Principles for Financial Market Infrastructures - Executive Summary

The Principles for financial market infrastructures (PFMI) are the international standards aimed at ensuring that the infrastructure supporting financial markets is robust enough to withstand financial or operational shocks. This set of principles was issued by the Committee on Payments and Market Infrastructures (CPMI) and the International Organization of Securities Commissions (IOSCO) in 2012 and is considered one of the key standards for sound financial systems, along with the Basel Core Principles and the Insurance Core Principles, that the international community considers essential to strengthening and preserving financial stability.

The principles apply to all systemically important financial market infrastructures (FMIs), such as:

- payment systems (PS) –sets of instruments, procedures and rules for the transfer of funds between or among participants that include the participants and the entities operating the systems

- central securities depositories (CSDs) – providers of securities accounts, central safekeeping services and asset services that may include the administration of corporate actions and redemptions

- securities settlements systems (SSS) – systems that enable the transfer and settlement of securities by book entry according to a set of predetermined multilateral rules

- central counterparties (CCPs) – parties that interpose themselves between counterparties to contracts traded in one or more financial markets, becoming the buyer to every seller and the seller to every buyer and thereby ensuring the performance of open contracts

- trade repositories (TRs) – entities that maintain centralised electronic records of transaction data

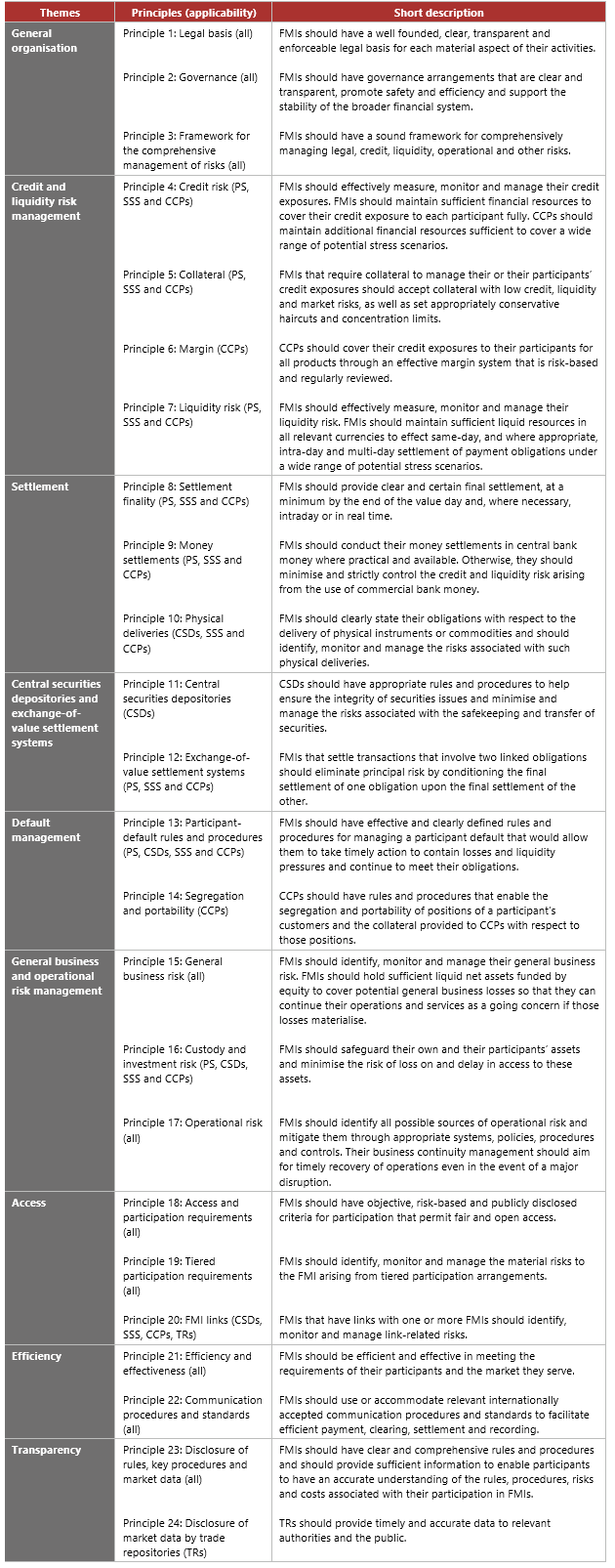

The 24 principles in the PFMI are grouped into nine themes. Most of the principles are applicable to all types of FMI. However, as shown in the table, some principles are only relevant to specific types of FMI.

The PFMI also require that FMIs be subject to appropriate and effective regulation, supervision and oversight by a central bank, market regulator or other relevant authority.

In this context, central banks, market regulators and other relevant authorities should:

- have the powers and resources to carry out their responsibilities in regulating, supervising and overseeing FMIs effectively

- clearly define and disclose their regulatory, supervisory and oversight policies with respect to FMIs

- adopt the PFMI and apply them consistently

- cooperate with each other, both domestically and internationally, as appropriate, in promoting the safety and efficiency of FMIs

This Executive Summary and related tutorials are also available in FSI Connect, the online learning tool of the Bank for International Settlements.