Domestic financial markets and offshore bond financing

Firms in emerging market economies markedly increased their issuance of bonds in offshore markets after the Great Financial Crisis. By contrast, increases in offshore bond issuance by firms in advanced economies were more muted. An empirical analysis suggests that the less developed state of financial markets in emerging economies may have encouraged firms there to step up their offshore bond issuance as external financing costs fell. Firms appear to use the proceeds of offshore bonds to boost their holdings of short-term assets. This may raise financial stability concerns.1

JEL classification: F23, F36, G15.

Firms from emerging market economies (EMEs) considerably stepped up their issuance of bonds in offshore bond markets after the Great Financial Crisis (GFC) of 2007-09. Taking advantage of easy external financing conditions and investor appetite for higher yields, many EME firms raised funds through bond issues outside their jurisdictions (McCauley et al (2015a)).

We examine whether limits to borrowing in domestic financial markets distorted firms' borrowing decisions, contributing to this surge in EME offshore bond issuance. We conduct the analysis by comparing EM bond issuers to firms located in small advanced economies. This analysis is carried out using a data set that matches bond- and firm-level data (aggregated by industry in part of our analysis), covering companies headquartered in 41 jurisdictions.

We find that limited financing opportunities in their domestic markets played an important role in inducing EME firms to raise funds overseas. We also show that firms use offshore bond proceeds to increase their holdings of short-term assets. This may raise financial stability concerns, for example by increasing the procyclicality of financing in the domestic financial sector.

The rest of the feature is organised as follows. The first section describes the characteristics of firms borrowing in offshore bond markets. The second section presents the empirical analysis. The third section concludes.

Characteristics of firms borrowing in offshore bond markets

Tracking firm-level financing in offshore bond markets

Our firm-level data set comprises bonds issued or guaranteed by firms headquartered in one of 34 emerging economies or seven small advanced economies and marketed outside their jurisdictions.2 The data set covers the period 2000-15. The Annex provides further details.

We identify offshore bonds as those issued in a primary market outside the home country of the entity guaranteeing the bond. From the perspective of the economies covered, the major offshore markets are those of the European Union (Eurobonds) and the United States (yankee bonds). These two locations account for the bulk of international bond market activity.3 Transactions are mostly in dollars and euros, which respectively represent 70% and 19% of the total amount in the sample; the proportion raised in local currency is 6%.4

By using this criterion we track firms' financing at a consolidated level. Our approach is broadly in line with that used in compiling the BIS international debt securities statistics, by nationality, according to the ultimate borrower sector. Bonds issued by affiliates incorporated overseas are consolidated with the liabilities of the parent company, as long as the affiliates are not independent companies. They are thus classified according to the sector and country of the parent company. This overcomes a common limitation of other studies that focus on the immediate borrower, using a residence or balance of payments concept, which misses the relevance of the parent's nationality and sector. However, our measure differs from some previous approaches because we treat as standalone firms those that issue bonds without the explicit guarantee of their parent companies. Other measures group such bonds according to the parent company.

We use the primary market as the main criterion for determining whether a bond was issued offshore or onshore. While this is also the main criterion used to classify the market of issuance in the BIS international debt securities statistics, there are some methodological differences. Thus, we use the term "offshore issuance", consistent with research using similar data (Black and Munro (2010), Mizen et al (2012)).5 See the Annex for a more detailed discussion.

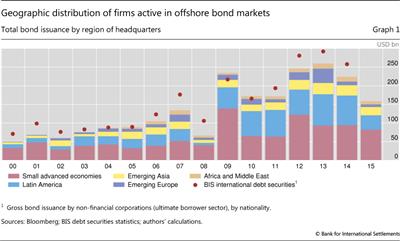

Two important features of this data set are worth noting. First, the coverage of firms' offshore bond issuance is comprehensive, which allows us to highlight aggregate trends. In aggregate, the amount issued is similar in size to the totals reported by the BIS international debt securities statistics by nationality (Graph 1).6 Second, since the data are compiled at the deal level, it provides the flexibility to carry out a sufficiently disaggregated analysis of industry- or firm-level financing patterns.

