Pandemic twist and inflation challenge markets

Risk appetite proved resilient during most of the review period, but a wake-up call from renewed Covid-19 concerns curtailed the gains in late November.1 Before the news of a new and threatening virus strain emerged, equity indices had risen strongly in many advanced economies (AEs). Corporate credit spreads in AEs had remained compressed, with issuance close to past records, indicating that financial conditions were still exceptionally accommodative. Government bond yields had increased, particularly sharply at the short end, as investors wrestled with fluid prospects of increased inflation and a removal of monetary accommodation. Government bond yields had also risen in emerging market economies (EMEs), as the fall in their currencies' value against a broadly appreciating US dollar revealed concerns about their economic outlook.

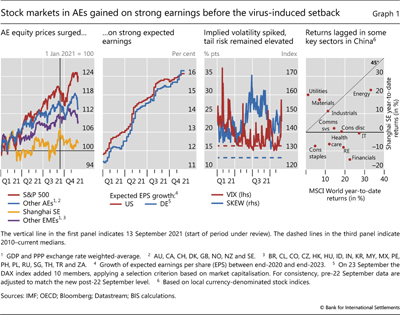

After what had been a strong quarter in most markets, stocks suffered important losses late in the review period. Equity prices in AEs, especially the United States, had climbed on the back of continued strength in both realised and expected earnings. However, the perceived risk of sharp corrections – as implied by option prices – remained elevated, pointing to persistent investor unease. The correction that eventually shook markets at the end of the period erased part of the previous gains in the United States, and left most other markets flat or with some losses.

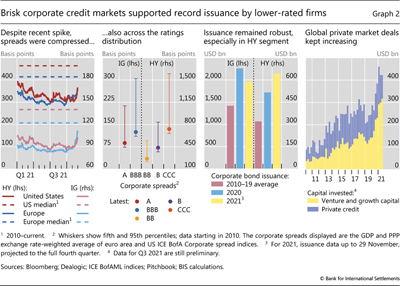

Resilient risk appetite sustained strong corporate credit through the period. Bond spreads were almost as narrow as at any time since 2010, even for companies at the lower end of the ratings spectrum, although they widened in late November. Investment grade issuance remained strong, while that in the high-yield segment approached record highs. Exceptionally easy credit conditions prevailed beyond public markets, especially in the demand for cryptoassets and the private capital markets that serve smaller and startup borrowers.

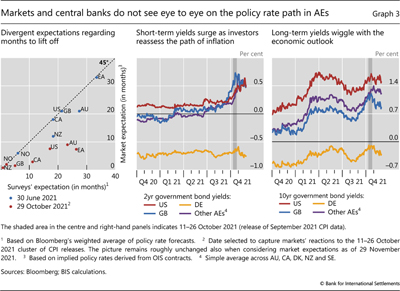

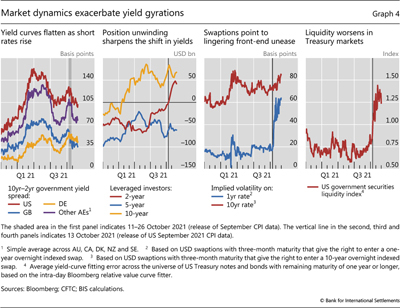

Yield curves in AEs rose and flattened, as short-term yields surged midway through the review period, amid sometimes disorderly trading conditions. Central banks in AEs continued dialling down the extraordinary support required by the pandemic, but they generally maintained cautious guidance for the short and medium term. The apparent disconnect between this guidance and the sharp moves in front-end yields raised questions about whether investors disagreed on the outlook for inflation or on the most likely policy response, or whether other factors were at play, such as the forced unwinding of leveraged positions.

Financial conditions continued to tighten for many EMEs. Government bond yields rose, especially outside emerging Asia. US dollar strength, which intensified at end-November, also contributed to the tightening and added to inflationary pressures. This worsened monetary policy trade-offs, especially for countries grappling with pandemic-related challenges against a background of limited fiscal space. The stability of the Chinese renminbi stood out, despite the headwinds from a weakening growth outlook amid challenges for its real estate sector.

Key takeaways

- Advanced economies' equity and corporate credit markets remained well supported, but sentiment was curtailed by concerns over a new virus variant as the period drew to a close.

- Government bond markets saw sharp yield moves, particularly at the front end, as investors' expectations for short-term rates diverged from central bank guidance.

- US dollar strength added to tightening financial conditions in several emerging market economies, where monetary authorities continued to fight persistent inflationary pressures.

