RCAP on timeliness: Basel III implementation dashboard

Updated on 3 October 2025

The timely transposition of Basel III regulatory standards into domestic regulations is monitored periodically based on information provided by each member jurisdiction. The RCAP Implementation dashboard uses colour codes to signal the different stages of adoption of the standards. The aim is to ensure that the internationally agreed timeline remains on track.

The RCAP: Basel III implementation dashboard shows views by standard and jurisdiction. It also includes references and links to domestic implementation documents.

The full Basel III implementation history can be downloaded here.

Basel III adoption progress summary (September 2025)

The Basel Committee on Banking Supervision (BCBS) and its oversight body, the Group of Central Bank Governors and Heads of Supervision (GHOS), have set as their highest priority the implementation of all aspects of the Basel III framework in full, consistently, and as soon as possible. This includes the finalised Basel III post-crisis reforms published by the Committee in 2017–19 and set to be in effect since 1 January 2023 with a five-year phase-in for some elements.

Continuing the periodic monitoring initiated more than a decade ago, this update sets out the adoption status of Basel III standards for each of the BCBS member jurisdictions1 as of end-September 2025. It is part of the Committee's Regulatory Consistency Assessment Programme (RCAP), which was established to follow progress in adopting and implementing corresponding domestic regulations, assessing their consistency and analysing regulatory outcomes.

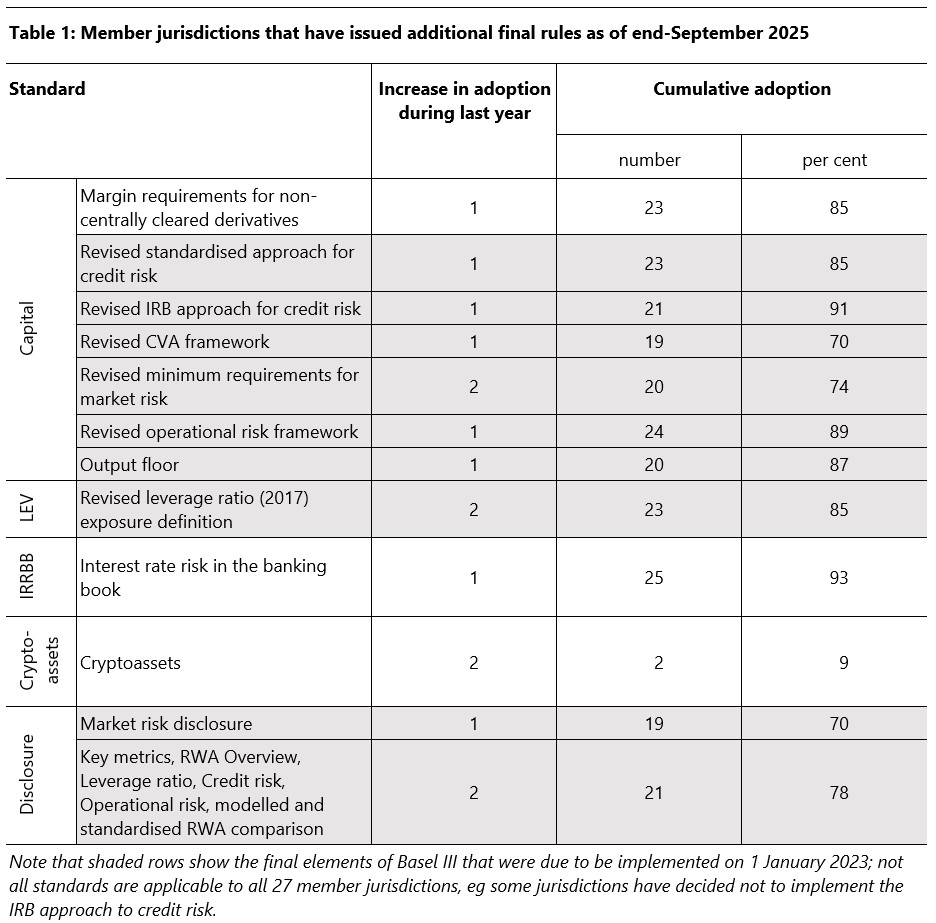

As of 30 September 2025, most member jurisdictions have published their rules implementing the final elements of Basel III, ie those standards with an implementation date of 1 January 2023 (see Table 1). Since the last summary as of end-September 2024, one additional jurisdiction has published all elements of Basel III, and another has published its market risk rules. Further progress has also been made for other standards. In the past 12 months, one additional jurisdiction implemented the interest rate risk in the banking book standard, two implemented different elements of the disclosure framework, one adopted the margin requirements for non-centrally cleared derivatives, and two adopted the framework for banks' exposures to cryptoassets.

Moreover, significant progress has also been made on the actual implementation of the Basel III standards by banks. Overall, the final Basel III standards became effective in more than 40% of the 27 member jurisdictions over the past 12 months. Consequently, the revised credit risk and operational risk standards, as well as the output floor, are now effective in around 80% of the member jurisdictions, the CVA standard in nearly 70%, and the revised market risk standards in nearly 40%.

Table 1 below shows the standards for which members published the final regulation during the past 12 months. The dashboard below highlights that in most jurisdictions all or the majority of the final elements of the Basel III framework are now in force.

Prior progress updates and the full history of implementation for each jurisdiction can be viewed via the RCAP Basel III implementation dashboard. Further evaluation of the consistency of jurisdictional implementations is addressed through the RCAP jurisdictional assessments.

1 The status of implementation in Russia has not been updated and reflects progress only as of end-September 2021.