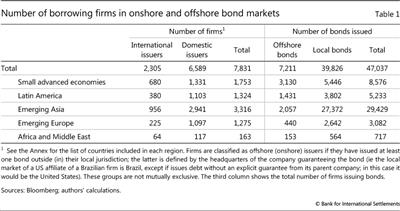

Table 1 summarises the offshore borrowing activity of firms in our data set. Some 2,300 companies have been active in offshore bond markets (compared with nearly 6,600 in local bond markets). Overall, these firms have issued a total of 7,200 bonds outside their jurisdictions. Consistent with global trends, the majority of these placements are in the EU (the Eurobond market) or in the US market (yankee bonds).

Asia has the largest number of firms active in offshore bond markets (nearly 1,000), but the value of the debt issued by Latin American firms (USD 639 billion) overshadows that of debt issued by Asian ones (USD 273 billion). Most companies raise funds in foreign currency: only 14% have issued bonds in local currency.7

One quarter of the total number of companies are industrial, surpassing energy firms, which, however, account for the highest share of total proceeds (27% of the total, compared with 13% for industrial firms). Technology and health care firms borrow less frequently; these industries typically have high cash flow-to-fixed assets ratios and accordingly lower financing needs.

The increase in offshore bond issuance after the GFC was larger for EME firms, particularly those in Latin America and emerging Europe (Graph 1). In many EMEs, the growth of firms' bond financing in international markets has outpaced that of cross-border bank lending. In several jurisdictions, international bonds already constitute the bulk of foreign lending to the non-bank sector (McCauley et al (2015b)). However, offshore issuance by EME firms slowed from 2015 in the face of rising market uncertainty. In contrast, issuance by firms in small advanced economies has been more stable.

Within the universe of issuing firms, 49% of total debt is issued offshore and 51% onshore. Firms issuing only onshore account for 26% of total debt issued. Among such firms, industrial and utilities companies have a more prominent role than energy firms. As described, most bonds issued offshore are in foreign currency; bonds issued onshore are overwhelmingly denominated in domestic currency, with a negligible 3% of amount issued in foreign currency (mostly dollars).

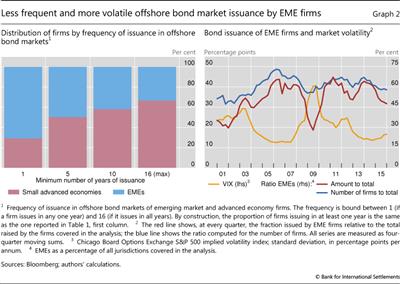

EME firms issue less regularly in offshore bond markets

EME firms issue less frequently in offshore bond markets than do firms from our sample of small advanced economies. For 2000-15, EME firms account for 71% of issuers who issued in at least one year; however, they account for only 40% of issuers who issued in at least 10 of the 16 years (Graph 2, left-hand panel). Thus, there is a large number of infrequent issuers from EMEs, and these, on aggregate, account for the bulk of the amount issued. The experienced issuers in our sample tend to come from the small advanced economies.

Issuance by EME firms is also more volatile. Graph 2 (right-hand panel) shows that issuance is correlated with shifts in market risk aversion, as measured by the VIX.8 In particular, the graph illustrates the negative correlation between the VIX and aggregate offshore bond issuance. This correlation is twice as high for firms in EMEs than for other small open economies. The share of EME firms in the total number of firms issuing offshore bonds thus increases when the VIX is abnormally low and shrinks when the VIX rises. A similar, and even stronger, pattern is found for the amount issued. Investors appear to be less receptive to offshore EME issues when risk aversion is high.

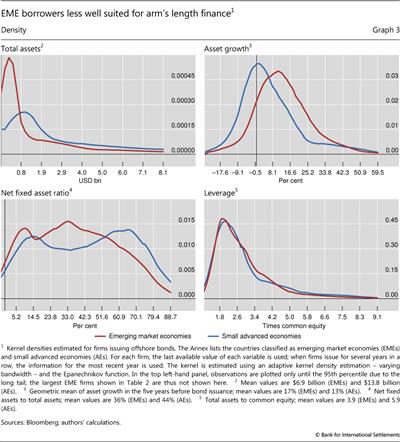

One explanation for these patterns is that EME issuers are less well suited for arm's length finance through bond issuance, only tapping markets when external financing conditions are easy (ie borrowing is procyclical with respect to the financial cycle). In fact, compared with their counterparts in small advanced economies, firms headquartered in EMEs tend to have fewer assets (Graph 3, top left-hand panel),9 faster recent growth (top right-hand panel) and a lower proportion of fixed to total assets (bottom left-hand panel). All this points to greater information asymmetries facing the EME issuers: it is harder for them to credibly demonstrate their economic value to investors, since a larger share of this value reflects intangible assets and future growth opportunities. By contrast, their leverage is about the same (bottom right-hand panel).