Risky assets rise on earnings strength

Global markets for risky assets had proved resilient during the period under review, before the resurgence of virus concerns at end-November. Equity markets had posted material gains, which were curtailed or fully erased on the news at the end of the period. Conditions were brisk in corporate credit markets, where issuance and pricing remained very supportive, despite the later souring of investors' sentiment.

After a faltering start, equity markets gained strong momentum before recoiling at end-November. Early in the review period, stock prices lost ground in most jurisdictions, as persistent pressure on supply chains and rising commodity prices weighed on risk-taking (Graph 1, first panel). In AEs, particularly the United States, equity markets subsequently rebounded on the back of sustained strength in expected earnings (second panel). This positive turn also temporarily boosted the stock prices of EMEs other than China. However, tail risks still loomed large for investors. During most of the review period, perceived downside risk – as derived from option prices – remained high by historical standards (third panel, solid and dashed blue lines). Implied volatility, in turn, spiked when the emergence of the Omicron variant of Covid-19 made the downside risk more tangible (solid red line). The news erased gains in most markets, hitting sectors such as energy, financials, and industrials particularly hard. The S&P 500, however, still managed to end the review period with some gains.

Stock markets were subdued in China, staying largely detached from global trends. Developments in real estate markets and the policy pivot towards greater state oversight of key economic activities compounded concerns about slowing growth. Accordingly, the sectors with the most solid performance year-to-date globally (IT, real estate, financials) suffered valuation losses (Graph 1, fourth panel). The exceptions were energy, materials and industrials, where performance was in line with global benchmarks.

The corporate bond market remained buoyant, especially in its riskiest segments, notwithstanding the recent virus-induced spike. Spreads on investment grade (IG) and high-yield (HY) corporate bonds remained below historical norms in both the United States and the euro area, (Graph 2, first panel). For individual rating categories, spreads stayed at the lower end of their post-Great Financial Crisis (GFC) distribution (second panel). Likewise, after a strong third quarter, corporate debt issuance rose comfortably above the average of the pre-pandemic decade (third panel). In particular, HY issuance in both the United States and the euro area surpassed the 2020 peaks on an annualised basis. Against this background, a record 80% of corporate bonds outstanding is currently rated BBB (ie just above HY) or below (HY), up from 75% in 2009.

The exceptionally easy financial conditions in credit markets were visible beyond corporate bonds, which are usually tapped by large companies. Indeed, the private credit markets, which serve smaller – typically, highly leveraged – borrowers, also sustained their post-GFC momentum (Graph 2, fourth panel; see also Aramonte and Avalos (2021, in this issue)). These strong flows continued while survey data indicated a material increase in non-performing loans (from nearly 1% in 2018 to 3% in 2020), declines in estimated recovery rates and a higher likelihood of covenant suspensions and acceptance of payment-in-kind. Resilient risk appetite extended beyond traditional finance, generating a growing demand for cryptoassets. Hence the introduction of the first bitcoin exchange-traded fund in the United States (Box A) and the continued startling growth in decentralised finance (see Aramonte et al (2021) in this issue).

Yield curves wobble amid unusual volatility

During most of the review period, while corporate asset markets remained ebullient, government bond markets saw significant volatility and heightened illiquidity. Two related developments characterised the path of fixed income markets: an apparent disconnect between central bank policy guidance and front-end rates that surfaced in October; and wide fluctuations in the shape of yield curves. As the review period drew to an end, the emergence of the new variant added some volatility to yields, but did not materially affect the disconnect – which had already narrowed somewhat.

Central banks in the largest AEs began to gradually lift the extraordinary measures deployed during the pandemic, while remaining on a cautious watch. In November, the Federal Reserve confirmed the widely anticipated beginning of its tapering of asset purchases, while the Bank of Canada stopped its securities purchasing programme altogether. The ECB had already indicated in December 2020 that purchases under the Pandemic Emergency Purchasing Programme (PEPP) would last at least until March 2022. Yet most major central banks indicated that the policy rate lift-off, while drawing closer, would not start soon, given the pandemic's lingering effects. Furthermore, they repeatedly stressed that the increase in inflation was transitory, even if more protracted than originally anticipated.

In the wake of a cluster of CPI releases in early October, fixed income markets swung and began pricing in policy rate hikes well in advance of central bank guidance. The extent of the gap can be assessed by comparing the time to lift-off implied by surveys of professional forecasters – typically well attuned to central bank communication – with that implied by overnight index swap (OIS) rates. While the two sets of expectations were perfectly aligned for most AEs in June (Graph 3, left-hand panel, blue dots on the 45-degree line), by late October OIS rates suggested that the first hike would occur much earlier than forecasters anticipated (red dots below the 45-degree line). The gap became particularly large in the case of Australia and the euro area, where the time to lift-off implied in OIS was less than half of that implied by surveys.

