Retail trading in the FX market

(Extract from page 39 of BIS Quarterly Review, December 2013)

In the late 1990s, FX trading was mainly the domain of large corporations and financial institutions. Banks charged small "retail" investors prohibitively high transaction costs, as their trades were considered too tiny to be economically interesting. This changed when retail-oriented platforms (eg FXCM and OANDA) started offering online margin brokerage accounts to private investors around 2000, streaming prices from major banks and EBS. Their business model was to bundle many small trades together and lay them off in the inter-dealer market. With trade sizes now much larger, dealers were willing to provide liquidity to such "retail aggregators" at attractive prices.

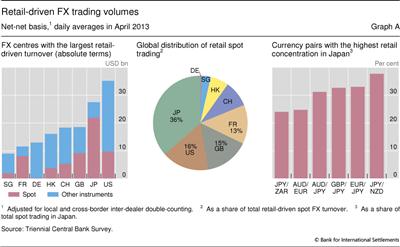

Retail FX trading has since grown quickly. New breakdowns collected in the 2013 Triennial show that retail trading accounted for 3.5% and 3.8% of total and spot turnover, respectively. The largest retail volumes in absolute terms are in the United States and Japan. That said, Japan, which has a very active retail segment, is clearly biggest in spot (Graph A, left-hand panel). In April 2013, retail trading in Japan accounted for 10% and 19% of total and spot, respectively. Retail investors differ from institutional investors in their FX trading patterns. They tend to trade directly in relatively illiquid currency pairs rather than via a vehicle currency (Graph A, right-hand panel).

The retail figures in the 2013 Triennial are lower than the level King and Rime (2010) reported based on anecdotal evidence. By design, the Triennial only captures retail trades that ultimately end up with dealers directly or indirectly through retail aggregators. Trades internalised on the platform are not captured. Nevertheless, this is probably not a big problem, as the scope for internalisation on retail platforms is limited.  The boundaries of retail are also becoming more blurred. Regulatory changes (eg leverage limits for margin brokerage accounts for private investors) in countries such as the United States have slowed growth in the retail segment and led some platforms to target themselves towards professional investors (eg small hedge funds). Furthermore, the recent poor returns on popular strategies, such as momentum and carry trades, suggest that growth in the retail segment may have slowed.

The boundaries of retail are also becoming more blurred. Regulatory changes (eg leverage limits for margin brokerage accounts for private investors) in countries such as the United States have slowed growth in the retail segment and led some platforms to target themselves towards professional investors (eg small hedge funds). Furthermore, the recent poor returns on popular strategies, such as momentum and carry trades, suggest that growth in the retail segment may have slowed.

For example, to conduct a carry trade, they go long in NZD/JPY, instead of entering a long position in NZD/USD and a short position in JPY/USD.

For example, to conduct a carry trade, they go long in NZD/JPY, instead of entering a long position in NZD/USD and a short position in JPY/USD.  Internalisation is crucial for large dealers in major pairs, where internal netting may be as high as 75-85%. But the scope for internalisation is limited for retail platforms with smaller flows, predominantly in minor currencies. Reports indicate that even a liquid pair such as GBP/USD has an internalisation ratio of 15-20%, suggesting that the scope for internalisation in eg JPY/ZAR is much lower. That said, internalisation ratios can differ strongly across retail platforms and jurisdictions but are unlikely to exceed 50%.

Internalisation is crucial for large dealers in major pairs, where internal netting may be as high as 75-85%. But the scope for internalisation is limited for retail platforms with smaller flows, predominantly in minor currencies. Reports indicate that even a liquid pair such as GBP/USD has an internalisation ratio of 15-20%, suggesting that the scope for internalisation in eg JPY/ZAR is much lower. That said, internalisation ratios can differ strongly across retail platforms and jurisdictions but are unlikely to exceed 50%.