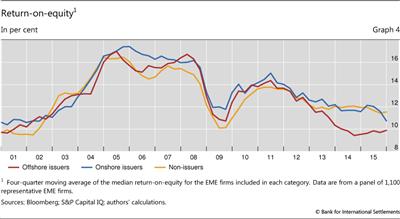

Additional perspective can be gained by examining the evolution of profitability (as measured by the return-on-equity) for three types of emerging market firm: firms that have borrowed in offshore bond markets, firms that have borrowed onshore (but not offshore), and firms that have not borrowed in bond markets (Graph 4). Overall, the profitability of firms that have borrowed in offshore markets has been lower than that of onshore borrowers for extended periods, particularly since the GFC. The gap in the profitability of offshore versus onshore issuers has widened recently. Tests of differences of medians or means indicate that the gap is statistically significant. We obtain similar results looking at other measures of profitability, such as the return-on-assets and net income margin.

While the bulk of EME firms that borrow offshore tend to be small and to issue infrequently, a small group of very large firms issues regularly in the international bond markets (Table 2). These firms are at the 95th percentile of the distribution of EME firms illustrated in Graph 3 (upper, left-hand panel). These larger firms account for 27% of the total amount of EME offshore debt issued, which, while significant, is not the bulk of issuance for these firms.

Domestic borrowing options and offshore bond issuance

Market imperfections that limit domestic borrowing options can influence firms' decisions to issue bonds offshore. Small and opaque firms that incur high costs on account of asymmetric information might be expected to borrow not from markets but from banks, which are more efficient in monitoring borrowers.10 Over time, they may rely less on banks and issue debt in financial markets. This could result from improved access to such markets, or from limits on banks' capacity to provide credit (for example, ceilings on large exposures).

Whether firms choose to raise additional debt onshore, either from banks or local capital markets, or offshore (in the Eurobond or yankee markets) depends on the relative benefits and costs. On the one hand, accessing offshore financial markets involves high fixed costs. Companies of uncertain quality are likely to be charged a higher risk premium, since a lack of familiarity exacerbates the problems of informational asymmetries. Access to offshore bond markets might also be more costly for firms based in countries with poor legal systems or weak institutions. Capital controls that restrict offshore bond issuance may also play an important role.

On the other hand, the depth and liquidity of offshore bond markets may imply lower costs of issuance, particularly when external financing costs fall, for example as a result of lower investor risk aversion. In spite of the costs cited above, it may therefore actually be easier and cheaper to issue in offshore financial markets if onshore financial markets are shallow or subject to more restrictions, as is generally the case in EMEs. Unfavourable conditions for local borrowing in EMEs could thus explain increased reliance on offshore financing during periods of lower risk aversion.

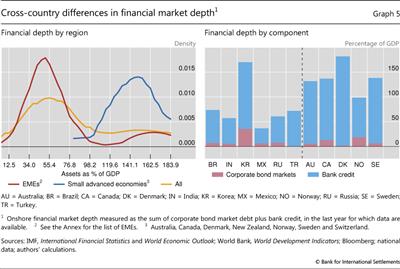

The depth of onshore debt markets is likely to be an especially important factor in deciding whether to issue offshore (Black and Munro (2010)). One measure of market depth is the sum of funds obtained locally from banks and capital markets as a ratio to GDP. On this basis, onshore financial depth tends to be much lower for EMEs than for our set of small advanced economies (Graph 5, left-hand panel). Among the largest countries included in emerging market indices, only Korea ranks similarly to the small advanced economies (Graph 5, right-hand panel). The other EME countries lag well behind: corporate bond markets are thin, and bank credit is lower as a share of GDP, despite rapid growth in recent years.11

Such factors might induce firms to issue bonds overseas when external financing becomes cheaper, even when they have no immediate need for cash. Non-bank lenders might be expected to monitor the use of funds less intensively than would international banks. Thus, arm's length borrowing could be associated with hoarding of cash or short-term assets (Bruno and Shin (2015)). At an aggregate level, bond issuance would be decoupled from capital expenditure.

