Capital flowed out of China through BIS reporting banks in Q1 2015

(Extract from pages 28-29 of BIS Quarterly Review, September 2015)

Robert N McCauley

Capital outflows from China are much discussed, with many analyses focused on a seeming decline in official foreign exchange reserves. Yet measuring capital outflows with declines in foreign exchange reserves neglects valuation changes due to dollar/euro movements. Moreover, official reserves can be used to fund dollar investments in, for instance, new multilateral development banks.

However, BIS locational international banking statistics show a net $109 billion outflow in Q1 2015 from banks in China to banks outside China. This has put downward pressure on the renminbi and, given close currency management, on official reserves. This box shows how weakening incentives to hold long-renminbi positions resulted in the net outflow that took place both in foreign currency and in the renminbi in the first quarter. These results offer clues as to what may happen in the third quarter, during which China changed its exchange rate policy.

In the first quarter, the incentives for holding long-renminbi, short-dollar positions waned. First, the Chinese authorities continued the easing cycle that began in November by cutting administered deposit rates. And second, the renminbi was allowed to depreciate against the dollar from less than 6.2 per dollar to over 6.25 in mid-March. As a result, option-implied currency volatility rose. In short, the interest rate differential narrowed and the cost of insuring against further depreciation increased, reducing incentives for the long-renminbi position.

To clarify this point, consider a stylised Chinese multinational firm, with its balance sheet partly in China and partly outside. In China, the firm borrows and makes deposits in both renminbi and foreign currency. Its foreign currency debt at home exceeds its foreign currency deposits there. Outside China, it also has a larger foreign currency debt than foreign currency deposits, but more renminbi deposits than renminbi debt.

In China, the firm borrows and makes deposits in both renminbi and foreign currency. Its foreign currency debt at home exceeds its foreign currency deposits there. Outside China, it also has a larger foreign currency debt than foreign currency deposits, but more renminbi deposits than renminbi debt.

In response to reduced incentives, if the multinational sought to reduce its long-renminbi, short-foreign currency position, how would it have done so? The firm needs to reduce net foreign currency liabilities while shedding renminbi deposits. One place to adjust is within China. The People's Bank of China (PBoC) reports that foreign currency deposits at banks in China banks grew by $83 billion in the first quarter while the increase in their foreign currency loans slowed to only $34 billion. Thus the multinational might have reduced its net foreign currency debt by building up foreign currency deposits in China. As a result, banks in China experienced a net inflow of $49 billion in foreign currency. If banks in China, in turn, placed their excess foreign currency funding with banks in the rest of the world, BIS reporting banks would experience a corresponding rise in liabilities to banks in China. And indeed, BIS reporting banks increased their liabilities to banks in China by $46 billion in the first quarter.

Thus the multinational might have reduced its net foreign currency debt by building up foreign currency deposits in China. As a result, banks in China experienced a net inflow of $49 billion in foreign currency. If banks in China, in turn, placed their excess foreign currency funding with banks in the rest of the world, BIS reporting banks would experience a corresponding rise in liabilities to banks in China. And indeed, BIS reporting banks increased their liabilities to banks in China by $46 billion in the first quarter.

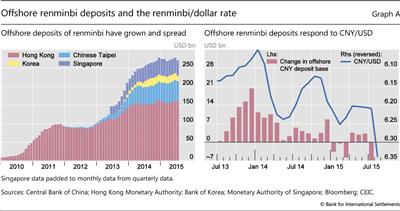

Alternatively, the firm could adjust its position outside China. For example, the treasurer could reduce renminbi deposits in an offshore bank. In fact, total renminbi deposits held in banks in Hong Kong SAR, Chinese Taipei, Singapore and Korea fell by $10 billion in Q1 2015 (Graph A). Or the treasurer could liquidate structured notes that are related to the renminbi/dollar rate that require his counterparty bank to hold renminbi as a hedge against fluctuations in the notes' currency value. Such a liquidation would not show up in these non-bank deposit data. But fortunately, the PBoC now reports total renminbi deposits held by the rest of the world in banks in China. According to the PBoC, such deposits fell by $57 billion, which would reflect both the $10 billion reduction of renminbi deposits and lower bank demand for renminbi, whether arising from customer transactions or banks' positioning of their own funds. Whatever its source, this $57 billion renminbi outflow accounts for the bulk of the $63 billion decline in claims on banks in China recorded by BIS reporting banks.

