What does the sectoral classification of offshore affiliates tell us about risks?

(Extract from pages 20-21 of BIS Quarterly Review, December 2014)

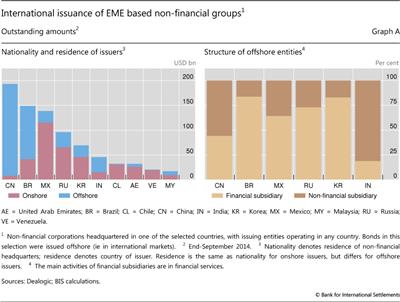

Around one half of the outstanding international debt securities of non-financial corporations headquartered in major EMEs was issued through subsidiaries abroad, albeit with significant variation between countries (Graph A, left-hand panel). This debt does not show up in the residence-based external debt statistics, which therefore paint an overly benign picture of the non-financial corporate sector's indebtedness. But the risk profile of offshore debt is likely to be very different depending on whether the issuing affiliate is a fully fledged firm with significant operations in the country of residence or if it is merely a conduit channelling funds to the parent.

But the risk profile of offshore debt is likely to be very different depending on whether the issuing affiliate is a fully fledged firm with significant operations in the country of residence or if it is merely a conduit channelling funds to the parent. Unfortunately, information on the full set of activities of offshore subsidiaries is not available at the aggregate level. That said, the sectoral classification of affiliates can help. Specifically, the non-financial affiliates of non-financial corporations are presumably more likely than purely financial affiliates to engage in activities other than providing funding for the parent. If so, the sector of the issuing entity could shed at least some light on the risk profile of offshore debt.

Unfortunately, information on the full set of activities of offshore subsidiaries is not available at the aggregate level. That said, the sectoral classification of affiliates can help. Specifically, the non-financial affiliates of non-financial corporations are presumably more likely than purely financial affiliates to engage in activities other than providing funding for the parent. If so, the sector of the issuing entity could shed at least some light on the risk profile of offshore debt.

The sector classification of offshore affiliates shows considerable variation between countries, even in the case of those with similar offshore shares. More than 80% of offshore issuance by firms headquartered in India is by non-financial subsidiaries (Graph A, right-hand panel). Much of this debt is raised by firms in the Metal & Steel sector with large operations around the world. Chinese firms also issue heavily through non-financial subsidiaries abroad, which account for well over one half of issuance abroad by firms headquartered in China. By contrast, Brazilian and Korean firms issue primarily through financial subsidiaries.

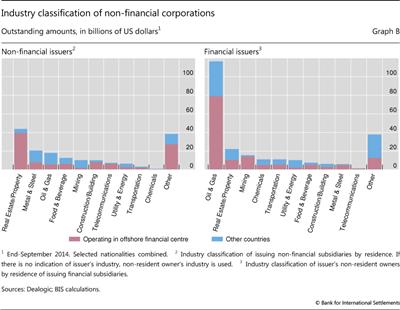

The split between financial and non-financial subsidiary also varies between industries. For instance, firms operating in the Oil & Gas sector overwhelmingly issue through financial subsidiaries (Graph B), suggesting that most of the funding is being channelled to the parent. For most other sectors, the proportion of debt issued by financial and non-financial subsidiaries is roughly similar.

Using the sectoral split as a proxy for risk profiles does have its limits. This is illustrated by the Real Estate/Property sector. The bulk of issuance from this sector is by firms headquartered in China, which issue mostly through non-financial affiliates. A possible reason is that non-financial affiliates can hold property that may serve as collateral. But this property need not be located in the country of issuance; it could equally well be situated in China or a third country. In fact, the vast majority of immediate (offshore) issuers belonging to this sector are resident in offshore financial centres (Graph B) such as the Cayman Islands that have tiny property markets compared with the volume of bonds outstanding.

International debt securities are those issued in a country other than the one in which the issuer resides. This analysis ignores local issuance, ie in the country of the issuer. For previous discussions of offshore borrowing, see R McCauley, C Upper and A Villar, "Emerging market debt securities issuance in offshore centres", BIS Quarterly Review, September 2013, pp 22-23; and B Gruić, M Hattori and H S Shin, "Recent changes in global credit intermediation and potential risks", BIS Quarterly Review, September 2014, pp 17-18. For a discussion of how the repatriation of such funds shows up in balance of payments statistics, see S Avdjiev, M Chui and H S Shin, "Non-financial corporations from emerging market economies and capital flows", BIS Quarterly Review, December 2014, pp 67-77.

International debt securities are those issued in a country other than the one in which the issuer resides. This analysis ignores local issuance, ie in the country of the issuer. For previous discussions of offshore borrowing, see R McCauley, C Upper and A Villar, "Emerging market debt securities issuance in offshore centres", BIS Quarterly Review, September 2013, pp 22-23; and B Gruić, M Hattori and H S Shin, "Recent changes in global credit intermediation and potential risks", BIS Quarterly Review, September 2014, pp 17-18. For a discussion of how the repatriation of such funds shows up in balance of payments statistics, see S Avdjiev, M Chui and H S Shin, "Non-financial corporations from emerging market economies and capital flows", BIS Quarterly Review, December 2014, pp 67-77.  See M Chui, I Fender and V Sushko, "Risks related to EME corporate balance sheets: the role of leverage and currency mismatch", BIS Quarterly Review, September 2014, pp 35-47, for a discussion of the risks associated with international debt issuance.

See M Chui, I Fender and V Sushko, "Risks related to EME corporate balance sheets: the role of leverage and currency mismatch", BIS Quarterly Review, September 2014, pp 35-47, for a discussion of the risks associated with international debt issuance.  In some cases, foreign-registered financial subsidiaries pool funding for a global business across different national markets. Aggregating funding for different business units in this way can help achieve economies of scale in issuance while the proceeds can be distributed across different national markets. Foreign investors' holdings of such securities do not affect the external debt statistics of the parent's country.

In some cases, foreign-registered financial subsidiaries pool funding for a global business across different national markets. Aggregating funding for different business units in this way can help achieve economies of scale in issuance while the proceeds can be distributed across different national markets. Foreign investors' holdings of such securities do not affect the external debt statistics of the parent's country.