Empirical model

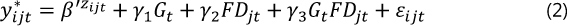

To explore if limits to borrowing onshore affect firms' offshore debt issuance, we estimate a reduced-form model, using an industry-country-quarter data panel. We restrict our analysis to sectors12 rather than individual firms because, at the time of writing, a fully balanced panel of data covering the 41 jurisdictions was not available.13 In particular, we test the hypothesis that looser external financing conditions increase offshore debt issuance to a greater degree in countries where the domestic financial system is less developed and, accordingly, where firms are more likely to have unmet financing needs. The model is defined by two equations:

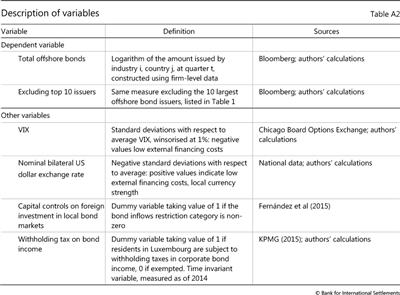

where  is the logarithm of the gross US dollar value of bonds issued offshore (by industry i, based in country j, in quarter t) and zjt is a vector of country-specific controls comprising country fixed effects, GDP per capita, GDP growth and industry fixed effects to account for each industry's demand for financing.14 Gt is the standardised measure of the time-varying external financing conditions in offshore markets, as represented by the VIX. We saw earlier that a lower VIX tends to be associated with greater EME offshore bond issuance; an explanation could be that the VIX is an indicator of risk aversion and hence of the tightness of external financing conditions. FDjt refers to domestic financial market attributes, which we measure with three variables: the depth of the onshore financial market (measured as in Graph 4, that is, as the sum of bank credit to the non-financial sector and non-financial corporate bonds outstanding), the presence or absence of capital controls on local bond markets, and the presence or absence of withholding taxes on corporate bond income. The tables in the Annex provide further details of the variables used. As negative values of the dependent variable

is the logarithm of the gross US dollar value of bonds issued offshore (by industry i, based in country j, in quarter t) and zjt is a vector of country-specific controls comprising country fixed effects, GDP per capita, GDP growth and industry fixed effects to account for each industry's demand for financing.14 Gt is the standardised measure of the time-varying external financing conditions in offshore markets, as represented by the VIX. We saw earlier that a lower VIX tends to be associated with greater EME offshore bond issuance; an explanation could be that the VIX is an indicator of risk aversion and hence of the tightness of external financing conditions. FDjt refers to domestic financial market attributes, which we measure with three variables: the depth of the onshore financial market (measured as in Graph 4, that is, as the sum of bank credit to the non-financial sector and non-financial corporate bonds outstanding), the presence or absence of capital controls on local bond markets, and the presence or absence of withholding taxes on corporate bond income. The tables in the Annex provide further details of the variables used. As negative values of the dependent variable  are ruled out, we estimate a censored regression model using maximum likelihood.

are ruled out, we estimate a censored regression model using maximum likelihood.

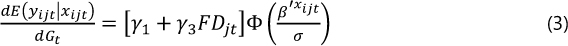

To determine whether limits to domestic borrowing encourage more offshore bond issuance when external financing conditions improve, we interact Gt and domestic financial market attributes FDjt. The impact (partial effect) of external financing conditions on the amount issued is then a function of financial market attributes. Formally, xijt

where xijt is a vector of explanatory variables. The empirical results will focus on equation (3). We expect the coefficient γ3 on FDjt to have a negative impact, so that offshore bond financing declines with financial deepening.15 To gauge by how much, we measure the derivative on the left-hand side by using the coefficients from equation (2) for low and high values of FDjt.