The relative shift in lift-off expectations raised questions about an apparent disconnect between central bank guidance and fixed income markets. Market repositioning aside (see below), such a disconnect could arise from differences in perceptions of the outlook – most notably as regards inflation – or a misunderstanding of central banks' reaction function. In analysing these alternative explanations, Box B presents suggestive evidence supporting the former. As the period under review wore on, some central banks gradually pivoted to less accommodative guidance, which appeared to soften the disconnect with market perceptions.

The disconnect had a forceful expression at the front end of AE term structures. With mounting evidence that supply shortages and energy price surges sustained the inflationary momentum, short- to medium-term yields increased markedly after the CPI releases (Graph 3, centre panel). Indeed, under market pressure, the Reserve Bank of Australia abandoned its yield control programme in late October, a few days before the Board meeting in which monetary policy decisions are routinely taken. Yields fell somewhat as the Omicron variant emerged in late November.

Long-term yields also saw some volatility during the review period. They had been on the rise since mid-August, particularly outside the United States (Graph 3, right-hand panel). In most AEs, 10-year yields had increased between 40 and 60 basis points between August and early October, in a move that seemed to closely track the sudden increase in energy prices. As volatility took off in October at the front end of the yield curve (centre panel), longer yields eased, notably in the United Kingdom and the United States.

Yield curves whipsawed as action shifted between the two ends of the term structures. In a matter of a few days following the CPI news in October, term structures that had been steepening over several weeks suddenly flattened, compressing term spreads to the levels prevailing in mid-year (Graph 4, first panel). The additional swings caused by the news of the Omicron virus strain affected all yields similarly, resulting in a parallel downward shift in term structures that had little impact on term spreads.

Investor positioning and leverage exacerbated the violent movement in yields. Market intelligence suggests that the initial jump in front-end yields caught leveraged investors wrong-footed, forcing them to unwind their positions. Indeed, in line with this interpretation, futures positions across several Treasuries contracts suddenly reversed in early October, following the US CPI release (Graph 4, second panel).

The sharp bout of volatility in Treasuries left scars in several closely related market segments. The implied volatility in short-rate swaptions remained very elevated (Graph 4, third panel). Moreover, a broad measure of liquidity conditions in Treasury markets, based on yield curve fitting errors, also worsened significantly in the wake of the dislocations (fourth panel). Similar developments took place in the bond markets of other AEs. This is a tell-tale sign of arbitrage capital's inability or unwillingness to lean against mispricing.

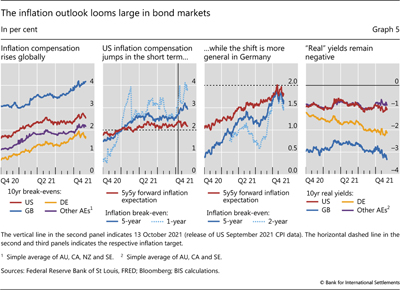

Investors' concern about the inflation outlook in AEs was an important factor behind these yield adjustments. Indeed, market measures of inflation compensation increased markedly during the period under review, following a long pause in some cases (Australia, Canada, New Zealand, Sweden and the United States) and continuing an earlier trend in others, such as the United Kingdom and the euro area (Graph 5, first panel). The surge was especially stark in the euro area, where the outsize increase in natural gas prices passed through to wholesale electricity prices.

The repricing of the inflation outlook was concentrated mainly on the short and medium term. This was most visible in the United States, where compensation for inflation over the one- and five-year horizons moved sharply above the Federal Reserve's 2% inflation target in October and November, after having been broadly in line with it (Graph 5, second panel, solid and dashed blue lines). In contrast, inflation compensation beyond five years continued fluctuating very close to the target (red line). In Germany, all measures of inflation compensation have been gradually approaching the ECB's target throughout the year, with shorter-term measures in particular surging during the review period (third panel).

Yields on inflation-linked government securities ("real yields") remained deeply negative. Despite the increase in nominal yields, not least during the review period, real yields fell further across all AEs (Graph 5, fourth panel). The 10-year US real yield has remained negative for about 22 months in a row, a record since the US Treasury began issuing inflation-protected securities in 1997. Some observers have interpreted this fact as an enduringly sober outlook for long-term economic growth. Market commentary also points to persistent supply-demand imbalances in this market segment against the backdrop of strong investor appetite for inflation hedges.