According to the PBoC, such deposits fell by $57 billion, which would reflect both the $10 billion reduction of renminbi deposits and lower bank demand for renminbi, whether arising from customer transactions or banks' positioning of their own funds. Whatever its source, this $57 billion renminbi outflow accounts for the bulk of the $63 billion decline in claims on banks in China recorded by BIS reporting banks.

So, piling up foreign currency deposits in China ($49 billion), and reducing long-renminbi positions outside China ($57 billion), our stylised multinational could set off transactions that would lead to almost $109 billion in net outflows from banks in China. That much of the outflow was renminbi-denominated signifies progress in cross-border renminbi use - but also that this use has depended on favourable yield differentials and currency expectations.

Of course, reality is more complex than a single actor adjusting its renminbi/dollar position on both sides of the border. Non-banks in China actually borrowed a further $7 billion in the quarter from BIS reporting banks. This counts as a capital inflow, so that the net outflow from banks and non-banks in China was $102 billion in Q1 2015. And other entities, such as small and medium-sized enterprises in Hong Kong SAR and Chinese Taipei, have also entered long-renminbi, short-dollar positions and might also have unwound them in Q1 2015.

Second quarter data suggest a partial reversal of these moves against a backdrop of renminbi/dollar stability. In China, net foreign currency liabilities rose by $19 billion. PBoC data show a $15 billion recovery in renminbi deposits placed in China by the rest of the world. This would in part reflect a $10 billion recovery in offshore deposits in the second quarter (Graph A, right-hand panel).

The third quarter is seeing reduced incentives to hold long-renminbi, short-dollar positions. Another cut in deposit rates narrowed the renminbi's yield advantage, and reform of the renminbi's management raised its volatility. Thus, the reward-to-risk ratio deteriorated, reducing the incentive to hold such positions.

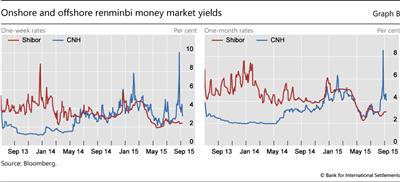

Indeed, yields give early evidence of liquidations of offshore renminbi deposits (Graph B). On 25 August, at the height of the recent equity and exchange market turbulence (see "EME vulnerabilities take centre stage", BIS Quarterly Review, September 2015), the offshore renminbi (CNH) interbank interest rates in Hong Kong reached the unprecedented levels of 10.1% for the one-week and 8.6% for the one-month tenor, reinforcing reports of renminbi selling. The August data on foreign exchange deposits and lending at Chinese banks and on offshore deposits will provide the first glimpses of the response to the altered risk-reward profile of long-renminbi positions.

H Zhu, "China: the myth of capital outflows", JPMorgan Chase, Asia-Pacific Economic Research, 28 July 2015, calculates an adjusted $15 billion drop in Chinese reserves in June 2014-June 2015.

H Zhu, "China: the myth of capital outflows", JPMorgan Chase, Asia-Pacific Economic Research, 28 July 2015, calculates an adjusted $15 billion drop in Chinese reserves in June 2014-June 2015.  V Bruno and H S Shin, "Global dollar credit and carry trades: a firm-level analysis", BIS Working Papers, no 510, August 2015.

V Bruno and H S Shin, "Global dollar credit and carry trades: a firm-level analysis", BIS Working Papers, no 510, August 2015.  See PBoC, "Financial statistics, Q1 2015".

See PBoC, "Financial statistics, Q1 2015".  Placements either at the PBoC by designated clearing banks or by offshore banks with banks in China. See W Nixon, E Hatzvi and M Wright, "The offshore renminbi market and renminbi internationalization", in L Song, R Garnaut, C Fang and L Johnston (eds), China's domestic transformation in a global context, ANU Press, 2015, page 276, for a list of clearing banks.

Placements either at the PBoC by designated clearing banks or by offshore banks with banks in China. See W Nixon, E Hatzvi and M Wright, "The offshore renminbi market and renminbi internationalization", in L Song, R Garnaut, C Fang and L Johnston (eds), China's domestic transformation in a global context, ANU Press, 2015, page 276, for a list of clearing banks.  W Gu and A Trivedi, "Yuan's devaluation brings losses for some", The Wall Street Journal, 18 August 2015.

W Gu and A Trivedi, "Yuan's devaluation brings losses for some", The Wall Street Journal, 18 August 2015.