Less developed onshore markets make borrowers look offshore

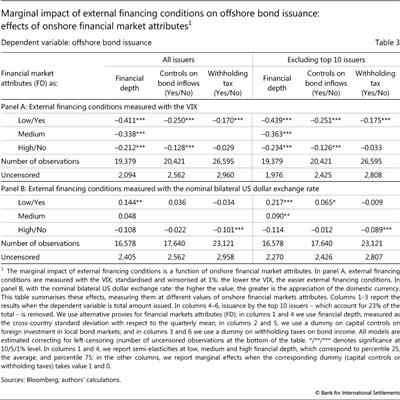

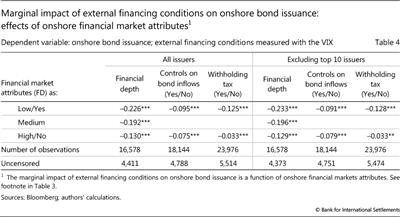

Our estimation results confirm that easier external financing conditions increase the amount issued in offshore bond markets, even when other variables are taken into account (Table 3, panel A). This finding is consistent with previous research (McCauley et al (2015a), Feyen et al (2015)). However, we also find that this effect varies with onshore financial market depth (column 1). It is twice as large for firms based in countries with low onshore market depth (we define "low" market depth as percentile 5; "high" market depth as percentile 95; and "medium" as the average).16

In addition, we also find that capital controls on foreign investments in local bonds matter, as does taxation of income on local corporate bonds (Mizen et al (2012)). The impact of global financial conditions is much larger for firms in countries that restrict foreigners' investments in local bond markets, or have withholding taxes on bond income (Table 3, panel A, columns 2 and 3).

Advanced economies rank high in our measure of financial depth, never use capital controls and rarely have withholding taxes on bonds. This can explain the more muted reaction of firms to external financing conditions, as described in the previous section.

We conduct several robustness checks. The results hold when we use net flows, other measures of external financing conditions, such as the MOVE index,17 or when we use a broader measure of onshore market depth that includes cross-border bank lending to domestic non-banks. And to explore whether the results are driven by a few unrepresentative borrowers, we exclude the offshore bond issuance of the top 10 issuers in the sample; these account for 23% of the total amount and 795 bonds. The results are virtually unchanged, and of similar size (columns 4-6).

To provide additional perspective on the role of external financing conditions, we replace the VIX as the measure of such conditions with the nominal bilateral US dollar exchange rate (Table 3, panel B). From the perspective of international investors, dollar weakness strengthens firms' balance sheets if they have borrowed in foreign currency. Thus, it improves companies' ability to raise funds (Avdjiev et al (2015)).

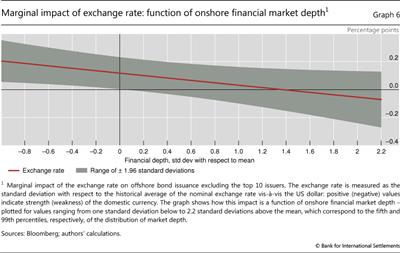

Domestic currency appreciation does indeed encourage offshore bond borrowing, which is mostly in foreign currency. The effect is stronger if firms are incorporated in countries with low market depth; its impact fades, and eventually becomes statistically insignificant, if onshore financial markets are deep (Table 3, panel B, column 1). The results are particularly strong when we exclude the top 10 issuers (columns 4-6).18 To further gauge this impact, we evaluate the results at the range of values of financial depth between our low and high thresholds. We find that the impact is positive and statistically significant from zero for levels of onshore development up to 0.2 standard deviations above the mean (Graph 6). In the last quarter with available data, this cutoff corresponds roughly to financial markets that are slightly deeper than those of Croatia.

Finally, we examine the impact of external financing conditions on onshore bond issuance (Table 4). This is qualitatively similar, underscoring that external financing conditions are also transmitted to local bond markets (Sobrun and Turner (2015)). However, the impact is half the size of that on offshore bond issuance, suggesting that integration remains incomplete and that there are still incentives for firms to borrow offshore. Low financial depth and withholding taxes on corporate bond income strengthen the impact of external financing conditions on onshore bond issuance, but surprisingly capital controls do not have an effect.

Overall, the results confirm that the impact of global financial conditions on firms' offshore bond financing is stronger when onshore financial markets have shortcomings. The findings can help explain why many EME firms hasten to issue offshore bonds when external financing is cheap.