Clouds on the horizon for EMEs

Several EMEs were battered by a combination of rising global rates and stubbornly high domestic inflation. Rising AE long-term rates early in the review period intensified funding strains, putting additional pressure on exchange rates. This compounded concerns about reduced fiscal space and persistent inflation in most countries, especially in Latin America. Home-grown challenges characterised the plight of other EMEs, notably China, which faced continued stress in its large property sector and a softening growth outlook. Several countries confronted worsening policy trade-offs, with inflation calling for tighter policy while recoveries lagged. The pandemic news at the end of the period only exacerbated these developments: broad financial conditions continued tightening, as sovereign yields rose further and exchange rates extended their depreciation.

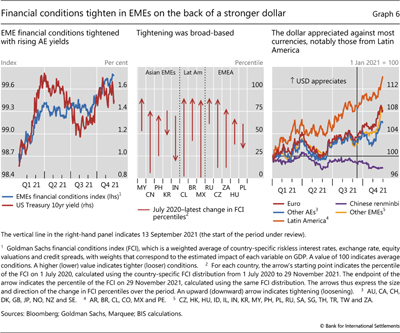

Financial conditions tightened for most EMEs. A commonly used gauge – combining information from riskless rates, credit spreads, exchange rates, and stock prices – pointed to a tightening just as AE long-term rates inched up early in the review period (Graph 6, left-hand panel). This mimicked developments during the first quarter, when the reflation trade had been in full swing. However, unlike then, financial conditions did not ease much when AE long yields reversed course. This probably reflected exchange rate weakness and rising local currency yields, as central banks fought persistent inflationary pressures (see below). Over the past 18 months, the financial headwinds have been particularly strong in Latin America, followed by China and Europe, the Middle East and Africa (centre panel). For many EMEs, the most recent conditions are close to the tightest they have been over the past year and a half.

Exchange rates were a key factor in most countries. While the dollar appreciated broadly during the period under review, especially towards the end, gains were particularly large vis-à-vis EME currencies, most notably in Latin America (Graph 6, right-hand panel). Together with rising energy prices, renewed currency weakness exacerbated the inflationary pressures that had been building earlier in the year. The Turkish lira was hard hit, plunging by as much as 15% on a single day, in the wake of a third consecutive rate cut despite high inflation. The Chinese renminbi, in contrast, was the most notable exception.

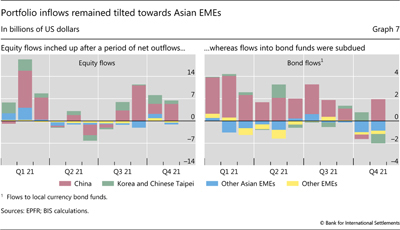

Flows into equity and bond funds painted a mixed picture, with the swings affecting Asian EMEs almost exclusively. Despite China's challenges, flows to equity funds in this country picked up after a few months of net outflows (Graph 7, left-hand panel). The rebound came after closer scrutiny on listings outside China made it difficult to get exposure to Chinese assets offshore. Equity flows to Korea and Chinese Taipei remained strong, as had been the case for these two global semiconductor hubs almost continuously since the outbreak of Covid-19. Other EMEs, in contrast, saw no equity flows on net over the period under review. Flows to bond mutual funds displayed varying country patterns. Positive inflows towards Chinese funds contrasted with large outflows from Asian EMEs other than China, Korea and Chinese Taipei (right-hand panel).

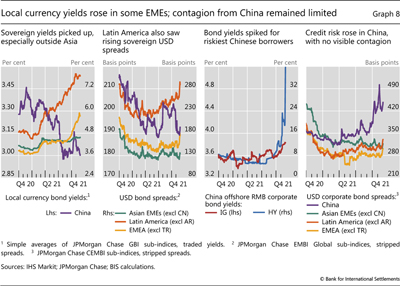

The predicament of several EMEs was visible in sovereign funding markets, especially in local currency. Prompted by persistent inflation, many central banks continued their hiking cycles (eg those of Brazil, Chile, the Czech Republic, Russia) or began tightening (eg Colombia, Poland). Accordingly, local currency sovereign bond yields rose in most EMEs, contributing to the tightening of financial conditions (Graph 8, first panel). By contrast, spreads on US dollar-denominated sovereign bonds pointed to a somewhat more benign picture, suggesting only moderate investor concerns about credit risk (second panel). Exceptions include China, where a temporary rise was probably due to spillovers from sectoral stress, and Latin America, where an ongoing upward path was boosted by the news on the pandemic front.

Turning to corporate markets, stress remained concentrated in China. As regards local currency yields, they inched up only slightly for investment grade Chinese borrowers but spiked sharply for the riskiest companies (Graph 8, third panel), not least in the wake of the recent Covid news. While spreads rose substantially in China, also for dollar-denominated corporate debt, they barely budged in other EMEs (fourth panel). As in AEs, credit spreads recorded an uptick towards the end of the review period.

1 The period under review is from 13 September to 29 November 2021.