETFs would be reflected in the turnover increase observed in the Triennial data.

16 Hedge funds and proprietary trading firms (PTFs) have led the increase in turnover in foreign exchange OTC markets. PTFs often utilise centralised electronic trading platforms and algorithmic trading strategies. See Schrimpf and Sushko (2019b) in this issue for a discussion.

17 This is a broader set of trades than just those generated by algorithms, also including "those which are generated manually but make use of automated spreading functionality, or even those where manual traders use the order submission management of third-party trading systems" (Haynes and Roberts (2015)).

18 The EU is also developing similar infrastructure in the form of organised trading facilities (OTFs).