How offshore bond proceeds are used

How offshore bond proceeds are invested can have implications for financial stability. In particular, firms might act as surrogate financial intermediaries, raising funds offshore to invest them in short-term financial assets. This could accentuate the procyclicality of the domestic financial system and pose the risk of sudden reversals.

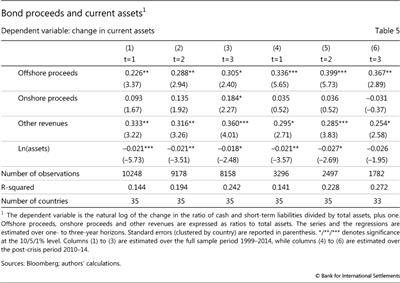

To shed light on this issue, we first test whether in our sample offshore bond issuance is allocated to short-term financial assets, as measured by current assets, and whether it differs from the allocation of onshore bond proceeds. Bonds issued in offshore markets by firms in the sample are overwhelmingly denominated in dollars and, conversely, issuances in onshore markets are mostly in local currency. A recent study by Bruno and Shin (2015) performs a related analysis.19

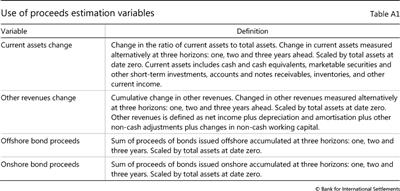

For the period 1998-2014, we adapt the bond use equation introduced by Bruno and Shin (2015, Tables 9 and 10), and apply it to a panel of 1,100 representative EME firms.20 The dependent variable is the change in current assets, which is the sum of cash and cash equivalents, marketable securities and other short-term investments, accounts and notes receivable, inventories and other current income. The right-hand side variables are offshore bond proceeds, onshore bond proceeds, other revenues and total assets. We perform the estimation at one- to three-year horizons.

As shown in Table 5, offshore bond proceeds have a positive and statistically significant impact on firms' holdings of current assets, which increases at two- and three-year horizons (columns 1-3). In contrast, onshore bond proceeds have no impact on such holdings (other sources of revenue do have an impact, but it is smaller). The impact of offshore bond proceeds on current assets is even stronger in the post-crisis period (columns 4-6).

As noted earlier, since about 2009, firms issuing bonds offshore have consistently been less profitable than firms issuing bonds (only) onshore or firms that issue no bonds. Firms that have relied on offshore bond financing thus appear to be less able to generate profits even if they are exposed to higher risks. The lower profitability of firms that rely on offshore bond financing may reflect macroeconomic conditions or may indicate that they are using the proceeds from offshore financing in a less productive way.

Conclusions

Two results of our analysis may be highlighted. First, firms' demand for offshore bond financing depends on their ability to raise funds locally. If borrowing in domestic markets is relatively constrained, as is the case in less developed domestic financial markets, an easing of external financing conditions increases the incentive to issue debt offshore.

Second, our empirical analysis indicates that offshore bond proceeds tend to be associated with increased investment in short-term assets. This could raise financial stability concerns. In particular, an increased volume of such investments could pose the risk of sudden reversals and might amplify financial cycles. In contrast, onshore bond proceeds are not linked to higher holdings of short-term assets.

Our results imply that policies that deepen domestic markets by reducing the cost of onshore borrowing could slow the growth of offshore bond issuance by EME firms. This could help alleviate some of the concerns about financial stability noted above.

References

Avdjiev, S, R McCauley and H S Shin (2015): "Breaking free of the triple coincidence in international finance", BIS Working Papers, no 524.

Black, S and A Munro (2010): "Why issue bonds offshore?", BIS Working Papers, no 334.

Brambor, T, W Clark and M Golder (2006): "Understanding interaction models: improving empirical analyses", Political Analysis, vol 14, pp 63-82.

Bruno, V and H S Shin (2015): "Global dollar credit and carry trades: a firm-level analysis", BIS Working Papers, no 510, forthcoming in Review of Financial Studies.

Denis, D and V Mihov (2003): "The choice among bank debt, non-bank private debt, and public debt: evidence from new corporate borrowings", Journal of Financial Economics, vol 70, pp 3-28.

