The financial stability implications of multifunction cryptoasset intermediaries - Executive Summary

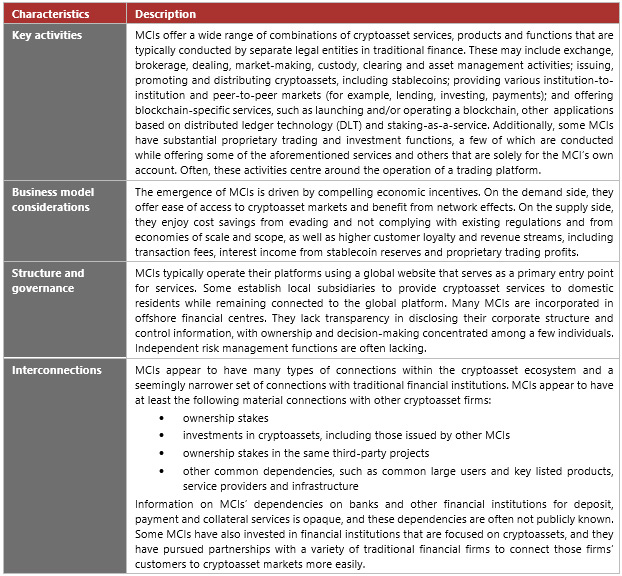

Multifunction cryptoasset intermediaries (MCIs) refer to individual firms, or groups of affiliated firms, that offer a wide range of cryptoasset services, products and functions centred around the operation of a trading platform. Most of these activities and their combinations have analogues in traditional finance. But often they are not provided by the same entity or are provided only under significant restrictions or controls to prevent conflicts of interest and promote market integrity, investor protection and financial stability.

The cryptoasset market turmoil in May and June 2022 and the collapse of FTX in November 2022 highlight the fact that MCIs represent a critical part of cryptoasset markets and can exacerbate structural vulnerabilities in those markets. Some MCIs are deeply interconnected with a broad range of counterparties across the cryptoasset ecosystem. As a result, a major MCI's failure could be significant for that ecosystem due to its centrality and interconnectedness in the market. MCIs also are a common entry point for retail and institutional investors into the cryptoasset ecosystem and are therefore potential channels for spillovers into the traditional financial system.

Against this background, the Financial Stability Board (FSB) published a report in 2023 entitled The Financial Stability Implications of Multifunction Crypto-asset Intermediaries to analyse the structure and functioning of MCIs, with the aim of assessing financial stability risks and deriving implications for policy consideration.

Multifunction cryptoasset intermediaries

Characteristics of the functioning and structure of MCIs

Financial stability implications of MCIs

MCI vulnerabilities mirror those of traditional finance, including leverage, liquidity mismatch, technology and operational vulnerabilities, and interconnections within the cryptoasset ecosystem and with traditional finance. Furthermore, certain combinations of functions could exacerbate these vulnerabilities. For example, the engagement of MCIs in proprietary trading, market-making on their own trading venues, and lending and borrowing cryptoassets could lead to higher leverage. In addition, MCIs' vulnerabilities may be further amplified by their lack of operational transparency and effective controls (for example, weaknesses in governance and risk management), by poor or no disclosures and by conflicts of interest.

The following transmission channels may be relevant to assess how vulnerabilities originating from MCIs could spill over to the traditional financial system and the real economy:

- Confidence effects: Adverse confidence effects may result from a widespread use of MCI services by unsophisticated cryptoasset investors and could be propagated through stablecoins.

- Financial institutions' exposures to cryptoassets and related services: There could be linkages between MCIs and financial institutions through their reliance on each other's services (for example, custody, trading and lending of cryptoassets); through direct exposures between them; or through MCI-issued stablecoins backed by traditional financial assets.

- Wealth effects: Adverse wealth effects from MCI stress or bankruptcy may apply to investors funding MCIs or investing in related cryptoassets or to users of their services, as MCIs often provide the only entry-exit point to the cryptoasset ecosystem for many investors.

- Cryptoassets' use in payments and settlement: MCIs could promote the adoption of stablecoins or other cryptoassets for remittances or as a medium of exchange or store of value. The failure of a major MCI or a stablecoin issued or promoted by an MCI could have significant effects on cryptoasset markets and lead to further spillovers.

Conclusions and policy implications

Despite evidence suggesting that MCI vulnerabilities do not yet pose a significant threat to financial stability, significant gaps in information limit the ability to accurately assess the implications of an MCI collapse. Although spillover effects from cryptoasset markets to the traditional financial system have been limited so far, stress events have caused significant losses to cryptoasset investors and shaken confidence in these markets.

Financial stability implications – both at individual jurisdiction and global levels – depend on how the cryptoasset sector develops, how the role of MCIs changes within the sector, the extent to which MCIs expand their linkages with traditional finance, and the effective implementation and enforcement of globally consistent cryptoasset regulation.

In light of the findings, the report identifies policy implications for consideration by the FSB in collaboration with the relevant standard-setting bodies (SSBs):

- Assess whether the amplification risks identified for combinations of MCI functions, as well as the lack of proper governance and extensive conflicts of interest, are adequately covered by the FSB and SSB recommendations or whether they would warrant additional mitigating policy measures.

- Consider ways to enhance cross-border cooperation and information sharing to help local authorities effectively regulate and supervise MCIs operating globally.

- Consider ways to address information gaps identified in the report, including whether disclosures and reporting are adequately covered by the FSB and SSB recommendations or whether they would warrant additional mitigating policy measures.

This Executive Summary and related tutorials are also available in FSI Connect, the online learning tool of the Bank for International Settlements.