Impact of Digitalisation on Operational Continuity in Resolution - Executive Summary

What is operational continuity?

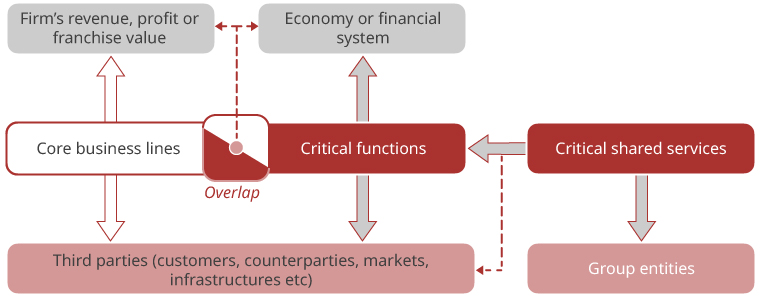

Effective resolution aims to ensure continuity of the critical functions (CFs) of a failing financial institution. CFs are activities undertaken by a financial institution for the benefit of third parties (eg households, businesses, other financial institutions), the failure of which could lead to the disruption of services that are vital for the functioning of the economy or the financial system. CFs may coincide with a firm's core business lines (which are material sources of its revenue and franchise value), but this is not necessarily the case.

CFs rely on critical shared services (CSS). A CSS is an activity, function or service performed for internal business units of a firm's group where its failure would undermine the financial institution's performance of its CFs. The two main categories of CSS are finance-related, involving the management of financial resources, and operational, involving the infrastructure necessary for the provision of CFs. Operational CSS include IT infrastructure and software-related services. CSS may be provided "in-house" within a financial institution or its group through various service delivery models, outsourced to external vendors or through a combination of both.

The concept of operational continuity in resolution (OCiR) refers to a financial institution in resolution's ability to continue the CSS that are necessary to maintain the provision, or facilitate the orderly wind-down, of the financial institution's CFs.

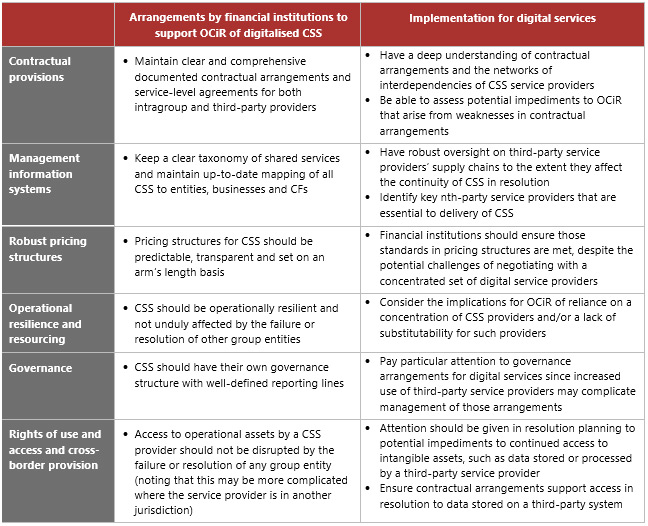

In 2016, the Financial Stability Board (FSB) published Guidance on Arrangements to Support Operational Continuity in Resolution. In 2024, a supplementary note was added to the end of that guidance to clarify its implementation in the context of the increasing digitalisation of CSS.

Operational continuity – the impact of digitalisation

The rapid digitalisation of financial services in recent years has been accompanied by increased dependency of firms on third-party service providers to support CSS. For example, more firms are embarking on group-wide digitalisation projects for data management, storage and applications that use third-party providers. This, in turn, gives rise to two factors that make preserving OCiR more complex.

First, data are increasingly stored and processed in other jurisdictions, and operational assets may be shared across multiple firms. This may lead to uncertainty in a resolution about access to data or questions of legal ownership.

Second, services may involve multiple supply chain layers. This means that the final service offered to a firm is not provided by a single third-party provider, but may depend on an intricate network of subcontractors, sub-outsourced or indirect providers (referred to as "nth-party service providers"). This may add complexity in the service delivery models, and if not adequately captured in the firm's operational continuity arrangements, could create potential challenges in resolution.

The supplementary note to the FSB guidance sets out considerations for approaching operational continuity of CSS that are digital in nature.

This Executive Summary and related tutorials are also available in FSI Connect, the online learning tool of the Bank for International Settlements.