OTC derivatives statistics at end-June 2021

Key takeaways

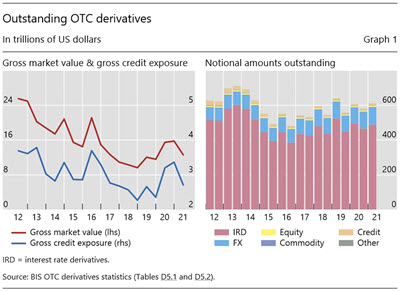

- The notional value of outstanding derivatives rose to $610 trillion at end-June 2021, an increase that appeared mainly driven by seasonal factors.

- The gross market value of OTC derivatives, which provides a measure of amounts at risk, decreased by 20% to $12.6 trillion in H1 2021, close to its end-2019 level. Gross credit exposure dropped by 19% to $2.7 trillion over the same period.

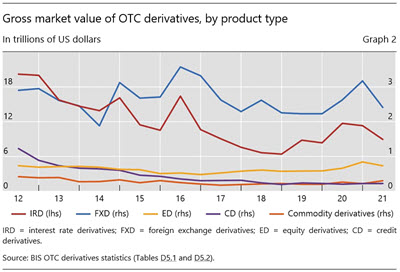

- The decline in gross market value was broad-based. It contracted by more than 20% in H1 2021 for both interest rate and FX derivatives. These declines followed the sharp rises observed in 2020 amidst the pandemic-related market turbulence.

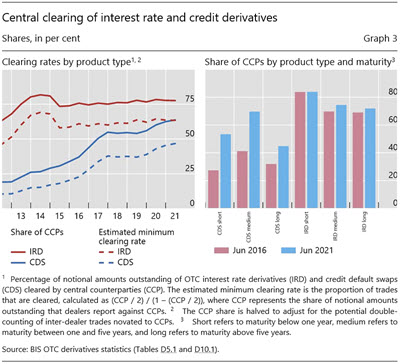

- Central clearing rates of credit default swaps (CDS) continued to rise in H1 2021, reaching 64%. The rise was most notable for short- and medium-term contracts.

Gross market value of OTC derivatives nears pre-Covid level

The gross market value of derivatives contracts – summing positive and negative values – stood at $12.6 trillion at end-June 2021, down a full 20% from end-2020 (Graph 1, left-hand panel).

Similarly, gross credit exposure – which adjusts gross market values for legally enforceable bilateral netting agreements (but not for collateral) – also saw a large contraction (from $3.4 trillion at end-2020 to $2.7 trillion at end-June 2021). The two measures had jumped noticeably in 2020 amidst heightened market uncertainty during the initial phases of the Covid-19 pandemic. Their return to near pre-Covid levels in mid-2021 coincided with a less uncertain macroeconomic outlook.1, 2

The gross market value of both interest rate and FX derivatives decreased in the first half of 2021. That for interest rate derivatives dropped by 21% to $8.9 trillion at end-June, slightly above its end-2019 level ($8.4 trillion) (Graph 2). And that for FX derivatives fell by 24% to $2.4 trillion, just above its end-2019 level ($2.2 trillion).3

In contrast to the market value, the notional value of outstanding derivatives contracts increased from $582 trillion at end-December 2020 to $610 trillion at end-June 2021, reflecting the seasonal pattern observed in recent years (Graph 1, right-hand panel). Indeed, the notional amount of interest rate derivatives has exhibited a sawtooth pattern since 2016, with amounts at end-June greater than year-end values. Looking at year-on-year variations to adjust for this pattern, the amounts at end-June 2021 were in fact down slightly from a year earlier ($607 trillion). One notable exception is related to equity derivatives, whose outstanding amounts increased by 16% over the past year, with most of the rise coming from the US markets (Graph A.4).

Central clearing of credit default swaps continued to rise

The rate of central clearing of CDS continued to trend upwards. The share of CDS contracts (notional amounts) cleared by central counterparties (CCPs) rose by almost 2 percentage points in the first half of 2021, to 64% (Graph 3, left-hand panel, blue line). This is up from 56% in 2019, where the clearing rate had prevailed since end-2017. The recent rise was mainly driven by multi-name contracts (Graph A.6). By contrast, the clearing rate for interest rate derivatives (red line) has remained relatively stable since 2015, at around 75%. While the clearing rate of FX derivatives has remained low (4% at end-June 2021), it is trending higher (Graph A.2).

Among CDS contracts, clearing rates of short- and medium-term contracts have risen the most in recent years. The rate for short-term contracts (less than one year) was 53% at end-June 2021, up 26 percentage points since end-June 2016.4 Similarly, the rate for medium-term contracts (one to five years) stood at 70%, up 29 percentage points. By contrast, the rate for long-term contracts (more than five years) rose by only 13 percentage points to reach 45% (Graph 3, right-hand panel).

1 The VIX, an indicator of market sentiment, stood at 15 points at end-June 2021, similar to the end-2019 pre-Covid level of 14 points, and substantially below the levels at end-June 2020 (34 points) and end-2020 (23 points).

2 See BIS international banking statistics and global liquidity indicators at end-March 2021 for discussion of a similar drop in banks' "instruments other than loans", which includes financial derivatives.

3 Valuation changes due to exchange rate movements had little role in the decline in H1 2021. The decreases in gross market value were roughly the same when measured at constant H1 2021 exchange rates (–20% for interest rate derivatives and –24% for FX derivatives). In addition, the decline in H1 2021 was broad based, with all jurisdictions reporting decreases for both risk categories.

4 The rise in the clearing rate for CDS has coincided with the phase-in of the uncleared margin rule (UMR). Before the first phase of the UMR (implemented in September 2016), only 37% of CDS contracts were cleared by CCPs, roughly half of the rate observed at end-June 2021. The UMR requires entities with notional amounts higher than certain thresholds to pledge initial margin for non-centrally cleared derivatives. See BCBS-IOSCO, Margin requirements for non-centrally cleared derivatives, 2020.