Diamond, D (1984): "Financial intermediation and delegated monitoring", The Review of Economic Studies, vol 51, no 3, July, pp 393-414.

Fernández, K, M Klein, A Rebucci, R Schindler and M Uribe (2015): "Capital control measures: a new dataset", NBER Working Papers, no 20970.

Feyen, E, S Ghosh, K Kibuuka and S Farazi (2015): "Public global liquidity and external bond issuance in emerging markets and developing economies", World Bank Policy Research Working Paper, WPS7363, July.

Fuertes, A and J Serena (2016): "How firms borrow in international bond markets: securities regulation and distribution of credit risks", Bank of Spain Working Paper, no 1603.

Gruić, B and P Wooldridge (2012): "Enhancements to the BIS debt securities statistics", BIS Quarterly Review, December, pp 63-76.

KPMG (2015): "Luxembourg Investment Funds. Withholding Tax Study".

McCauley, R, P McGuire and V Sushko (2015a): "Global dollar credit: links to US monetary policy and leverage", Economic Policy, vol 30, no 82, April, pp 187-229.

--- (2015b): "Dollar credit to emerging market economies", BIS Quarterly Review, December, pp 27-41.

Mizen, P, F Packer, E Remolona and S Tsoukas (2012): "Why do firms issue abroad? Lessons from onshore and offshore corporate bond finance in Asian emerging economies", BIS Working Papers, no 401.

Scott, D (1979): "On optimal and data-based histograms", Biometrika, vol 66, no 3, pp 605-10.

Sobrun, J and P Turner (2015): "Bond markets and monetary policy dilemmas for the emerging markets", BIS Working Papers, no 508.

Annex: Data description

In this article, we use a data set that matches all the bonds issued in the period 2000 to 2015 with firm-level data for the company backing the bond. Its features are described in detail in Fuertes and Serena (2016). The data series are described in more detail in Tables A1 and A2.

The data set covers non-financial firms headquartered in 41 jurisdictions, comprising 34 emerging economies and seven small advanced economies. The countries and regions covered are: Latin America: Argentina, Brazil, Chile, Colombia, Ecuador, Mexico, Peru and Venezuela; emerging Europe: Bulgaria, Bosnia, Croatia, Estonia, Hungary, Lithuania, Poland, Romania, Russia, Serbia, Slovakia, Slovenia, Turkey and Ukraine; Africa and Middle East: Egypt, Morocco, Nigeria, Saudi Arabia, South Africa and the United Arab Emirates; emerging Asia: India, Indonesia, Malaysia, the Philippines, Thailand and South Korea; small advanced economies: Australia, Canada, Denmark, New Zealand, Norway, Sweden and Switzerland.

It does not include firms based in the euro area countries, Japan, the United Kingdom or the United States during the full period under analysis. Domestic bond markets in these larger advanced economies are deeper and more receptive to new issues. As a consequence, firms based in these countries would find it less costly to issue onshore than do firms in small open economies.21

Firms' financing patterns are monitored at a consolidated level, broadly in line with the BIS international debt securities statistics, by nationality, according to the ultimate borrower sector.

This is underscored by the similarity of these measures, on an aggregate level (see Graph 1). There are three potential explanations for the differences. First, while our measure is broadly consistent with the criteria used in the BIS nationality measure, we make a distinction between affiliates which are financially dependent on their parent companies, and those which are standalone companies. Unlike the BIS nationality measure, we classify standalone affiliates according to the country of incorporation of the affiliate. Thus, a company such as Jaguar Land Rover - which borrows without explicit support from Tata Motors, its Indian parent company - is treated as a UK-based company. Second, offshore bonds are defined as those marketed outside the jurisdiction of the issuer, as given by the registration domain (ISIN/CUSIP). This definition stresses the primary market, consistent with the BIS definition (Gruić and Wooldridge (2012)). However, ours is a narrower measure, since bonds issued domestically under foreign law, or subsequently listed overseas, are not reclassified. For this reason we use the term offshore bonds, instead of international, which should be reserved for the broader concept. Finally, the coverage of data providers might be different.

1 The views expressed here are those of the authors and do not necessarily reflect those of the BIS. We are grateful to Claudio Borio, Dietrich Domanski, Torsten Ehlers, Branimir Gruić, Hyun Song Shin and Christian Upper for helpful comments and suggestions, and to Julieta Contreras and Tania Romero for excellent research support.

2 Similar matched firm-bond-level data have been used to investigate the use of bond proceeds to hoard cash (Bruno and Shin (2015)) or the choice of primary market of issuance (Fuertes and Serena (2016)).

3 Firms also issue global bonds, which are fully fungible securities issued simultaneously in two or more markets (for instance, yankee and Eurobond). Other primary bond markets are less popular, but do attract some firms: samurais, kangaroos and kiwis, for example, refer to bonds issued by foreign firms in the Japanese, Australian and New Zealand markets, respectively.

4 The dollar is dominant in both the US and the EU markets, where it accounts for 91% and 51% of the total, respectively. The latter proportion rises to 74% in the case of issuances by emerging economy firms, and falls to 20% for the advanced economy companies in our sample.

5 The term offshore issuance is sometimes used in a different sense: to refer to issuance by overseas affiliates.

6 These differences can be explained by distinct coverage of data providers, or methodological differences, such as the treatment of standalone affiliates. For a more detailed discussion, see the Annex and Fuertes and Serena (2016).

7 The percentage is 36% for small advanced economies and is below 10% in most emerging economies. South Africa is a remarkable exception: 11 out of 33 firms active offshore have issued bonds in the local currency. Also, 46 out of 166 Brazilian companies issuing bonds offshore have issued in Brazilian reals.

8 For related findings, see Feyen et al (2015).

9 Graph 3 and the left-hand panel of Graph 5 use kernel density estimation. A kernel density provides a smooth visual representation of the frequency of different values of a random variable (eg the value of assets over a sampled population) that is clearer and more accurate than the widely used (discrete) histogram. Technically, a kernel (a weighting function) is used to provide a smooth estimate of the underlying statistical density of a random variable. Scott (1979) shows that the kernel density estimate converges more quickly than a histogram to the underlying density for continuous random variables.

10 See Diamond (1984). Small firms may also be unable to access financial markets because of high fixed issuance costs, such as underwriting, registration or legal fees. The evidence for US markets supports this view (Denis and Mihov (2003)).

11 The results are similar when we use a broader measure of onshore depth which includes cross-border bank lending to non-banks. Cross-border lending adds to onshore financial market depth since the borrowing transaction is onshore, although the funds originate from abroad.

12 Industries are classified according to the Global Industry Classification Standard (GICS), which classifies firms in 10 sectors: Basic Materials, Communications, Consumer Discretionary, Consumer Staples, Energy, Health Care, Industrial, Technology, Utilities and Financials. In this exercise, we remove financial firms.

13 That said, some preliminary analysis of firm-level data tends to confirm the results.

14 As discussed above, industries differ in their dependence on financial markets. For example, due to operational aspects, firms in the technology or health care sector have high internal cash flows and less need for external financing; in contrast, energy and utilities companies have substantial fixed assets and a high dependence on debt to carry out their activities. Reliance on offshore bond borrowing might also be higher for industries with more dollar assets.

15 In the case of continuous variables such as financial depth, empirical tests of the hypothesis are different from a standard Wald test of the interaction term. Even if γ3 is not significant, its impact can be significant for relevant values of financial depth since its standard error includes cov(γ1,γ3) (Brambor et al (2006)).

16 Financial depth enters in the econometric model as a continuous variable, and the partial effect is thus a function of this continuous measure. To gauge its shape, we report this effect in Table 3 at three specific points: two values at the tails and, since financial depth is standardised, with respect to the mean and the average.

17 The MOVE index - the Merrill Lynch Option Volatility Estimate - measures the implicit volatility in the US Treasury markets.

18 The reason may be that these large companies are more likely to invest abroad. As a result, the value of their assets might be less affected by the domestic exchange rate.

19 While we analyse offshore versus onshore bond issuance, Bruno and Shin (2015) examine US dollar versus non-US dollar bond issuance. Their findings support the view that US dollar bond issuance by EME firms may reflect carry trades. Accordingly, our results are consistent with theirs.

20 This sample is also used in Graph 4.

21 The data set also does not cover China, which is experiencing a process of external financial liberalisation that distorts domestic firms' access to local and international bond markets.